Grantor Vs Grantee On Mortgage

Description

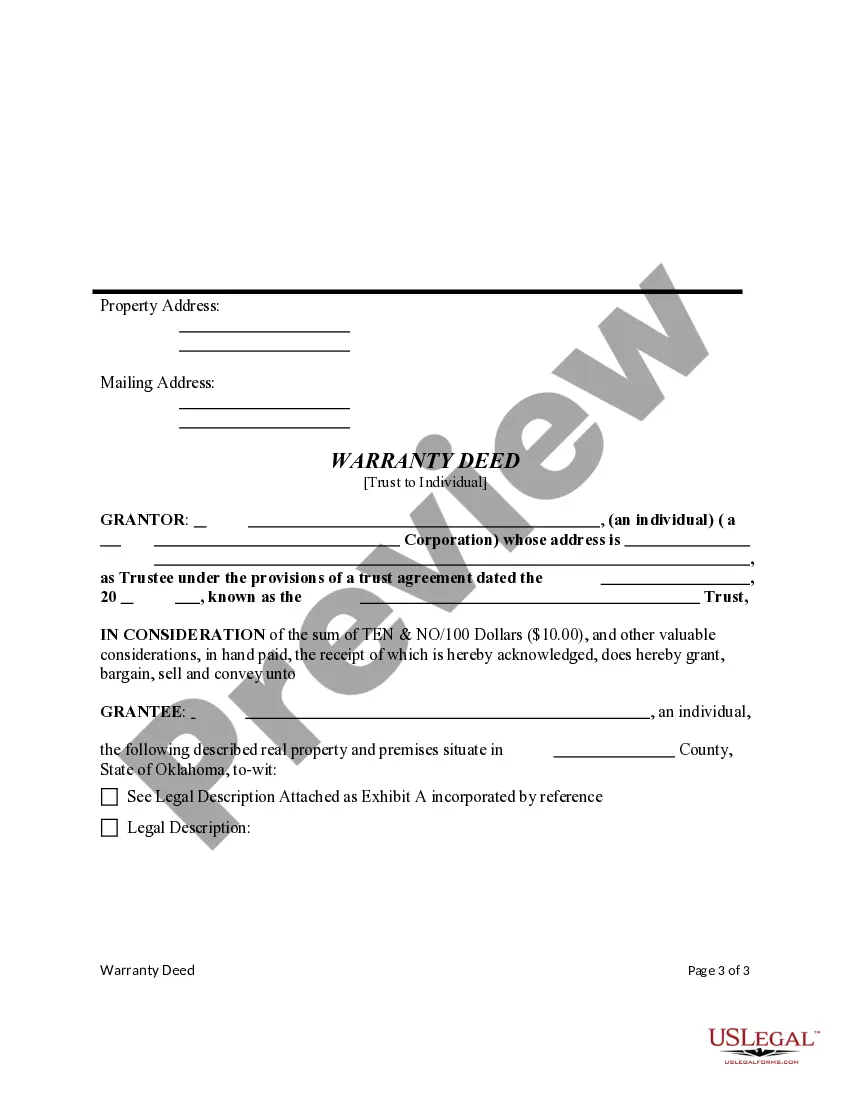

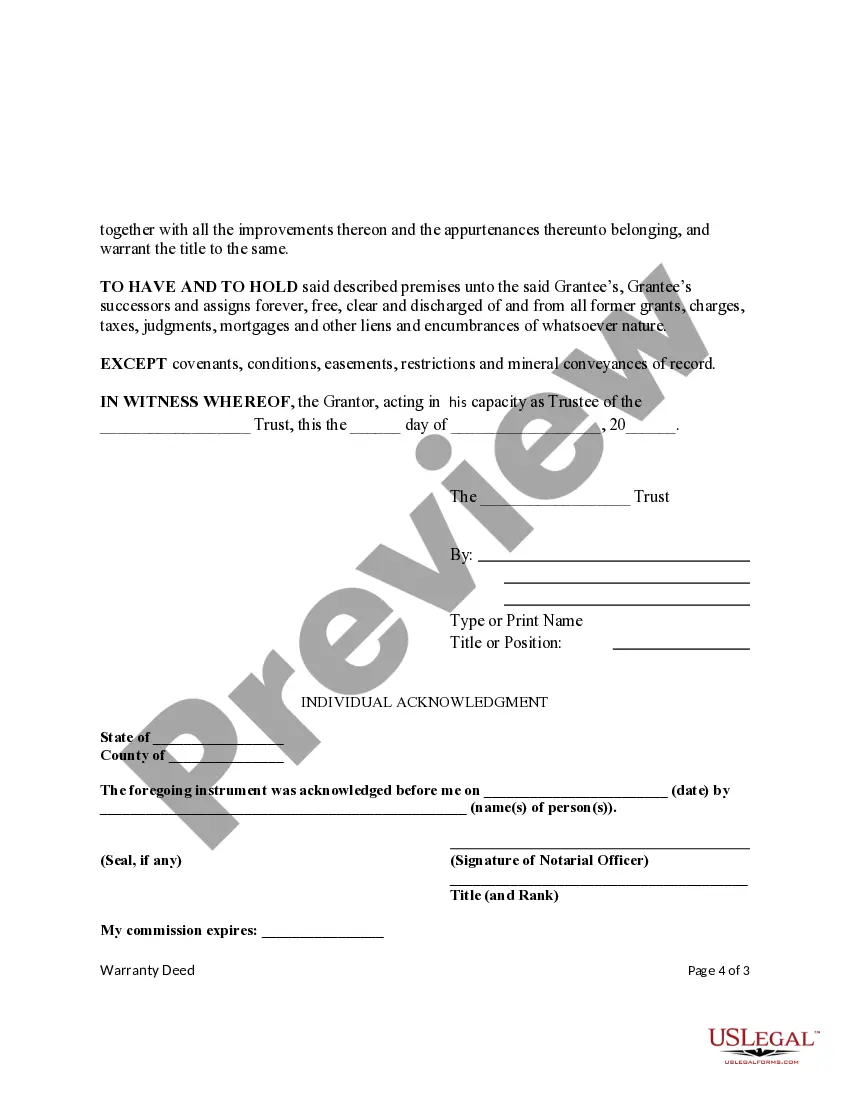

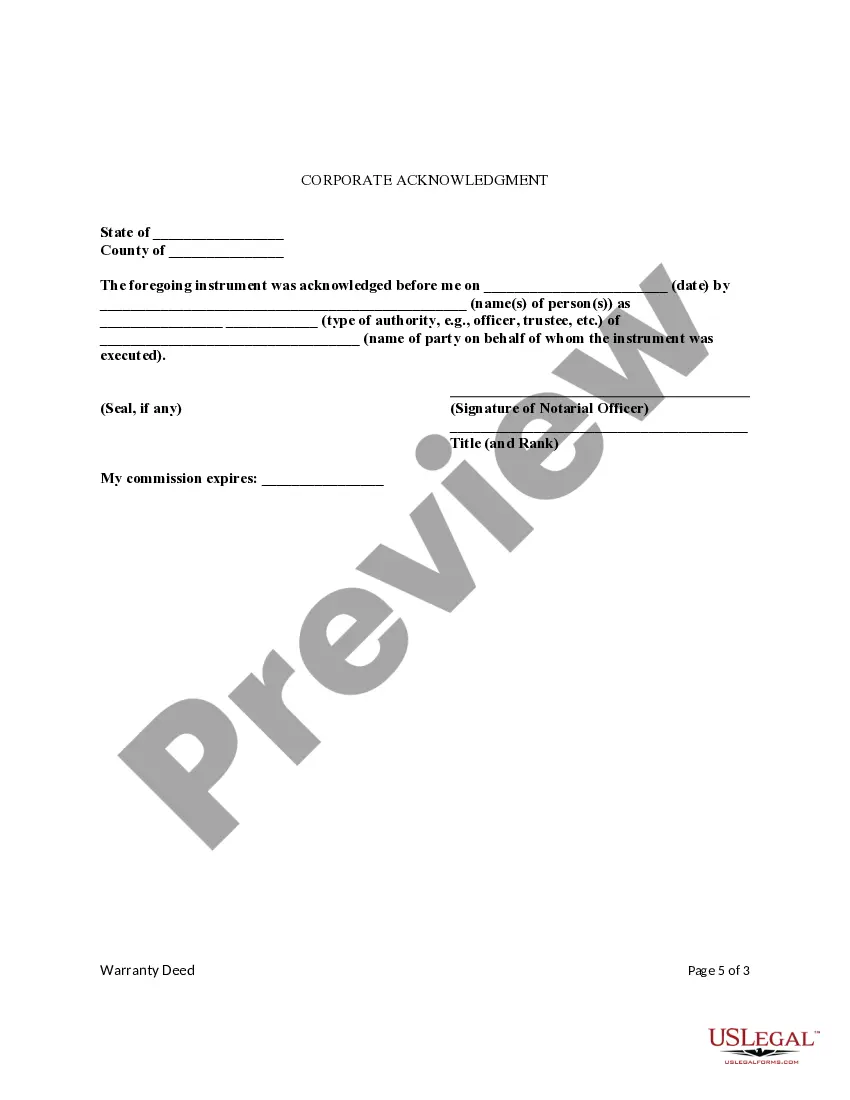

How to fill out Oklahoma Warranty Deed From A Trust As Grantor To An Individual As Grantee.?

Locating a reliable source for the most up-to-date and suitable legal templates is a significant part of navigating bureaucracy.

Identifying the correct legal documents requires precision and diligence, which is why it is essential to obtain examples of Grantor Vs Grantee On Mortgage solely from credible sources, such as US Legal Forms. An incorrect template can consume your time and delay the situation you are facing. With US Legal Forms, you have minimal concerns.

Once you have the form on your device, you can edit it with the editor or print it and complete it manually. Alleviate the stress associated with your legal paperwork. Browse through the extensive US Legal Forms catalog to discover legal templates, assess their applicability to your situation, and download them immediately.

- Use the library navigation or search bar to find your template.

- Examine the form’s description to verify if it meets the demands of your state and locality.

- View the form preview, if available, to confirm that it is indeed the document you seek.

- Return to the search and look for the appropriate document if the Grantor Vs Grantee On Mortgage does not fulfill your needs.

- Once you are confident about the relevance of the form, download it.

- If you are a registered user, click Log in to verify your identity and access your chosen templates in My documents.

- If you haven't created an account yet, click Buy now to acquire the template.

- Select the pricing structure that best fits your needs.

- Proceed with the registration to finalize your purchase.

- Complete your purchase by selecting a payment method (credit card or PayPal).

- Choose the document format for downloading Grantor Vs Grantee On Mortgage.

Form popularity

FAQ

In most cases, a landlord is neither the grantor nor the grantee concerning a mortgage. The landlord typically rents property and does not involve mortgage transactions directly. However, if the landlord is financing the property, they may become a grantor, but this is usually more relevant in lease agreements than mortgage discussions.

In a mortgage, the grantor is the property owner who transfers their rights to another party, while the grantee is the one receiving those rights, typically the lender. This relationship is central to the transaction and illustrates the concept of grantor vs grantee on mortgage. Clearly understanding these roles can prevent issues during the mortgage process. If you have questions, US Legal Forms offers resources to assist you.

Often, the grantor and seller are the same person in a property transaction. The grantor sells the property and transfers ownership to the grantee, who becomes the new owner. Understanding grantor vs grantee on mortgage highlights this relationship and helps clarify the flow of rights and responsibilities during the transaction. For detailed templates, US Legal Forms is a helpful resource.

In a real estate transaction, the seller is typically the grantor. This means they are transferring property rights to the buyer, who is the grantee. Understanding the roles in grantor vs grantee on mortgage can clarify who holds what responsibilities. If you are navigating a property sale, check out US Legal Forms for resources that can assist you.

In most cases, the grantor is synonymous with the owner of the property. The grantor holds the title to the property and has the authority to transfer it to the grantee. When considering grantor vs grantee on mortgage, it’s vital to understand this relationship because ownership dictates responsibilities and rights in the transaction. If you have further questions about ownership rights, consider using the US Legal Forms platform.

Yes, typically, the grantor is the owner of the property when transferring rights in a mortgage. The grantor holds the title and legally conveys that ownership to the grantee. In the scenario of grantor vs grantee on mortgage, the owner, or grantor, is responsible for ensuring the transfer is valid. It is important to establish clear ownership during any mortgage process.

In the context of a mortgage, the grantor is not necessarily the landlord. The grantor is the person who transfers property rights to another party, often the grantee. In many cases, the landlord may also be the grantor if they sell or refinance the property, but this is not always the case. Understanding the roles of grantor vs grantee on mortgage is essential for various real estate transactions.

The strongest form of deed is a general warranty deed, which offers maximum protection to the grantee. It guarantees that the grantor holds clear title to the property and promises compensation if title issues arise in the future. This type of deed establishes trust in the transaction and clarifies the roles of grantor vs grantee on mortgage. Consider using US Legal Forms to access legally sound documentation for your real estate dealings.

The weakest deed is typically the quitclaim deed, which does not guarantee valid ownership. It simply transfers whatever interest the grantor has, which could be nonexistent. This makes it risky for the grantee, who inherits any potential issues. Learning about the implications of grantor vs grantee on mortgage transactions can protect buyers from unexpected complications.

The most undesirable deed is often considered the quitclaim deed due to its lack of protection for the grantee. It offers no assurances about the ownership rights being transferred. Consequently, the grantee may find themselves responsible for title issues after the transaction. Understanding the variations in deeds, including the roles of the grantor vs grantee on mortgage, can help buyers make informed choices.