Probate Deed Of Appropriation

Description

How to fill out Oklahoma Fiduciary Deed For Probate Estate - Testate Or Intestate?

There’s no longer a reason to squander time looking for legal documents to comply with your local state laws.

US Legal Forms has gathered all of them in one location and simplified their availability.

Our website offers over 85,000 templates for various business and personal legal situations categorized by state and purpose.

Complete your payment for your subscription with a credit card or through PayPal to proceed.

- All forms are professionally drafted and validated for correctness, so you can be assured of acquiring a current Probate Deed Of Appropriation.

- If you are acquainted with our platform and already possess an account, ensure your subscription is active before obtaining any templates.

- Log In to your account, select the document, and click Download.

- You can also access all saved documents at any time you need by opening the My documents tab in your profile.

- If you have never utilized our platform before, the procedure will require a few additional steps to finalize.

- Here’s how new users can find the Probate Deed Of Appropriation in our catalog.

- Carefully read the page content to guarantee it includes the sample you are looking for.

- To do this, make use of the form description and preview options if available.

Form popularity

FAQ

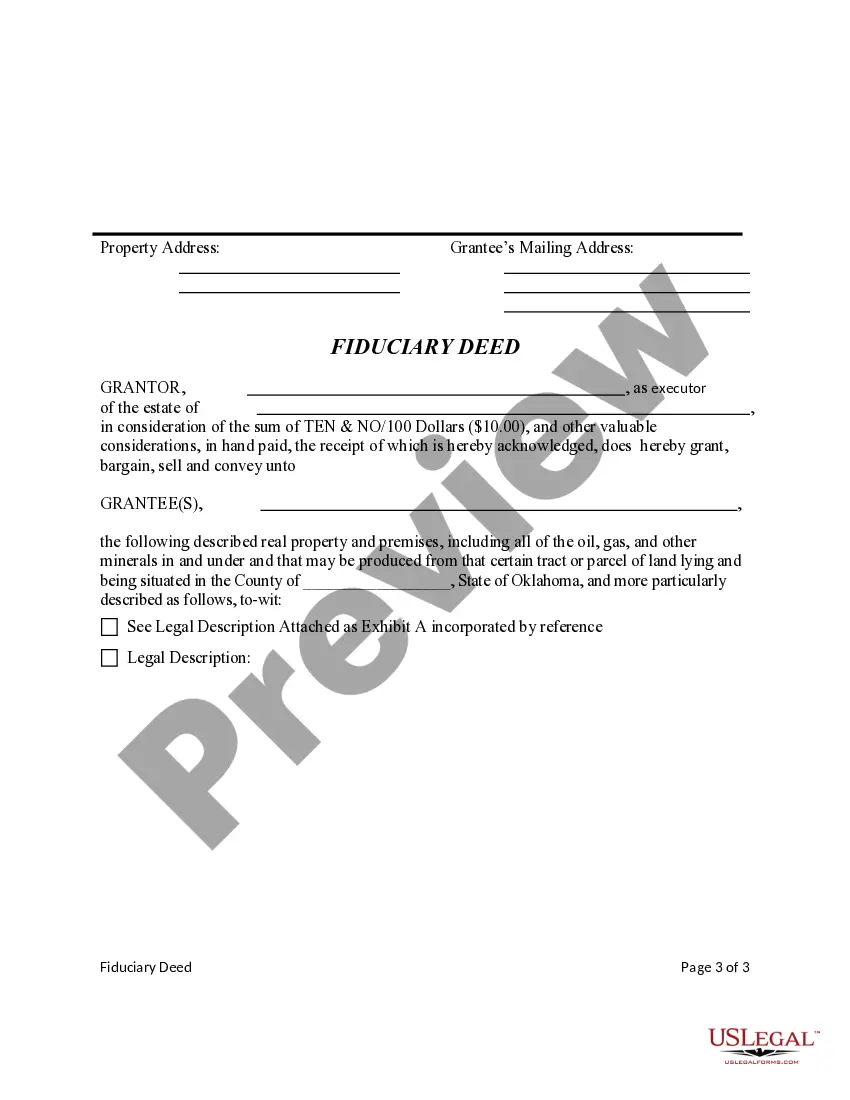

To appropriate assets means taking control of property or funds designated for specific use or beneficiaries. This concept is especially relevant in estate planning and probate, as proper appropriation ensures that assets are distributed according to legal directives. Utilizing a probate deed of appropriation can provide the necessary structure to clarify and implement the intentions of the deceased.

Appropriate in a contract refers to the act of assigning rights, duties, or benefits to specific parties as outlined in the agreement. This term underscores the importance of clarity and mutual consent between involved parties. When dealing with inheritance matters, understanding how to properly execute a probate deed of appropriation can facilitate fulfilling contractual obligations regarding asset distribution.

In the context of a will, to appropriate means to allocate or distribute assets to designated heirs or beneficiaries as specified by the testator. This process is crucial in ensuring that the estate's distribution follows the deceased's wishes. A probate deed of appropriation makes it easier to enforce these specific directives and provides a clear roadmap for asset distribution.

In legal terms, to appropriate means to take something for one's own use, often without the owner's consent. It can refer to assets, funds, or property designated for specific purposes. Within the context of a probate deed of appropriation, this term is vital as it ensures that legal rights are honored and that distributions to beneficiaries align with the decedent's wishes.

An appropriation of shares in an estate refers to the process of designating specific shares or assets to particular beneficiaries according to the terms of a will or trust. This action ensures that beneficiaries receive their entitled portion of the estate. When creating a probate deed of appropriation, clarity is paramount, as it outlines which assets go to whom, minimizing disputes during the probate process.

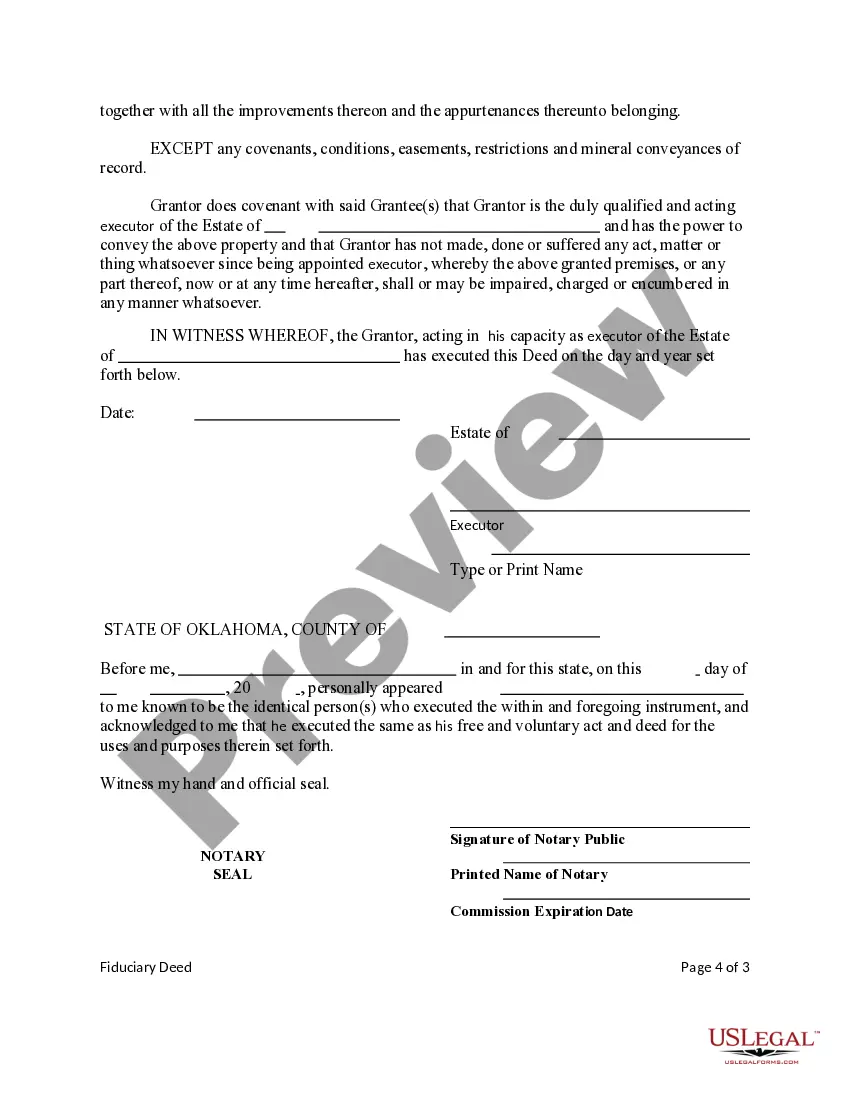

The appropriation of shares in an estate refers to the process of allocating shares to beneficiaries after the probate deed of appropriation is granted. Executors assess the estate and distribute the shares according to the deceased's wishes outlined in the will. This process ensures fair distribution among heirs and provides legal documentation. Resources like US Legal Forms can assist executors in managing these transactions smoothly.

In Australia, not all wills must go through probate; however, the probate deed of appropriation may be required for larger estates or certain circumstances. If a will is contested or significant assets are involved, obtaining a grant of probate becomes essential. It's advisable to consult legal experts or resources like US Legal Forms to understand when probate is necessary in specific situations.

A letter of appropriation for shares formalizes the transfer of shares from the deceased's estate to the beneficiaries following the probate deed of appropriation. This document outlines the specific shares being transferred and confirms the recipient's entitlement. It provides legal clarity and helps to avoid disputes. Utilizing templates from US Legal Forms can simplify drafting this important document.

If an executor fails to distribute the estate after the probate deed of appropriation has been granted, beneficiaries can take action. They may seek legal advice or file a complaint with the probate court. The court can issue an order for the executor to fulfill their duties, and in severe cases, a replacement executor may be appointed. Platforms like US Legal Forms offer insights to navigate such situations effectively.

Typically, once the probate deed of appropriation is granted, the executor must take a few steps before releasing funds. Generally, this process can take a few weeks to a few months, depending on the complexity of the estate. The executor needs to settle debts and taxes, followed by distributing the remaining assets. Using resources like US Legal Forms can expedite the process by providing necessary documentation and guidance.