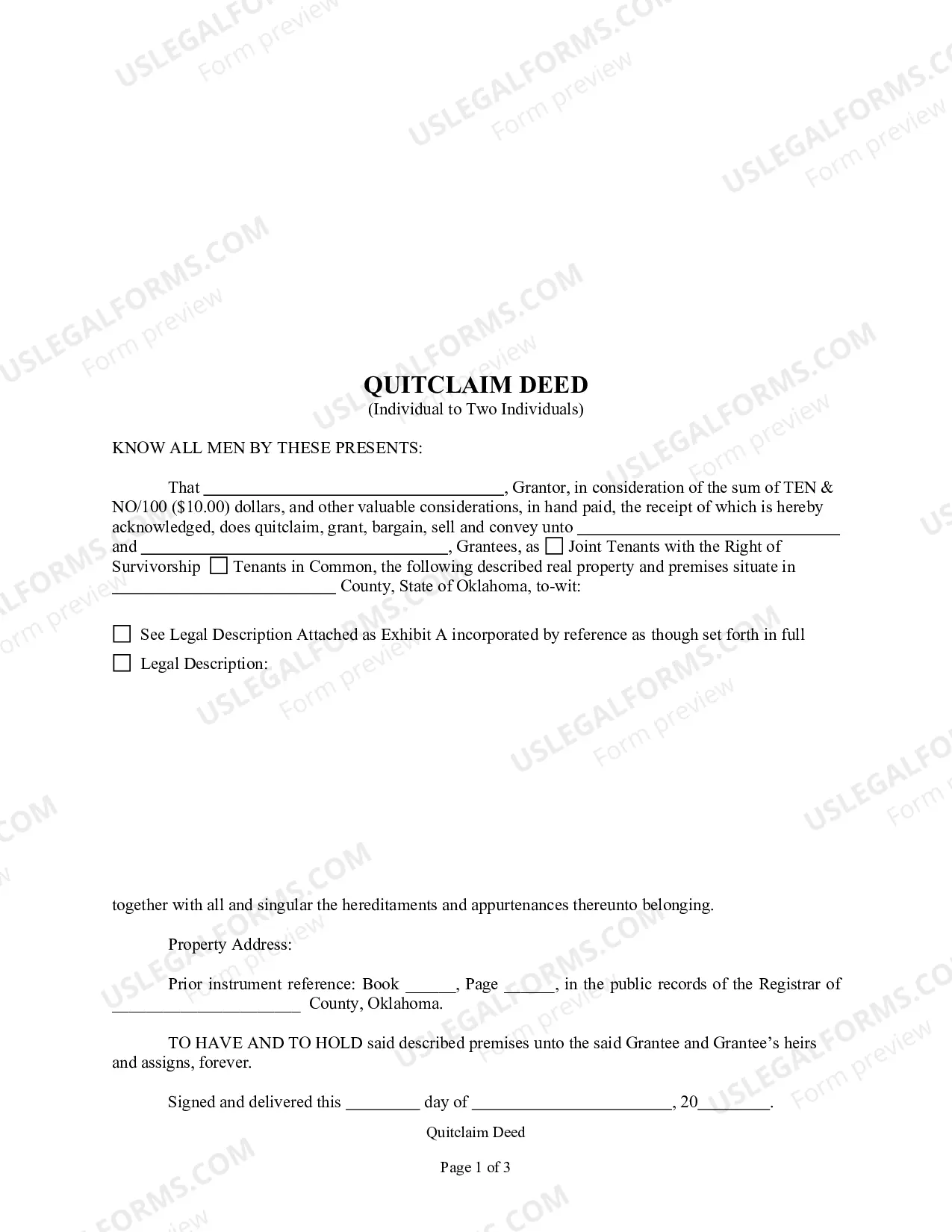

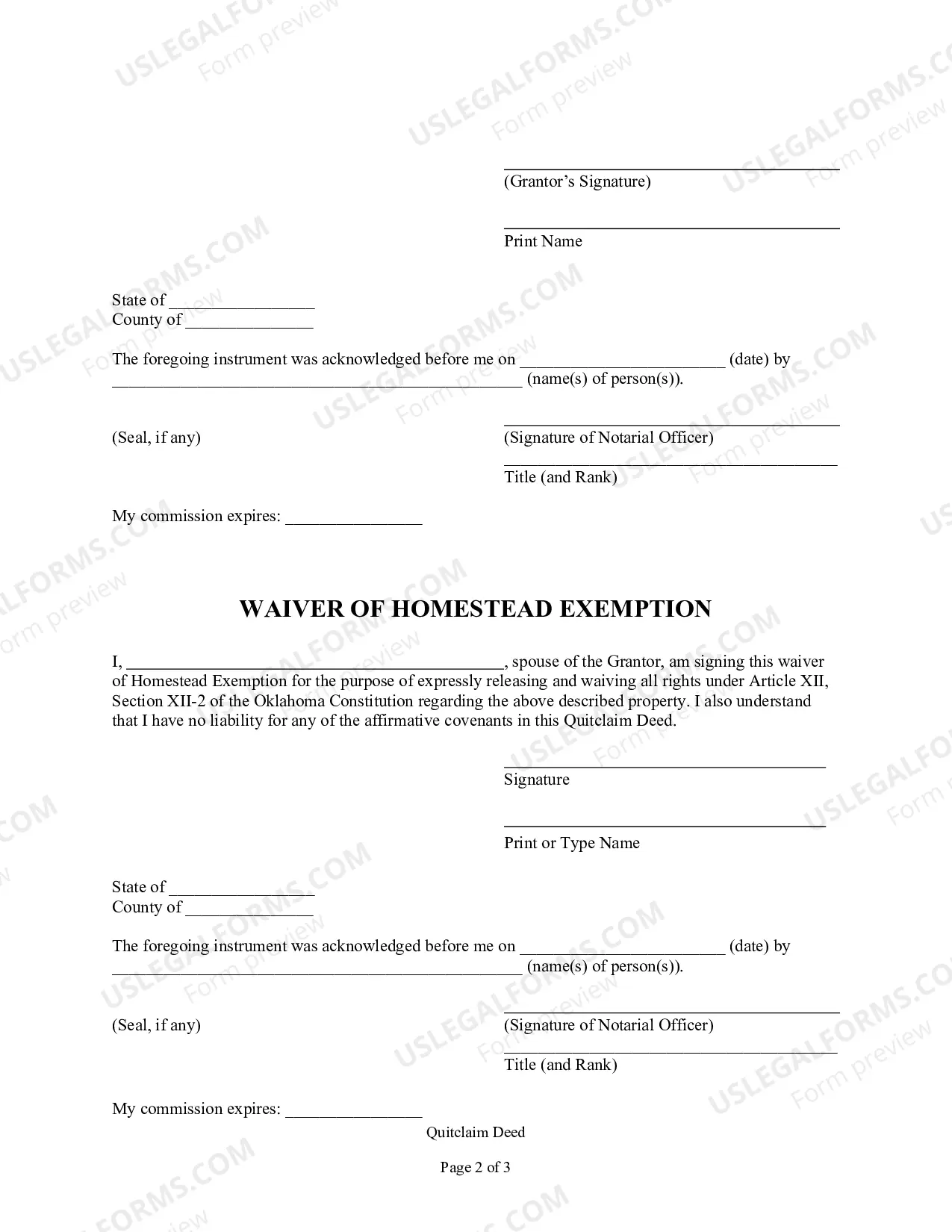

A Joint Tenants Quit Claim Deed Example with Rights of Survivorship is a legal document used to transfer ownership of property between co-owners while ensuring that the surviving owner(s) inherit the deceased owner's share automatically. This type of deed is commonly used in joint tenancy agreements to avoid probate and simplify the transfer process upon the death of one owner. In a joint tenancy arrangement, multiple individuals own equal shares of the property, and each owner has the right to the entire property. If one owner passes away, their share automatically transfers to the remaining owner(s) without the need for probate. This feature is known as the "right of survivorship." Below are a few different examples of Joint Tenants Quit Claim Deeds with Rights of Survivorship: 1. Joint Tenants Quit Claim Deed with Rights of Survivorship for Real Estate: This type of deed is commonly used when two or more individuals jointly own residential or commercial property. It ensures that if one owner dies, the surviving owner(s) will inherit the deceased owner's share. 2. Joint Tenants Quit Claim Deed with Rights of Survivorship for Bank Accounts: In some cases, individuals choose to hold bank accounts together as joint tenants. This deed ensures that the surviving owner(s) will have immediate access to the account funds upon the death of one owner, without the need for probate. 3. Joint Tenants Quit Claim Deed with Rights of Survivorship for Investments: When co-owning stocks, bonds, or other investment assets, individuals may use this deed to guarantee that the surviving owner(s) will gain full ownership of the investments upon the other owner's death. 4. Joint Tenants Quit Claim Deed with Rights of Survivorship for Vehicles: In some states, joint owners of vehicles can utilize this deed to ensure that if one owner passes away, the surviving owner(s) will automatically become the sole owner of the vehicle. It is essential to consult with a qualified attorney or legal professional to prepare and execute a Joint Tenants Quit Claim Deed with Rights of Survivorship. The specifics and requirements may vary based on the jurisdiction and the type of property or asset being transferred.

Joint Tenants Quit Claim Deed Example With Rights Of Survivorship

Description

How to fill out Joint Tenants Quit Claim Deed Example With Rights Of Survivorship?

Accessing legal document samples that meet the federal and state regulations is a matter of necessity, and the internet offers many options to choose from. But what’s the point in wasting time searching for the right Joint Tenants Quit Claim Deed Example With Rights Of Survivorship sample on the web if the US Legal Forms online library already has such templates collected in one place?

US Legal Forms is the most extensive online legal catalog with over 85,000 fillable templates drafted by lawyers for any business and life scenario. They are easy to browse with all documents arranged by state and purpose of use. Our professionals stay up with legislative changes, so you can always be sure your form is up to date and compliant when obtaining a Joint Tenants Quit Claim Deed Example With Rights Of Survivorship from our website.

Getting a Joint Tenants Quit Claim Deed Example With Rights Of Survivorship is quick and easy for both current and new users. If you already have an account with a valid subscription, log in and save the document sample you need in the preferred format. If you are new to our website, follow the instructions below:

- Examine the template utilizing the Preview feature or via the text description to ensure it meets your requirements.

- Browse for a different sample utilizing the search tool at the top of the page if necessary.

- Click Buy Now when you’ve located the right form and select a subscription plan.

- Create an account or sign in and make a payment with PayPal or a credit card.

- Select the best format for your Joint Tenants Quit Claim Deed Example With Rights Of Survivorship and download it.

All documents you locate through US Legal Forms are reusable. To re-download and complete earlier obtained forms, open the My Forms tab in your profile. Benefit from the most extensive and easy-to-use legal paperwork service!

Form popularity

FAQ

What is sold is a tax sale certificate, a lien on the property. Tax sale certificates can earn interest of up to 18 per cent, depending on the winning percentage bid at the auction. At the auction, bidders bid down the interest rate that will be paid by the owner for continuing interest on the certificate amount.

Bid down the lien. By law, you must pay the total taxes, penalties, and interest owed for each property. When you bid for properties, you are bidding on the interest you will receive while you hold the tax lien. Bidding starts at the statutory maximum rate of 18 percent and goes down.

The tax collector is required by state law to hold a tax sale each year for the prior year's unpaid municipal charges. If you do not pay your property taxes, a lien will be sold against the property for any unpaid taxes owed from the previous year. This includes sewer charges or any other municipal charges.

Durable Power of Attorney This is sometimes used with elderly individuals preparing for the onset of Alzheimer's or other debilitating diseases and gives a child broad leverage to manage their affairs even after they become incompetent. A durable power of attorney ends only upon the death of the principle.

Redemption Period If No One Bought the Lien If no one bids on the lien at the tax lien sale, the municipality must wait for six months before starting the foreclosure. (N.J. Stat. Ann. § -86).

CONCLUSION. We hope you learned a lot from Ted's lesson, ?Is New Jersey a tax lien or tax deed state?? New Jersey is a tax lien state, and New Jersey tax lien certificates pay a rate of 18% per annum. The auctions are a down bidding process.

A tax lien is filed against you with the Clerk of the New Jersey Superior Court. CODs are filed to secure tax debt and to protect the interests of all taxpayers.