Transfer On Death Avenue

Description

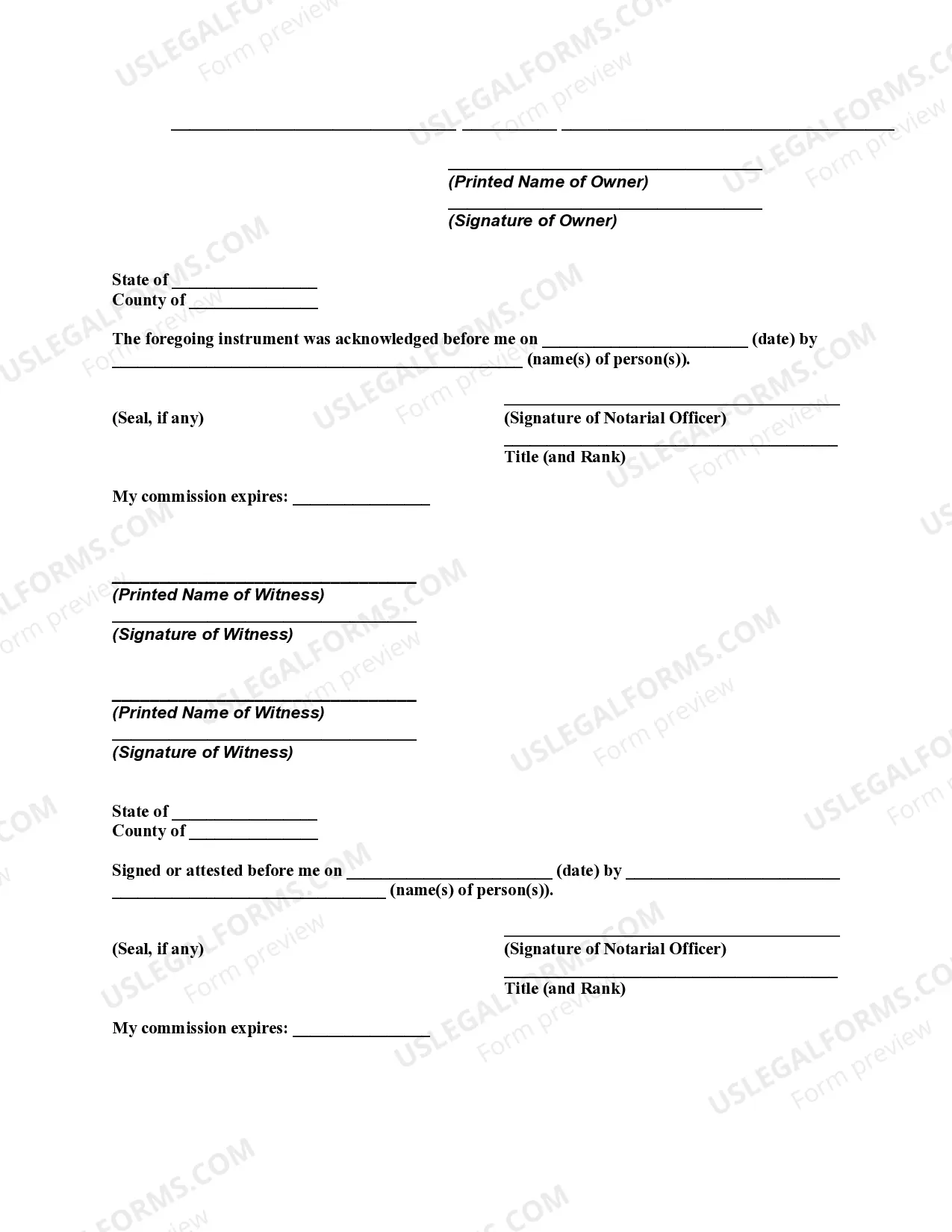

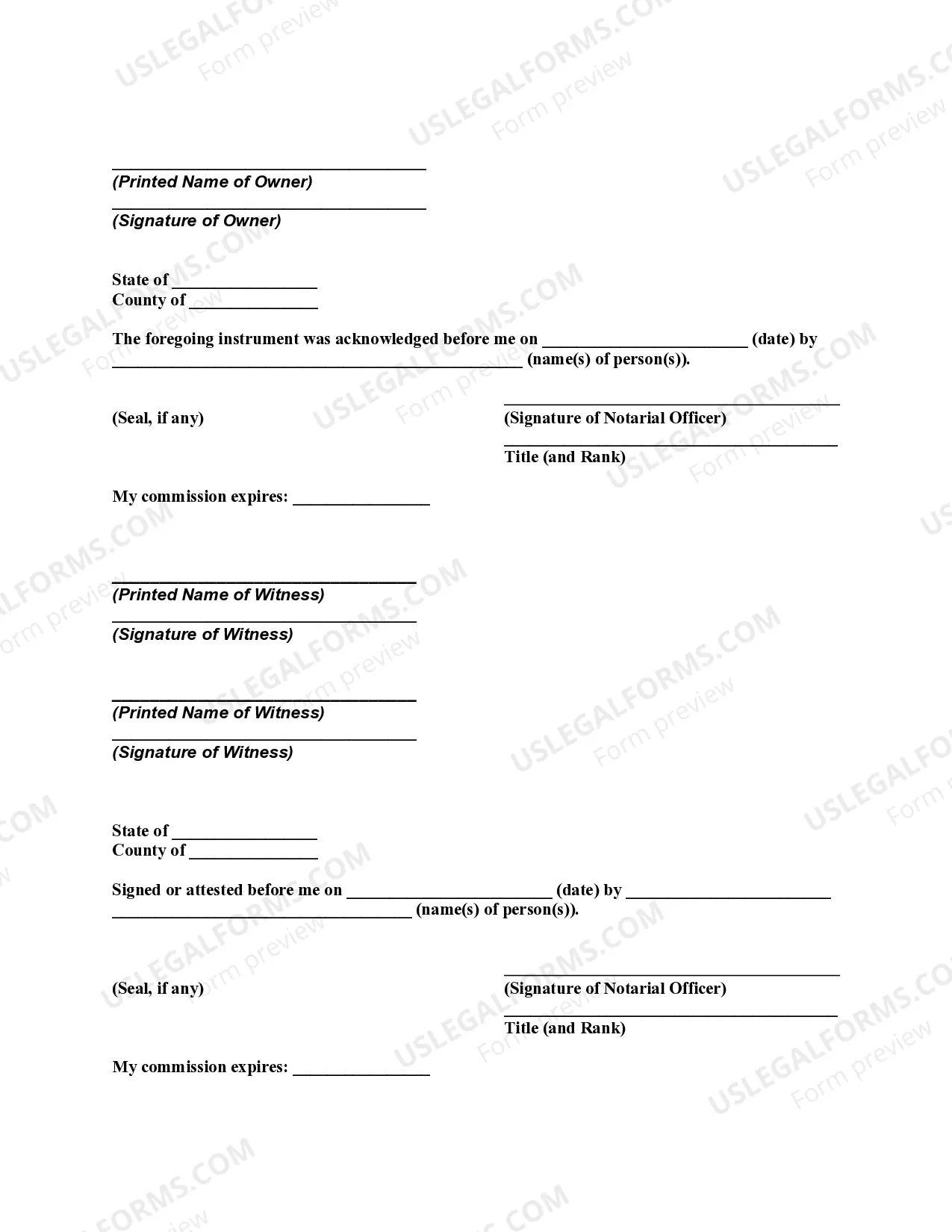

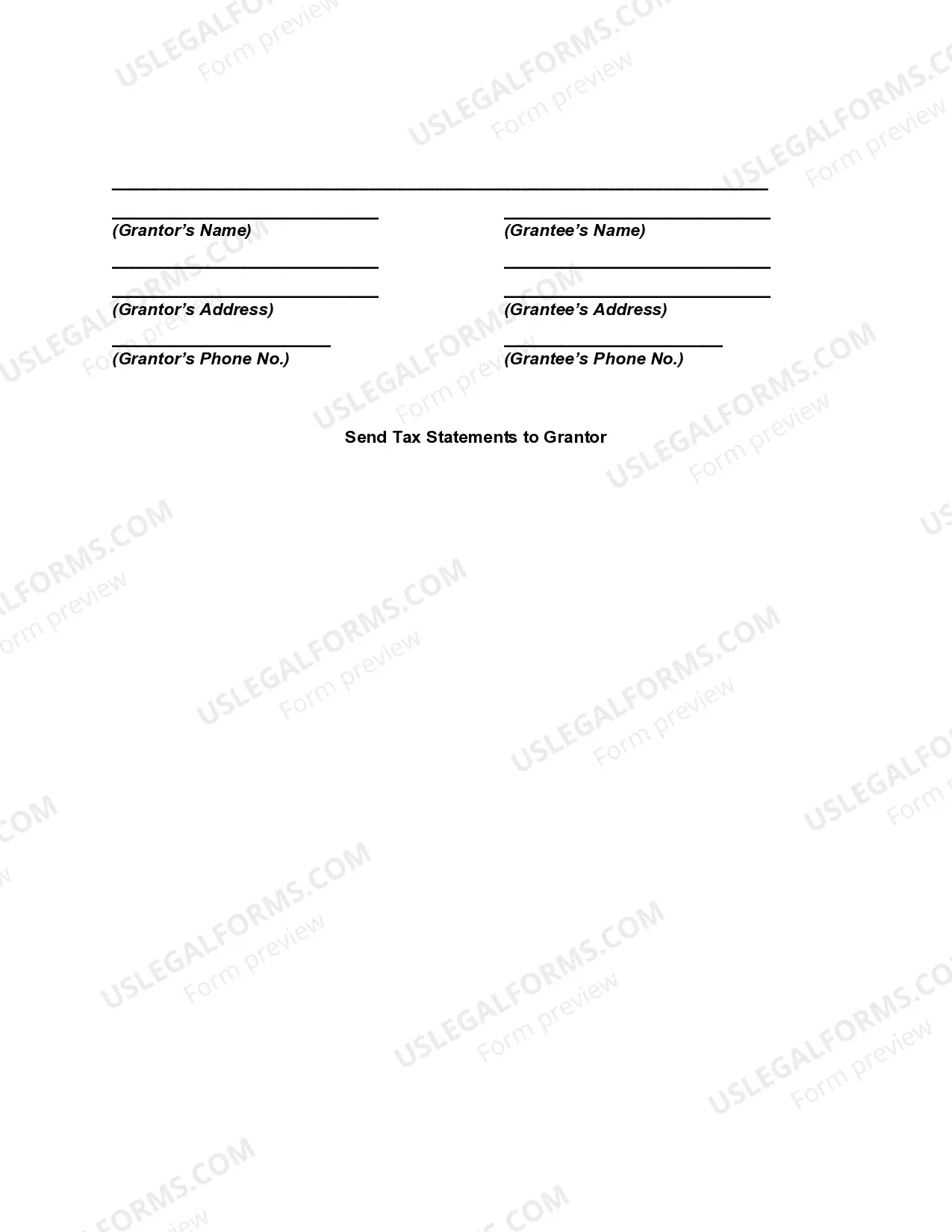

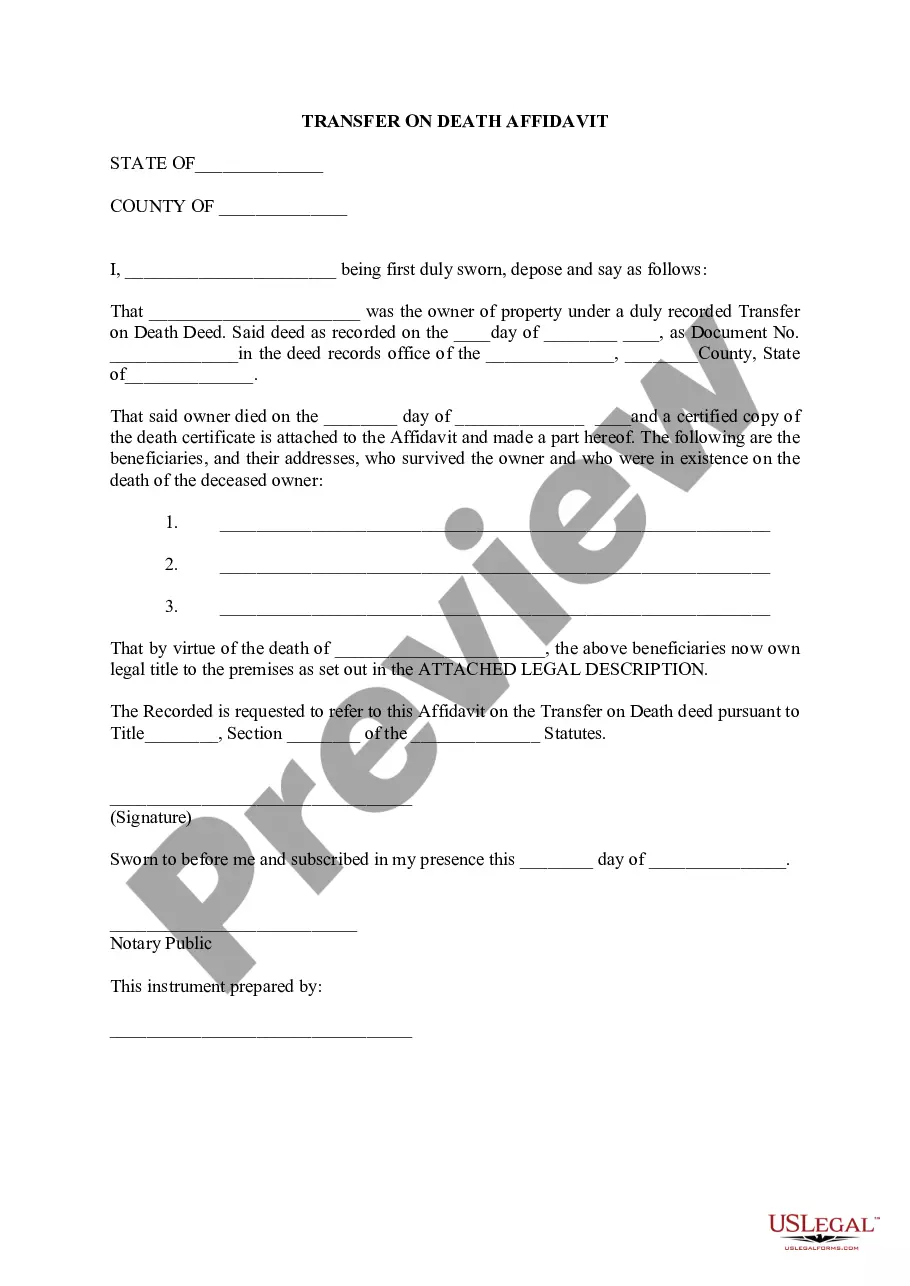

How to fill out Oklahoma Transfer On Death Deed?

- If you are a returning user, log into your account to download your desired form template. Ensure your subscription is active, or renew it as per your payment terms.

- For first-time users, begin by checking the Preview mode and the form description. Verify that you have selected the necessary document that aligns with your local jurisdiction standards.

- If you need an alternative template, utilize the Search tab above to find other forms. Once you find the appropriate one, proceed to the next step.

- Purchase the selected document by clicking the Buy Now button and choosing your desired subscription plan. You will need to create an account to gain access to the entire library.

- Complete your purchase by entering your credit card information or utilizing your PayPal account to finalize your subscription.

- Download your form and save it to your device for further completion. Access it anytime via the My Forms section of your profile.

In conclusion, US Legal Forms offers an efficient solution for individuals and attorneys navigating the process on Transfer on Death Avenue. Their robust library of over 85,000 legal forms ensures that you have access to the resources needed to complete your documents accurately.

Don’t wait any longer—get started now and simplify your legal document needs with US Legal Forms!

Form popularity

FAQ

In Illinois, you must file your transfer on death instrument with the county recorder's office where the property is located. This is crucial for making your transfer on death avenue legally valid. You can find the specific office by visiting your county's official website or contacting them directly. It's essential to ensure that your filing is complete and accurate to facilitate a smooth transfer.

To file a transfer on death instrument in Illinois, start by completing the required form with accurate property details and your beneficiary's information. Next, you must sign the document in front of a notary. After that, you will file the document with the appropriate county recorder’s office. Following these steps ensures that your transfer on death avenue is properly documented.

You can handle a transfer on death avenue without a lawyer, but it's often beneficial to have one. A lawyer can provide guidance through the legal requirements and ensure all paperwork is correctly completed. This ensures that your assets transfer smoothly to your beneficiaries without any complications. Consider consulting a legal expert for peace of mind.

Accounts such as transfer on death accounts are designed specifically to bypass probate. When the account owner passes away, the beneficiary receives the funds directly, ensuring a quicker and smoother transition of assets. By utilizing the transfer on death avenue, you can provide financial peace of mind to your loved ones during a challenging time.

Certain assets naturally bypass probate, providing simplicity during the estate transfer process. For instance, assets held in a transfer on death account, payable-on-death accounts, and jointly owned property automatically transfer to the designated heirs without the complications of probate. Understanding these options can save your heirs time and reduce stress in their difficult moments.

A transfer on death deed has its own set of challenges worth considering. For example, if there are multiple heirs, disputes can arise over the property, complicating the intended straightforward transfer. Additionally, once you execute a transfer on death deed, you usually cannot revoke it without proper legal procedures, limiting your options if your circumstances change.

While transfer on death accounts offer several advantages, they also come with disadvantages. One major concern is that the named beneficiary may have control over the account immediately after your passing, potentially leading to conflicts. Furthermore, if you do not name a beneficiary, the account may go through probate, undermining the very purpose of establishing a transfer on death account.

Transfer on death is not exactly the same as being a beneficiary, although they are closely related concepts. In the context of a transfer on death account, the designated beneficiary automatically receives the assets without going through probate. Essentially, the transfer on death avenue provides a streamlined process for beneficiaries to inherit assets promptly.

To transfer a bank account when someone dies, you typically need to provide the bank with a copy of the death certificate and any relevant documentation, especially if the account was not set as a transfer on death. If the account features a POD designation, the process will be much simpler, as the beneficiary can claim the funds directly. If you find this process overwhelming, platforms like US Legal Forms can guide you through the necessary legal steps.

Setting up a transfer on death bank account is often a straightforward process. You will need to fill out a simple form with your bank, naming a beneficiary who will receive the funds upon your death. Using the transfer on death avenue provides peace of mind, knowing that your funds will directly pass to your loved ones without additional hassles.