Deed Reserving Life Estate Without

Description

How to fill out Oklahoma Warranty Deed To Child Reserving A Life Estate In The Parents?

It’s well known that you cannot transform into a legal expert instantly, nor can you discover how to rapidly compose Deed Reserving Life Estate Without without possessing a specialized background.

Assembling legal paperwork is a lengthy procedure that necessitates specific education and expertise.

So why not entrust the creation of the Deed Reserving Life Estate Without to the experts.

You can revisit your documents from the My documents section at any moment.

If you are a current client, you can simply Log In, and locate and download the template from the same section.

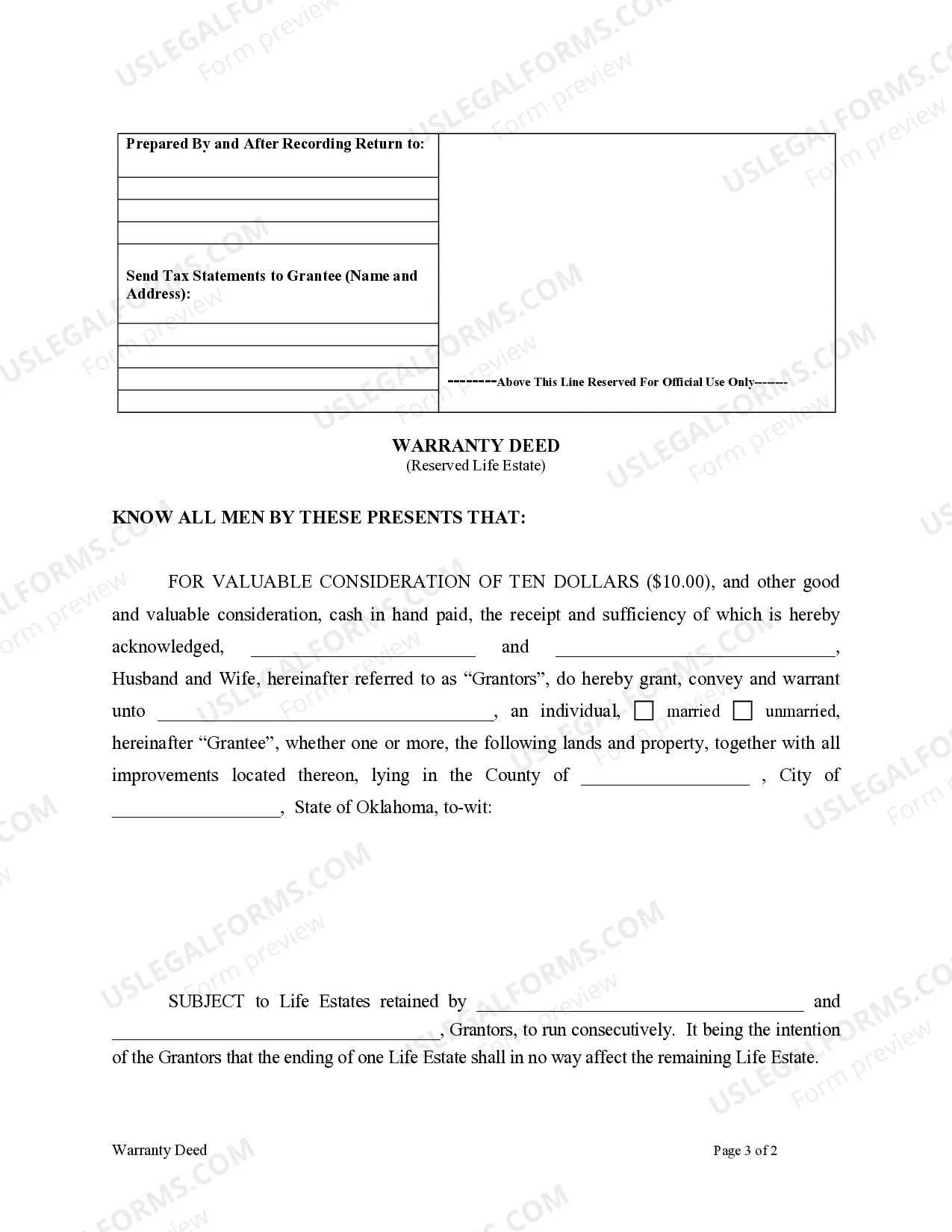

- Locate the document you require by utilizing the search bar at the top of the webpage.

- Preview it (if this feature is available) and review the accompanying description to see if Deed Reserving Life Estate Without aligns with what you’re looking for.

- Initiate your search anew if you need a different document.

- Create a complimentary account and choose a subscription plan to purchase the document.

- Select Buy now. Once the transaction is completed, you can obtain the Deed Reserving Life Estate Without, fill it out, print it, and send or mail it to the relevant individuals or organizations.

Form popularity

FAQ

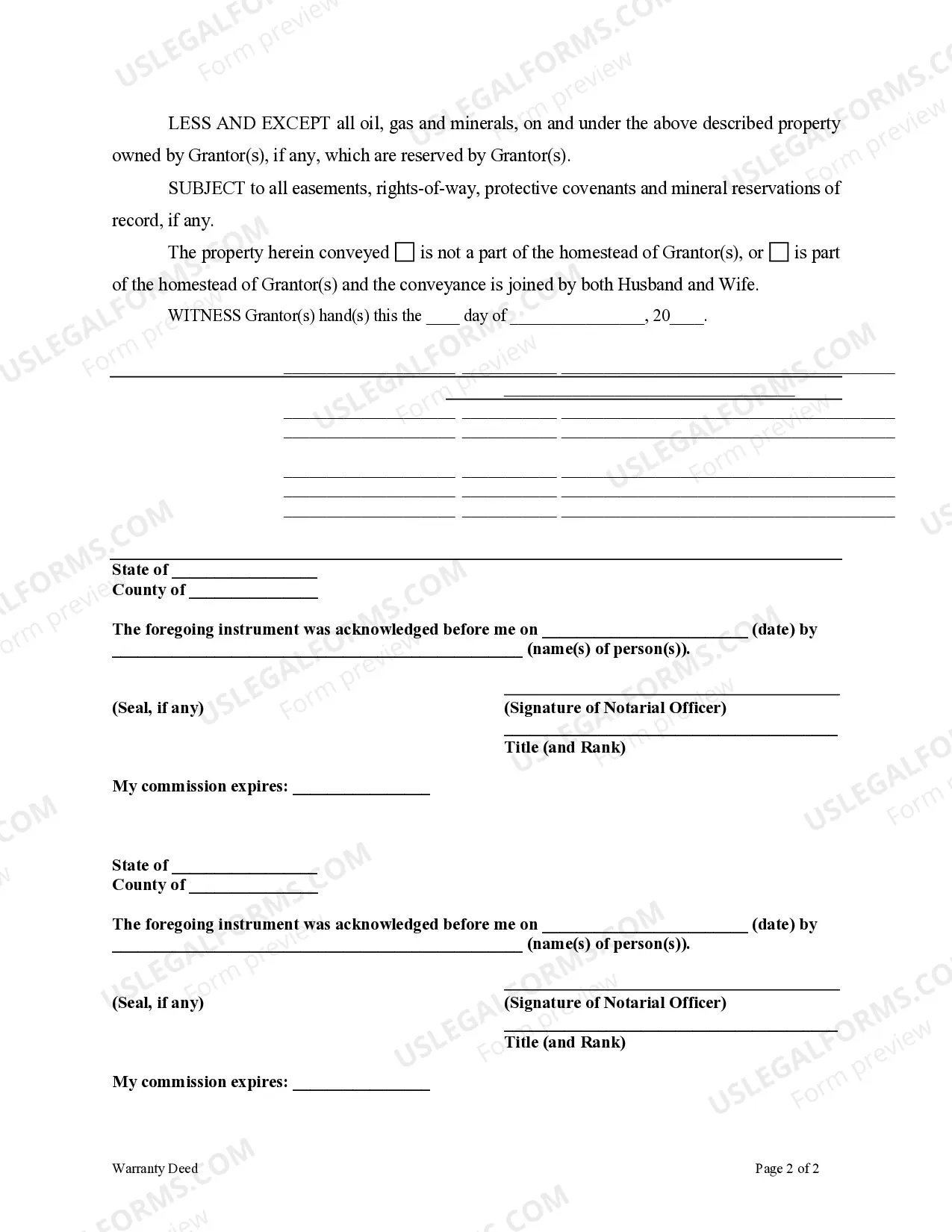

One way to get around the requirement for the remainderman's approval is to use a testamentary power of appointment. This is a clause in a will that allows the life tenant to change the person to whom the property will be bequeathed after death. Invoking a power of appointment won't make the life estate invalid.

There is no simple way to reverse a life estate because a life estate deed is a legal transfer of the title of a property. This is legally binding and the transaction is complete when the life estate is executed. Essentially, in order to reverse a life estate both parties would need to agree to make it happen.

A life estate is a form of ownership that allows one person to live in or on a piece of real property until they pass away. At their death, the real property passes to the intended beneficiary of the original owner.

An additional potential problem with a Life Estate is that it does not offer creditor protection to the beneficiary, so if the heir has a debt or is sued, the creditor or court can come after the house. As you can see, a traditional Life Estate has the potential to create major conflict within a family.

Upon the life tenant's death, the remaindermen receive what is known as a "stepped-up" basis in the property. This means the property's tax basis is its fair market value at the time of the life tenant's death, not the value at which the life tenant originally purchased the property.