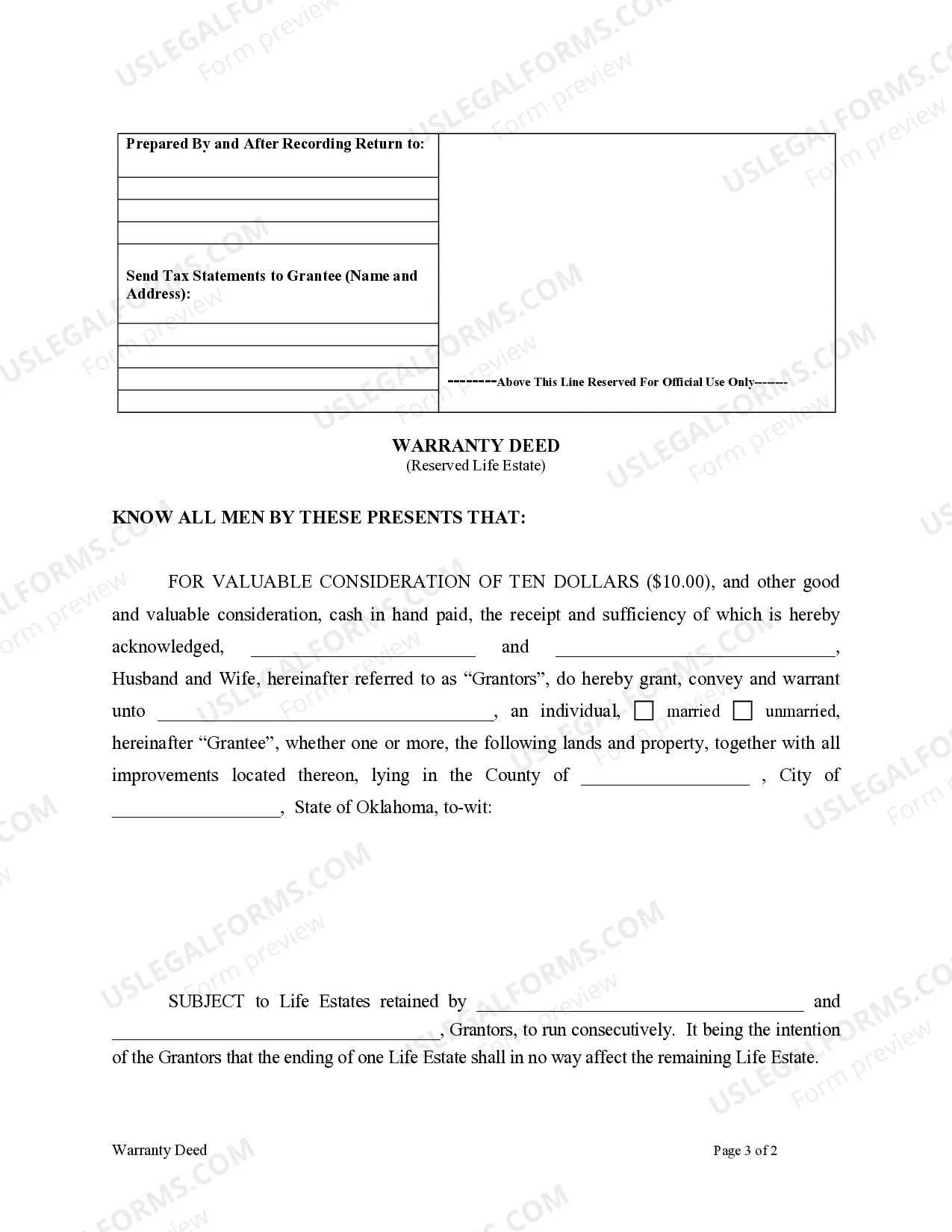

Deed Reserving Life Estate With Condition Subsequent

Description

How to fill out Oklahoma Warranty Deed To Child Reserving A Life Estate In The Parents?

Whether for professional reasons or for private issues, everyone eventually must deal with legal circumstances in their lifetime.

Completing legal paperwork requires meticulous care, beginning with choosing the appropriate form template.

With an extensive US Legal Forms catalog available, you don’t have to waste time searching for the correct template throughout the internet. Utilize the library’s straightforward navigation to find the right form for any situation.

- Locate the template you require using the search bar or catalog browsing.

- Review the form’s details to confirm it corresponds with your situation, state, and county.

- Click on the form’s preview to inspect it.

- If it is not the correct form, return to the search function to find the Deed Reserving Life Estate With Condition Subsequent example you need.

- Obtain the document if it satisfies your needs.

- If you have a US Legal Forms account, simply click Log in to access previously saved templates in My documents.

- If you do not yet have an account, you can acquire the form by clicking Buy now.

- Choose the appropriate pricing option.

- Complete the profile registration form.

- Select your payment method: you may use a credit card or PayPal account.

- Pick the document format you desire and download the Deed Reserving Life Estate With Condition Subsequent.

- Once downloaded, you can fill out the form using editing software or print it and complete it by hand.

Form popularity

FAQ

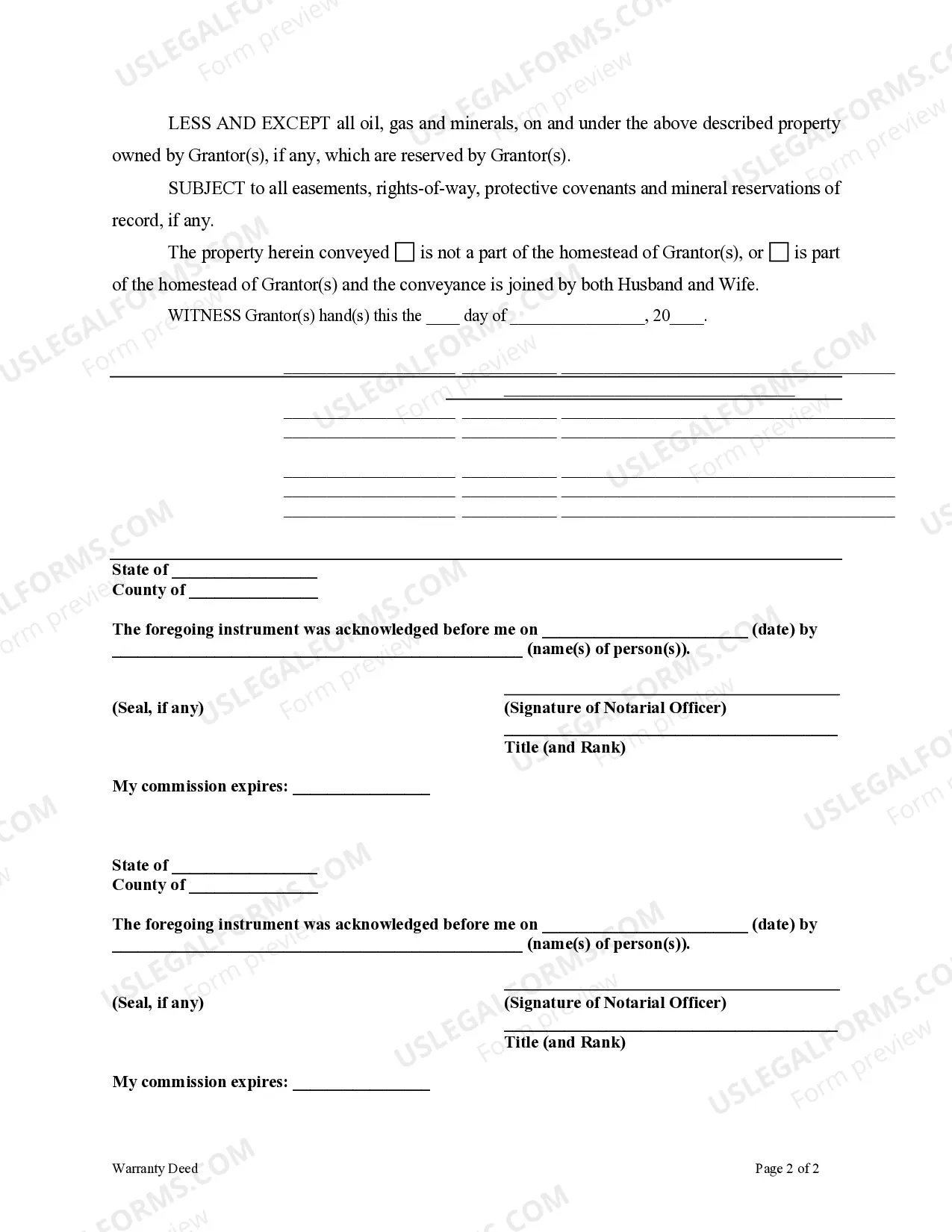

An additional potential problem with a Life Estate is that it does not offer creditor protection to the beneficiary, so if the heir has a debt or is sued, the creditor or court can come after the house. As you can see, a traditional Life Estate has the potential to create major conflict within a family.

Duties Of A Life Tenant While in possession of the land, a life tenant owes the following duties to future interest holders: The duty to pay ordinary taxes on the land and interest on a mortgage: A life tenant has a duty to pay taxes to the extent the property produces income.

There is no simple way to reverse a life estate because a life estate deed is a legal transfer of the title of a property. This is legally binding and the transaction is complete when the life estate is executed. Essentially, in order to reverse a life estate both parties would need to agree to make it happen.

An example of a life estate with Jane Smith as the remainderman is "to John Smith for life, then to Jane Smith." Jane Smith is the remainderman in this example because she is the person inheriting title to the property following the death of John Smith.

When the life tenant dies, the remainderman typically receives a step-up tax basis in the property. This means the remainderman takes ownership of the home at its fair market value at the time of the life tenant's death. This can save the remainderman capital gains tax when the property is sold.