Limited Lliability

Description

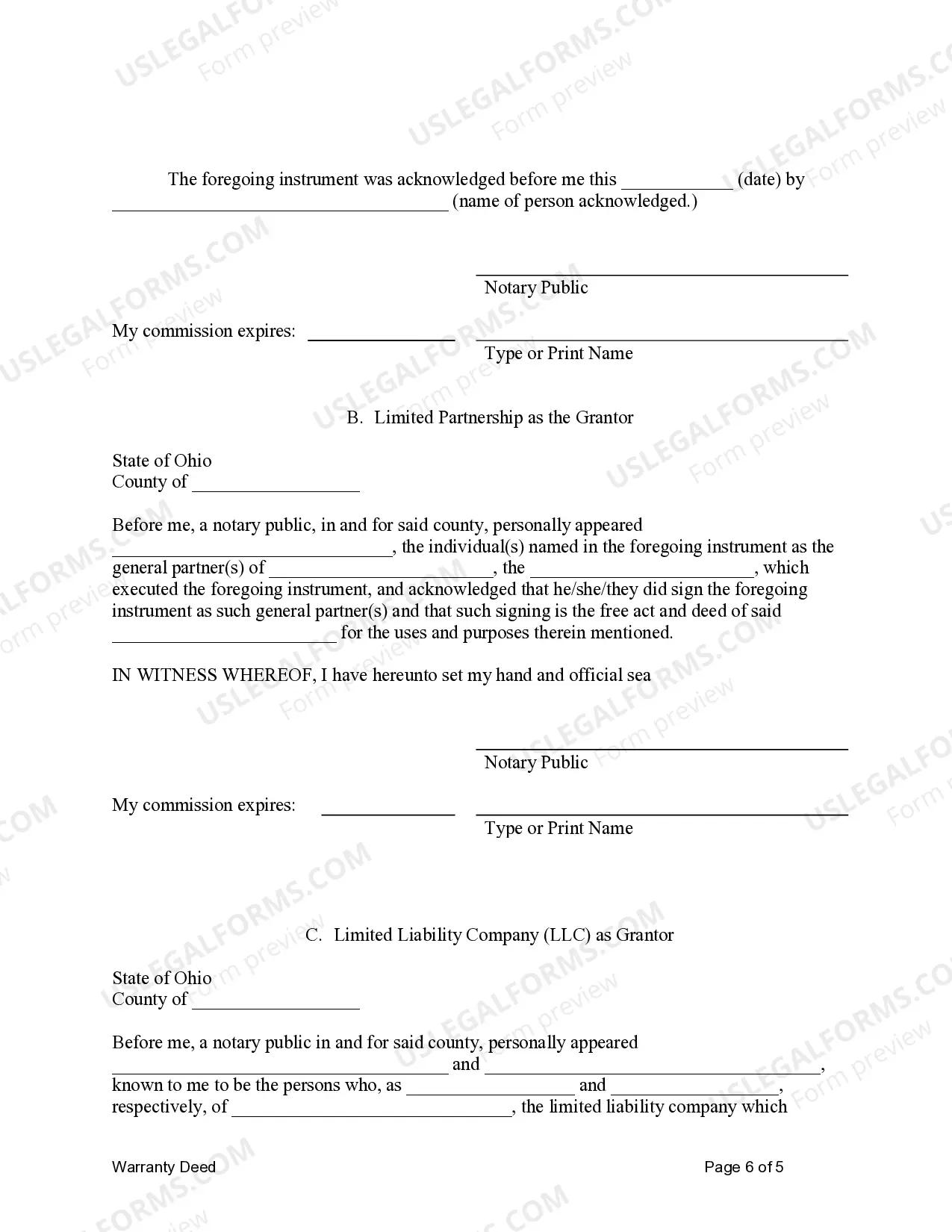

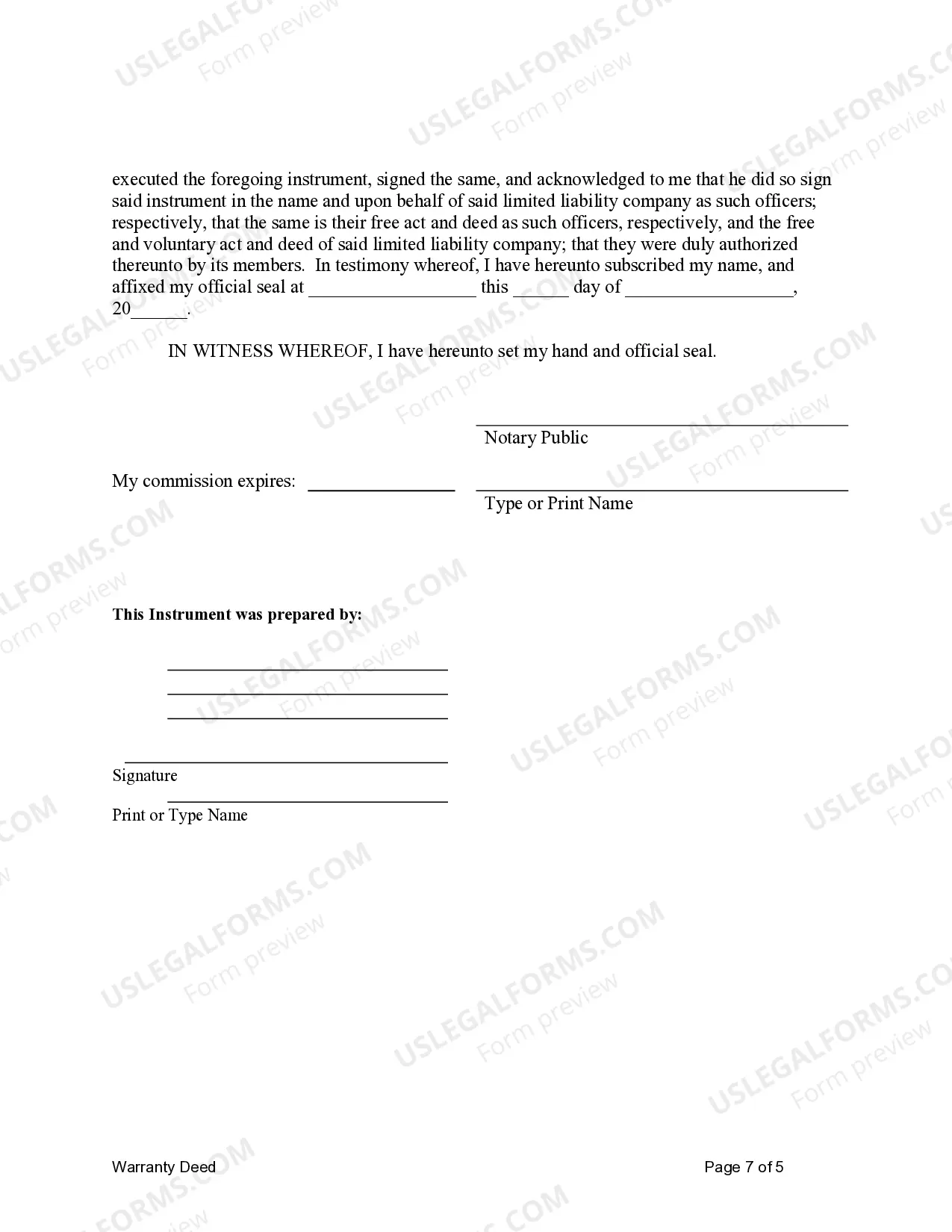

How to fill out Ohio Warranty Deed From Limited Partnership Or LLC Is The Grantor, Or Grantee?

- If you are an existing user, log in to your account and click the Download button next to your chosen template. Ensure that your subscription is active; if not, renew it according to your pricing plan.

- For first-time users, start by exploring the Preview mode to review the form descriptions. Confirm that you select the appropriate template that aligns with your jurisdiction's specifications.

- If you need different templates, utilize the Search tab to find the correct ones based on the inconsistencies observed in your initial search.

- Once satisfied, click on the Buy Now button to select a subscription package that best suits your needs, and create an account to access a wealth of resources.

- Complete your purchase by providing your credit card or PayPal details for the subscription.

- After the transaction, download your selected form and save it for completing later. You can access it any time from the My Forms section in your profile.

Utilizing US Legal Forms ensures that you benefit from a vast collection of over 85,000 tailored legal forms, more than competitors offer at similar prices. Moreover, premium users can access expert assistance for precise document completion.

In conclusion, US Legal Forms empowers users to navigate the complexities of limited liability with ease. Don’t hesitate to explore our library and secure your legal peace of mind today!

Form popularity

FAQ

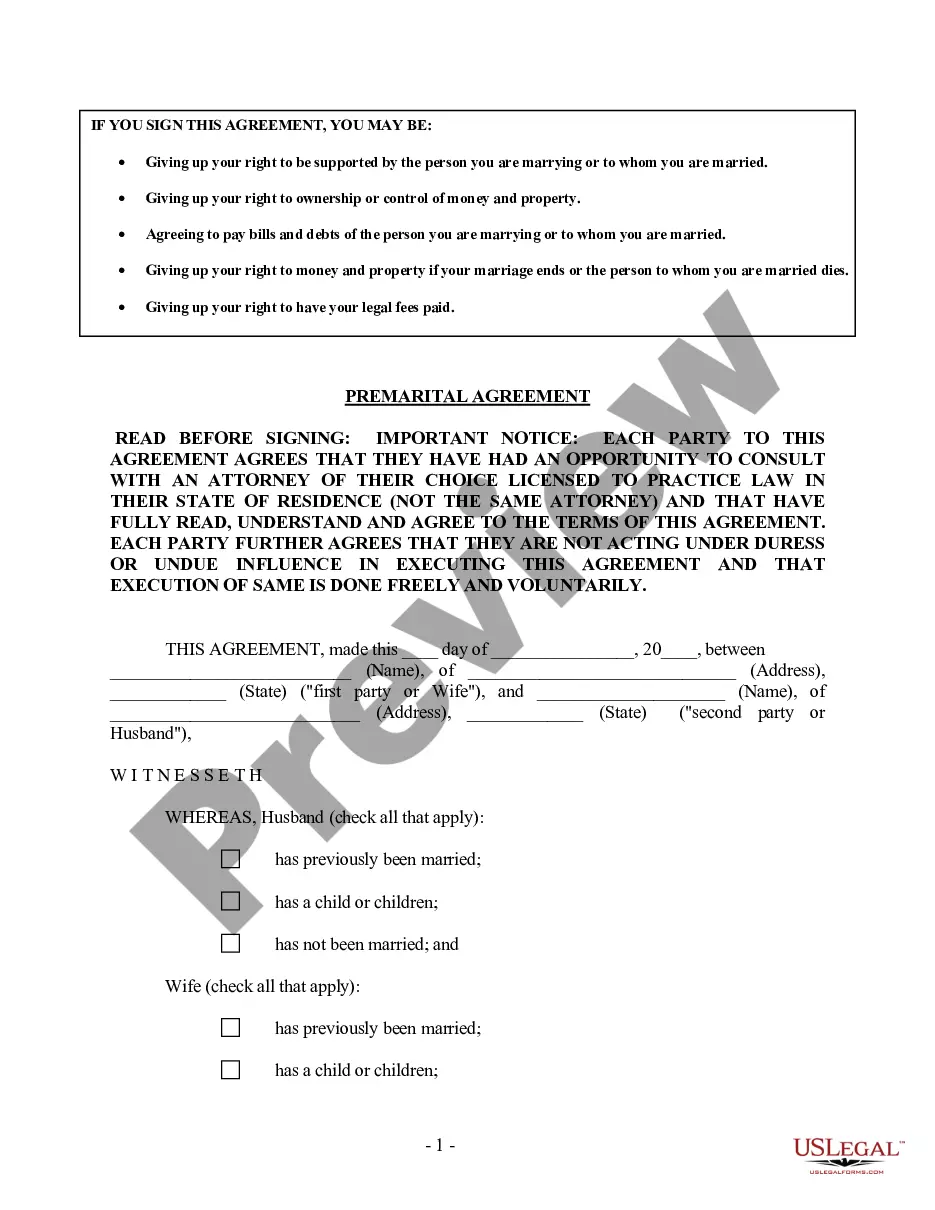

Limited liability means that an owner's financial risk is confined to their investment in the company, protecting personal assets from claims against the business. In contrast, unlimited liability holds owners personally responsible for all business debts, potentially risking personal property. Understanding these two concepts is crucial for entrepreneurs, as limited liability allows for growth and innovation while safeguarding individual assets. You can benefit from useful resources on platforms like US Legal Forms to better grasp these distinctions.

A limited liability company (LLC) can be best described as a distinct legal entity that protects its owners from personal liability. This business structure allows for flexibility in management, taxation, and fewer formalities compared to traditional corporations. An LLC profits and losses can pass through to owners personally, avoiding double taxation. Essentially, an LLC enables individuals to pursue business opportunities securely and effectively.

Limited liability refers to the legal protection that limits an owner's financial responsibility to their investment in a company. In essence, if the business faces legal action or financial failure, the owner's personal assets, like homes or cars, remain untouched. This principle encourages individuals to invest in businesses without the fear of losing their personal wealth. It's a foundational concept in protecting entrepreneurs as they pursue their business endeavors.

A limited liability company (LLC) is a business structure that combines features of partnerships and corporations. It protects owners from personal liability while providing flexibility in management and taxation. For instance, LLCs allow profits to be taxed at the individual level rather than at the corporate level, enhancing financial benefits. This unique combination offers business owners a favorable way to limit personal exposure to risks.

A limited company typically refers to a business structure where owner liability is limited to their investments. For example, 'XYZ Tech Ltd.' operates under this structure, allowing shareholders to limit their financial responsibility. If the company faces bankruptcy, shareholders lose only their investment in the company, not personal assets. This protection under the concept of limited liability is crucial for attracting potential investors.

An example of a limited liability company in the US is 'ABC Catering, LLC.' This business structure allows the owners to enjoy the benefits of lower personal risk while operating a catering service. If ABC Catering, LLC incurs debts or liabilities, the owners are not personally responsible for these obligations beyond their investment in the company. Using a platform like US Legal Forms can streamline the process of establishing an LLC and safeguarding your personal assets.

A common real-world example of limited liability occurs when an individual starts a limited liability company (LLC). In this case, if the business faces legal troubles or debts, the owner’s personal assets, such as their home or savings, remain protected. This means that only the assets owned by the LLC can be used to settle debts, effectively separating personal and business finances. This concept of limited liability encourages entrepreneurship by reducing personal risk.

Determining a reasonable salary for an LLC depends on various factors, such as the nature of your business and your financial situation. Typically, many business owners aim for a salary that reflects the work they perform, often falling within the range of $40,000 to $100,000 annually. It's important to balance your salary with the profits of the business to ensure sustainability and compliance with tax regulations. Tools and resources from UsLegalForms can assist you in calculating an appropriate salary.

You should consider forming an LLC when you start generating income or engaging in regular business activities. An LLC provides limited liability, which protects your personal assets from business debts. If your business grows or if you take on partners, it becomes even more crucial to establish an LLC to safeguard your interests. Evaluate your business needs closely to determine the right time.

Yes, you can create an LLC even if you do not have a running business. Many entrepreneurs establish an LLC to protect their personal assets and prepare for future ventures. This strategy allows you to be ready when opportunities arise, and it showcases your commitment to professionalism. However, remember that an LLC requires ongoing maintenance, so consider your timeline and goals.