Ohio Withholding Poa

Description

Form popularity

FAQ

Yes, Ohio has a dedicated withholding form that employers must use to report state income taxes withheld from employees. This Ohio withholding poa outlines the necessary information for both the employer and the employee, ensuring compliance with state tax laws. It's crucial to fill out this form correctly to avoid any future issues with tax authorities. For easy access and instructions, check out the offerings on uslegalforms.

Yes, Ohio is indeed a mandatory withholding state, meaning employers must withhold state income taxes from their employees' wages. This ensures that taxes are collected throughout the year rather than in a lump sum during tax season. Familiarizing yourself with Ohio withholding poa is essential for compliance and smooth payroll operations. For more detailed information, uslegalforms offers reliable resources.

To find your Ohio withholding number, check your previous tax returns or documents issued by the Ohio Department of Taxation. This number is also included in any recent correspondence related to your withholding account. If you're still having trouble locating it, reaching out to the department can provide clarity. Uslegalforms can also assist with finding and managing your withholding information.

You can find your Ohio withholding account number on tax documents or any correspondence from the Ohio Department of Taxation. This number is crucial for reporting and managing your withholding taxes efficiently. If you cannot locate it, consider contacting the department directly for assistance. Additionally, resources on uslegalforms may help you navigate this process.

Yes, Ohio requires specific state tax forms to ensure proper tax withholding from wages. Employers must submit the Ohio withholding poa to meet state requirements. Filling out these forms accurately helps avoid penalties and ensures that both employers and employees are on the same page regarding tax obligations. For assistance with these forms, look into the tools provided by uslegalforms.

To set up an Ohio withholding account, you must first register with the Ohio Department of Taxation. This process involves completing necessary forms and providing your business information. Once established, your Ohio withholding poa will help streamline your tax obligations, ensuring you withhold the correct amounts from employee wages. For step-by-step guidance, consider using the resources available on uslegalforms.

The Ohio 942 form is specifically designed for employers to report annual withholding tax information. This form provides critical details about the total amount withheld from employee wages throughout the tax year. Understanding the purpose of the Ohio 942 form is vital for accurate tax reporting and maintaining compliance. The uslegalforms platform can assist you in filling out and submitting this form.

Yes, Ohio has a state withholding form known as the Ohio withholding poa. This form is essential for employees and employers as it outlines the amount of state income tax to be withheld from wages. Utilizing the correct withholding form ensures compliance with state tax regulations, making the process smoother for everyone involved. You can easily access this form through the uslegalforms platform.

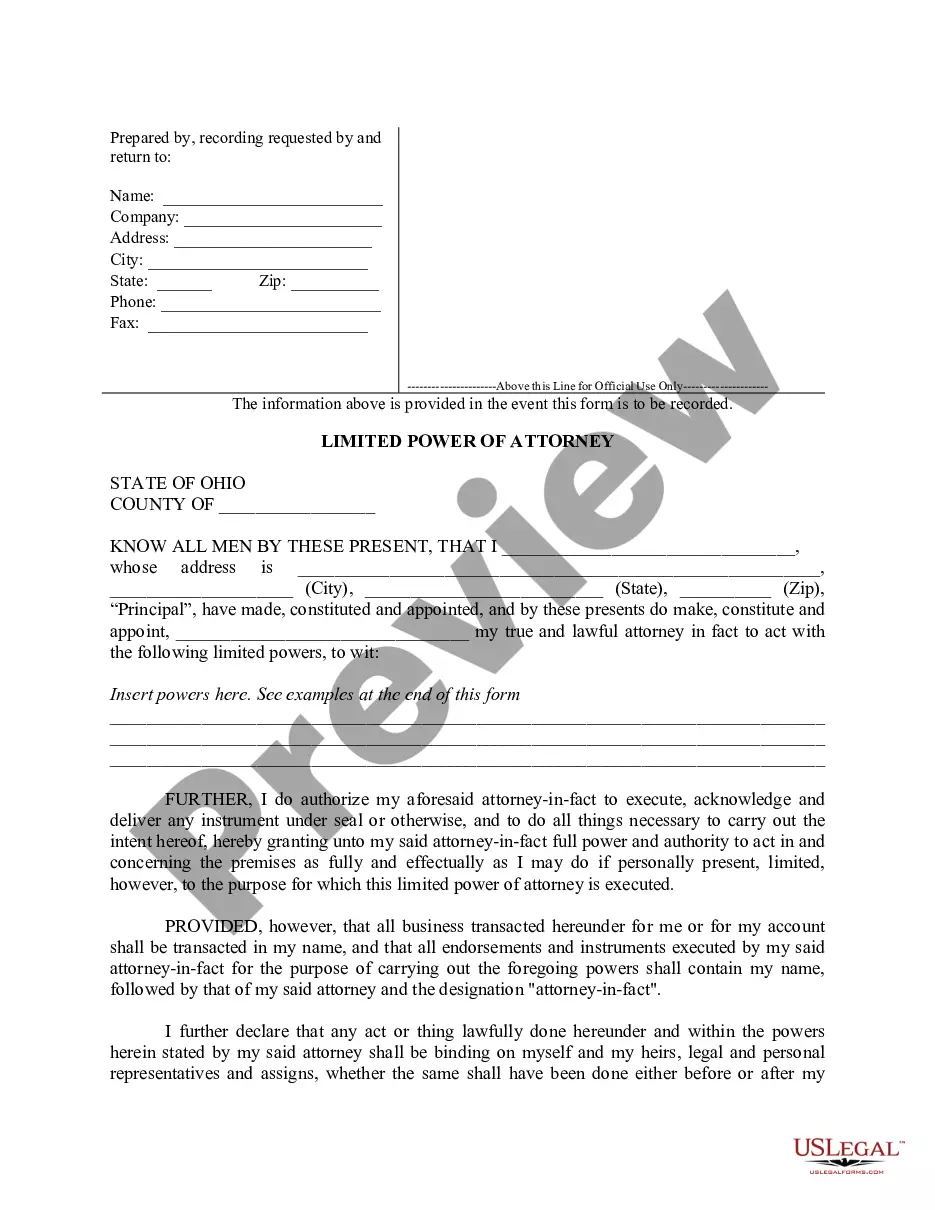

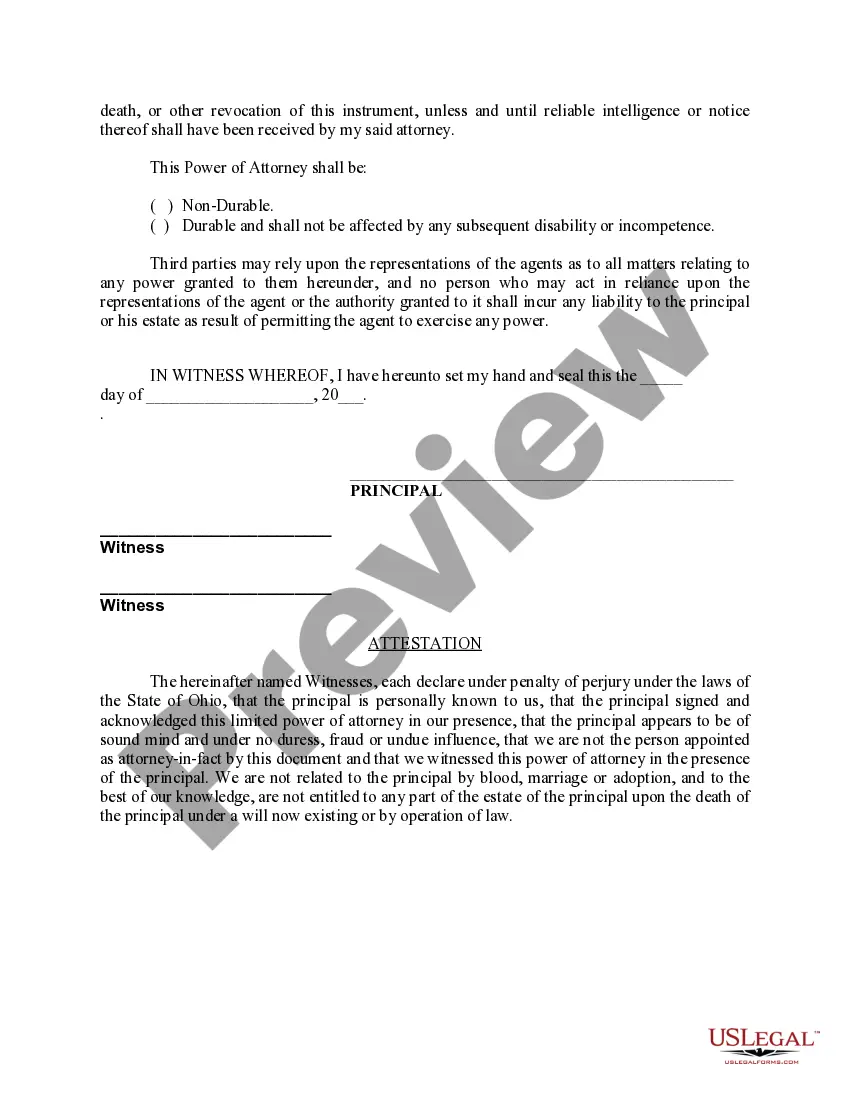

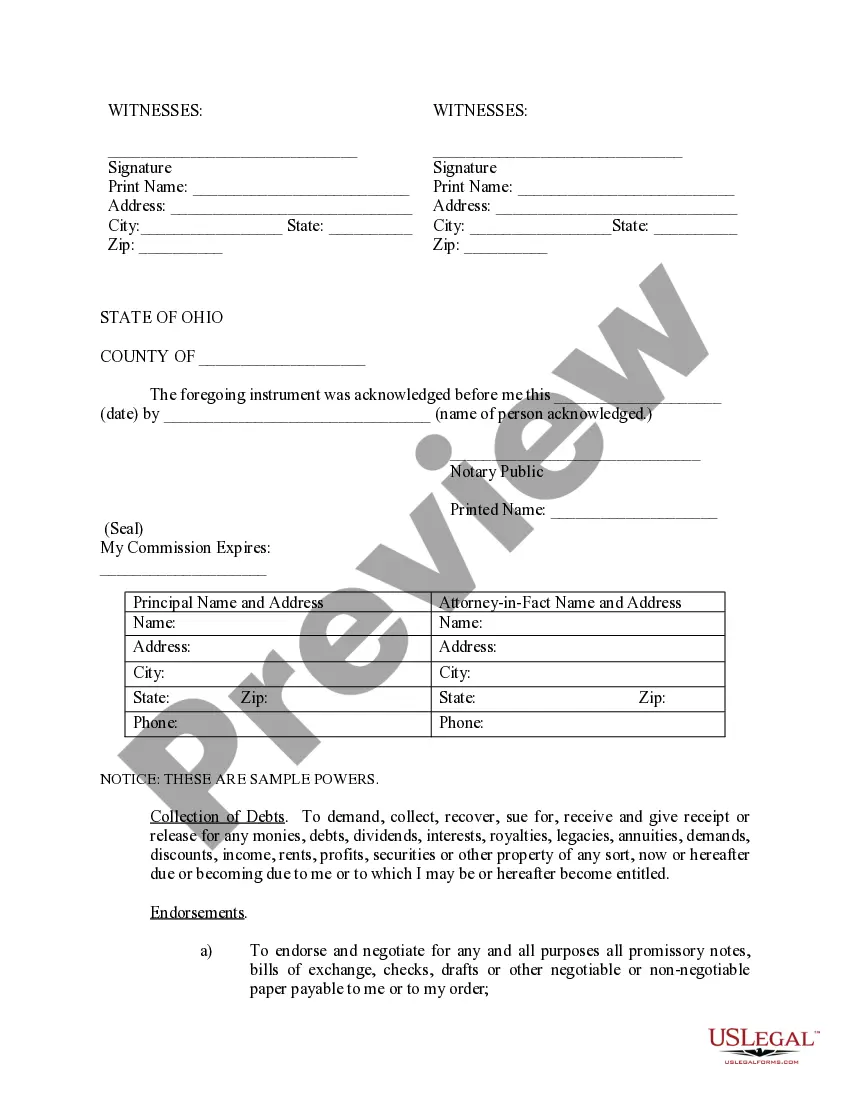

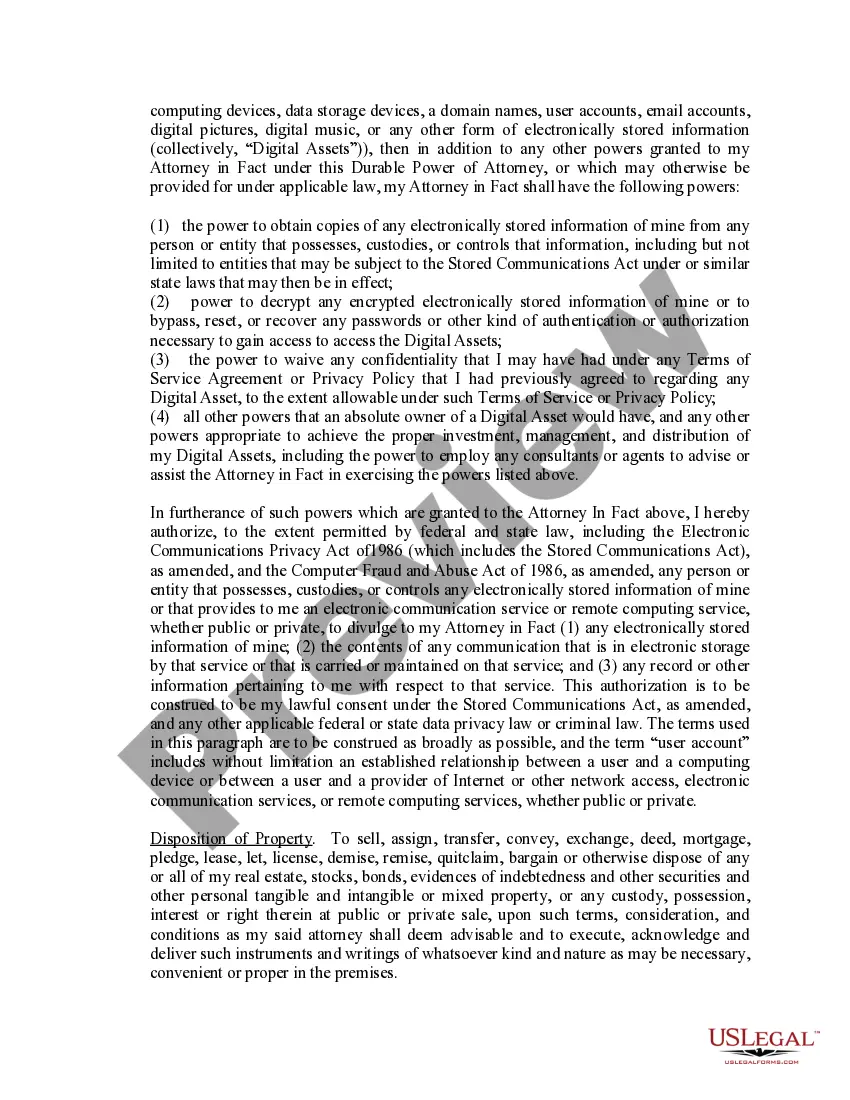

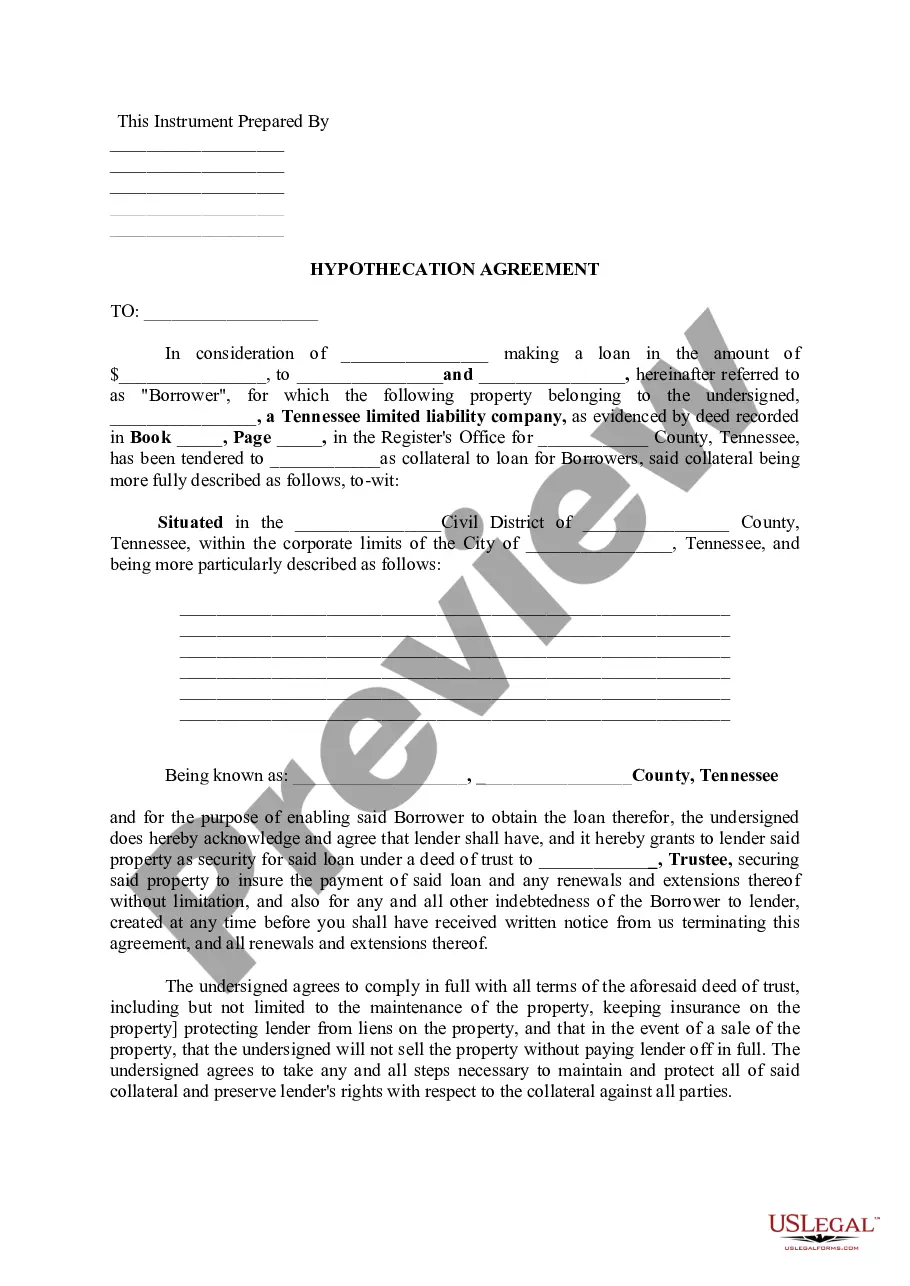

A power of attorney for taxes in Ohio allows you to designate an individual to manage your tax matters. This includes the authority to communicate with tax authorities, file tax returns, and address any tax issues. Utilizing an Ohio withholding POA helps streamline your tax processes, ensuring compliance and timely submissions. USLegalForms offers templates and support to help you set up an effective power of attorney for your tax needs.

The best way to submit your power of attorney (POA) to the IRS is to use Form 2848, Power of Attorney and Declaration of Representative. Complete the form with accurate information and submit it directly to the IRS, either by mail or electronically, depending on the situation. By using your Ohio withholding POA, you ensure your tax matters are in good hands, allowing your appointed representative to act on your behalf. USLegalForms provides useful resources and guidance on correctly filing your POA.