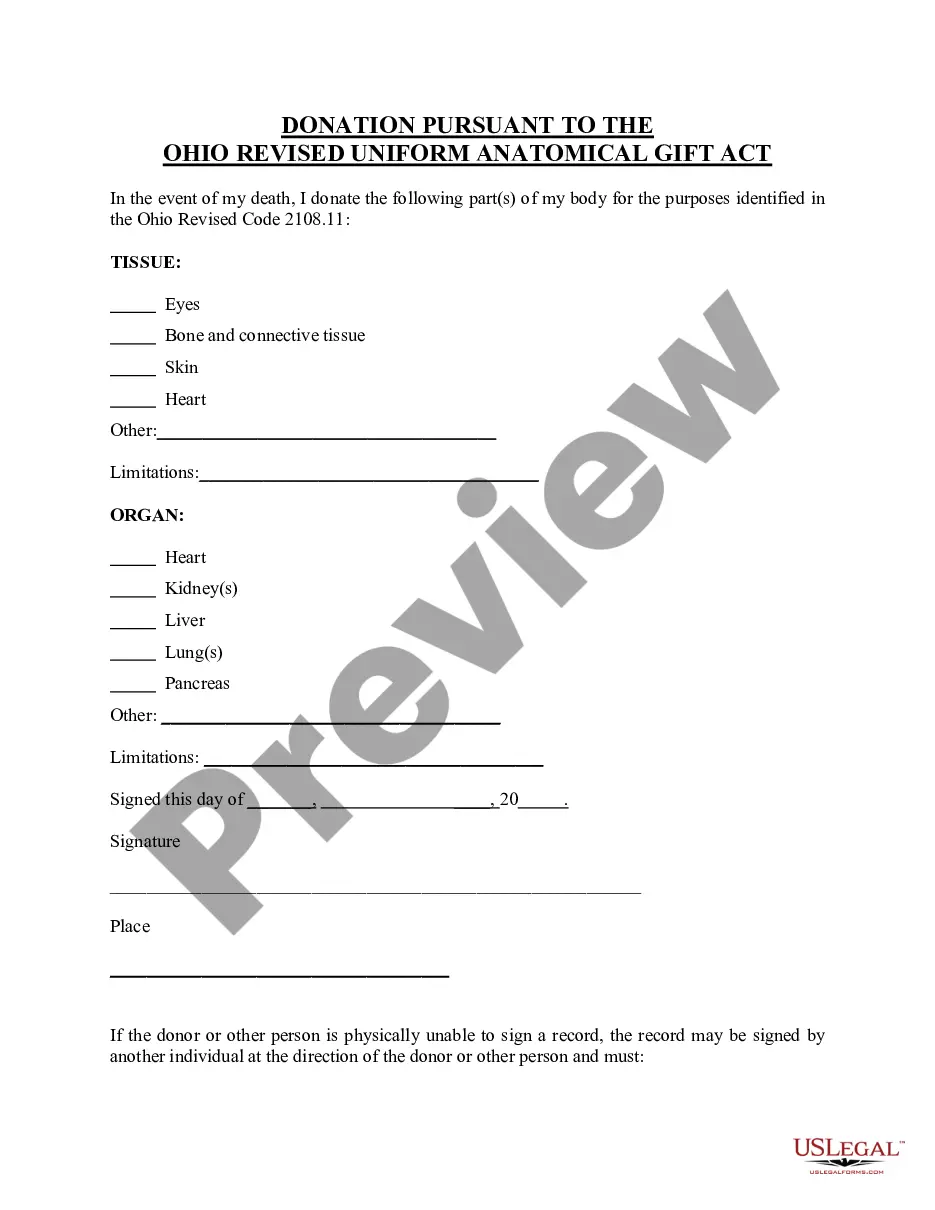

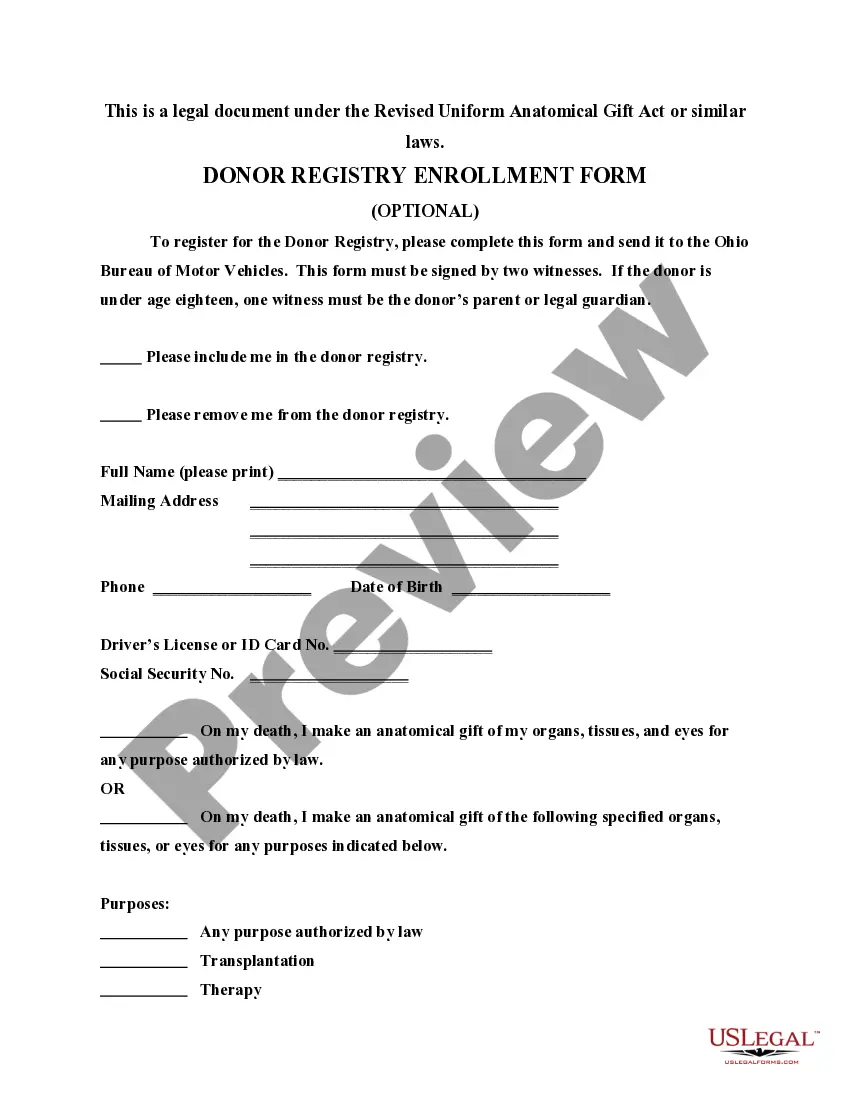

Revised Uniform Anatomical Gift Act Donation with Donor Registry Enrollment Form

Uniform Anatomical Gift - General - Ohio

2108.04 Persons who may make anatomical gift.

An anatomical gift of a donor's body or part may be made during the life of the donor for the purpose of transplantation, therapy, research, or education in the manner provided in section 2108.05 of the Revised Code by any of the following:

(A) The donor, if the donor is an adult or if the donor is a minor and either of the following applies:

(1) The donor is emancipated.

The donor is authorized to apply for a temporary instruction permit issued under section 4507.05 of the Revised Code because the donor is at least fifteen years and six months of age.

An agent of the donor, unless the durable power of attorney for health care or other record prohibits the agent from making an anatomical gift;

A parent of the donor, if the donor is an unemancipated minor;

The donor's guardian.

2108.05 Manner of making anatomical gift.

A donor may make an anatomical gift by doing any of the following:

(1) Authorizing a statement or symbol to be imprinted on the donor's driver's license or identification card indicating that the donor has certified a willingness to make an anatomical gift;

(2) Specifying in the donor's will an intent to make an anatomical gift;

(3) Specifying an intent to make an anatomical gift in the donor's declaration as described in section 2133.16 of the Revised Code;

(4) During a terminal illness or injury of the donor, communicating in any manner to a minimum of two adults, at least one of whom is a disinterested witness, that the donor intends to make an anatomical gift;

(5) Following the procedure in division (B) of this section.

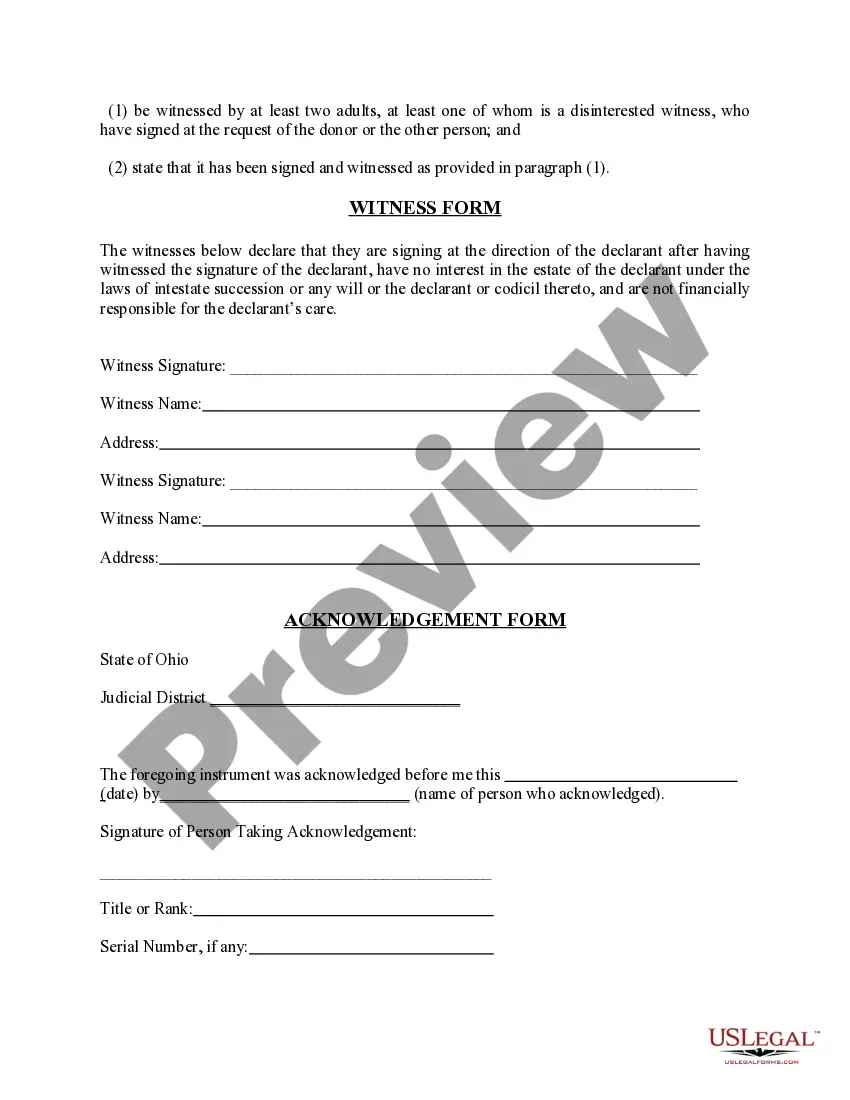

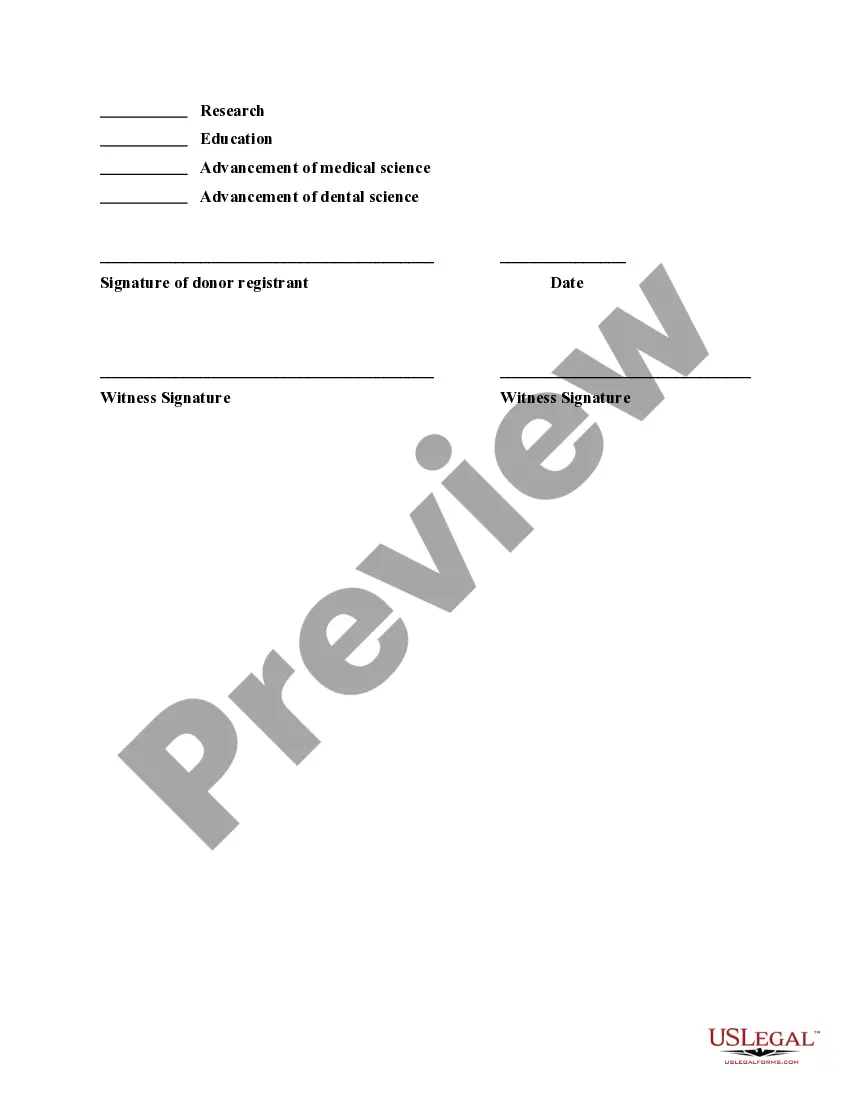

A donor or other person authorized to make an anatomical gift under section 2108.04 of the Revised Code may make a gift by a donor card or other record signed by the donor or other person making the gift or by authorizing that a statement or symbol indicating that the donor has certified a willingness to make an anatomical gift be included in a donor registry. If the donor or other person is physically unable to sign a record, the record may be signed by another individual at the direction of the donor or other person and shall do both of the following:

Be witnessed by at least two adults, at least one of whom is a disinterested witness, who have signed at the request of the donor or the other person;

State that it has been signed and witnessed as provided in division (B)(1) of this section.

Once a donor has authorized a statement or symbol to be imprinted on the donor's driver's license or identification card indicating that the donor has certified a willingness to make an anatomical gift, the donor does not need to recertify the donor's willingness to make an anatomical gift upon renewal of the driver's license or identification card. The authorization shall remain in effect until the donor withdraws that authorization.

Revocation, suspension, expiration, or cancellation of a driver's license or identification card upon which an anatomical gift is indicated does not invalidate the gift.

An anatomical gift made by will takes effect on the donor's death whether or not the will is probated. Invalidation of the will after the donor's death does not invalidate the gift.

2108.06 Amendment of anatomical gift.

An anatomical gift made under section 2108.04 of the Revised Code may be amended by any of the following means:

(1) By a record signed by the donor or other person authorized to make an anatomical gift under section 2108.04 of the Revised Code;

(2) Subject to division (C) of this section, by a record signed by another individual acting at the direction of the donor or other person authorized to make an anatomical gift under section 2108.04 of the Revised Code if the donor or other person is physically unable to sign;

(3) By a later-executed document of gift that amends a previous anatomical gift or portion of an anatomical gift, either expressly or by inconsistency;

(4) By any form of communication during a terminal illness or injury addressed to at least two adults;

(5) By a parent who is reasonably available, if the donor is an unemancipated minor who has died;

(6) If made in a will, by the manner provided for amendment of wills or by any of the applicable means described in divisions (B)(1) to (5) of this section.

An anatomical gift made under section 2108.04 of the Revised Code may be revoked by any of the following means:

(1) By a record signed by the donor or other person authorized to make an anatomical gift under section 2108.04 of the Revised Code;

(2) Subject to division (C) of this section, by a record signed by another individual acting at the direction of the donor or other person authorized to make an anatomical gift under section 2108.04 of the Revised Code if the donor or other person is physically unable to sign;

(3) By a later-executed document of gift that revokes a previous anatomical gift or portion of an anatomical gift, either expressly or by inconsistency;

(4) By any form of communication during a terminal illness or injury addressed to at least two adults;

(5) By a parent who is reasonably available, if the donor is an unemancipated minor who has died;

(6) By the destruction or cancellation of the document of gift, or the portion of the document of gift, used to make the gift, with the intent to revoke the gift;

(7) If made in a will, by the manner provided for revocation of wills or by any of the applicable means described in divisions (B)(1) to (6) of this section.

A record signed pursuant to division (A)(2) or (B)(2) of this section shall do both of the following:

(1) Be witnessed by a minimum of two adults who have signed at the request of the donor or other person;

(2) State that it has been signed and witnessed as provided in division (C)(1) of this section.

2108.07 Refusal to make anatomical gift.

An individual may refuse to make an anatomical gift of the individual's body or part by doing any of the following:

(1) Indicating a refusal in a record signed by either of the following:

(a) The individual;

(b) Another individual acting at the direction of the individual, if the individual is physically unable to sign.

(2) Indicating a refusal in the individual's will, whether or not the will is admitted to probate or invalidated after the individual's death;

(3) Indicating a refusal by any form of communication made by the individual during the individual's terminal illness or injury addressed to a minimum of two adults.

A record signed pursuant to division (A)(1)(b) of this section shall do both of the following:

(1) Be witnessed by at least two adults who have signed at the request of the individual;

(2) State that it has been signed and witnessed as provided in division (B)(1) of this section.

(C) An individual who has made a refusal may amend or revoke the refusal by doing any of the following:

(1) Amending or revoking the refusal in the manner provided in division (A) of this section for making a refusal;

(2) Subsequently making an anatomical gift pursuant to section 2108.05 of the Revised Code that is inconsistent with the refusal;

(3) Destroying or canceling the record evidencing the refusal, or the portion of the record used to make the refusal, with the intent to revoke the refusal.

In the absence of an express, contrary indication by the individual set forth in the refusal, an individual's unrevoked refusal to make an anatomical gift of the individual's body or part bars all other persons from making an anatomical gift of the individual's body or part.

The parent of a deceased unemancipated minor who is reasonably available may revoke a refusal made by the minor.

2108.10 Making anatomical gift after donor's death.

A person authorized to make an anatomical gift under section 2108.09 of the Revised Code may make an anatomical gift by a document of gift signed by the person making the gift or by that person's oral communication that is electronically recorded or is contemporaneously reduced to a record and signed by the individual receiving the oral communication.

An anatomical gift made by a person authorized to make a gift under section 2108.09 of the Revised Code may be amended or revoked orally or in a record by any member of a prior class who is reasonably available. If more than one member of the prior class is reasonably available, the gift made by a person authorized to make a gift under section 2108.09 of the Revised Code may be amended if a majority of the reasonably available members agree to the amendment or revoked if at least half of the reasonably available members agree to the revocation.

A revocation under division (B) of this section shall be effective only if the procurement organization, transplant hospital, physician, or technician knows of the revocation, before an incision has been made to remove a part from the donor's body or before invasive procedures have begun to prepare the recipient.

2108.13 Delivery of document of gift not required.

A document of gift need not be delivered during the donor's lifetime to be effective.

On or after an individual's death, a person in possession of a document of gift or a refusal to make an anatomical gift with respect to the individual shall allow examination and copying of the document of gift or refusal by a person authorized to make or object to the making of an anatomical gift with respect to the individual or by a person to which the gift could pass under section 2108.11 of the Revised Code.

Note: All Information and Previews are subject to the Disclaimer located on the main forms page, and also linked at the bottom of all search results.

Related Ohio Legal Forms