Promissory Note Template Ohio With Collateral

Description

How to fill out Ohio Installments Fixed Rate Promissory Note Secured By Commercial Real Estate?

Whether for corporate reasons or personal issues, everyone must confront legal matters at some stage in their life.

Filling out legal documents requires meticulous care, starting from choosing the appropriate form template.

With a comprehensive US Legal Forms catalog available, you will never need to waste time searching for the appropriate sample online. Utilize the library’s intuitive navigation to find the right template for any scenario.

- For instance, if you select an incorrect version of a Promissory Note Template Ohio With Collateral, it will be rejected once you submit it.

- Thus, it is crucial to have a trustworthy source of legal paperwork like US Legal Forms.

- If you need to acquire a Promissory Note Template Ohio With Collateral example, follow these straightforward steps.

- Obtain the template you require by utilizing the search bar or catalog navigation.

- Review the form’s details to ensure it aligns with your circumstances, state, and county.

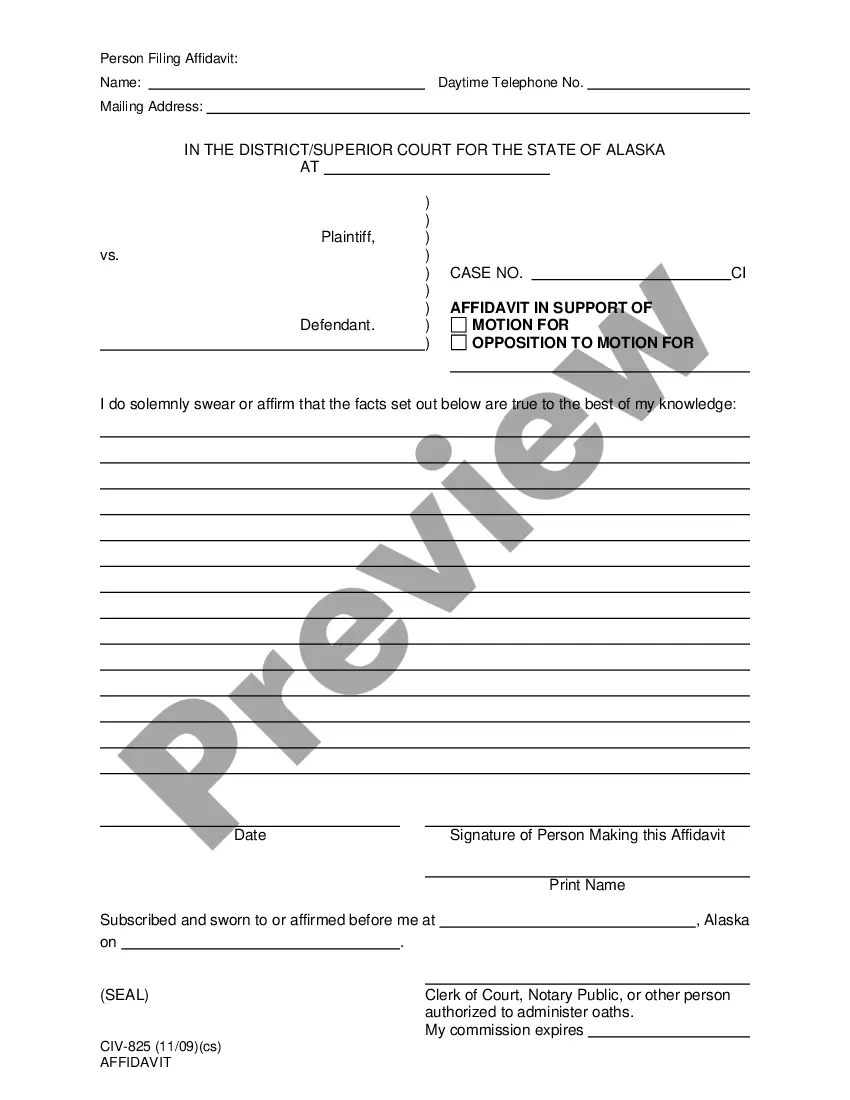

- Click on the form’s preview to inspect it.

- If it is the wrong form, return to the search tool to find the Promissory Note Template Ohio With Collateral example you need.

- Download the template once it fulfills your requirements.

- If you have a US Legal Forms account, simply click Log in to access previously stored documents in My documents.

- If you do not have an account yet, you can acquire the form by clicking Buy now.

- Choose the appropriate pricing option.

- Complete the profile registration form.

- Select your payment option: you can utilize a credit card or PayPal account.

- Choose the document format you desire and download the Promissory Note Template Ohio With Collateral.

- Once it is saved, you can fill out the form using editing software or print it and complete it by hand.

Form popularity

FAQ

The note can include specific details such as the borrower and lender's identities, the loan amount, interest rate, repayment terms, maturity date, and collateral (if any). There are two main categories of promissory notes: secured (with collateral) and unsecured (without collateral).

A Secured Promissory Note is a legal agreement that requires a borrower to provide security for a loan. With this lending document, the borrower puts forth their personal property or real estate as collateral if the loan isn't repaid.

At its most basic, a promissory note should include the following things: Date. Name of the lender and borrower. Loan amount. Whether the loan is secured or unsecured. If it's secured with collateral: What is the collateral? ... Payment amount and frequency. Payment due date. Whether the loan has a cosigner, and if so, who.

A home mortgage secures a promissory note with the title to the property as collateral. This is done in case the lender ever needs to foreclose and sell the property because the homeowner didn't make their loan payments. Your lender will keep the original promissory note until your loan is paid off.

A Secured Promissory Note is a legal agreement that requires a borrower to provide security for a loan. With this lending document, the borrower puts forth their personal property or real estate as collateral if the loan isn't repaid.