Note Residential Real Forbes

Description

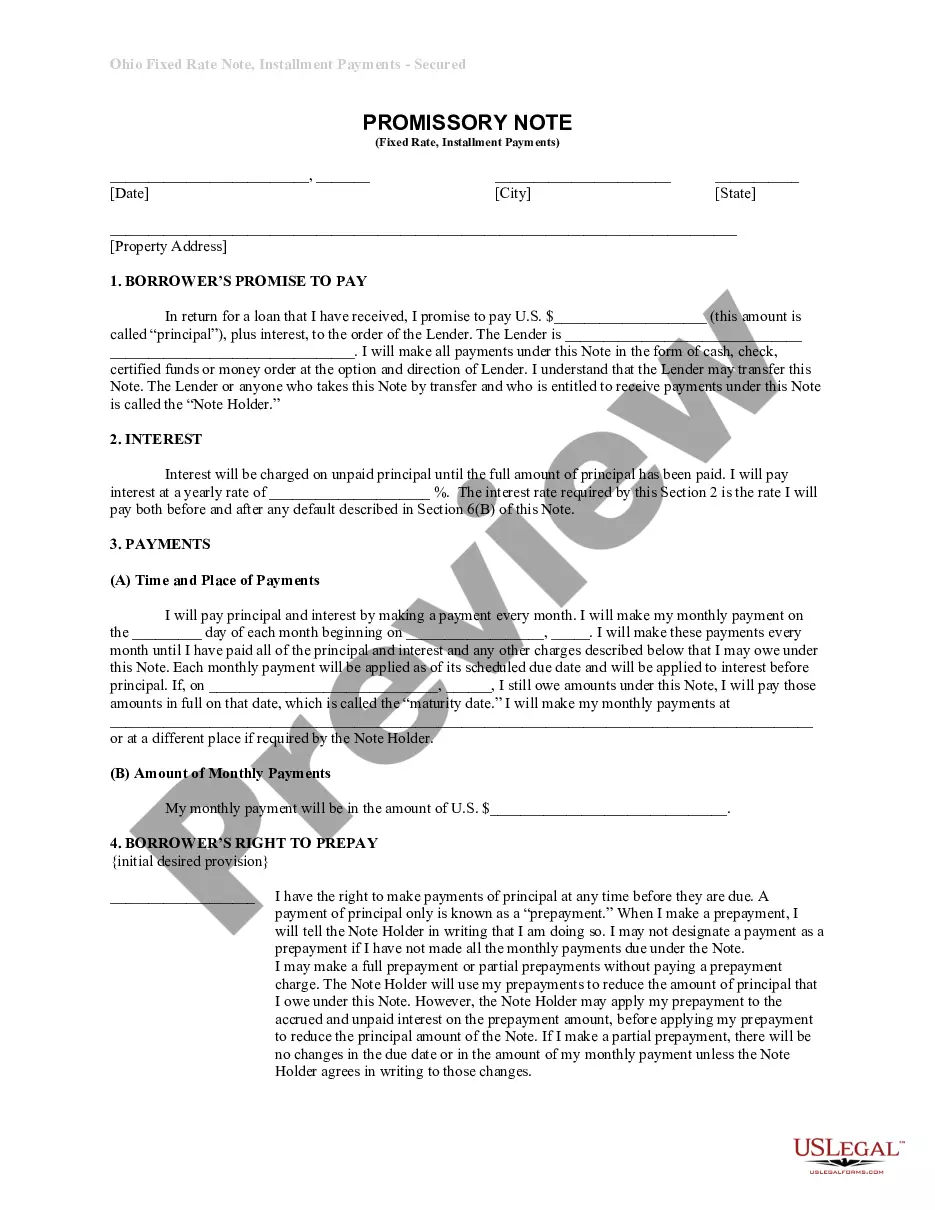

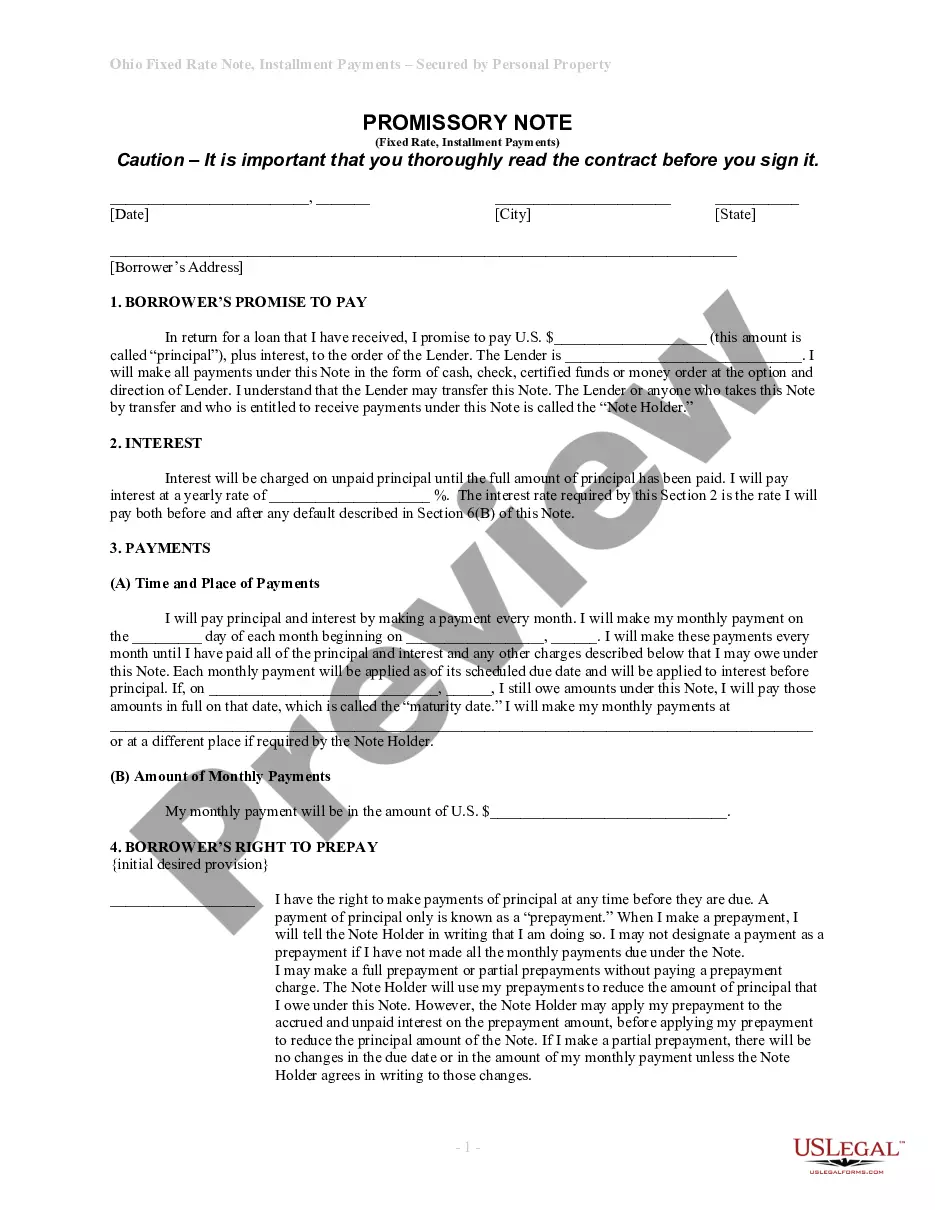

How to fill out Ohio Installments Fixed Rate Promissory Note Secured By Residential Real Estate?

Locating a reliable source to obtain the most up-to-date and pertinent legal templates is a significant part of dealing with bureaucracy. Selecting the appropriate legal documents requires accuracy and careful consideration, which is why it is essential to acquire samples of Note Residential Real Forbes exclusively from reputable sources, such as US Legal Forms. An incorrect template will squander your time and delay your current situation. With US Legal Forms, you have minimal concerns. You can access and review all the specifics regarding the document’s application and relevance for your circumstance and in your state or locality.

Follow the outlined steps to complete your Note Residential Real Forbes.

Eliminate the complications associated with your legal paperwork. Discover the extensive US Legal Forms library where you can find legal templates, assess their relevance to your situation, and download them instantly.

- Utilize the catalog navigation or search bar to find your template.

- Review the form’s description to confirm it meets the requirements of your state and locality.

- Examine the form preview, if available, to ensure it is the form you require.

- Return to the search and locate the appropriate template if the Note Residential Real Forbes does not meet your needs.

- Once you are confident about the form’s relevance, download it.

- If you are a registered customer, click Log in to verify and access your chosen forms in My documents.

- If you do not have an account yet, click Buy now to purchase the template.

- Choose the pricing plan that fits your needs.

- Proceed to the registration to complete your purchase.

- Conclude your purchase by selecting a payment method (credit card or PayPal).

- Choose the file format for downloading Note Residential Real Forbes.

- Once you have the form on your device, you can modify it with the editor or print it and complete it manually.

Form popularity

FAQ

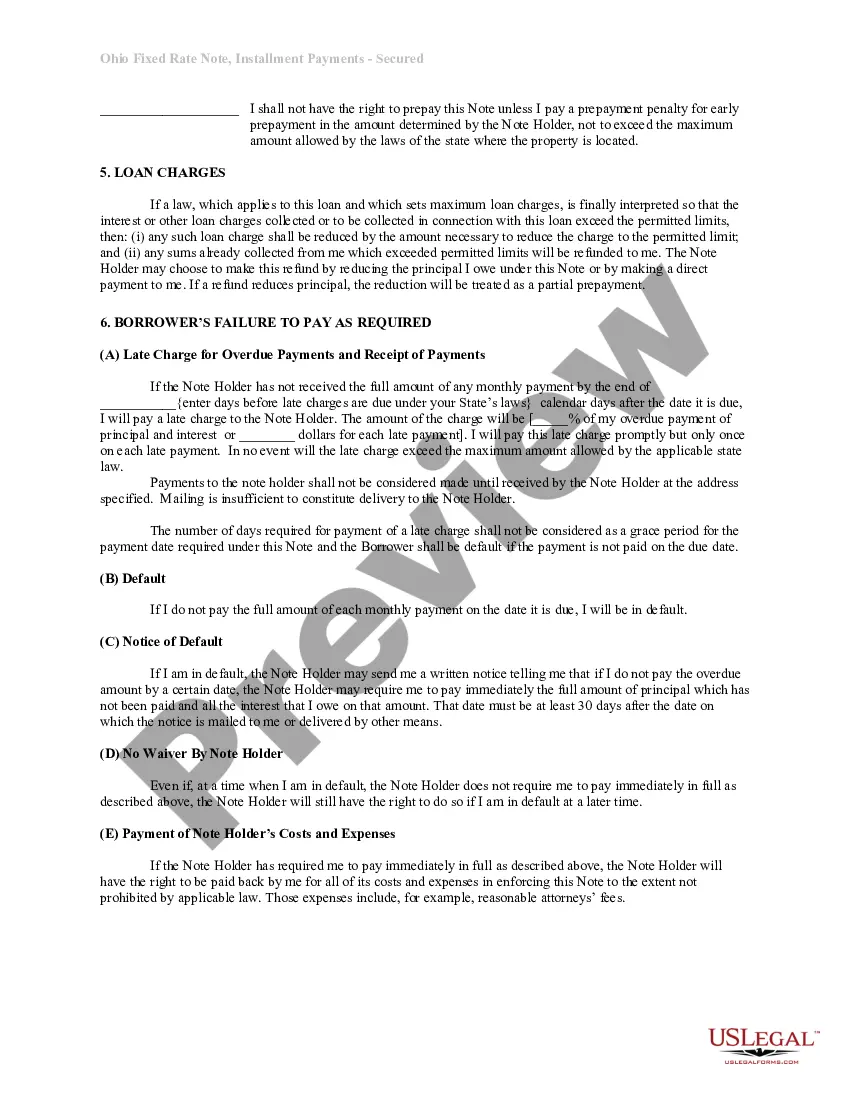

Real Estate Closing At this meeting, borrowers sign a mortgage note, which generally holds two parts: A promissory note is a legal document representing the borrower's agreement to repay the loan. The note details the loan value, the interest rate charged by the lender, the due dates for payments, and the loan terms.1.

The loan's terms, repayment schedule, interest rate, and payment information are included in the note. The borrower, or issuer, signs the note and gives it to the lender, or payee, as proof of the repayment agreement.

The monthly income rule "You want to make sure that your monthly mortgage is no more than 28% of your gross monthly income," says Reyes.

One of the biggest risks associated with investing in mortgage notes is the potential for default. If the borrower on the property is unable to make their mortgage payments, the investor will not receive their expected returns.

Your mortgage lender holds the mortgage note until you fully pay off your loan. Once you do that, your lender will send the note to you, along with a notation that your note is paid in full. Often, you will sell your home or refinance to a new mortgage before paying off your mortgage in full.