Financial Power Of Attorney In Ohio

Description

How to fill out Ohio Financial Power Of Attorney?

Finding a go-to place to access the most current and appropriate legal templates is half the struggle of dealing with bureaucracy. Discovering the right legal papers needs accuracy and attention to detail, which is why it is important to take samples of Financial Power Of Attorney In Ohio only from reputable sources, like US Legal Forms. A wrong template will waste your time and delay the situation you are in. With US Legal Forms, you have very little to worry about. You may access and view all the information concerning the document’s use and relevance for your situation and in your state or county.

Take the following steps to finish your Financial Power Of Attorney In Ohio:

- Use the catalog navigation or search field to find your template.

- View the form’s information to ascertain if it suits the requirements of your state and area.

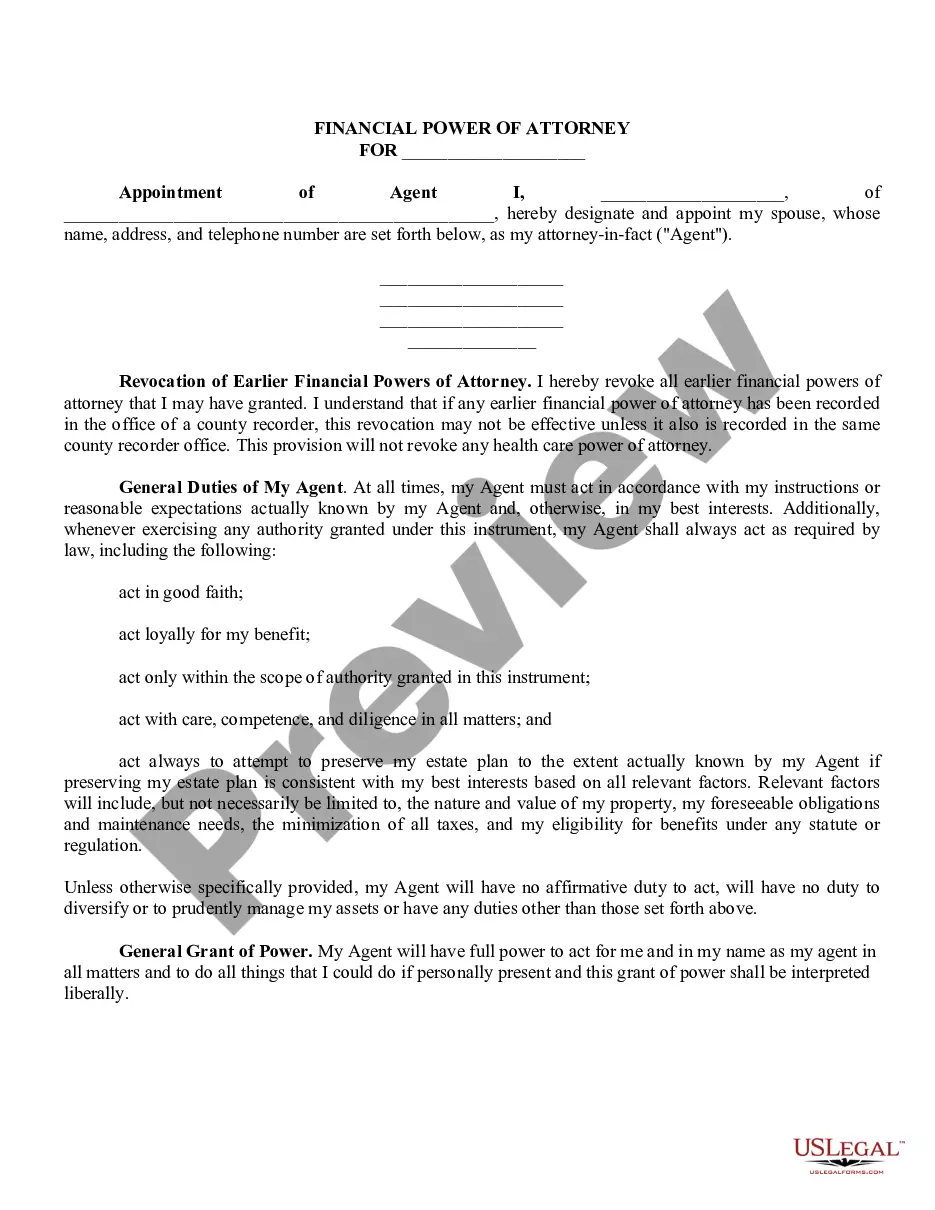

- View the form preview, if available, to ensure the template is definitely the one you are looking for.

- Return to the search and locate the right template if the Financial Power Of Attorney In Ohio does not suit your requirements.

- If you are positive about the form’s relevance, download it.

- When you are an authorized customer, click Log in to authenticate and gain access to your selected templates in My Forms.

- If you do not have a profile yet, click Buy now to obtain the template.

- Pick the pricing plan that suits your requirements.

- Go on to the registration to complete your purchase.

- Complete your purchase by picking a payment method (credit card or PayPal).

- Pick the file format for downloading Financial Power Of Attorney In Ohio.

- When you have the form on your gadget, you can modify it with the editor or print it and complete it manually.

Get rid of the hassle that accompanies your legal documentation. Check out the comprehensive US Legal Forms library to find legal templates, examine their relevance to your situation, and download them on the spot.

Form popularity

FAQ

Notarization. Although getting your POA notarized is not technically required in Ohio, it is highly advised. If a POA is signed in the presence of a notary public, that makes it more acceptable to financial institutions and others, even if state law does not explicitly mandate it.

Creating a FPOA Choose an agent. An attorney-in-fact or ?agent? is an adult who can make your financial choices when you can't. It is very important to choose someone that you trust. ... Fill out the FPOA form. Read it carefully and initial next to the rights you want your agent to have. ... Sign the form. Sign the form.

Does a Power of Attorney Have to Be Filed with the Court? No, power of attorney documentation is not filed with the courts. However, in some parts of Ohio, the property will get filed with the county recorder's office to allow the attorney to manage real estate property.

A power of attorney(POA) is a document giving someone permission to do something for someone else. It gives another person the legal authority to act on your behalf. You may record your power of attorney at your local county Recorder's Office, but you don't have to.

The POA cannot transfer the responsibility to another Agent at any time. The POA cannot make any legal or financial decisions after the death of the Principal, at which point the Executor of the Estate would take over. The POA cannot distribute inheritances or transfer assets after the death of the Principal.