Revocation Living Trust For Property

Description

How to fill out Ohio Revocation Of Living Trust?

- If you have previously used US Legal Forms, log in and download the required trust revocation template directly to your device. Ensure that your subscription remains active; renew it if necessary.

- For first-time users, begin by browsing the comprehensive collection of forms on the US Legal Forms website. Check the preview mode and description of the revocation template to ensure it aligns with your legal requirements.

- If needed, utilize the Search tab to find alternative templates. Confirm that the chosen form suits your jurisdiction and needs before moving forward.

- Select the desired document by clicking the Buy Now button and choose a subscription plan that fits your requirements. You will need to register for an account to gain full access.

- Complete your purchase by entering your credit card or PayPal information. After processing, you can download your form and save it on your device.

- Access your downloaded documents anytime later from the My Forms section on your profile.

Follow these steps closely to ensure a smooth process in revoking your living trust. Utilizing US Legal Forms can make this task much easier with their extensive library and expert support.

Take control of your legal documents today by exploring US Legal Forms, where you can access a diverse array of templates and expert assistance.

Form popularity

FAQ

Revoking a revocable trust for property is a straightforward process. Generally, it involves creating a written document that states your intent to revoke the trust. You need to sign this document and notify any relevant parties, such as beneficiaries or institutions holding trust assets. Platforms like USLegalForms can guide you through this process and provide you with the necessary forms to make revocation a simple undertaking.

Yes, a revocation living trust for property is specifically designed to allow you the flexibility to revoke or dissolve it at any time. As the grantor, you retain control over the trust and can make adjustments as your circumstances change. This feature provides peace of mind, knowing that you can alter your estate planning decisions when necessary. Utilizing a reliable platform like US Legal Forms can simplify the process of managing your trust.

To dissolve a revocation living trust for property, you typically need to complete a specific form designed for this purpose. This form notifies the relevant parties of your decision to dissolve the trust and outlines the distribution of the trust assets. It is essential to follow the required legal procedures to ensure the trust is dissolved properly and avoids any future complications. Using a service like US Legal Forms can provide the necessary templates and guidance.

While a revocation living trust for property offers benefits, it does come with some disadvantages. One significant drawback is that it does not provide protection from creditors; assets within the trust can still be reached by creditors. Additionally, maintaining a revocation living trust requires ongoing management, including updating it with any changes in your assets or personal situation. Therefore, careful consideration is essential.

The downside of putting assets in a trust includes the initial effort and costs required to set it up. Some people may feel overwhelmed by the administrative responsibilities that come with managing a trust. Furthermore, if not carefully crafted, a revocation living trust for property can lead to unintended tax implications. Therefore, informed decisions are vital when considering this option.

One potential downfall of having a trust is the complexity it adds to estate planning. While a revocation living trust for property can streamline transfers, it also necessitates careful management and understanding of the trust's terms. Additionally, if not correctly drafted, it may lead to misunderstandings among beneficiaries. Engaging an expert can help mitigate these risks.

A common mistake parents make is failing to properly fund the trust after its establishment. Without transferring assets into the trust, it cannot fulfill its purpose. This can lead to complications later on, especially concerning the distribution of property. Therefore, it is crucial for parents to ensure that they include all relevant assets in their revocation living trust for property.

One disadvantage of a family trust is the potential costs involved in setting it up and maintaining it. While a revocation living trust for property offers benefits, it can also require legal assistance and ongoing management, which some may find burdensome. Additionally, if not properly funded, a family trust may fail to protect your loved ones as intended. Thus, careful consideration and planning are essential.

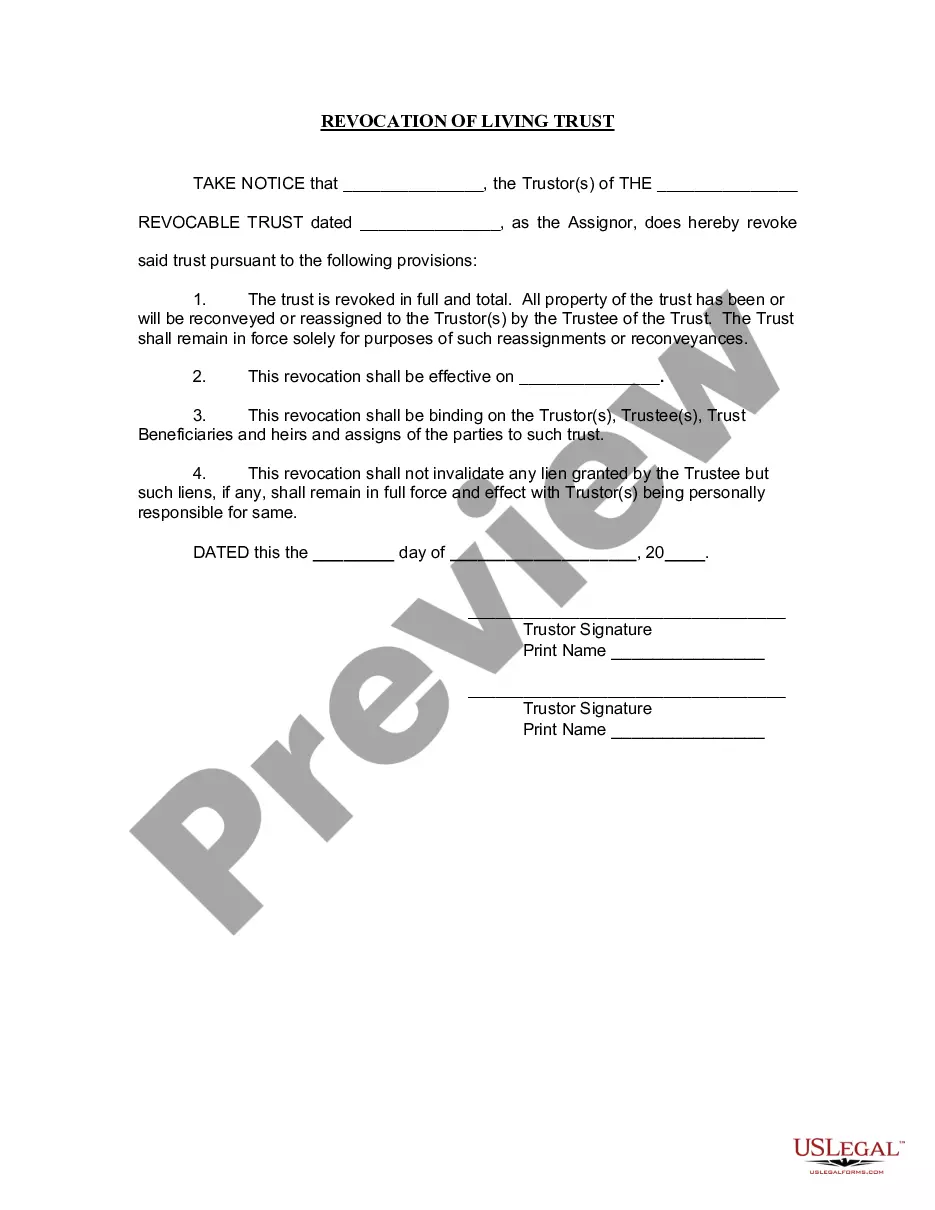

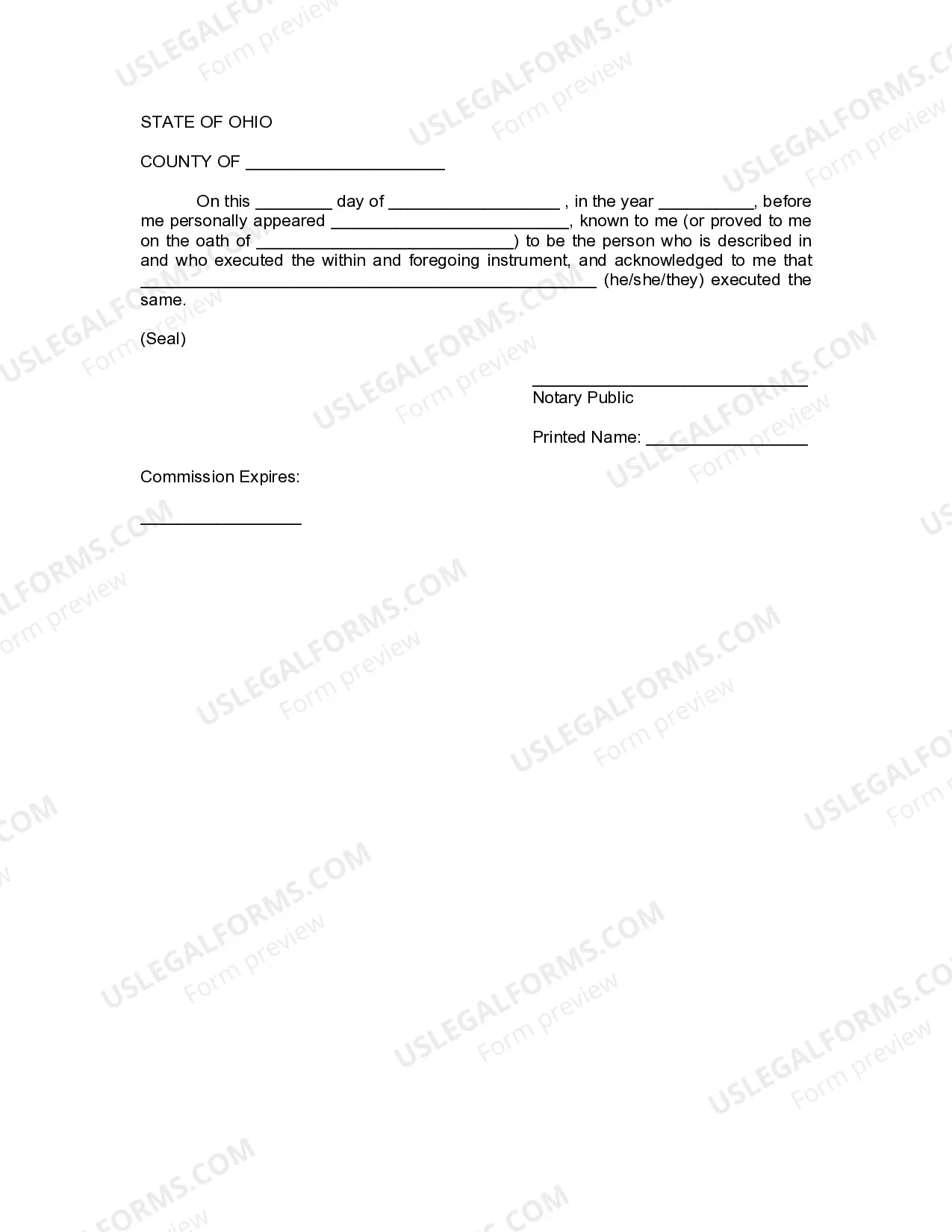

A revocation of living trust sample typically includes the trust's name, the date it was created, and a declaration of revocation. Additionally, it should state that the trust is no longer in effect and that assets are returned to the grantor. For practical examples, you might explore resources like US Legal Forms where you can find templates tailored to your needs.

Revoking a revocable living trust is relatively straightforward. Generally, your parents would need to create a revocation document stating their intent to terminate the trust. This document must be signed and dated, and then any assets held by the trust should be transferred back to their ownership. For assistance, consider using platforms like US Legal Forms to access templates that simplify the process.