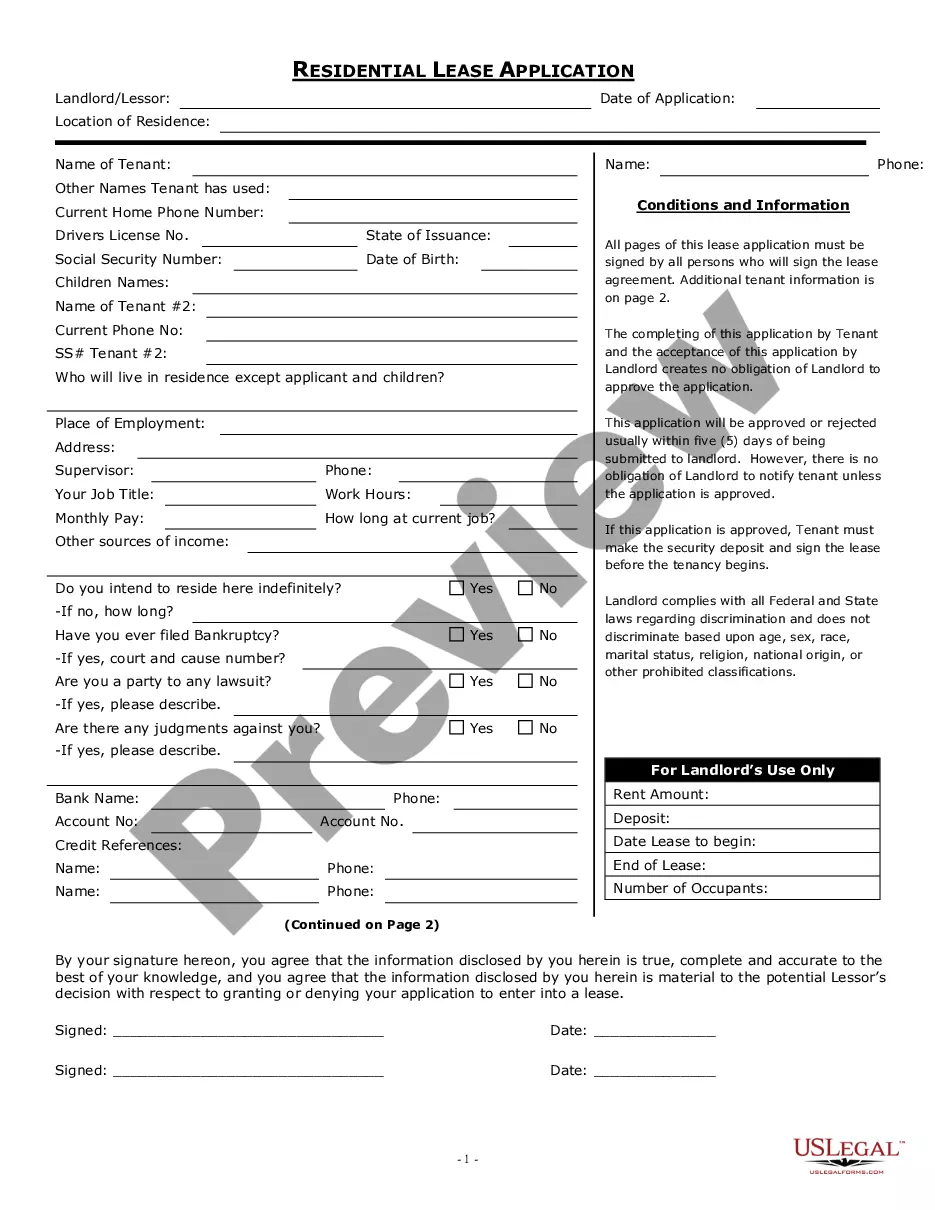

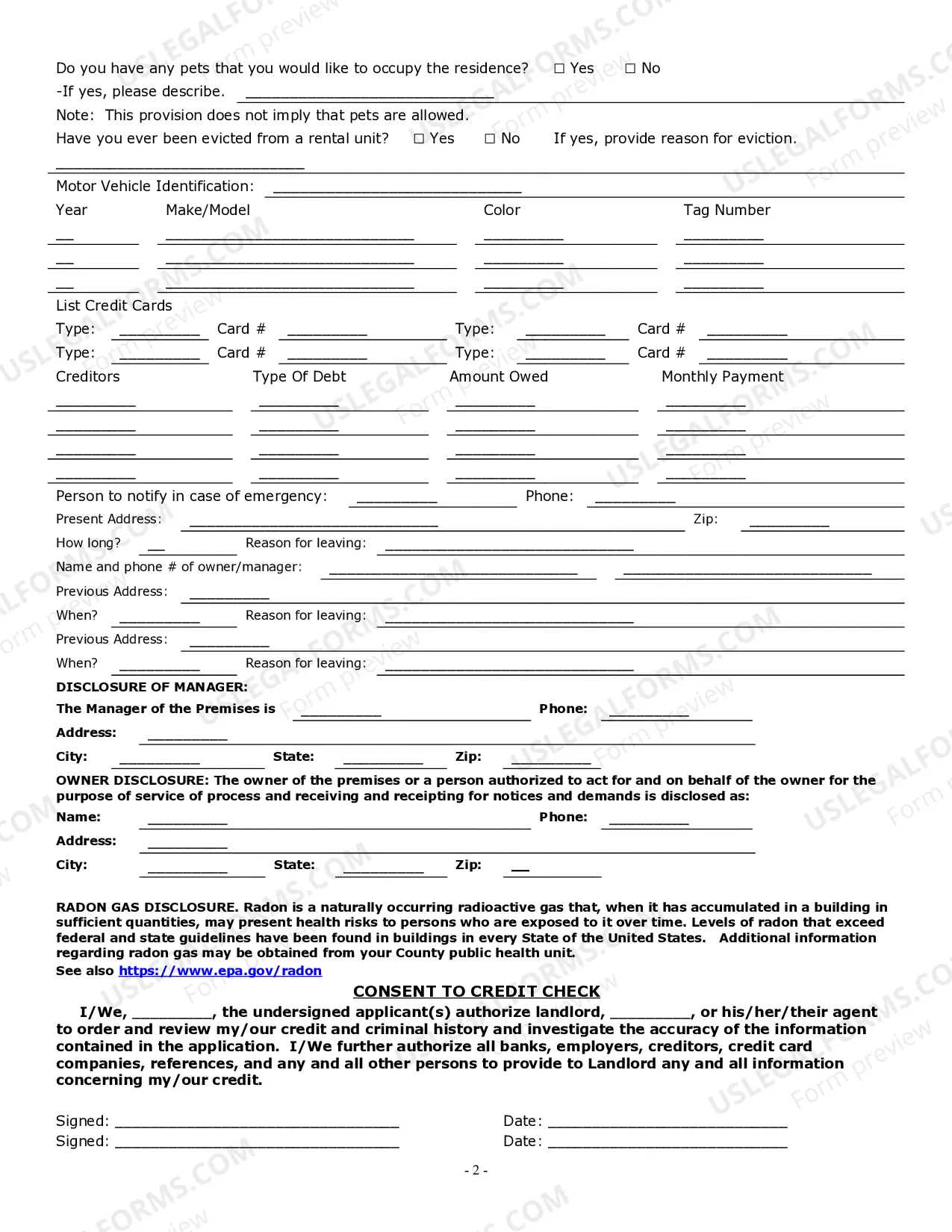

Ohio Rental Application Withholding

Description

How to fill out Ohio Residential Rental Lease Application?

It’s well known that you cannot instantly become a legal expert, nor can you swiftly learn how to prepare the Ohio Rental Application Withholding without having a specialized education.

Drafting legal documents is a lengthy process that demands specific training and abilities. So why not entrust the creation of the Ohio Rental Application Withholding to the professionals.

With US Legal Forms, one of the most comprehensive legal document collections, you can locate anything from court documents to templates for office communication.

If you need a different template, restart your search.

Create a free account and select a subscription plan to purchase the form. Click Buy now. Once the payment is completed, you can download the Ohio Rental Application Withholding, complete it, print it, and send or mail it to the appropriate individuals or institutions. You can access your forms from the My documents tab at any time. If you’re a returning customer, you can simply Log In, and find and download the template from the same tab. Regardless of the purpose of your documents—be it financial and legal, or personal—our website has you covered. Give US Legal Forms a try now!

- We understand how crucial compliance and adherence to federal and local regulations are.

- That’s why, on our platform, all forms are location-specific and current.

- Here’s how to begin with our site and acquire the form you need in just a few minutes.

- Find the document you require using the search bar at the top of the page.

- Review it (if this option is available) and examine the supporting description to verify if the Ohio Rental Application Withholding is what you’re looking for.

Form popularity

FAQ

Courtesy withholding in Ohio refers to the voluntary withholding of state income tax from employee wages, which can benefit both employers and employees. This option allows employers to manage their Ohio rental application withholding obligations more efficiently. If an employer chooses to offer courtesy withholding, they must comply with specific guidelines set by the state. For detailed information and assistance, uslegalforms can provide valuable resources to help you navigate these requirements.

Yes, Ohio provides specific withholding forms that you must use for reporting and remitting your Ohio rental application withholding taxes. The most commonly used form is the Ohio Withholding Tax Return, which you can file electronically or on paper. Ensure you complete the form accurately to avoid delays or penalties. You can find these forms on the Ohio Department of Taxation website or through uslegalforms for easy access.

Obtaining your Ohio withholding account number involves registering your business with the Ohio Department of Taxation. After you complete the registration process, you will receive a unique account number that is essential for managing your Ohio rental application withholding. Keep this number secure, as you will need it for filing and reporting taxes. If you face challenges, consider using resources available through uslegalforms to assist in the registration process.

To create a withholding account in Ohio, you need to complete the registration process with the Ohio Department of Taxation. Start by gathering your business information, including your federal tax identification number and business structure. You can register online through the Ohio Business Gateway, which simplifies the process. Once registered, you will receive your Ohio rental application withholding account information.

To set up an Ohio withholding account, you first need to register with the Ohio Department of Taxation. This process can typically be completed online, where you will provide necessary information about your business and employees. For a seamless experience and to ensure compliance with Ohio rental application withholding, consider using resources from the US Legal Forms platform to guide you through the steps.

In Ohio, deciding whether to use 1 or 0 for tax withholding relates to your financial circumstances. If you're single and do not have dependents, you may choose 1. However, if you have multiple sources of income or dependents, selecting 0 might be more appropriate. The US Legal Forms platform offers tools to help clarify these choices, especially regarding Ohio rental application withholding.

When filling out your tax form, whether to put 0 or 1 depends on your personal tax situation. If you expect to owe taxes, you might want to put 0 to withhold more. Conversely, if you anticipate a refund, putting 1 could be more beneficial. For clarity on Ohio rental application withholding, refer to the guidance provided on the US Legal Forms platform.

The number for Ohio withholding tax is 1-800-282-1780, which connects you to the Ohio Department of Taxation. They can assist with inquiries regarding your specific withholding requirements. For further guidance on Ohio rental application withholding, consider visiting the US Legal Forms platform for comprehensive resources and forms.

To determine your tax withholding, you can review your expected income and consult the Ohio tax withholding tables. It's also useful to consider any deductions or credits you may qualify for. By using resources available on the US Legal Forms platform, you can easily navigate these calculations, particularly for Ohio rental application withholding.

When determining how much to withhold for Ohio taxes, consider both state and local tax rates. Generally, you should calculate your withholding based on your expected annual income and the applicable tax brackets. Utilizing tools like the US Legal Forms platform can help simplify this process, ensuring you meet Ohio rental application withholding requirements.