Commercial Lease Application With Option To Purchase

Description

How to fill out Ohio Commercial Rental Lease Application Questionnaire?

Managing legal paperwork can be perplexing, even for seasoned experts.

When you seek a Commercial Lease Application With Option To Purchase but lack the time to thoroughly search for the proper and current version, the process can be stressful.

Access state- or county-specific legal and business documents.

US Legal Forms addresses any requirements you may have, from personal to corporate paperwork, all in a single location.

If it’s your first visit to US Legal Forms, create an account for unrestricted access to all platform benefits. Here’s what to do after you’ve found the required form.

- Utilize advanced tools to fill out and manage your Commercial Lease Application With Option To Purchase.

- Access a comprehensive resource pool of articles, guides, handbooks, and materials pertinent to your situation and needs.

- Save time and energy when searching for the documents you need, and take advantage of US Legal Forms’ sophisticated search and Preview tool to locate the Commercial Lease Application With Option To Purchase and obtain it.

- If you possess a subscription, Log In to your US Legal Forms account, find the form, and download it.

- Check your My documents section to review the documents you've saved and manage your folders as desired.

- A comprehensive online form repository could revolutionize the way individuals handle these situations efficiently.

- US Legal Forms is a leading provider in online legal documentation, offering over 85,000 state-specific forms at your convenience.

- With US Legal Forms, you can.

Form popularity

FAQ

In a commercial lease, an option gives you the right, but not the obligation, to purchase the property during or at the end of the lease term. This means that you can secure your future investment without committing right away. It’s crucial in a commercial lease application with option to purchase, as it provides flexibility and potential for profit if property values increase. Understanding this option helps you make informed decisions about your future business space.

Writing a Letter of Intent (LOI) for a commercial lease requires clear communication of your intent, including key terms like rent and duration. Start by outlining your commercial lease application with option to purchase, clearly indicating your interest in those specific terms. Be succinct but comprehensive, as this document serves as a foundation for negotiations. Finally, indicate any contingencies and ensure both parties understand the next steps to move forward.

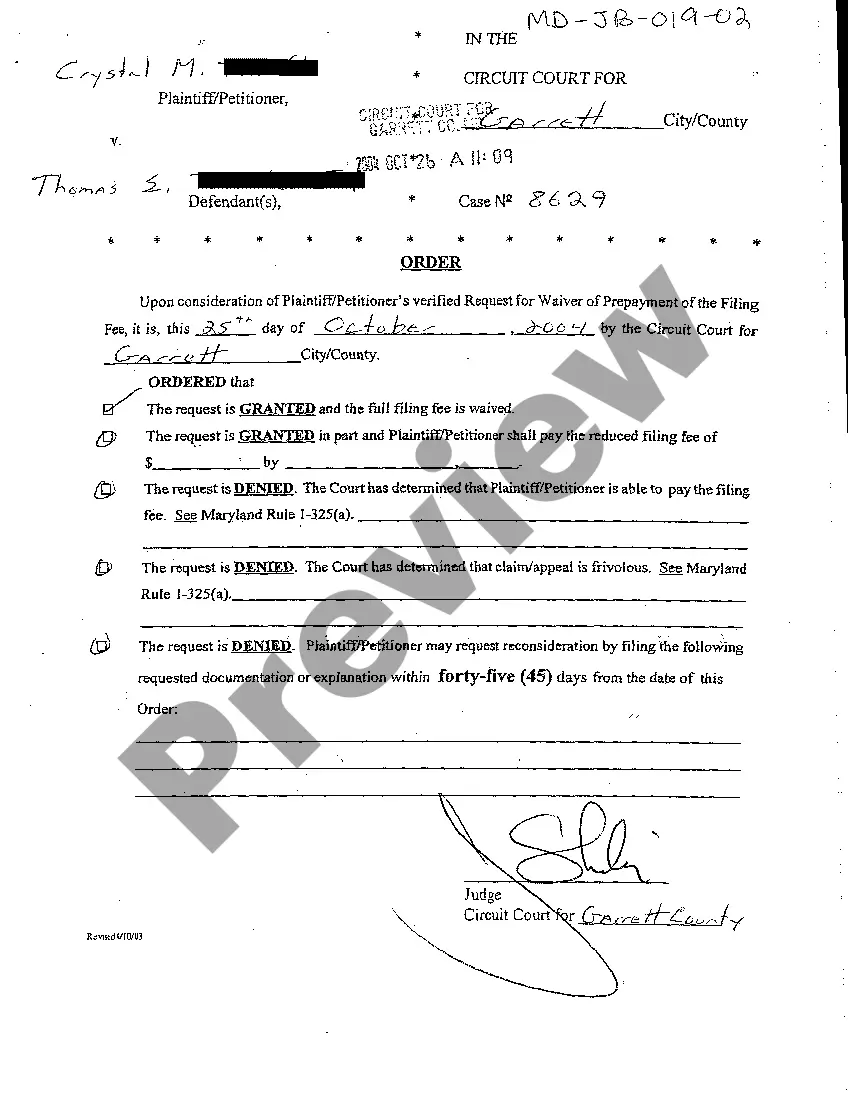

To exercise an option in a lease, first review your commercial lease application with option to purchase to ensure you meet all conditions. Then, provide written notice to your landlord within the specified timeframe outlined in the lease. This notice typically states your intent to move forward with the purchase, following any agreed-upon terms. Lastly, carefully complete any necessary paperwork to finalize the process, keeping communication open with the property owner.

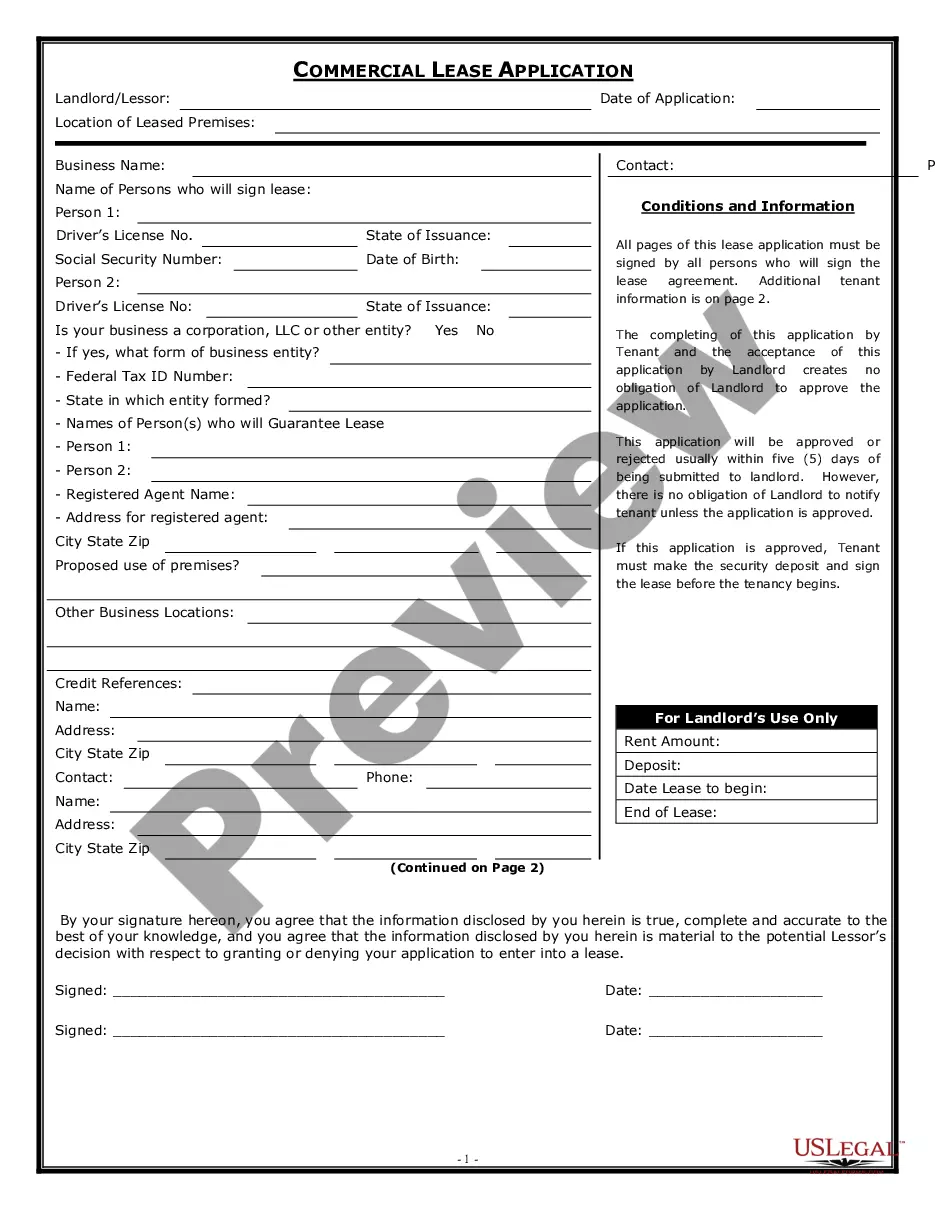

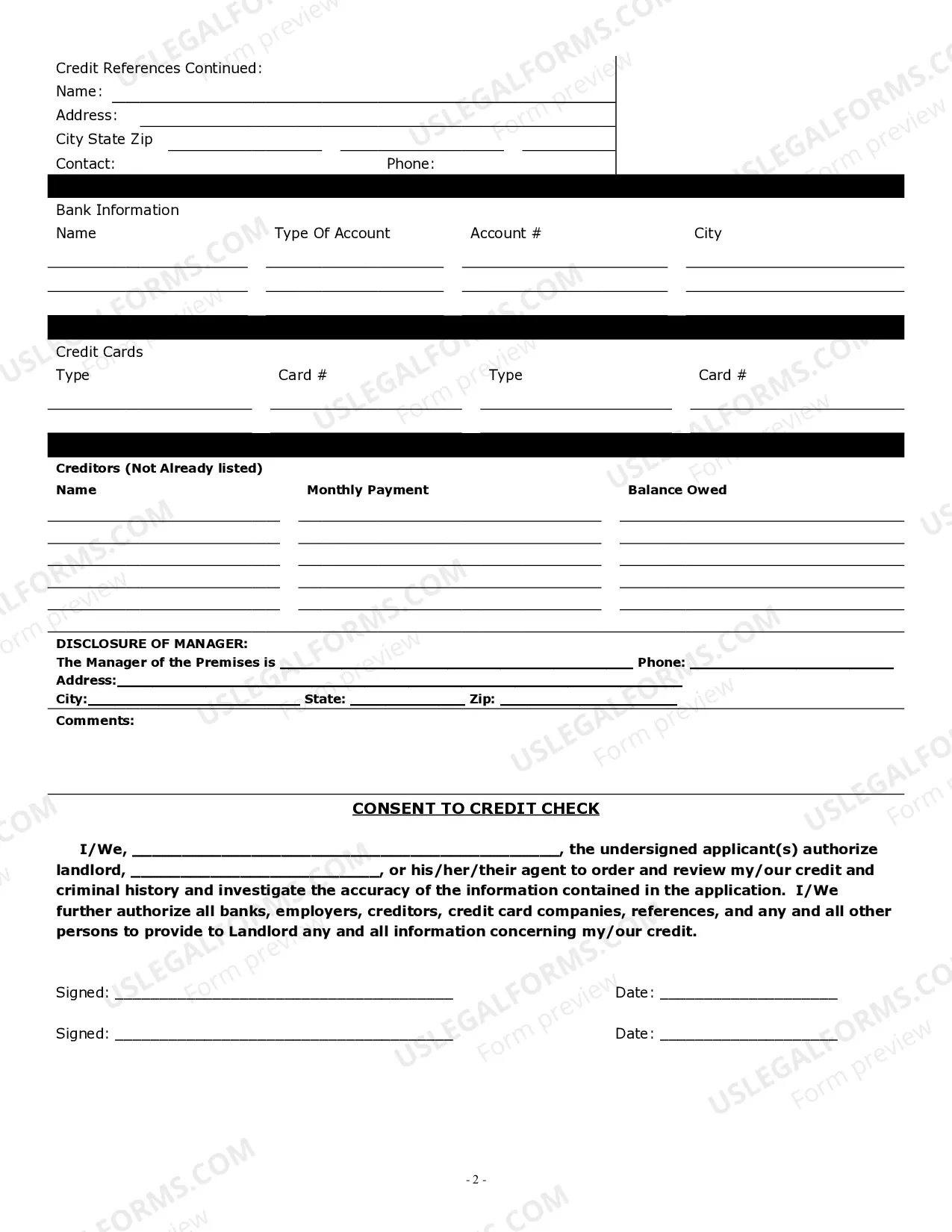

Filling in a lease agreement requires attention to detail. Start by providing necessary information such as tenant and landlord names, property address, and terms of the lease. When dealing with a commercial lease application with option to purchase, ensure you clearly state the purchase option details. Properly completing this document is essential for avoiding misunderstandings and securing your rights.

Creating an addendum to a lease contract involves outlining the specific changes you want to make. Clearly state the provisions being altered or added, while referencing the original commercial lease application with option to purchase. By detailing any adjustments, both you and the other party can agree on the updates, maintaining a clear record of your agreement.

A lease with an option to buy can be a practical choice for many car buyers. It allows you to drive the vehicle while exploring its long-term suitability. If you decide to purchase the car later, you can do so without starting a new commercial lease application with option to purchase. This flexibility can make it easier for you to commit when you're ready.

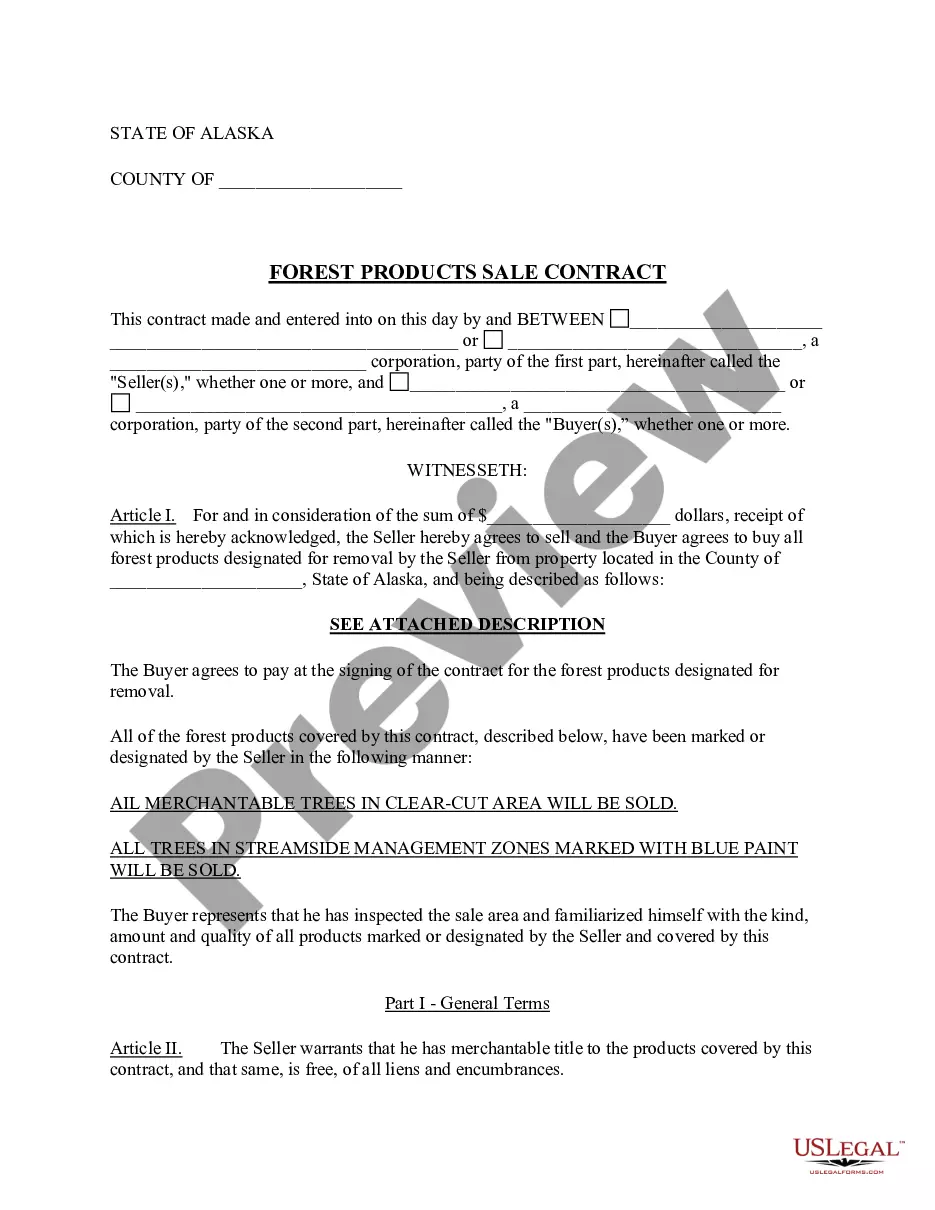

An option agreement for the purchase of commercial real property located in California. This Standard Document gives the optionee an exclusive right to purchase real property, establishes the option deadline and the terms of any future purchase, and provides for default remedies including specific performance.

Here are our top 8 sections to include in your commercial property proposal: Lease Term or Lease Type: ... Rent Obligations: ... Security Deposit: ... Permitted Use or Exclusive Use Clauses: ... Maintenance and Utilities: ... Personal Guarantee: ... Amendments, Modifications, or Termination Clauses: ... Subleases:

?A lease option is a contract in which a landlord and tenant agree that, at the end of a specified period, the renter can buy the property at a specified price. The tenant pays an up-front option fee and an additional amount each month that goes toward the eventual down payment.?