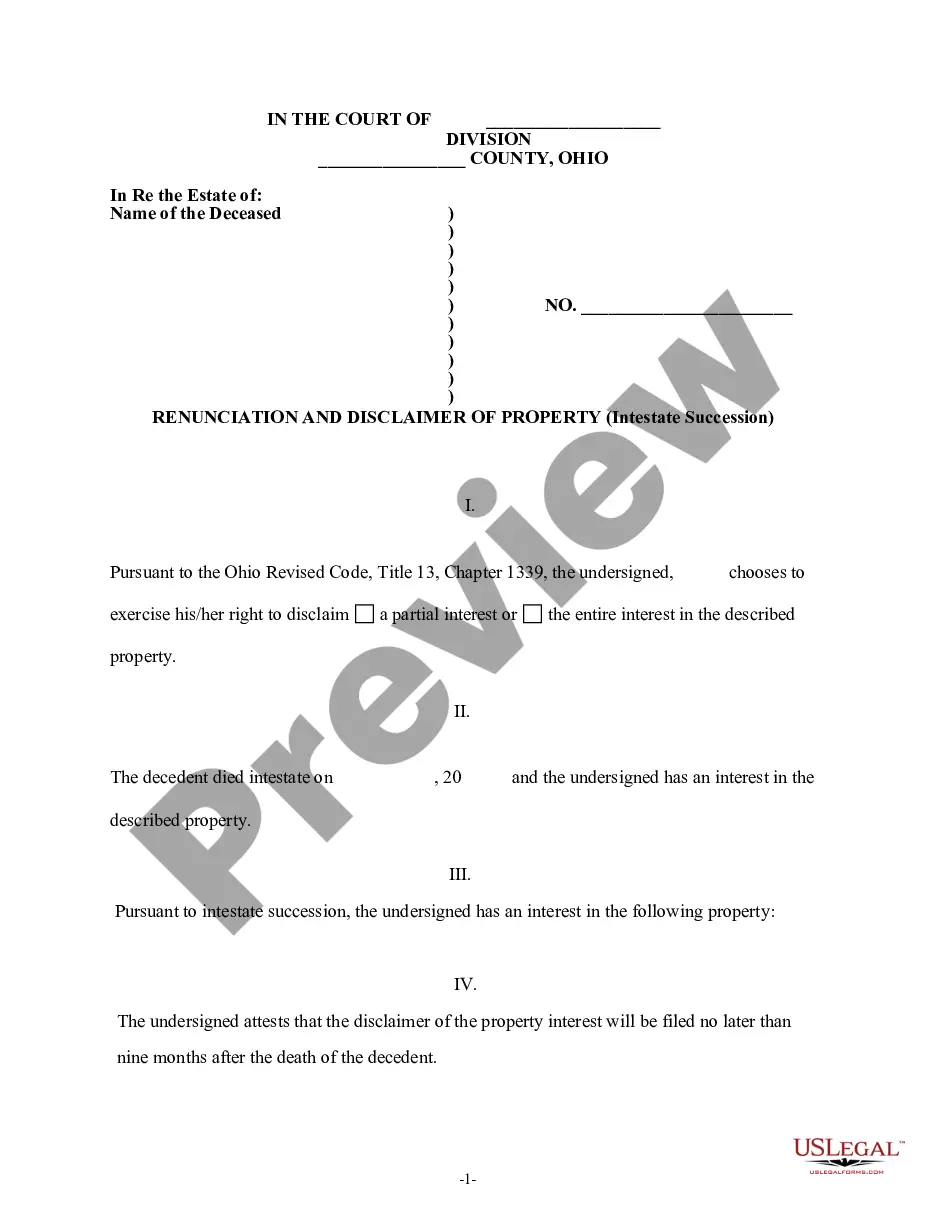

Renunciation And Disclaimer of Property received by Intestate Succession

Disclaimer of Property Interest-Ohio

Ohio Revised Code

TITLE [13] XIII COMMERCIAL TRANSACTIONS -- OHIO UNIFORM COMMERCIAL CODE

CHAPTER 1339: FIDUCIARY LAW

Disclaimer of testamentary and nontestamentary succession to

real and personal property.

Text of Statute

(A) As used in this section:

(1) "Disclaimant" means any person, any guardian or personal

representative of a person or estate of a person, or any attorney-in-fact

or agent of a person having a general or specific authority to act granted

in a written instrument, who is any of the following:

(a) With respect to testamentary instruments and intestate

succession, an heir, next of kin, devisee, legatee, donee, person succeeding

to a disclaimed interest, surviving joint tenant, surviving tenant by the

entireties, surviving tenant of a tenancy with a right of survivorship,

beneficiary under a testamentary instrument, or person designated to take

pursuant to a power of appointment exercised by a testamentary instrument;

(b) With respect to nontestamentary instruments, a grantee, donee,

person succeeding to a disclaimed interest, surviving joint tenant, surviving

tenant by the entireties, surviving tenant of a tenancy with a right of

survivorship, beneficiary under a nontestamentary instrument, or person

designated to take pursuant to a power of appointment exercised by a nontestamentary

instrument;

(c) With respect to fiduciary rights, privileges, powers, and immunities,

a fiduciary under a testamentary or nontestamentary instrument. This section

does not authorize a fiduciary to disclaim the rights of beneficiaries

unless the instrument creating the fiduciary relationship authorizes such

a disclaimer.

(2) "Property" means all forms of property, real and personal, tangible

and intangible.

(B)

(1) A disclaimant, other than a fiduciary under an instrument

who is not authorized by the instrument to disclaim the interest of a beneficiary,

may disclaim, in whole or in part, the succession to any property by executing

and by delivering, filing, or recording a written disclaimer instrument

in the manner provided in this section.

(2) A disclaimant who is a fiduciary under an instrument may disclaim,

in whole or in part, any right, power, privilege, or immunity, by executing

and by delivering, filing, or recording a written disclaimer instrument

in the manner provided in this section.

(3) The written instrument of disclaimer shall be signed and acknowledged

by the disclaimant and shall contain all of the following:

(b) A description of the property, part of property, or interest

disclaimed, and of any fiduciary right, power, privilege, or immunity disclaimed;

(4) The guardian of the estate of a minor or an incompetent, or the

personal representative of a deceased person, with the consent of the probate

division of the court of common pleas, may disclaim, in whole or in part,

the succession to any property, or interest in property, that the ward,

if an adult and competent, or the deceased, if living, might have disclaimed.

The guardian or personal representative, or any interested person may file

an application with the probate division of the court of common pleas that

has jurisdiction of the estate, asking that the court order the guardian

or personal representative to execute and deliver, file, or record the

disclaimer on behalf of the ward or estate. The court shall order the guardian

or personal representative to execute and deliver, file, or record the

disclaimer if the court finds, upon hearing after notice to interested

parties and such other persons as the court shall direct, that:

(b) It would not materially, adversely affect the minor or incompetent,

or the beneficiaries of the estate of the decedent, taking into consideration

other available resources and the age, probable life expectancy, physical

and mental condition, and present and reasonably anticipated future needs

of the minor or incompetent or the beneficiaries of the estate of the decedent.

A written instrument of disclaimer ordered by the

court under this division shall be executed and be delivered, filed, or

recorded within the time and in the manner in which the person could have

disclaimed if the person were living, an adult, and competent.

(C) A partial disclaimer of property that is subject to

a burdensome interest created by the donative instrument is not effective

unless the disclaimed property constitutes a gift that is separate and

distinct from undisclaimed gifts.

(D) The disclaimant shall deliver, file, or record the disclaimer,

or cause the same to be done, not later than nine months after the latest

of the following dates:

(1) The effective date of the donative instrument if both

the taker and the taker's interest in the property are finally ascertained

on that date;

(2) The date of the occurrence of the event upon which both the

taker and the taker's interest in the property become finally ascertainable;

(3) The date on which the disclaimant attains twenty-one years of

age or is no longer an incompetent, without tendering or repaying any benefit

received while the disclaimant was under twenty-one years of age or an

incompetent, and even if a guardian of a minor or incompetent had filed

an application pursuant to division (B)(4) of this section and the probate

division of the court of common pleas involved did not consent to the guardian

executing a disclaimer.

(E) No disclaimer instrument is effective under this section if either

of the following applies under the terms of the disclaimer instrument:

(2) The disclaimant may transfer, or direct to be transferred, to

self the entire legal and equitable ownership of the property subject to

the disclaimer instrument.

(F)

(1) Subject to division (F)(2) of this section, if the

interest disclaimed is created by a nontestamentary instrument, the disclaimer

instrument shall be delivered personally or by certified mail to the trustee

or other person who has legal title to, or possession of, the property

disclaimed.

(2) If the interest disclaimed is created by a testamentary instrument,

by intestate succession, or by a transfer on death deed pursuant to section

5302.22 of the Revised Code, the disclaimer instrument shall be filed in

the probate division of the court of common pleas in the county in which

proceedings for the administration of the decedent's estate have been commenced,

and an executed copy of the disclaimer instrument shall be delivered personally

or by certified mail to the personal representative of the decedent's estate.

(3) If no proceedings for the administration of the decedent's estate

have been commenced, the disclaimer instrument shall be filed in the probate

division of the court of common pleas in the county in which proceedings

for the administration of the decedent's estate might be commenced according

to law. The disclaimer instrument shall be filed and indexed, and fees

charged, in the same manner as provided by law for an application to be

appointed as personal representative to administer the decedent's estate.

The disclaimer is effective whether or not proceedings thereafter are commenced

to administer the decedent's estate. If proceedings thereafter are commenced

for the administration of the decedent's estate, they shall be filed under,

or consolidated with, the case number assigned to the disclaimer instrument.

(4) If an interest in real estate is disclaimed, an executed copy

of the disclaimer instrument also shall be recorded in the office of the

recorder of the county in which the real estate is located. The disclaimer

instrument shall include a description of the real estate with sufficient

certainty to identify it, and shall contain a reference to the record of

the instrument that created the interest disclaimed. If title to the real

estate is registered under Chapters 5309. and 5310. of the Revised Code,

the disclaimer interest shall be entered as a memorial on the last certificate

of title. A spouse of a disclaimant has no dower or other interest in the

real estate disclaimed.

(G) Unless the donative instrument expressly provides that, if there

is a disclaimer, there shall not be any acceleration of remainders or other

interests, the property, part of property, or interest in property disclaimed,

and any future interest that is to take effect in possession or enjoyment

at or after the termination of the interest disclaimed, shall descend,

be distributed, or otherwise be disposed of, and shall be accelerated,

in the following manner:

(1) If intestate or testate succession is disclaimed, as

if the disclaimant had predeceased the decedent;

(2) If the disclaimant is one designated to take pursuant to a power

of appointment exercised by a testamentary instrument, as if the disclaimant

had predeceased the donee of the power;

(3) If the donative instrument is a nontestamentary instrument,

as if the disclaimant had died before the effective date of the nontestamentary

instrument;

(4) If the disclaimer is of a fiduciary right, power, privilege,

or immunity, as if the right, power, privilege, or immunity was never in

the donative instrument.

(H) A disclaimer pursuant to this section is effective as of, and relates

back for all purposes to, the date upon which the taker and the taker's

interest have been finally ascertained.

(I) A disclaimant who has a present and future interest in property,

and disclaims the disclaimant's present interest in whole or in part, is

considered to have disclaimed the disclaimant's future interest to the

same extent, unless a contrary intention appears in the disclaimer instrument

or the donative instrument. A disclaimant is not precluded from receiving,

as an alternative taker, a beneficial interest in the property disclaimed,

unless a contrary intention appears in the disclaimer instrument or in

the donative instrument.

(J) The disclaimant's right to disclaim under this section is barred

if, before the expiration of the period within which the disclaimant may

disclaim the interest, the disclaimant does any of the following:

(1) Assigns, conveys, encumbers, pledges, or transfers,

or contracts to assign, convey, encumber, pledge, or transfer, the property

or any interest in it;

(2) Waives in writing the disclaimant's right to disclaim and executes

and delivers, files, or records the waiver in the manner provided in this

section for a disclaimer instrument;

(4) Permits or suffers a sale or other disposition of the property

pursuant to judicial action against the disclaimant.

(K) A fiduciary's application for appointment or assumption of duties

as a fiduciary does not waive or bar the disclaimant's right to disclaim

a right, power, privilege, or immunity.

(L) The right to disclaim under this section exists irrespective

of any limitation on the interest of the disclaimant in the nature of a

spendthrift provision or similar restriction.

(M) A disclaimer instrument or written waiver of the right to disclaim

that has been executed and delivered, filed, or recorded as required by

this section is final and binding upon all persons.

(N) The right to disclaim and the procedures for disclaimer established

by this section are in addition to, and do not exclude or abridge, any

other rights or procedures existing under any other section of the Revised

Code or at common law to assign, convey, release, refuse to accept, renounce,

waive, or disclaim property.

(O)

(1) No person is liable for distributing or disposing of

property in a manner inconsistent with the terms of a valid disclaimer

if the distribution or disposition is otherwise proper and the person has

no actual knowledge of the disclaimer.

(2) No person is liable for distributing or disposing of property

in reliance upon the terms of a disclaimer that is invalid because the

right of disclaimer has been waived or barred if the distribution or disposition

is otherwise proper and the person has no actual knowledge of the facts

that constitute a waiver or bar to the right to disclaim.

(P)

(1) A disclaimant may disclaim pursuant to this section

any interest in property that is in existence on September 27, 1976, if

either the interest in the property or the taker of the interest in the

property is not finally ascertained on that date.

(2) No disclaimer executed pursuant to this section destroys or

diminishes an interest in property that exists on September 27, 1976, in

any person other than the disclaimant.

Title XIII, Chap. 1339, § 1339.68