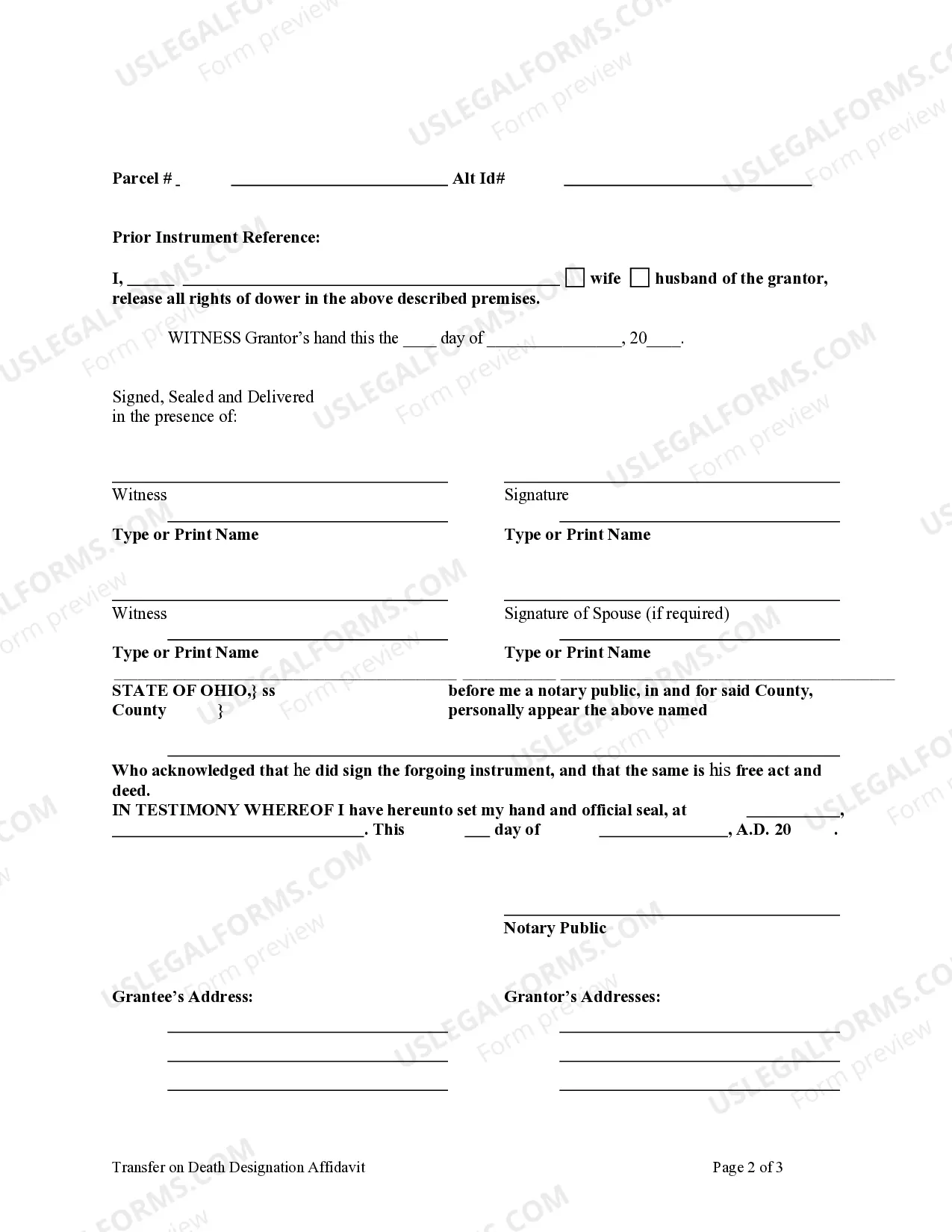

Transfer on Death Designation Affidavit from Individual to Trust: This affidavit is used to transfer the title of a parcel of land, attaching any existing covenants, upon the death of the Affiant/Owner to the Beneficiary. It should be signed in front of a Notary Public. The designation of the beneficiary in an affidavit of transfer on death may be revoked or changed at any time, without the consent of that designated transfer on death beneficiary, by the owner of the interest by executing in accordance with Chapter 5301 of the Ohio Revised Code and recording a transfer on death designation affidavit conveying the owner's entire, separate interest in the real property to one or more persons, including the owner, with or without the designation of another transfer on death beneficiary.

Transfer On Death Joint Tenants With Rights Of Survivorship

Description

Form popularity

FAQ

Filling out a transfer on death designation affidavit involves providing specific details about the property and the beneficiaries. You'll need to list the owner’s information, describe the property, and name the designated beneficiaries. Make sure to follow your state’s requirements regarding signatures and notarization. Utilizing resources from US Legal Forms can help ensure you complete this process accurately.

A Transfer on Death joint tenants with rights of survivorship allows property transfer upon the owner's death without going through probate. In contrast, right of survivorship ensures that when one joint tenant passes away, the remaining tenant automatically inherits the property. Both concepts facilitate asset distribution but operate under different legal frameworks. Understanding these differences is crucial in estate planning.

To write a deed with right of survivorship, start by clearly stating the names of the joint tenants involved. You should include specific language indicating the right of survivorship, such as 'as joint tenants with rights of survivorship.' Additionally, ensure that the deed is properly signed and notarized. Consider seeking guidance from US Legal Forms to ensure the deed meets state requirements.

While a Transfer on Death joint tenants with rights of survivorship can simplify asset distribution, it may have drawbacks. One concern is that creditors can still reach the transferred assets, which may affect beneficiaries. Additionally, some states may impose specific requirements that could complicate the process. It's essential to evaluate these factors before deciding on a TOD.

One significant disadvantage of the right of survivorship is that it limits your ability to control your share of the property posthumously. When one joint tenant dies, their interest automatically transfers to the surviving tenant, which can sometimes lead to unintended heirs, especially if the survivor’s financial situation changes. Additionally, this arrangement may not be flexible for those looking to leave their property to a person other than the joint tenant. Understanding these limitations can inform your estate planning.

No, the right of survivorship itself cannot be transferred to another party. This right is inherently tied to the ownership structure established in a transfer on death joint tenants with rights of survivorship. If you wish to change ownership or convey your interest to someone else, you must first dissolve the joint tenancy and establish new ownership terms. Consulting legal resources, like UsLegalForms, can clarify this process.

While it is possible to complete a transfer on death deed without a lawyer, legal advice is highly recommended. A lawyer can help you navigate the complexities of transfer on death joint tenants with rights of survivorship, ensuring the deed complies with state laws and accurately reflects your wishes. They can also assist in resolving any potential disputes among heirs. Investing in professional guidance can prevent future complications.

Yes, a survivorship deed can be changed, but the process involves specific steps. To modify or revoke the deed, the current owners must typically create a new document or, in some cases, file a revocation. It’s advisable to consult with professionals familiar with transfer on death joint tenants with rights of survivorship to ensure all legal requirements are satisfied. This ensures your intentions are properly reflected.

The key difference lies in how the property is transferred upon death. A transfer on death deed allows the property to bypass probate, automatically transferring to the designated beneficiary after the owner's death. In contrast, joint tenants with rights of survivorship means both parties hold equal ownership rights, and upon the death of one, their share automatically goes to the surviving owner. Understanding both options can guide your estate planning.

Yes, the right of survivorship can be challenged under certain circumstances. If there is evidence of fraud, undue influence, or a lack of mental capacity at the time of signing the transfer on death joint tenants with rights of survivorship deed, it may be contested in court. Additionally, disputes can arise if one party believes they did not consent to the arrangement. It’s essential to navigate these situations carefully.