Transfer On Death Designation Without Will Philippines

Description

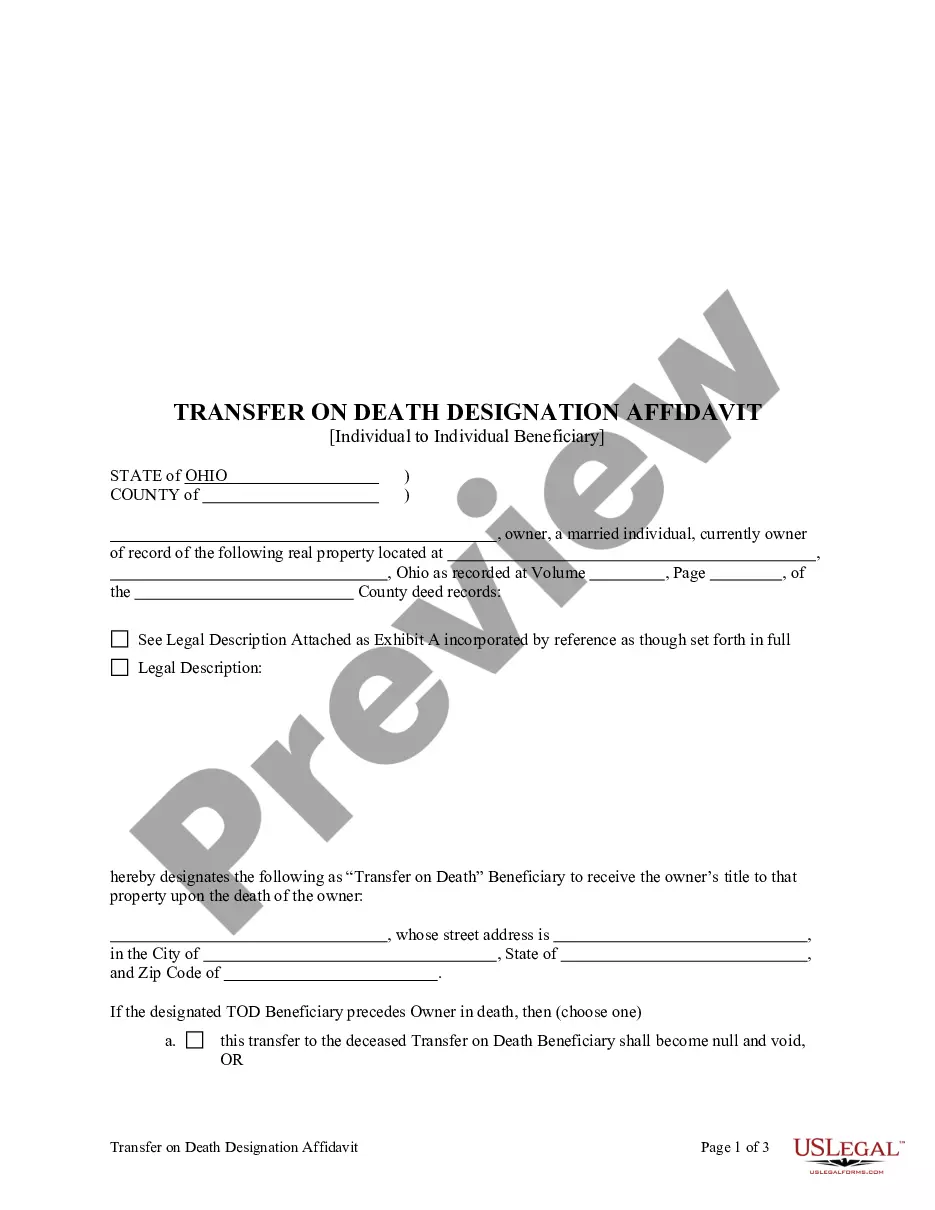

How to fill out Ohio Transfer On Death Designation Affidavit - TOD From Individual To A Trust?

Creating legal documents from the ground up can often feel daunting.

Certain situations may require extensive research and significant financial investment.

If you’re seeking a more straightforward and economical method of producing Transfer On Death Designation Without Will Philippines or any other paperwork without unnecessary complications, US Legal Forms is readily available.

Our online library of over 85,000 current legal forms encompasses nearly every aspect of your financial, legal, and personal matters.

Before proceeding to download the Transfer On Death Designation Without Will Philippines, consider these suggestions: Review the form preview and descriptions to ensure it meets your needs. Verify that the form you choose complies with the laws and regulations of your state and county. Select the most appropriate subscription plan to acquire the Transfer On Death Designation Without Will Philippines. Download the document, then fill it out, sign it, and print it. US Legal Forms boasts a pristine reputation and over 25 years of experience. Join us today and make document preparation straightforward and efficient!

- With just a few clicks, you can swiftly obtain state- and county-compliant templates carefully assembled by our legal experts.

- Utilize our platform whenever you need dependable and trustworthy services to quickly locate and download the Transfer On Death Designation Without Will Philippines.

- If you're familiar with our website and have already created an account, simply Log In to your profile, choose the form, and download it or retrieve it anytime later from the My documents section.

- Not yet an account holder? No worries. Setting it up takes just a few minutes, allowing you to explore the catalog.

Form popularity

FAQ

In the Philippines, heirs to an estate without a will are determined by the laws of intestate succession. Typically, the surviving spouse, legitimate children, and illegitimate children have priority as heirs. If no immediate family exists, the estate may pass to more distant relatives. Understanding these rules can be complicated, but the Transfer on death designation without will Philippines can clarify and expedite the transfer process for heirs.

To transfer a land title in the Philippines after the owner’s death, start by obtaining a certified copy of the death certificate and the land title. You will also require documents proving the relationship to the deceased, such as a birth certificate or affidavit of heirship. Once you have all necessary documents, submit them to the Registry of Deeds for processing. Remember, utilizing the Transfer on death designation without will Philippines can help streamline this process.

When a parent passes away without a will, the property can still be transferred through the legal process known as intestate succession. You will need to identify the legal heirs and gather necessary documents, including the death certificate and proof of kinship. Engaging with a legal platform like US Legal Forms can provide guidance on filling out the required forms efficiently. The Transfer on death designation without will Philippines is a beneficial tool for ensuring properties transfer smoothly.

To transfer a land title from a deceased parent in the Philippines, you need to secure a copy of the death certificate and the title of the property. Next, gather the required documents, such as a notarized affidavit of self-adjudication or a court order, if necessary. Following this, you can file the transfer application at the Registry of Deeds. Utilizing the Transfer on death designation without will Philippines can simplify this process by allowing direct transfer of ownership.

Transferring a title when someone dies involves understanding the deceased's estate plan. If there is a Transfer on death designation without will Philippines, you can easily transfer the title to the designated beneficiary. In situations without such a designation, you will need to follow the probate process, which can be complex. Using a platform like US Legal Forms can help you navigate these challenges and ensure all paperwork is completed correctly.

To transfer title deeds after death, you need to follow specific legal steps. First, determine whether the deceased had a Transfer on death designation without will Philippines. If they did, this designation allows you to transfer the title directly to the beneficiary without going through probate. If not, you may need to gather necessary documents, such as the death certificate, and possibly seek legal guidance to ensure a smooth transfer.

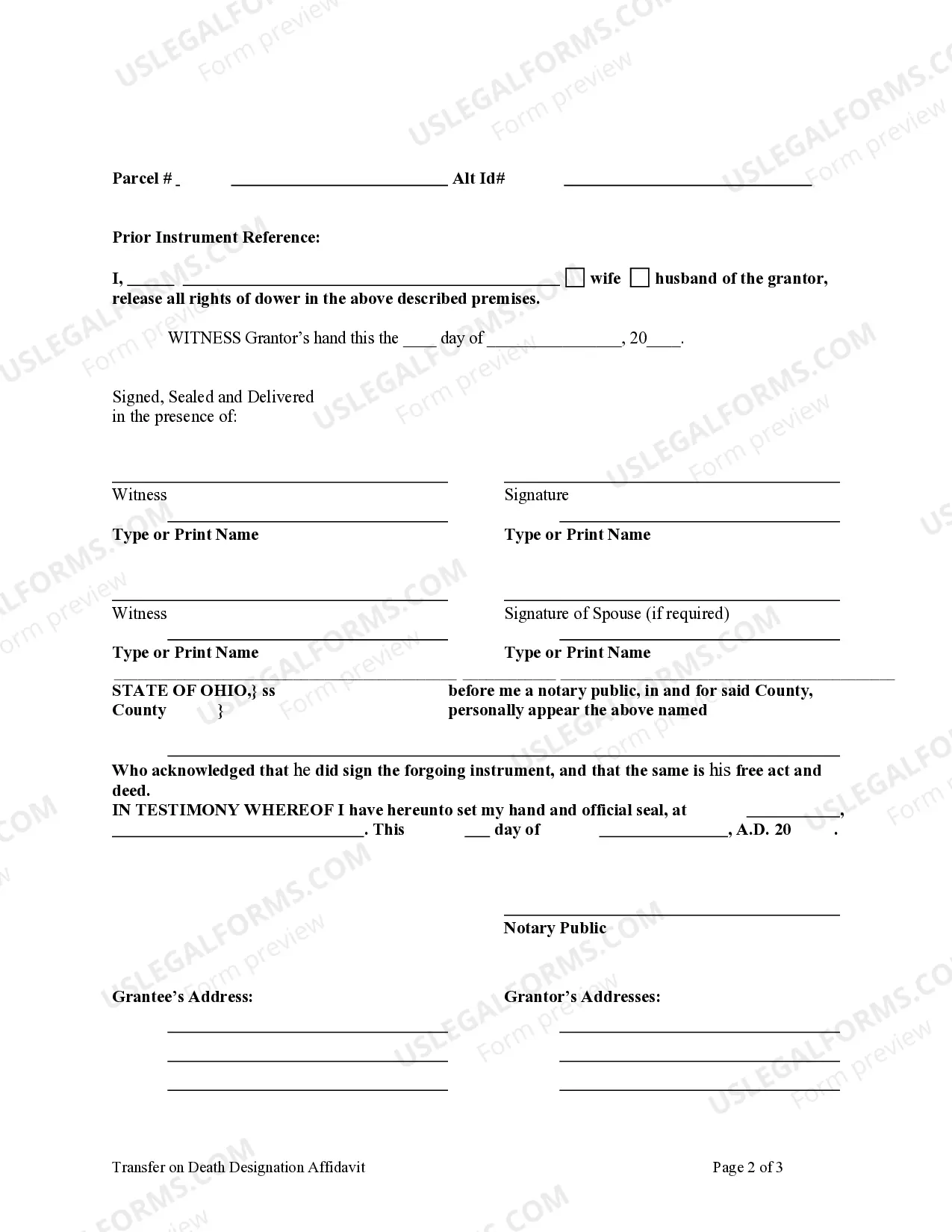

To obtain a transfer on death deed, you must fill out a specific form that clearly states your intention to transfer your property upon your death. This deed must be signed in front of a notary public and then recorded with the appropriate government office. Once completed, it ensures that your property passes directly to your beneficiaries, bypassing the probate process. Utilizing a transfer on death designation without a will in the Philippines simplifies the transfer of your assets and grants peace of mind.

When a person dies without a will in the Philippines, their bank account typically goes through a legal process called intestate succession. This means the assets, including bank accounts, will be distributed according to Philippine law. The court appoints an administrator to manage the estate, which can lead to delays and complications for heirs. To avoid such issues, consider using a transfer on death designation without a will in the Philippines to ensure your assets go directly to your chosen beneficiaries.

Transferring land registry after death often involves a transfer on death designation without will Philippines. You will need to provide the death certificate and any relevant documentation that establishes the beneficiary's right to the property. It's vital to follow the specific procedures outlined by your local land registry office. Platforms like US Legal Forms can provide you with the necessary forms and clear guidance to navigate this process effectively.

To complete a transfer on death deed, you must first ensure that the property owner has designated a beneficiary within the deed. This transfer on death designation without will Philippines allows the property to pass directly to the beneficiary after the owner's death without going through probate. The deed must be signed, notarized, and recorded at the local land office to be effective. Utilizing US Legal Forms can assist you in obtaining the correct forms and understanding the recording process.