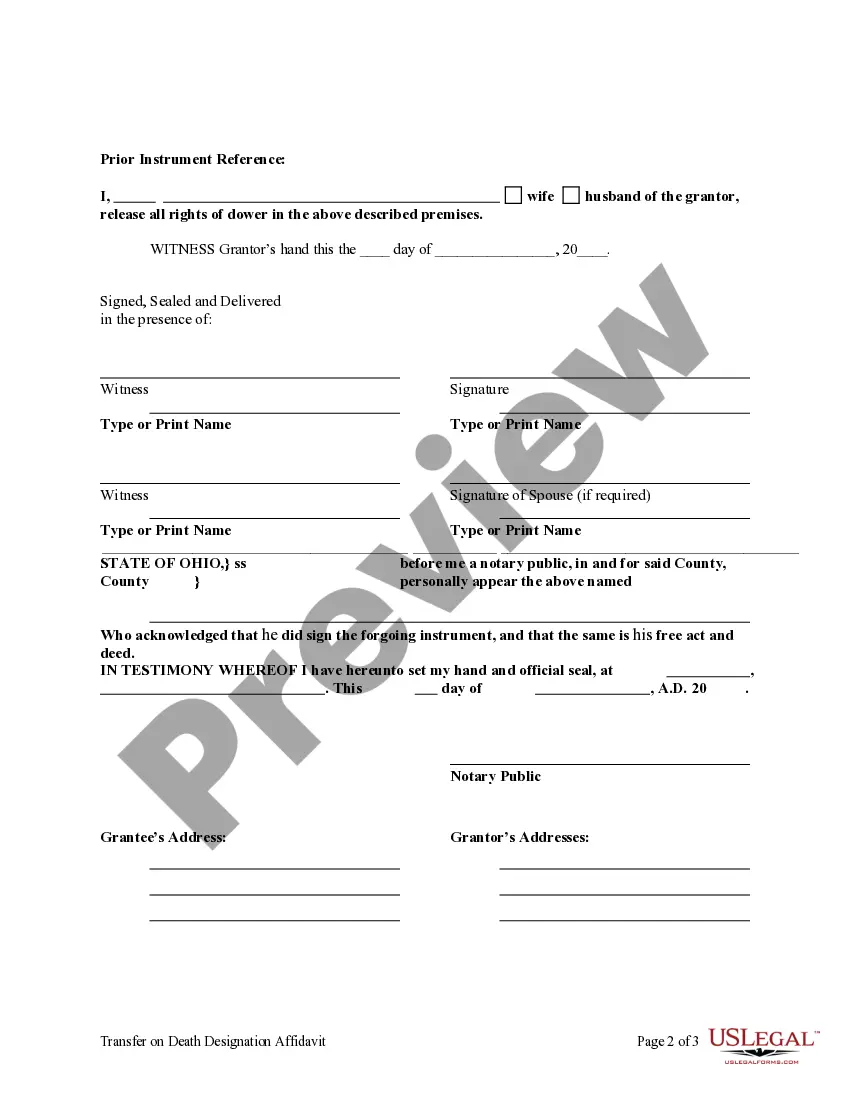

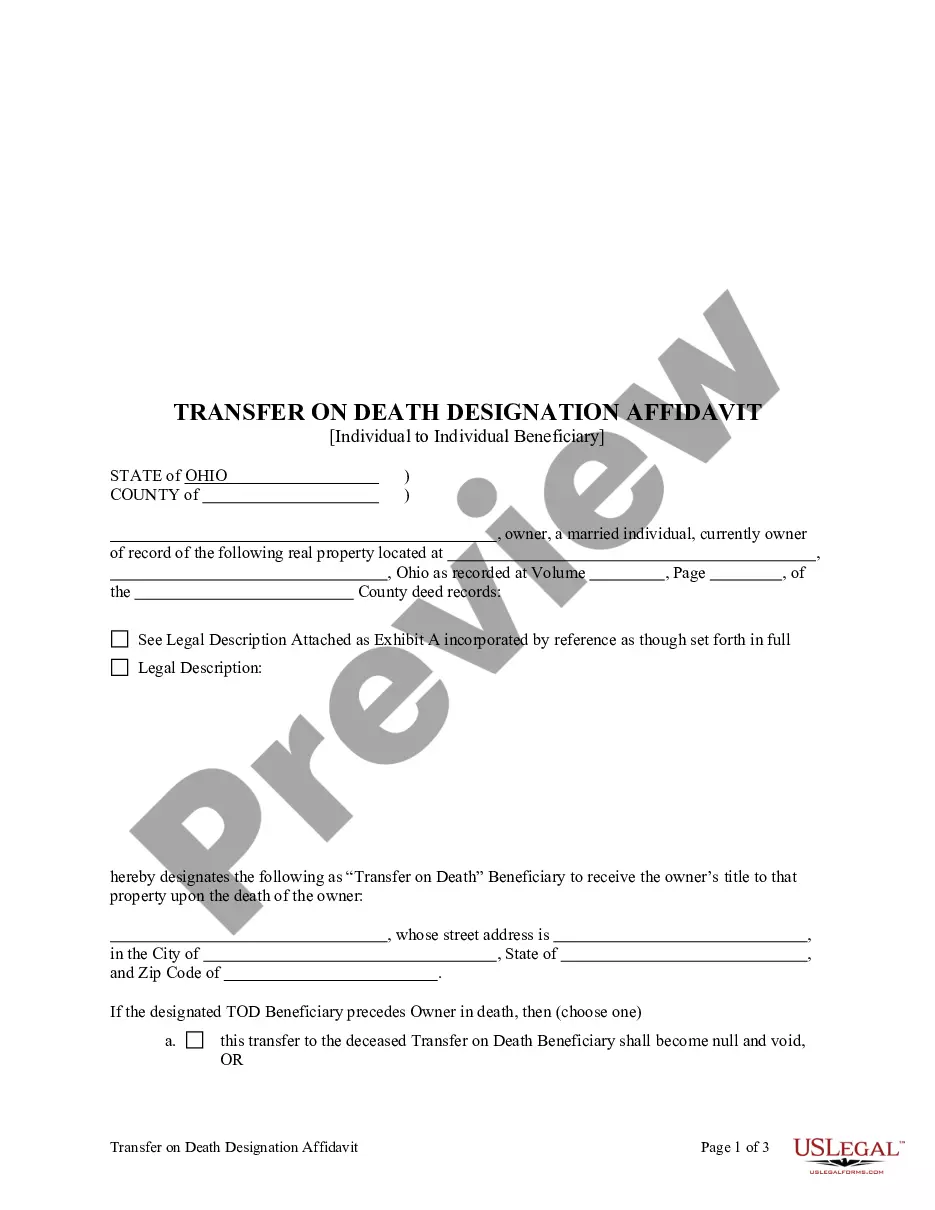

Transfer on Death Designation Affidavit from Individual to Individual: This affidavit is used to transfer the title of a parcel of land, attaching any existing covenants, upon the death of the Affiant/Owner to the Beneficiary. It should be signed in front of a Notary Public. The form does NOT include provision for an contingent beneficiary in the event the designated beneficiary predeceases the affiant/owner. The designation of the beneficiary in an affidavit of transfer on death may be revoked or changed at any time, without the consent of that designated transfer on death beneficiary, by the owner of the interest by executing in accordance with Chapter 5301. of the Ohio Revised Code and recording a transfer on death designation affidavit conveying the owner's entire, separate interest in the real property to one or more persons, including the owner, with or without the designation of another transfer on death beneficiary.

Tod Form Ohio With A Baby

Description

How to fill out Ohio Transfer On Death Designation Affidavit - TOD From Individual To Individual Without Contingent Beneficiary?

- Log into your US Legal Forms account if you're already a member. Ensure your subscription is active before downloading the necessary template.

- If you're new to our service, start by browsing the extensive library featuring over 85,000 editable legal forms. Make sure you preview the form description to ensure it meets your needs.

- Should you find any discrepancies, utilize the search functionality to pinpoint the correct form for your jurisdiction.

- Purchase the document by selecting your preferred subscription plan and clicking on the Buy Now button. You’ll need to create an account to gain full access.

- Complete your transaction using a credit card or PayPal, then download your form to your device.

- Access your downloaded form anytime through the 'My Forms' section in your profile for future reference or completion.

In conclusion, US Legal Forms simplifies the process of obtaining essential legal documents, helping parents manage their responsibilities effortlessly. With over 85,000 forms available and expert assistance, you can ensure your legal needs are met accurately.

Start your journey today by visiting US Legal Forms and experience the convenience of having legal documents just a few clicks away!

Form popularity

FAQ

To file a TOD form in Ohio with a baby, you need to complete the form and ensure it complies with state requirements. After filling out the form, you must sign it in the presence of a notary. Once executed correctly, you can submit the form to the appropriate authorities. UsLegalForms can guide you through each step, ensuring your filing process is easy and accurate.

Yes, a TOD form in Ohio with a baby allows you to avoid probate for the assets that you transfer using this method. This means your property can pass directly to your designated beneficiary upon your death, speeding up the process and reducing costs. However, ensure that you understand how this fits with your entire estate plan for full effectiveness.

You aren't required to hire a lawyer to complete a TOD form in Ohio with a baby. The form is designed to be user-friendly and straightforward. However, if you have unique concerns or complex assets, obtaining legal help could provide valuable peace of mind and clarity. UsLegalForms offers resources and templates to simplify the process for you.

Whether a TOD form in Ohio with a baby is better than a will depends on your personal circumstances. A TOD form allows property transfer without going through probate, which can save time and expenses. In contrast, a will covers a broader range of assets and can address complex familial situations. Evaluating both options is important to make the right choice for your estate.

The best way often depends on your specific situation and objectives. A TOD form in Ohio with a baby can simplify the transfer of property, avoiding probate. However, you might also consider a will or trust, depending on your needs. Consulting a professional can help you determine which option will best protect your assets and beneficiaries.

One downside of a TOD form in Ohio with a baby is that it may not address all aspects of your estate, potentially leaving some matters unresolved. Additionally, if you name your child as the beneficiary, they may lack the capacity to manage the property until they reach adulthood. It's essential to consider these factors and seek advice on how a TOD fits into your overall estate plan.

You do not necessarily need an attorney to complete a TOD form in Ohio with a baby. However, having legal guidance can ensure you fill out the form correctly and understand the implications of your choices. An attorney can offer personalized advice, especially in unique situations like leaving property for a child. Ultimately, the decision is yours.

You can obtain a TOD form in Ohio through various avenues. Many people find it convenient to visit the USLegalForms platform, which offers easy access to the necessary documents. You can also check with your local bank or financial institution, as they may provide blank forms and guidance on completing them. Additionally, local government offices and legal aid organizations can assist you in acquiring the TOD form for Ohio with a baby.

To transfer property after a parent's death with a will in Ohio, begin by gathering the will and filing it with the probate court. A TOD form Ohio with a baby might also simplify matters if the property includes vehicles. After the will is validated, the executor will distribute assets according to the instructions laid out. This process helps ensure that your parent's wishes are honored while facilitating the transfer of property to beneficiaries.

Yes, a minor can be designated as a beneficiary on a TOD account in Ohio. However, it is important to consider how this might affect the transfer process, as legal restrictions may apply. Using a TOD form Ohio with a baby may help establish clear intentions, ensuring the minor receives the designated assets upon reaching the age of majority. Consulting with a legal professional can offer helpful guidance in these situations.