Affidavit For Transfer Without Probate Ohio With Fill Out

Description

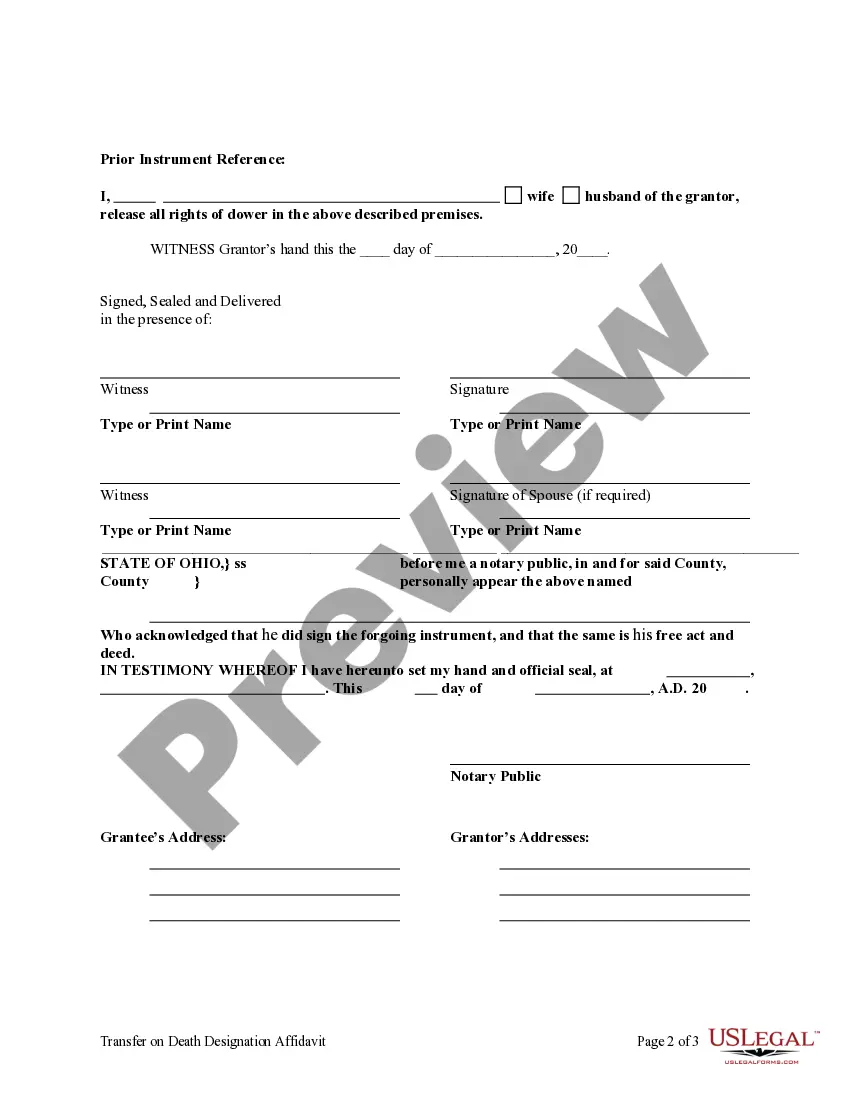

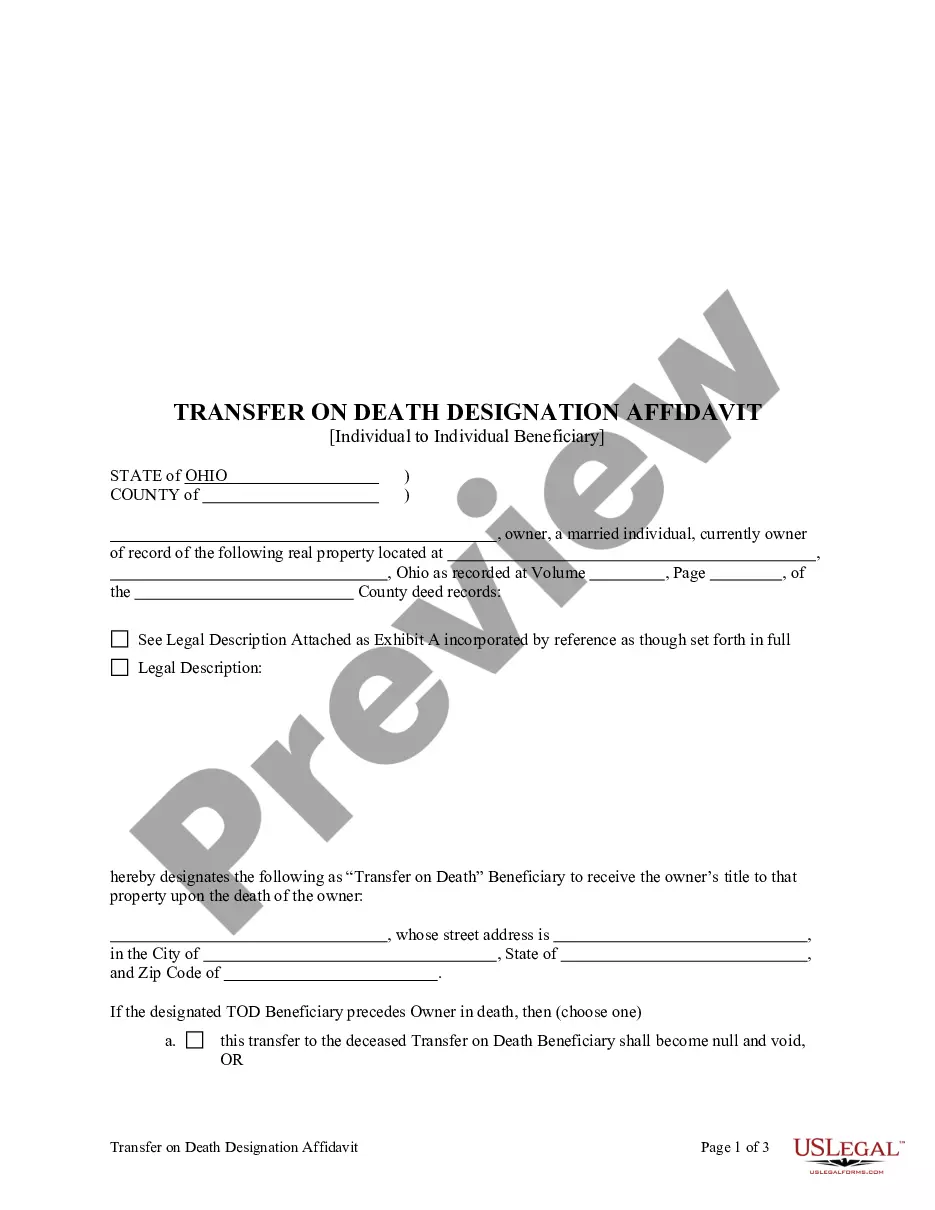

How to fill out Ohio Transfer On Death Designation Affidavit - TOD From Individual To Individual Without Contingent Beneficiary?

There’s no longer a reason to devote hours searching for legal documents to meet your local state obligations. US Legal Forms has gathered all of them in one location and enhanced their availability.

Our platform provides over 85,000 templates for various business and individual legal matters categorized by state and purpose. All forms are expertly drafted and verified for accuracy, so you can feel assured in obtaining an up-to-date Affidavit For Transfer Without Probate Ohio With Fill Out.

If you are acquainted with our platform and already possess an account, please ensure your subscription is active before obtaining any templates. Log In to your account, select the document, and click Download. You can also revisit all obtained documents at any time by accessing the My documents section in your profile.

Completing legal paperwork under federal and state guidelines is quick and straightforward with our library. Try US Legal Forms today to keep your documentation well-organized!

- Examine the page content closely to verify it includes the sample you need.

- To assist with this, utilize the form description and preview options if available.

- Use the Search field above to look for another template if the previous choice wasn’t suitable.

- Click Buy Now beside the template name once you locate the correct one.

- Choose the most appropriate subscription plan and create an account or Log In.

- Process your payment for the subscription using a card or via PayPal to proceed.

- Select the file format for your Affidavit For Transfer Without Probate Ohio With Fill Out and download it to your device.

- Print your form to fill it out manually or upload the template if you prefer to do it using an online editor.

Form popularity

FAQ

How to create a Transfer on Death for your homeChoose your recipients. You can choose one or more people to become owner of any home or land that you own.Find a copy of your deed.Complete the TOD for real estate form.Take the form to a notary .Submit the form at your County Recorder's Office.

Step 1 Appraisal. Before completing paperwork for filing, any person who wants to petition an estate with this affidavit is responsible for first having the estate appraised by an appraiser.Step 2 Complete Paperwork. Gather and complete the following required documents:Step 3 File With the Court.Step 4 Notify.

How to create a Transfer on Death for your carComplete the BMV TOD form. Include the name of one or more recipients.Take the form to a notary . You need to sign the form in front of a notary, and have it stamped.Submit the form at your county's Clerk of Courts Title Office.

Ohio has a simplified probate process for small estates. To use it, an executor files a written request with the local probate court asking to use the simplified procedure.

Although the beneficial interest in the property could be transferred without a Grant of Probate, an Executor would be unable to register the legal interest in the property at the Land Registry without the Grant.