Ohio Llc Operating Agreement Template With Single Member

Description

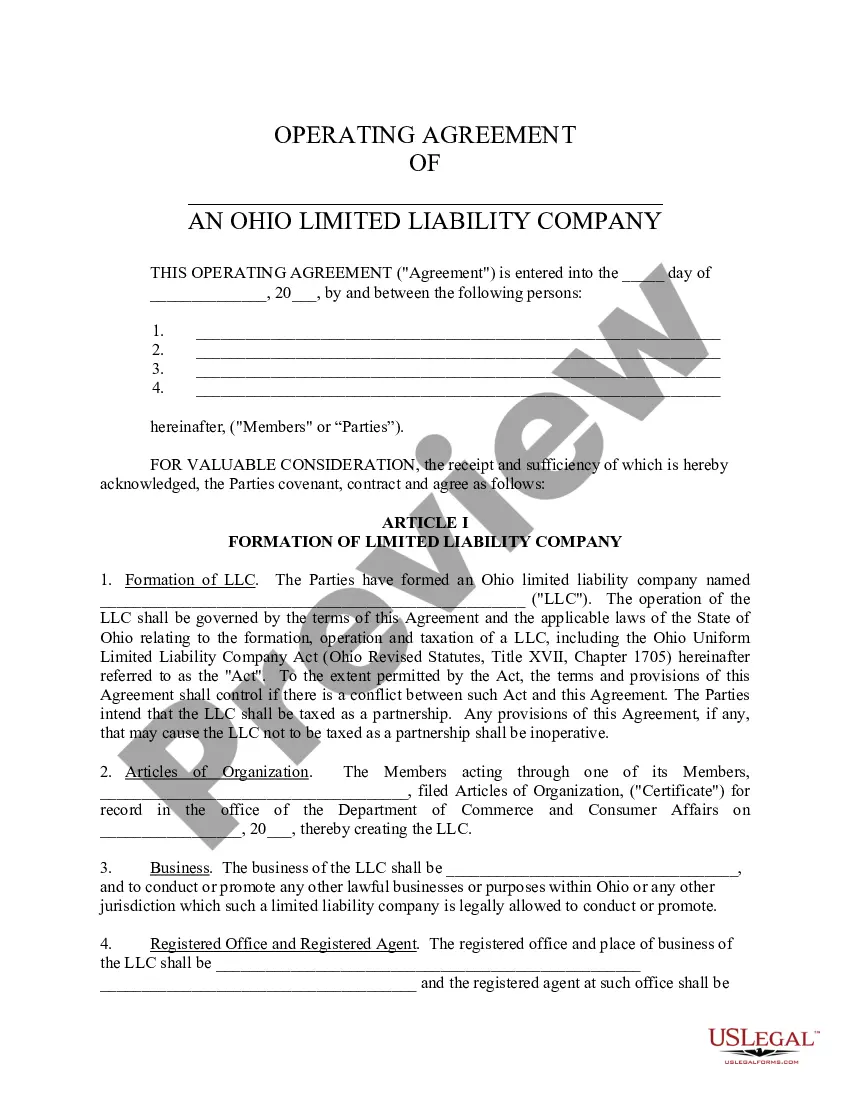

How to fill out Ohio Limited Liability Company LLC Operating Agreement?

Whether for business purposes or for individual matters, everyone has to manage legal situations at some point in their life. Filling out legal paperwork requires careful attention, starting with choosing the appropriate form template. For instance, when you choose a wrong edition of the Ohio Llc Operating Agreement Template With Single Member, it will be turned down once you send it. It is therefore important to have a trustworthy source of legal files like US Legal Forms.

If you have to obtain a Ohio Llc Operating Agreement Template With Single Member template, stick to these easy steps:

- Get the sample you need by using the search field or catalog navigation.

- Examine the form’s information to ensure it matches your situation, state, and county.

- Click on the form’s preview to view it.

- If it is the wrong form, go back to the search function to locate the Ohio Llc Operating Agreement Template With Single Member sample you require.

- Get the file when it matches your needs.

- If you have a US Legal Forms account, simply click Log in to access previously saved documents in My Forms.

- If you do not have an account yet, you can obtain the form by clicking Buy now.

- Select the proper pricing option.

- Finish the account registration form.

- Pick your payment method: use a bank card or PayPal account.

- Select the document format you want and download the Ohio Llc Operating Agreement Template With Single Member.

- When it is saved, you can fill out the form with the help of editing software or print it and complete it manually.

With a substantial US Legal Forms catalog at hand, you never need to spend time looking for the appropriate sample across the web. Utilize the library’s easy navigation to get the right template for any occasion.

Form popularity

FAQ

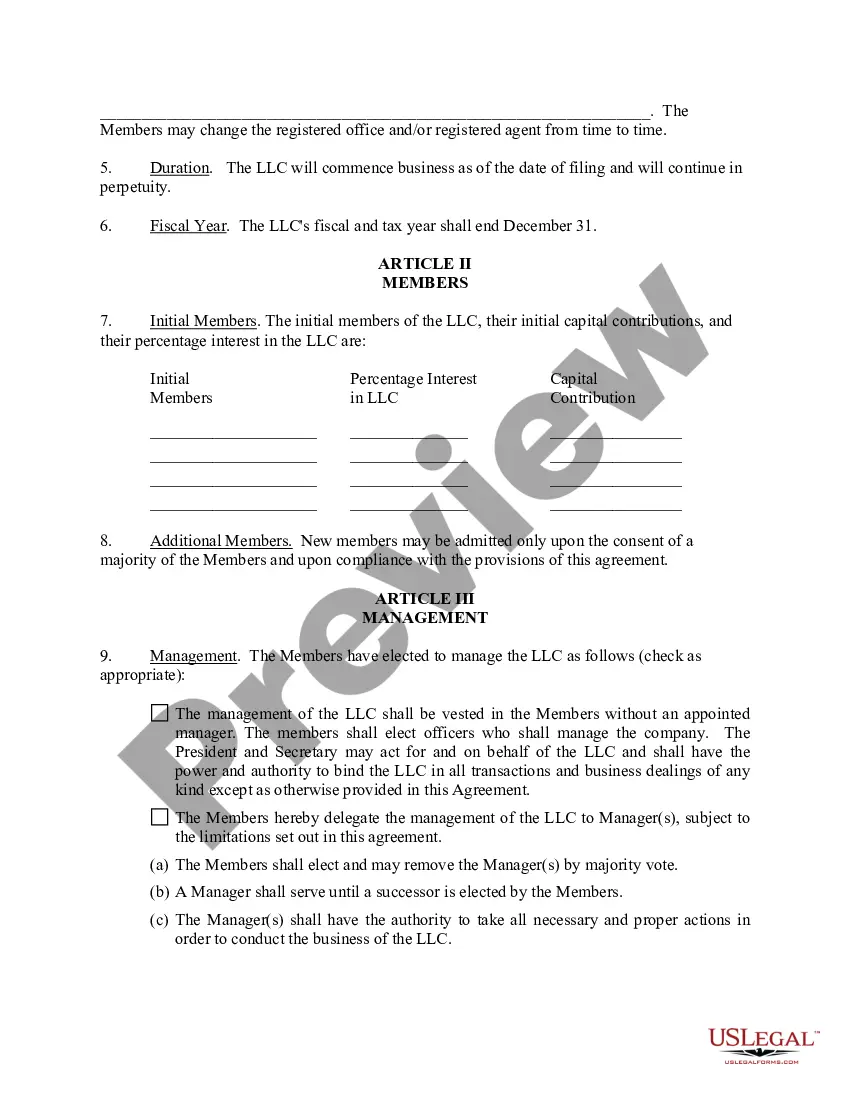

An Operating Agreement is not required by the state of Ohio, but it's highly recommended for LLCs with multiple owners. Having an Operating Agreement in place can protect your business from potential disputes and provide clarity on how decisions are to be made.

How to Add a Member to Your Ohio LLC Make sure you comply with Ohio's Revised LLC Act. ing to Ohio Rev Code § 1706.27, an Ohio LLC may add a new member in any of the following ways: ... Update your Ohio LLC Operating Agreement. ... Check your Ohio LLC Articles of Organization. ... Contact the IRS.

How to Form a Single-Member LLC in Ohio Name Your SMLLC. Ohio requires that the name of your SMLLC follow certain rules. ... File Articles of Organization. ... Prepare an Operating Agreement. ... Do You Need an EIN? ... Register With the Department of Taxation. ... Apply for Business Licenses. ... No Annual Reports.

No, it's not legally required in Ohio under § 176.081. Single-member LLCs need an operating agreement to preserve their corporate veil and to prove ownership. And multi-member LLCs need one to help provide operating guidance, determine voting rights and contributions.

Converting a Single-Member LLC to a Multi-Member LLC If your LLC already has an employer identification number (EIN), you have to file Form 8832 with the IRS to elect partnership taxation and provide the names of the new members.