New York Is In Which City

Description

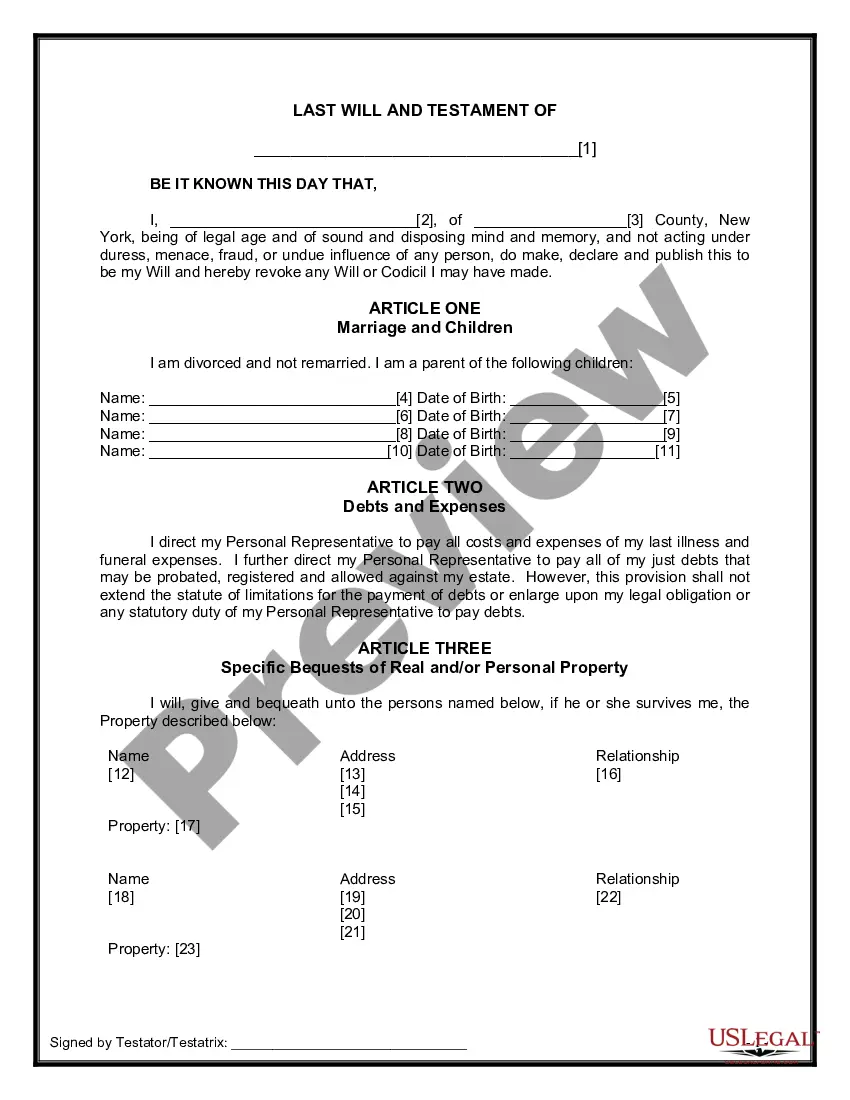

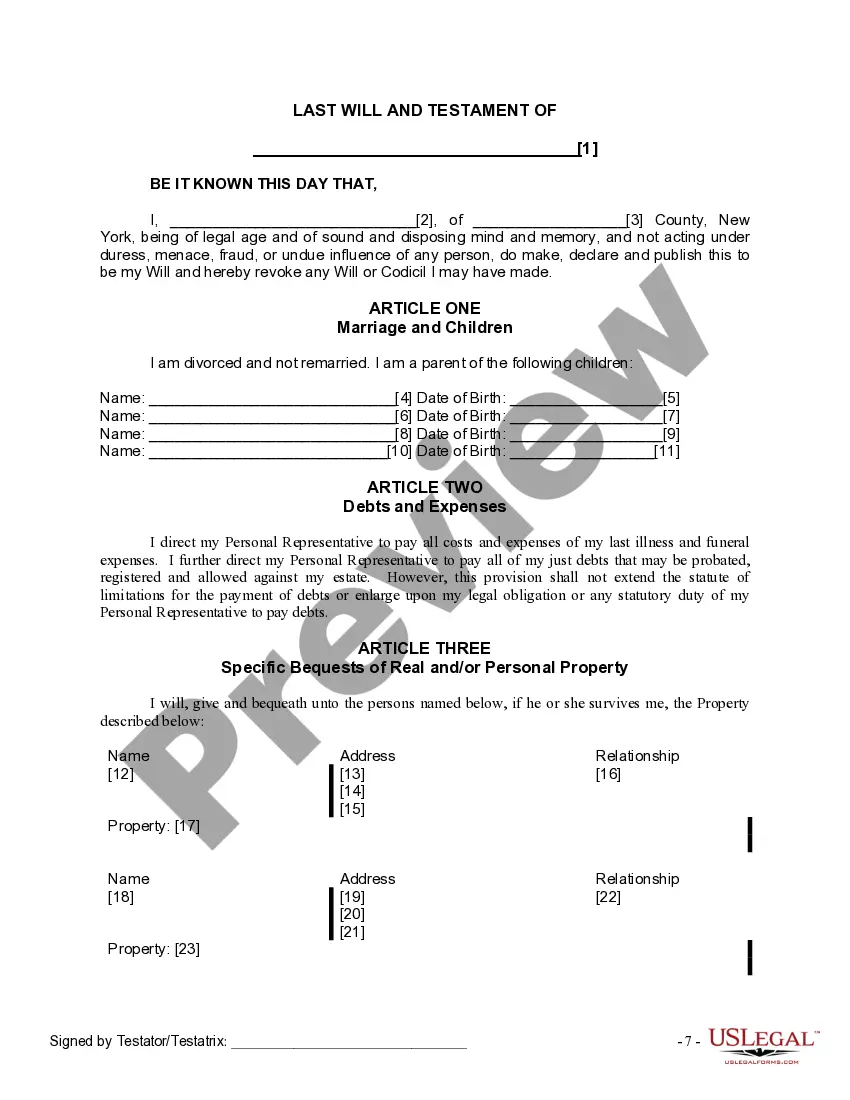

How to fill out New York Last Will And Testament For Divorced Person Not Remarried With Adult And Minor Children?

Locating a reliable source for the latest and most pertinent legal templates is a significant part of navigating bureaucracy.

Selecting the appropriate legal documents demands accuracy and meticulousness, which is why it is essential to source samples of New York Is In Which City exclusively from trustworthy providers like US Legal Forms.

Remove the stress associated with your legal documentation. Explore the extensive US Legal Forms catalog to find legal templates, verify their applicability to your circumstances, and download them instantly.

- Utilize the directory navigation or search bar to find your document.

- Examine the form’s description to confirm it aligns with your state and county requirements.

- Check the form preview, if available, to verify that it is indeed the document you need.

- Return to the search results and seek the correct template if the New York Is In Which City does not meet your requirements.

- If you are confident in the document’s relevance, download it.

- After registering, click Log in to verify and access your chosen templates in My documents.

- If you haven't created an account yet, click Buy now to purchase the template.

- Select the pricing option that aligns with your needs.

- Proceed with the registration to finalize your order.

- Complete your purchase by choosing a payment method (credit card or PayPal).

- Select the file format for downloading New York Is In Which City.

- Once you have the document on your device, you can edit it with the editor or print it and fill it in by hand.

Form popularity

FAQ

You can file New York Form IT-370, the application for automatic extension of time to file, at the NYS Department of Taxation and Finance. This form can also be submitted electronically via online services that ease the filing process. Keep in mind that New York is in which city when determining your filing location and understanding local submission guidelines. Platforms like USLegalForms can assist you in navigating these requirements effectively.

New York has a 4.00 percent state sales tax rate, a max local sales tax rate of 4.875 percent, and an average combined state and local sales tax rate of 8.52 percent. New York's tax system ranks 49th overall on our 2023 State Business Tax Climate Index.

You are a New York City resident if: your domicile is New York City; or. you have a permanent place of abode there and you spend 184 days or more in the city.

If you want to get close to withholding your exact tax obligation, claim 2 allowances for yourself and an allowance for however many dependents you have (so claim 3 allowances if you have one dependent).

Residents of all of the following are considered residents of New York City: Bronx. Brooklyn. Manhattan.

Allowances: A withholding allowance is an exemption that lowers the amount of income tax your employer must deduct from your paycheck.