Will Person Without Withholding Tax

Description

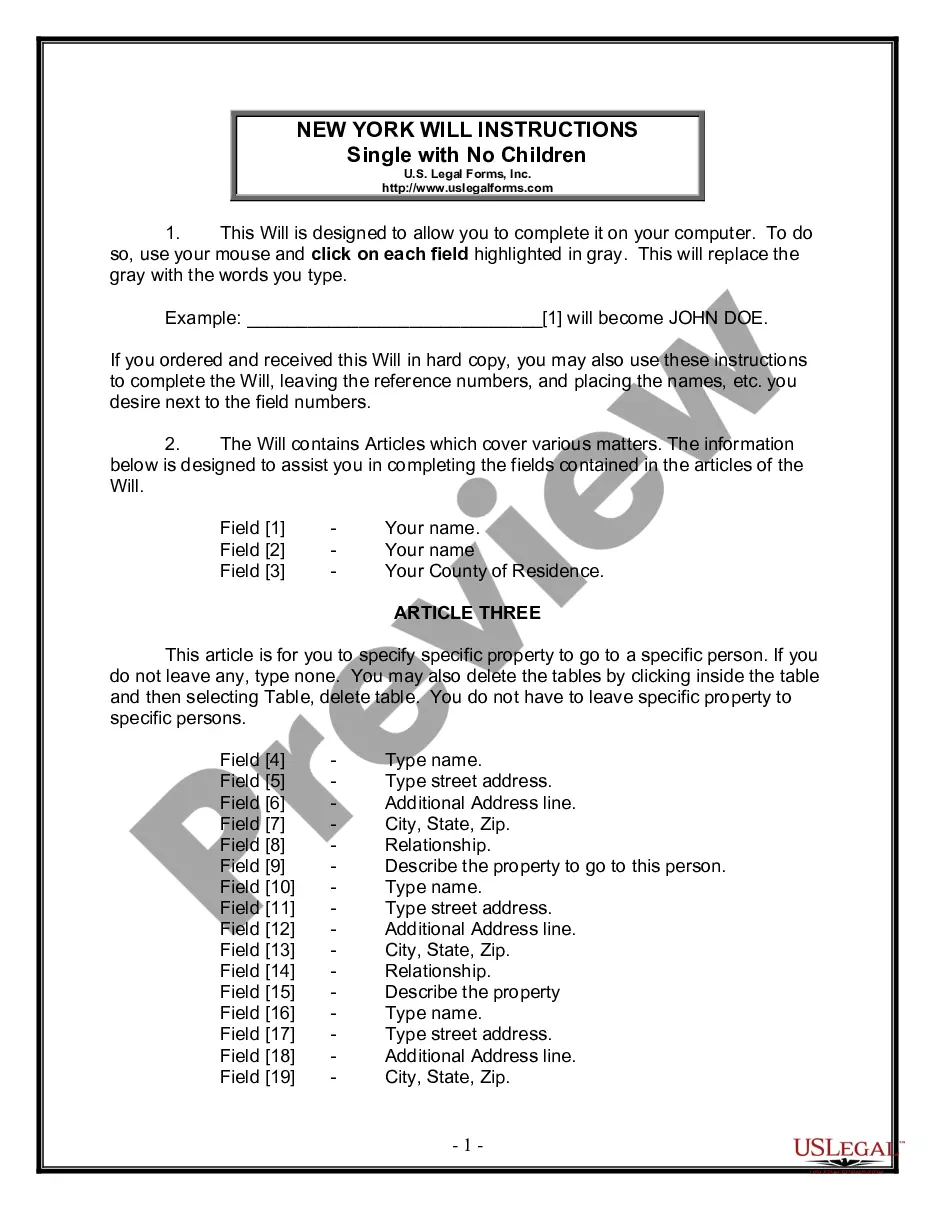

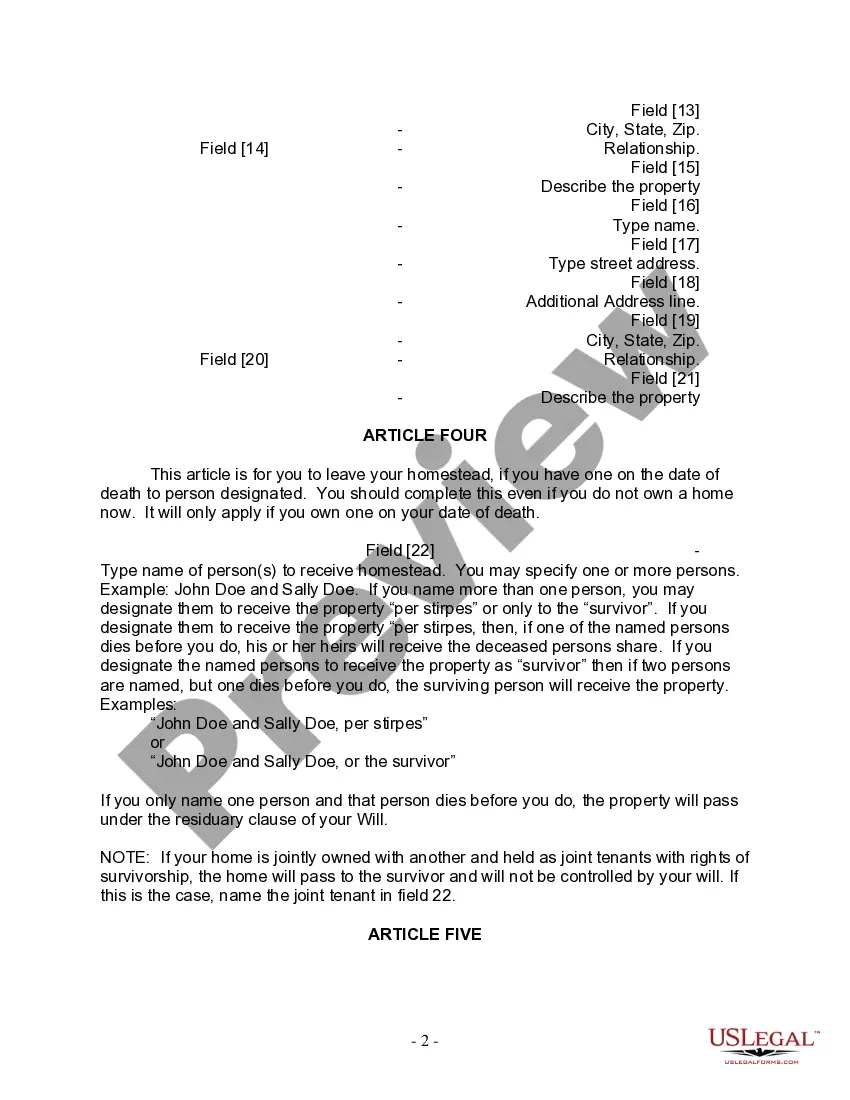

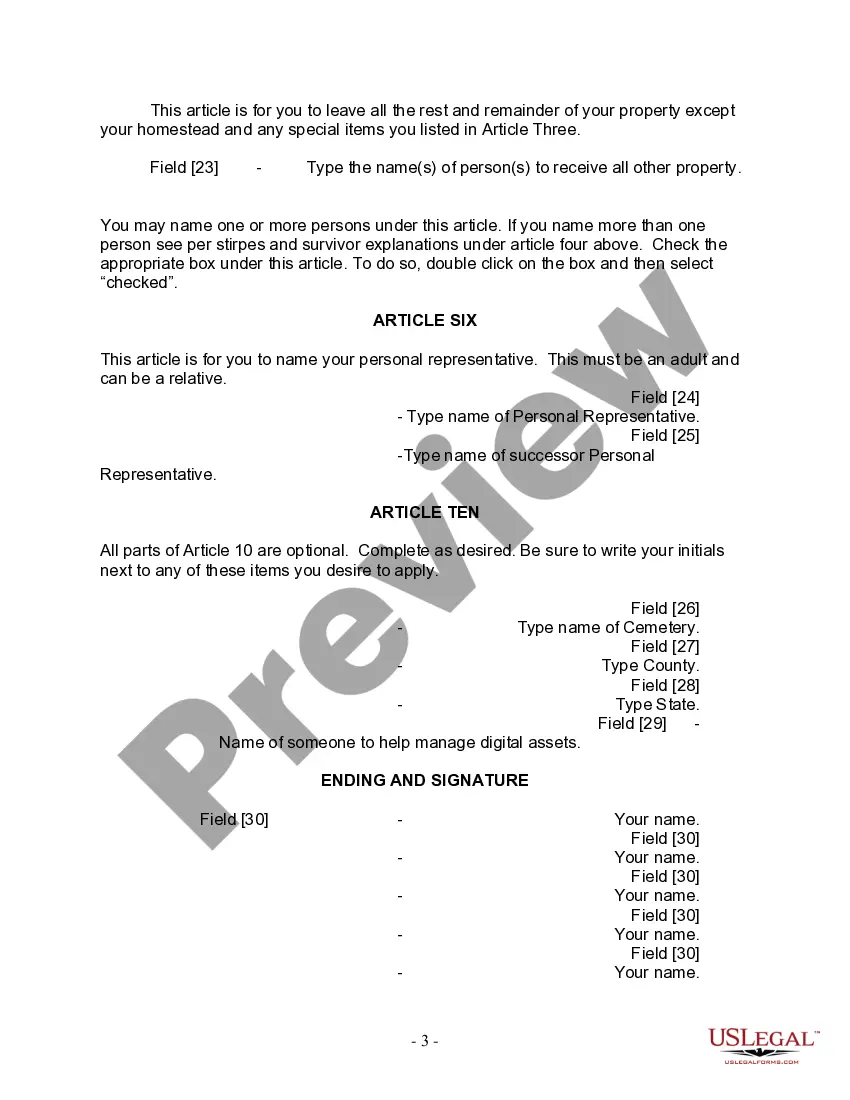

How to fill out New York Last Will And Testament For Single Person With No Children?

Drafting legal documents from scratch can often be daunting. Some cases might involve hours of research and hundreds of dollars spent. If you’re looking for a an easier and more cost-effective way of preparing Will Person Without Withholding Tax or any other paperwork without the need of jumping through hoops, US Legal Forms is always at your fingertips.

Our virtual catalog of over 85,000 up-to-date legal forms covers virtually every aspect of your financial, legal, and personal affairs. With just a few clicks, you can quickly get state- and county-compliant templates carefully prepared for you by our legal professionals.

Use our platform whenever you need a trustworthy and reliable services through which you can quickly locate and download the Will Person Without Withholding Tax. If you’re not new to our services and have previously created an account with us, simply log in to your account, select the template and download it away or re-download it at any time in the My Forms tab.

Not registered yet? No problem. It takes little to no time to register it and navigate the catalog. But before jumping straight to downloading Will Person Without Withholding Tax, follow these recommendations:

- Check the document preview and descriptions to make sure you have found the document you are looking for.

- Make sure the template you choose conforms with the requirements of your state and county.

- Pick the best-suited subscription option to purchase the Will Person Without Withholding Tax.

- Download the form. Then fill out, sign, and print it out.

US Legal Forms boasts a good reputation and over 25 years of expertise. Join us today and transform document execution into something simple and streamlined!

Form popularity

FAQ

The amount is taxable in most circumstances. The CPP death benefit is normally included in the estate's income and reported on the estate's trust return for the year the amount was received.

Exemption From Withholding If an employee qualifies, he or she can also use Form W-4 to tell you not to deduct any federal income tax from his or her wages. To qualify for this exempt status, the employee must have had no tax liability for the previous year and must expect to have no tax liability for the current year.

How Do I Fill Out Form W-8BEN? Part I ? Identification of Beneficial Owner: Line 1: Enter your name as the beneficial owner. ... Line 2: Enter your country of citizenship. ... Line 3: Enter your permanent residence/mailing address. ... Line 4: Enter your mailing address, if different.

How to Fill out and Read Form W-8BEN Line 1: Provide your name or your business name. Line 2: Provide your country of citizenship. Line 3: Enter your permanent residence address. Line 5: Enter your U.S. tax identification number. Line 6: Enter your foreign tax identifying number.