Vehicle Power Of Attorney Form With Adults With Disabilities

Description

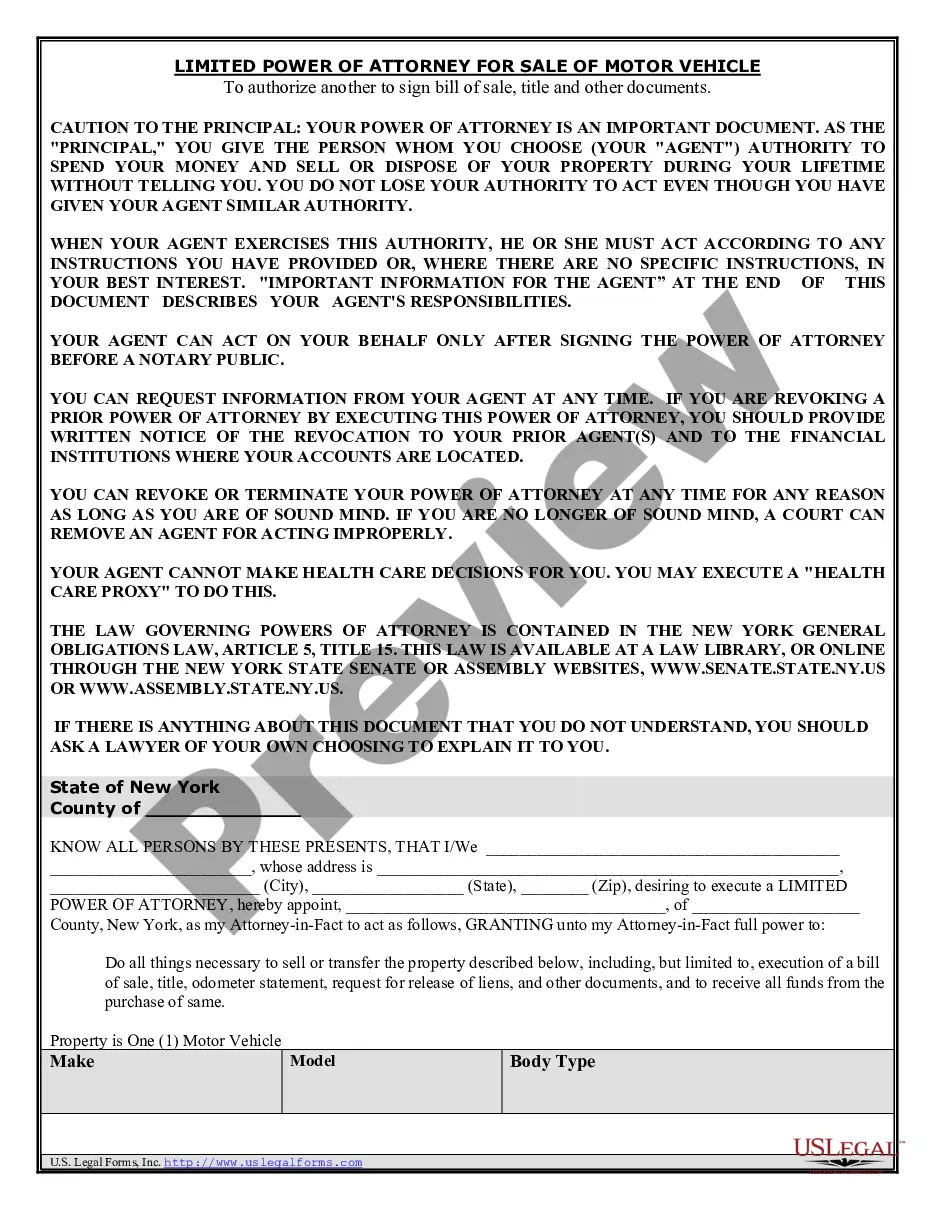

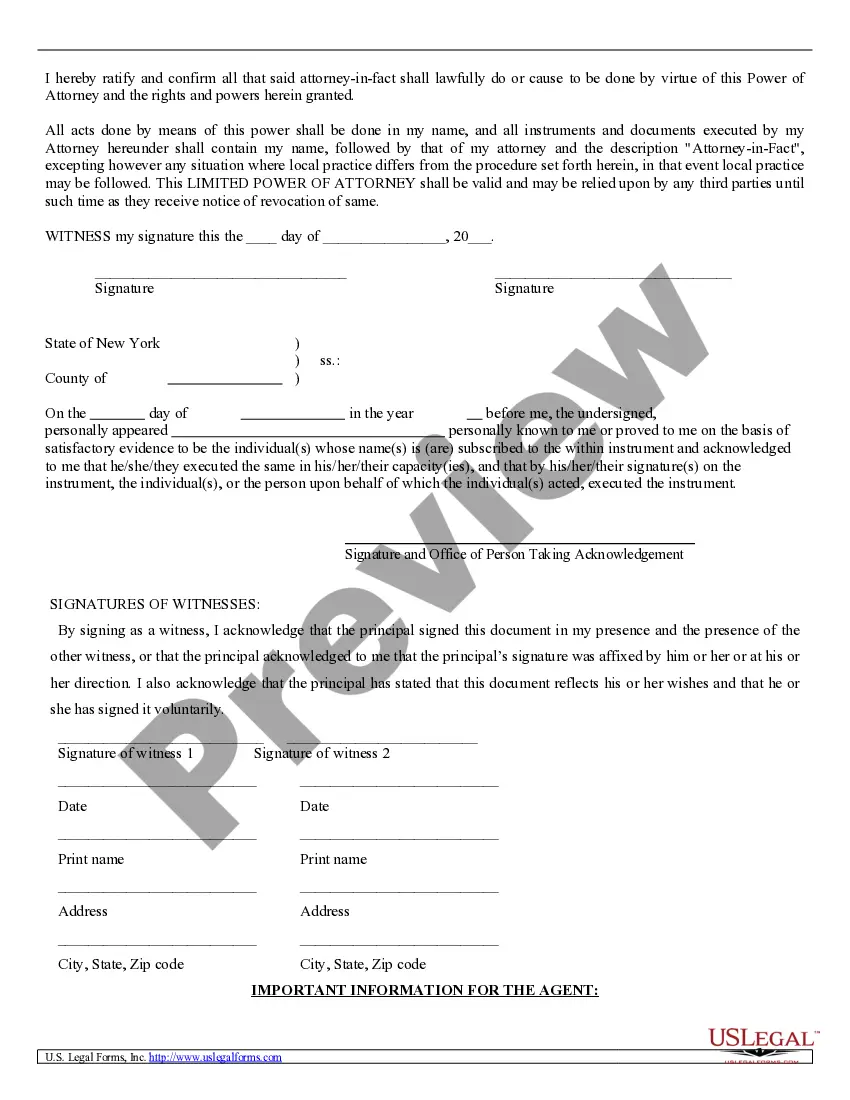

How to fill out New York Power Of Attorney For Sale Of Motor Vehicle?

Finding a go-to place to access the most current and relevant legal samples is half the struggle of handling bureaucracy. Choosing the right legal files requirements accuracy and attention to detail, which explains why it is important to take samples of Vehicle Power Of Attorney Form With Adults With Disabilities only from trustworthy sources, like US Legal Forms. A wrong template will waste your time and delay the situation you are in. With US Legal Forms, you have little to be concerned about. You can access and check all the details regarding the document’s use and relevance for the situation and in your state or region.

Take the following steps to complete your Vehicle Power Of Attorney Form With Adults With Disabilities:

- Utilize the library navigation or search field to locate your sample.

- Open the form’s information to check if it matches the requirements of your state and county.

- Open the form preview, if there is one, to make sure the template is the one you are looking for.

- Get back to the search and look for the appropriate template if the Vehicle Power Of Attorney Form With Adults With Disabilities does not fit your needs.

- When you are positive about the form’s relevance, download it.

- When you are an authorized user, click Log in to authenticate and access your selected forms in My Forms.

- If you do not have an account yet, click Buy now to get the form.

- Pick the pricing plan that suits your requirements.

- Proceed to the registration to complete your purchase.

- Finalize your purchase by choosing a payment method (credit card or PayPal).

- Pick the document format for downloading Vehicle Power Of Attorney Form With Adults With Disabilities.

- Once you have the form on your gadget, you may alter it using the editor or print it and finish it manually.

Remove the inconvenience that comes with your legal paperwork. Discover the extensive US Legal Forms catalog to find legal samples, examine their relevance to your situation, and download them immediately.

Form popularity

FAQ

You can make several different types of POAs in Massachusetts. In particular, many estate plans include two POAs: a financial POA, which allows someone to handle your financial or business matters, and. a medical POA, which allows someone to make medical decisions on your behalf.

A Massachusetts motor vehicle power of attorney form is a form used to designate a person to represent another person in matters related to titling and registration at the Massachusetts Registry of Motor Vehicles. This is a type of limited power of attorney that pertains to motor vehicles only.

One major downfall of a POA is the agent may act in ways or do things that the principal had not intended. There is no direct oversight of the agent's activities by anyone other than you, the principal. This can lend a hand to situations such as elder financial abuse and/or fraud.

The POA cannot transfer the responsibility to another Agent at any time. The POA cannot make any legal or financial decisions after the death of the Principal, at which point the Executor of the Estate would take over. The POA cannot distribute inheritances or transfer assets after the death of the Principal.

You are not required to file your power of attorney unless you are using it for a real estate transaction. Real Property Law §421. You can also file a copy with the County Clerk's Office if you would like to be sure you can obtain copies if needed. Remember, your power of attorney cannot help you if it cannot be found.