New York Corporate Extension Form

Description

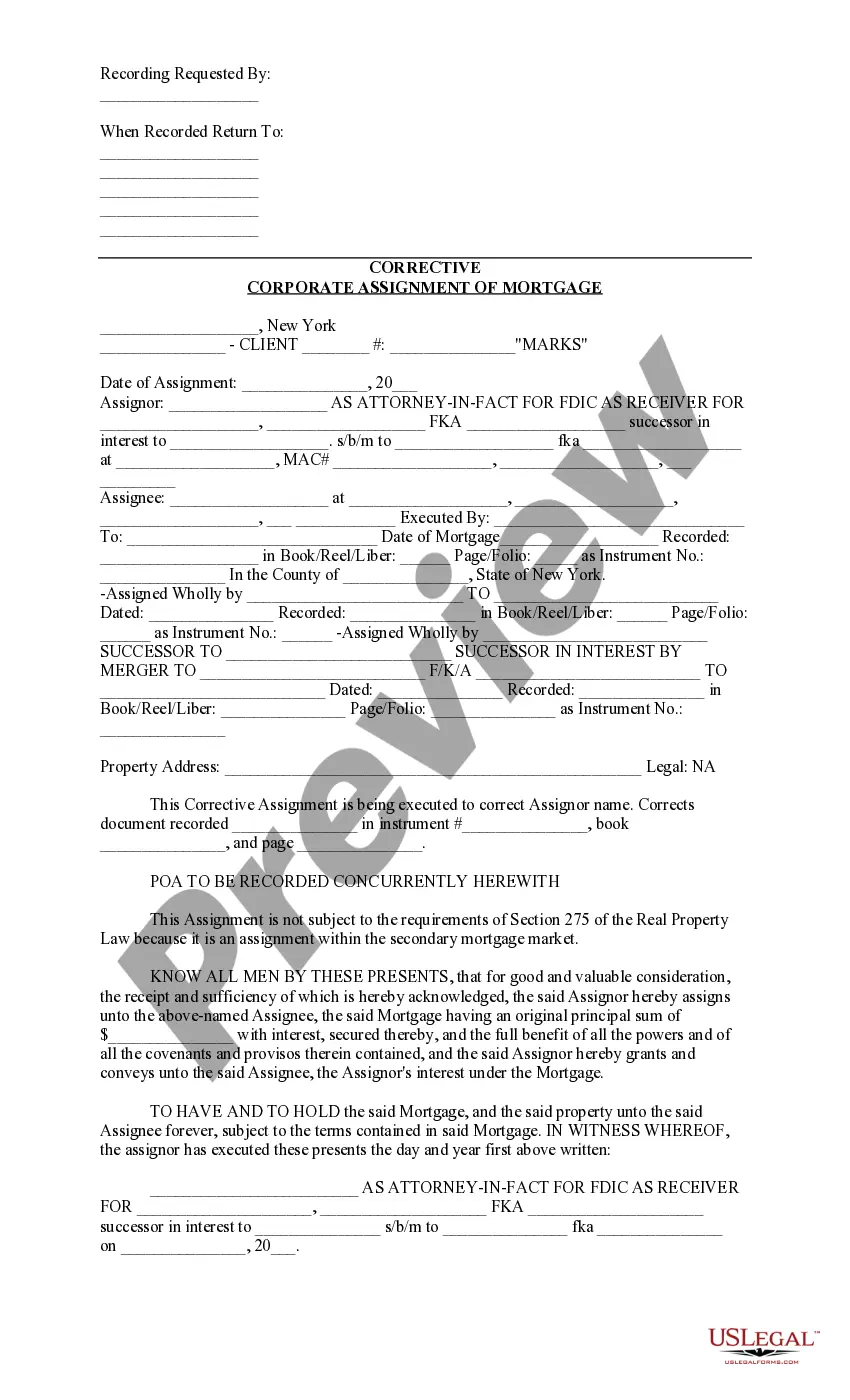

How to fill out New York Corrective Corporate Assignment Of Mortgage?

Which is the most reliable service to obtain the New York Corporate Extension Form and other updated versions of legal documents.

US Legal Forms is the answer! It's the best compilation of legal templates for any purpose.

If you do not yet possess an account with us, here are the steps you should follow to create one.

- Each document is expertly crafted and verified for adherence to federal and state laws.

- They are categorized by region and state of application, making it simple to find the one you require.

- Veteran users of the platform merely need to Log In to the site, confirm that their subscription is active, and click the Download button next to the New York Corporate Extension Form to obtain it.

- After saving, the document is still accessible for future use in the My documents section of your account.

Form popularity

FAQ

Yes, you can file a New York State tax extension online using approved platforms. Services like USLegalForms simplify this process, offering you the ability to fill out and submit the New York corporate extension form with ease. Online filing provides instant confirmation, helping you maintain peace of mind. It’s a convenient option for busy business owners.

Form 4868 is an automatic extension for individual tax returns, while Form 7004 is specifically for certain business entities, including S Corporations. If you are filing an extension for a corporate tax return, use the New York corporate extension form or Form 7004. Each form has its regulations and deadlines, so it’s essential to choose the right one for your situation.

If your S Corporation files late, even with an extension, you could face penalties. Generally, the penalties accrue at a certain rate based on the amount of unpaid tax. Filing the New York corporate extension form on time helps mitigate these risks. It’s always advisable to file as early as possible to avoid complications.

To file an extension for your corporate tax return, complete the New York corporate extension form accurately. You can do this via mail or online services like USLegalForms, which facilitate a quick and easy process. Make sure you file before the deadline to avoid any penalties. After filing, keep proof of submission to reflect compliance.

Filing a New York corporate extension form is straightforward. First, gather necessary information about your business, including tax identification details. You can either use an online platform like USLegalForms for a seamless experience, or complete the form manually and mail it. It's essential to submit the form before the due date to ensure you receive automatic approval.

Yes, you can file a New York corporate extension form electronically. Many platforms, including USLegalForms, offer easy online filing solutions. Filing electronically can improve accuracy and speed up the processing time. Just ensure you have all required information ready when you start.

To mail your New York State corporate extension form, locate the address specified on the form itself, usually found in the instructions. Typically, you would send it to the New York State Department of Taxation and Finance. Ensure you use the correct postage to avoid delays. Don’t forget to keep a copy for your records.

Yes, you can file an extension for an S Corporation using the New York corporate extension form. This extension gives your S Corp additional time to file its return without facing penalties. However, it’s crucial to submit your extension request before the due date to ensure it's valid. If you need assistance, platforms like USLegalForms can help simplify the process, providing the necessary forms and guidance.

When submitting the NYC extension form, it’s essential to mail it to the correct address to ensure timely processing. For most businesses, the form should be sent to the NYC Department of Finance. You can find the specific mailing address on the form instructions or the department’s website. Ensuring you send your New York corporate extension form to the right place helps you avoid delays in processing your extension request.

Most states comply with the IRS federal extension 1120S, allowing businesses to extend their filing deadline. However, it's crucial to verify the specific rules for each state, as some may have their own requirements. Always check with the state tax authority to ensure your New York corporate extension form aligns with accepted federal extensions. By staying informed, you can avoid any unexpected issues with your tax filing.