New York Property Tax Search By Name

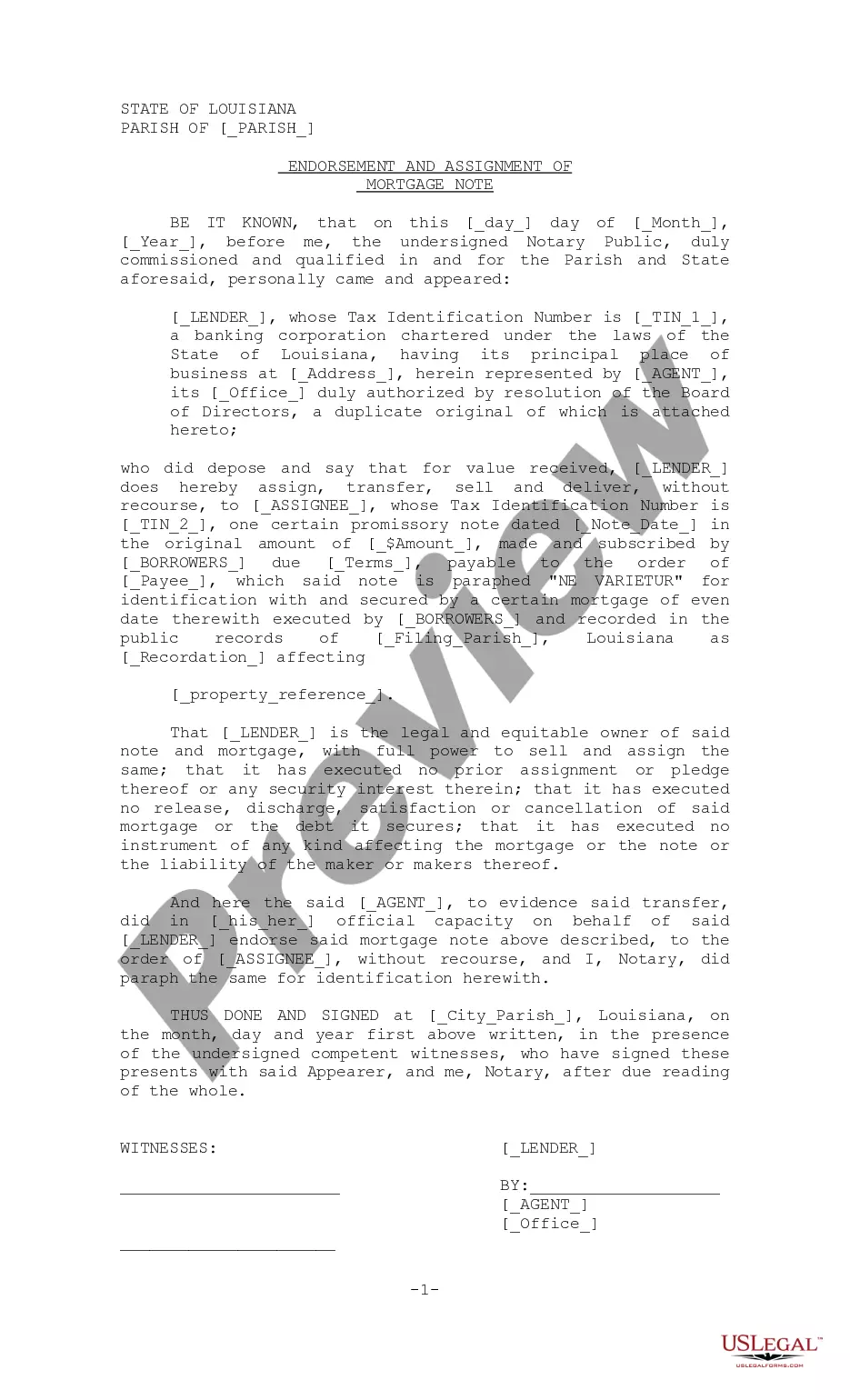

Description

How to fill out New York Release Of Lien Of Estate Tax?

The New York Property Tax Search By Name you see on this page is a reusable formal template drafted by professional lawyers in compliance with federal and state regulations. For more than 25 years, US Legal Forms has provided people, organizations, and attorneys with more than 85,000 verified, state-specific forms for any business and personal situation. It’s the fastest, most straightforward and most reliable way to obtain the paperwork you need, as the service guarantees the highest level of data security and anti-malware protection.

Getting this New York Property Tax Search By Name will take you only a few simple steps:

- Search for the document you need and review it. Look through the file you searched and preview it or review the form description to confirm it satisfies your requirements. If it does not, use the search option to get the right one. Click Buy Now when you have found the template you need.

- Sign up and log in. Select the pricing plan that suits you and create an account. Use PayPal or a credit card to make a quick payment. If you already have an account, log in and check your subscription to continue.

- Acquire the fillable template. Pick the format you want for your New York Property Tax Search By Name (PDF, DOCX, RTF) and save the sample on your device.

- Fill out and sign the document. Print out the template to complete it manually. Alternatively, use an online multi-functional PDF editor to rapidly and accurately fill out and sign your form with a legally-binding] {electronic signature.

- Download your papers one more time. Use the same document again anytime needed. Open the My Forms tab in your profile to redownload any previously saved forms.

Subscribe to US Legal Forms to have verified legal templates for all of life’s scenarios at your disposal.

Form popularity

FAQ

A: Because the STAR exemption is a reduction on your school tax bill, you can determine if you are receiving it by reviewing your school tax bill or contacting your assessor.

If your STAR check hasn't shown up and your due date to pay your school property taxes has passed, contact the Department of Taxation and Finance through your Online Services Account or by calling the office at 518-457-2036 from a.m. to p.m., Monday through Friday.

You can search for property records and property ownership information online, in person, or over the phone with a 311 representative. Property owners of all boroughs except Staten Island can visit ACRIS. To search documents for Staten Island property, visit the Richmond County Clerk's website.

The IT-119 form is a NY State form for a STAR credit for new homeowners (property tax relief). The property key is shown on the notice you received from the Tax Department. When entering on the IT-119, the R has been pre-populated on the form (Line 1a), enter the six remaining letters and numbers to complete.

A: Because the STAR exemption is a reduction on your school tax bill, you can determine if you are receiving it by reviewing your school tax bill or contacting your assessor.