Account Transfer Trust With Your Account

Description

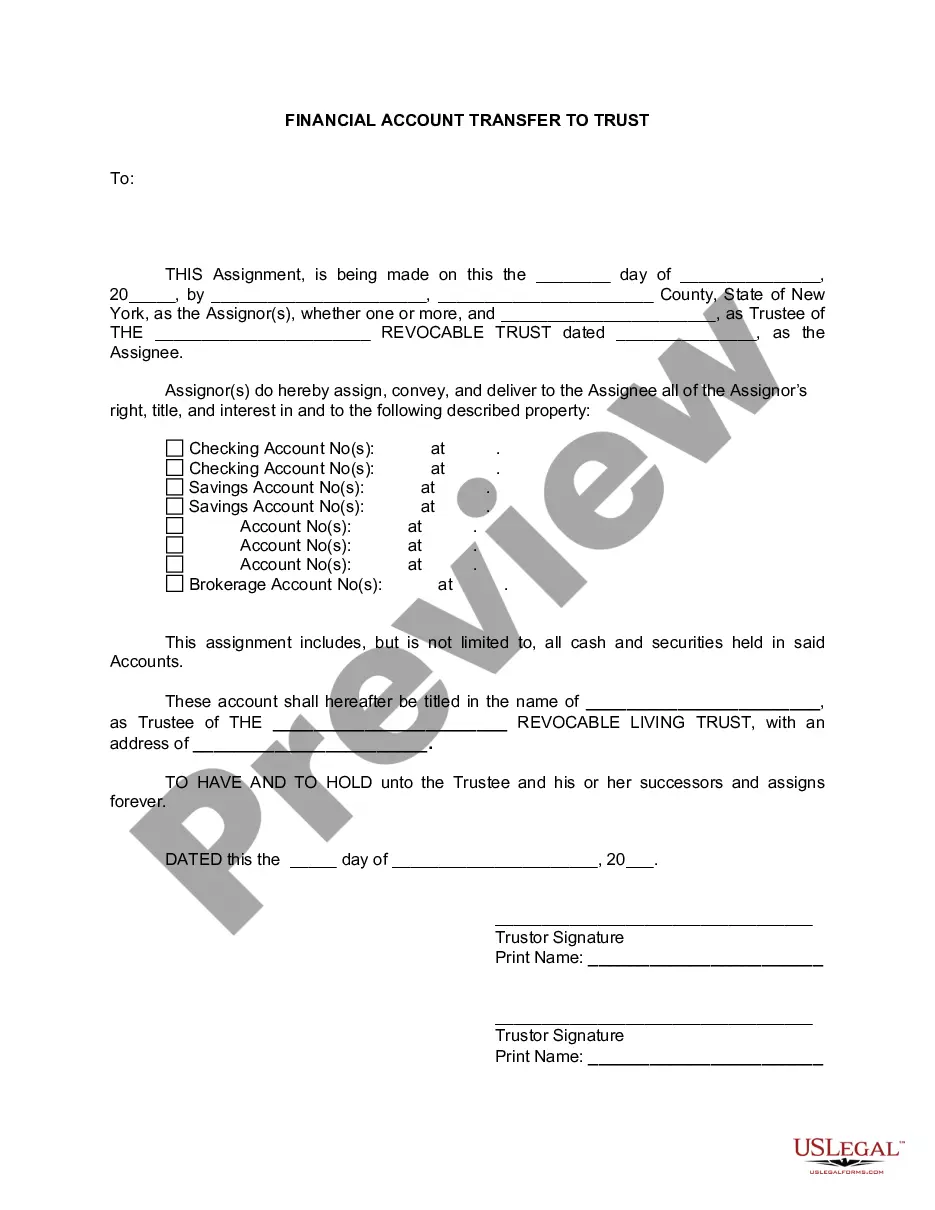

How to fill out New York Financial Account Transfer To Living Trust?

- For existing users, start by logging in to your account. Ensure your subscription is active; if it’s expired, renew it according to your plan.

- If it's your first time, browse through the Preview mode and description of the desired form. Confirm that it fits your specific needs and complies with local jurisdiction requirements.

- Should you need a different template, utilize the Search bar above to find the document that best matches your criteria before proceeding.

- Once you find the right form, click on the Buy Now button and select your preferred subscription plan. You will need to create an account for full access.

- Next, finish your purchase by entering your credit card details or using your PayPal account to complete the transaction.

- Finally, download your form to your device and access it anytime in the My Forms section of your profile.

Utilizing US Legal Forms ensures you benefit from an expansive form collection, giving you more options for a competitive price.

Get started today and experience hassle-free legal document handling with US Legal Forms. Your legal needs are just a few clicks away!

Form popularity

FAQ

Yes, an irrevocable trust is subject to the 5-year rule. When you set up an account transfer trust with your account, the IRS closely monitors transfers to assess long-term eligibility for government assistance programs. Understanding this rule helps you properly plan the timing of your trust setup and transfer of assets, ensuring that you meet both your financial goals and regulatory requirements.

Yes, you can make your trust the beneficiary of your checking account. By establishing an account transfer trust with your account, you ensure that funds can seamlessly transfer to your beneficiaries without needing probate assistance. This approach allows for efficient distribution of your assets, providing clarity and peace of mind for you and your loved ones.

To avoid inheritance tax with a trust, you should set up an account transfer trust with your account that holds your assets. This can help legally minimize or eliminate the taxable estate by distributing your wealth while you're alive or designating beneficiaries. Structuring your trust properly can ensure that your heirs benefit without facing hefty tax burdens, making it a crucial step in inheritance planning.

The 5 year rule for trusts refers to a guideline regarding the transfer of assets into trusts and potential tax implications. When you create an account transfer trust with your account, assets transferred may be scrutinized for five years to determine if they qualify for Medicaid eligibility. Knowing this rule can significantly impact your financial planning, as it helps protect your assets while ensuring compliance with taxation laws.

To transfer your bank account to your trust, you need to contact your bank and request the necessary forms for a trust account setup. Ensure you have your trust documents ready, as the bank will require them to facilitate the transfer. This process embodies an account transfer trust with your account, which promotes smoother asset management. For assistance in this procedure, look to US Legal Forms for easy-to-follow guidance.

Yes, transferring your checking account into your trust can be beneficial. It allows for a seamless account transfer trust with your account, which aids in avoiding probate issues. However, consider your day-to-day access needs, as having your checking account in a trust may affect how you manage your funds. US Legal Forms provides resources to help you assess the best approach to this decision.

One of the biggest mistakes parents make is failing to properly fund the trust, leaving it empty and ineffective. It's essential to remember that an account transfer trust with your account relies on the transfer of assets into the trust. Moreover, parents should clearly communicate their intentions to beneficiaries to avoid confusion. Tools from US Legal Forms can help you ensure your trust is correctly established.

Certain assets may not be suitable for a trust, including retirement accounts like IRAs or 401(k)s, as they have specific tax implications. Additionally, personal items with sentimental value might be better handled through a will. It’s important to understand these nuances to ensure a successful account transfer trust with your account. US Legal Forms can provide clarity on what assets fit into a trust.

To fill out a trust fund, you need to start by gathering necessary information, such as the names of the trustor and beneficiaries. Next, clearly indicate the assets to be included in the trust fund. Additionally, ensure your trust document is properly structured to facilitate an account transfer trust with your account. If you want a streamlined process, consider using US Legal Forms for templates and guidance.

Deciding whether to transfer your bank account to trust depends on your individual circumstances. If you desire to manage your assets effectively and avoid potential probate challenges, an account transfer trust with your account might be beneficial. However, consider consulting with a legal or financial expert to explore the implications fully. Platforms like uslegalforms can guide you through the process and help make an informed decision tailored to your needs.