Account Transfer Trust With A Trust

Description

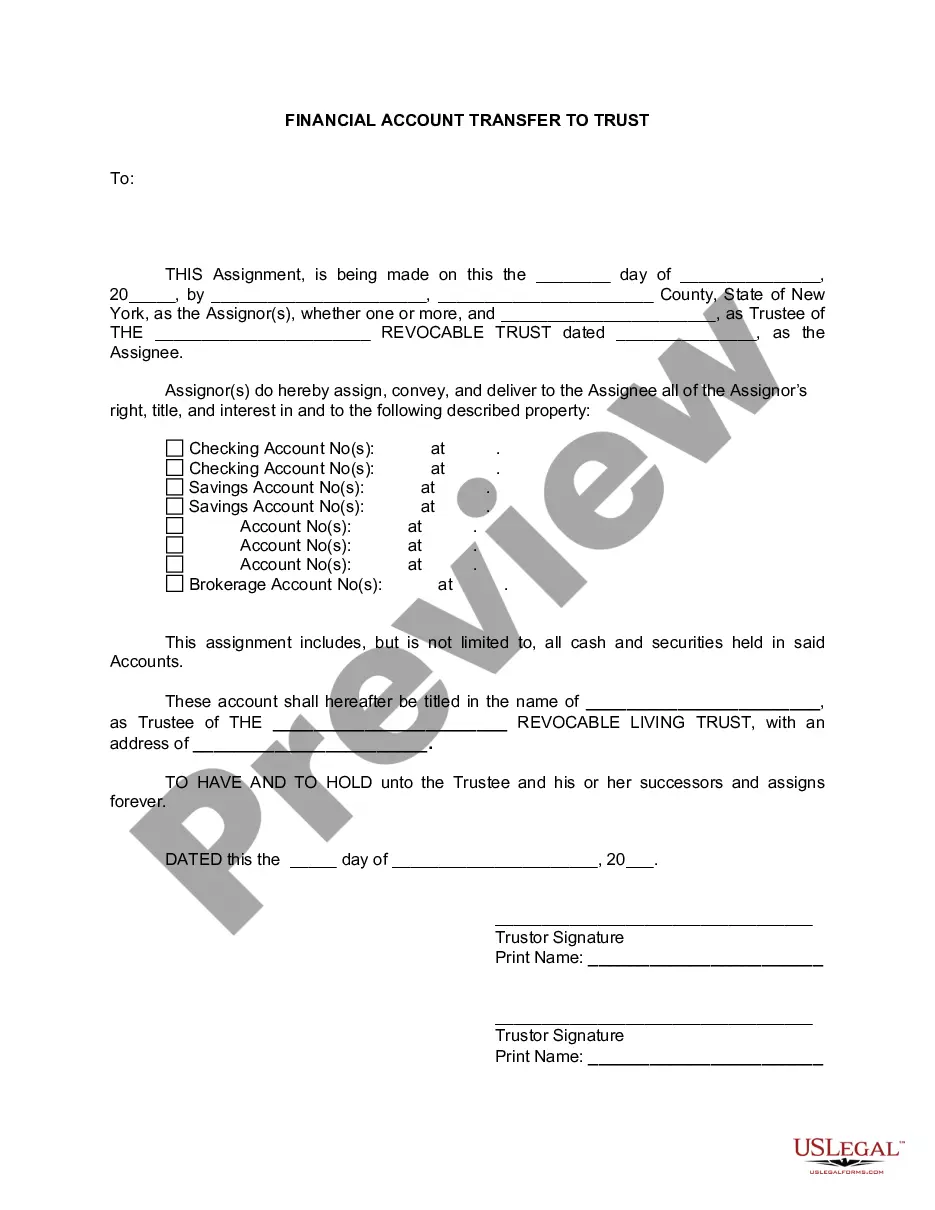

How to fill out New York Financial Account Transfer To Living Trust?

- Log into your US Legal Forms account. If you're a returning user, click on this link to access your account and download your desired form template.

- Verify your subscription status. Ensure your subscription is active; if not, take the necessary steps to renew it according to your payment plan.

- Review form details in Preview mode. Confirm that the selected form matches your needs and complies with local jurisdiction requirements.

- Search for additional forms if necessary. Utilize the Search tab to find alternative templates if you need adjustments.

- Select your purchase plan. Click on the Buy Now button and choose the subscription option that suits you best, then register for access to the extensive library.

- Complete your purchase. Enter your payment details either through credit card or PayPal to finalize the subscription.

- Download your form. Save the document onto your device and access it anytime through the My Forms menu.

In conclusion, US Legal Forms offers a robust collection of legal forms, ensuring that you have everything you need to complete your account trust transfer accurately. Their services empower both individuals and attorneys, making legal documentation seamless.

Don't wait any longer; start your legal journey today with US Legal Forms!

Form popularity

FAQ

Yes, you can roll a trust into another trust, which simplifies management and potentially streamlines tax obligations. An account transfer trust with a trust facilitates this process, allowing assets to be consolidated under new terms. This can significantly enhance the efficiency of your estate plan and ensure that your assets are managed according to your wishes. Consulting with a legal professional will guide you through the necessary steps for this transition.

Yes, a trust can indeed be split into two separate trusts. This process can be beneficial for various reasons, such as managing assets more effectively or addressing different interests of beneficiaries. By utilizing an account transfer trust with a trust, you can structure this split in a way that aligns with your overall estate planning goals. Collaborating with an attorney will ensure compliance and clarity throughout the process.

Yes, a trust can distribute assets to another trust, which is a strategic way to manage wealth. This approach is often used in estate planning to achieve specific financial goals or to accommodate beneficiaries' needs. Utilizing an account transfer trust with a trust can facilitate these distributions while maintaining proper oversight. It's advisable to work with a legal expert to structure the transfer correctly.

Yes, decanting a trust typically results in the creation of a new trust. This process allows trustees to transfer assets from an existing trust into a new account transfer trust with a trust, often with updated terms or conditions. Decanting can help address changes in circumstances, ensuring that the trust remains relevant and effective. Engaging the right legal advice will help navigate this process smoothly.

Yes, you can transfer assets from one trust to another. This process, known as an account transfer trust with a trust, enables flexibility in managing your assets. It allows you to adapt to changing needs or preferences over time. However, it is essential to consult with a legal professional to ensure compliance with relevant laws and regulations.

Having your parents place their assets in a trust can offer significant advantages, such as avoiding probate and streamlining asset distribution after their passing. However, it's essential for them to weigh the benefits against potential downsides, such as setup complexity and costs. An account transfer trust with a trust may be an excellent option to consider, but ensuring that it aligns with their financial goals is crucial. Consulting with experts, like those at US Legal Forms, can provide valuable insights tailored to their needs.

One significant downfall of having a trust is the potential for mismanagement due to lack of knowledge or experience. Without proper understanding, individuals might make mistakes that could affect the distribution of assets held within an account transfer trust with a trust. Furthermore, while trusts can help avoid probate, they do not eliminate estate taxes, which can still be a concern. Staying informed and working with professionals can help navigate these pitfalls effectively.

A family trust can sometimes lead to family conflicts, especially if beneficiaries have different views about asset distribution. Furthermore, establishing and maintaining a family trust requires ongoing attention and may incur legal fees. While the benefits often outweigh these concerns, it's important to address them when creating an account transfer trust with a trust. Consulting with a qualified professional can help mitigate these issues.

One downside of placing assets in a trust is the complexity involved in setting it up. Often, you must fund the trust correctly to ensure your assets transition smoothly through an account transfer trust with a trust. Additionally, managing a trust may involve ongoing administrative tasks and costs that could deter some individuals. However, these challenges can be managed effectively with the right guidance and resources.

You can transfer funds from one trust to another trust. This is often done for estate planning or to consolidate assets. An account transfer trust with a trust serves as an effective mechanism for managing such transactions. It's advisable to consult a legal expert to verify the procedure and ensure compliance with applicable regulations.