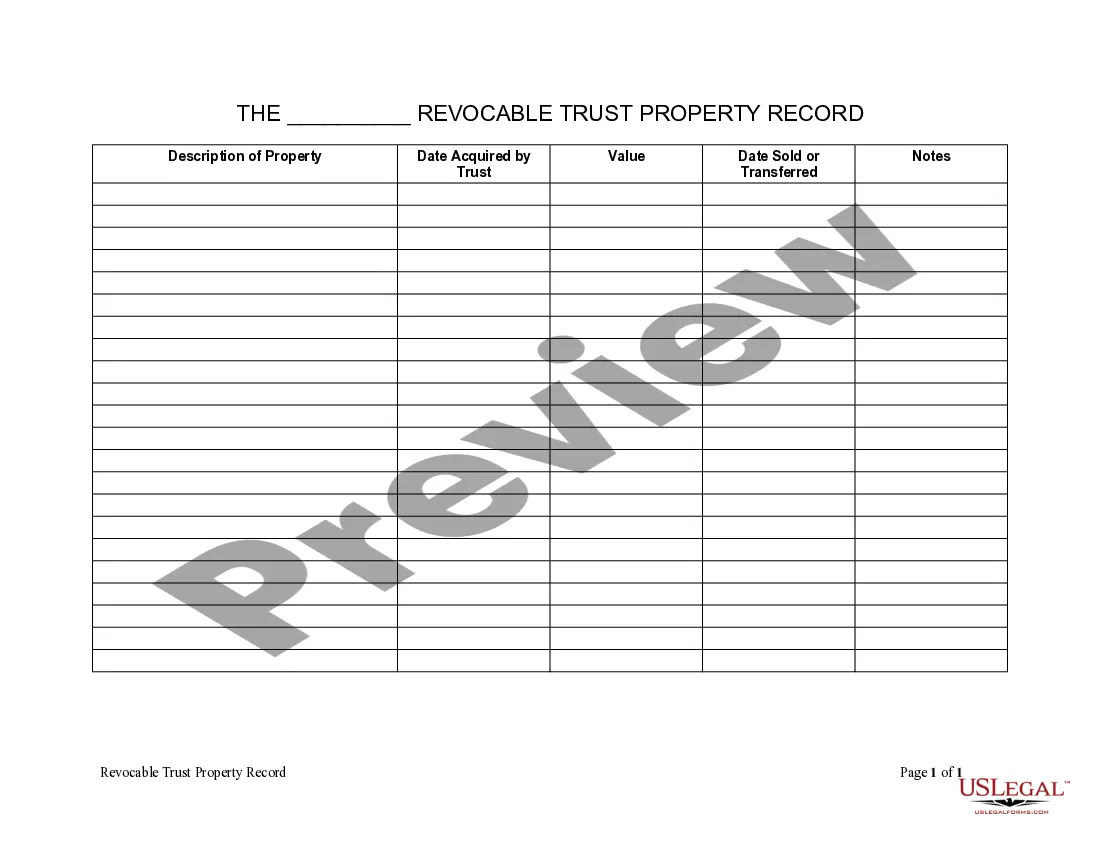

Revocable Living Trust For Property

Description

How to fill out New York Living Trust Property Record?

- Log in to your US Legal Forms account if you're a returning user and download the form template you need by clicking the Download button. Ensure your subscription is up to date; if not, renew it as per your payment plan.

- For first-time users, start by previewing the available forms. Confirm that the document matches your needs and complies with your local regulations.

- If the desired form isn't suitable, use the Search tab to find a better match. Once you select the right template, proceed to the next step.

- Purchase the selected document by clicking the Buy Now button and choose your preferred subscription plan, which will require account registration for full access.

- Complete your purchase by entering your credit card information or using your PayPal account for a seamless transaction.

- Download your form to your device. You can later access it from the My Forms section in your profile whenever needed.

By following these steps, you can effortlessly create a revocable living trust for property using US Legal Forms. Their extensive library ensures you have access to all the legal templates you need for precise document preparation.

Get started today and take control of your estate planning with ease!

Form popularity

FAQ

One downside to a revocable living trust for property is that it does not provide tax benefits like some other estate planning tools. Additionally, setting up a living trust can involve upfront costs and requires managing your assets to ensure they are included in the trust. Furthermore, since you retain control over your property, creditors may still pursue claims against your assets within the trust. It's essential to weigh these factors carefully and consider using resources like USLegalForms for guidance on structuring your estate plan.

While a revocable living trust for property is beneficial for many assets, certain items should be excluded. You typically want to keep retirement accounts, life insurance policies with named beneficiaries, and vehicles out of the trust. This helps maintain their specific distribution mechanisms. Always seek personalized legal advice to ensure your trust aligns with your overall estate planning goals.

Including your house in a revocable living trust for property offers several benefits. It allows for smooth property transfer upon your passing, avoiding probate and its associated delays. Additionally, a trust can provide privacy, as your estate details will not become public record. Overall, it simplifies the process for your heirs while maintaining control over your asset during your lifetime.

In most cases, if you have a revocable living trust for property, your house may be protected from nursing home claims during your lifetime. However, Medicaid can review your trust and assets when determining eligibility for assistance. It's crucial to understand your state laws and how they apply to your situation. Consulting with a legal advisor can provide clarity and help you navigate this complex issue.

When creating a revocable living trust for property, consider including real estate, bank accounts, and valuable personal property. These assets can often benefit from a smoother transfer process upon your passing. Additionally, investment accounts and some life insurance policies can be included to manage your estate more efficiently. Ensure that you review your options and tailored your trust to meet your specific needs.

You should generally avoid placing certain types of assets into a revocable living trust for property. This includes your retirement accounts, such as 401(k)s and IRAs, as these have their own beneficiary designations. Also, personal items that may require specific distribution instructions, or your vehicle, might not be suitable for inclusion. It is always best to consult with a legal expert to determine the best approach for your individual situation.

The downside of putting assets in a revocable living trust for property includes the initial setup costs and paperwork involved. Additionally, while the trust can manage assets efficiently during your lifetime, it does not provide tax benefits during that period. It is vital to weigh these factors and consider your long-term financial goals when deciding to establish a trust.

To place your assets in a revocable living trust for property, first list the assets you wish to include. Once you have your list, you’ll need to execute the necessary paperwork to change the title of each asset to the trust. Engaging a trusted legal service, such as uslegalforms, can simplify managing this important step.

To put assets in a revocable living trust for property, start by identifying the assets you want to include, such as real estate, bank accounts, and investments. Then, you must formally transfer ownership of these assets to the trust, which typically involves filling out specific legal documents. Consider consulting with a legal professional or utilizing platforms like uslegalforms to streamline this process.

One of the biggest mistakes parents make when establishing a trust fund is not clearly defining the terms and conditions of the trust. This can lead to misunderstandings among heirs or misuse of funds. It’s essential to communicate your intentions and use a well-structured revocable living trust for property to avoid future issues.