New York State Trust Forms

Description

Form popularity

FAQ

To file a trust in New York, you typically need to use specific forms based on the nature of the trust. For example, Form NYC-202 or Form 1041 works for most trusts that earn income. It is essential to understand the type of trust you have, as the requirements may vary. Utilizing resources like US Legal Forms can provide you with the accurate New York state trust forms you need to ensure proper filing.

Yes, your trust may need to file a tax return depending on its structure and income. For example, revocable trusts typically do not require a separate tax return, as their income flows through to your personal return. However, irrevocable trusts often require separate filings, but this varies by situation. To ensure compliance with tax laws, it's smart to consult a tax professional familiar with New York state trust forms.

While trusts provide benefits such as avoiding probate and protecting assets, they also come with some downsides. For instance, setting up New York state trust forms can require a considerable amount of time and legal fees. Additionally, once you place assets in a trust, you may lose some control over them, as the trustee manages them according to the trust's rules. It’s crucial to weigh these factors carefully when considering a trust.

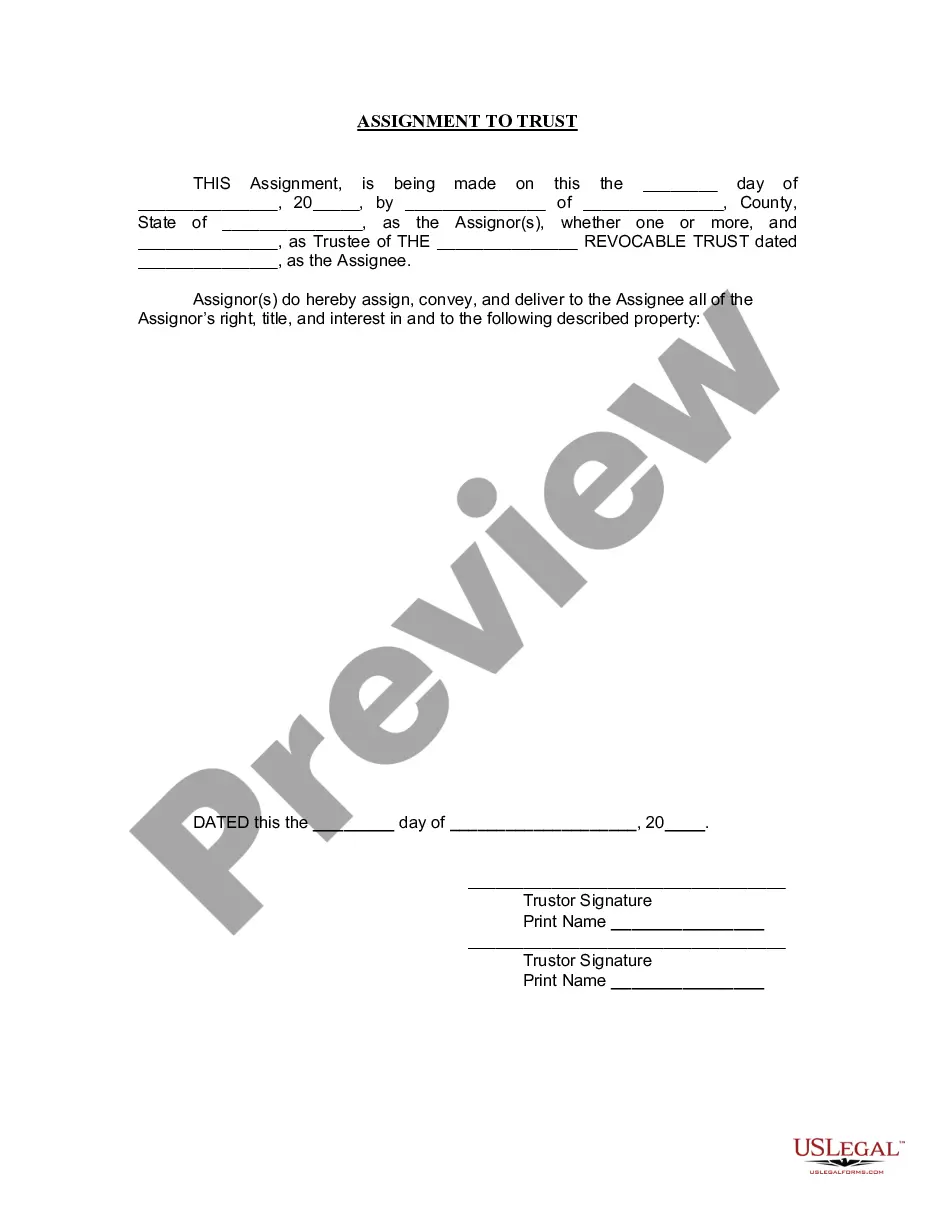

Yes, in New York, trusts generally need to be notarized to be legally binding. It is essential to have your trust document signed in the presence of a notary public, as this adds an extra layer of validity. Using New York state trust forms can streamline this process and ensure your trust meets all necessary legal requirements, reducing the chances of future disputes.

Filing a trust in New York involves a few essential steps. First, ensure you have completed the required New York state trust forms, which outline the terms of the trust. Next, you should obtain a Tax Identification Number (TIN) for the trust. If your trust requires court supervision, file the trust with the appropriate Surrogate's Court in your county.

One of the biggest mistakes parents often make when creating a trust fund is not clearly defining their intentions. Without specifying how assets should be managed and distributed, it can lead to confusion and conflict among beneficiaries. Additionally, overlooking the need for proper documentation using New York state trust forms can complicate the process. Ensure you create a well-structured trust that reflects your wishes.

In New York, a trust return must be filed for irrevocable trusts that generate income over a specified threshold. The trustee is typically responsible for this filing. It's best to seek guidance on this process and ensure that your trust complies with all state regulations, including the appropriate use of New York state trust forms.

A valid trust in New York requires a clear intent to create a trust, a competent grantor, and a specified beneficiary. Additionally, the trust must have lawful purposes and comply with statutory requirements. Utilizing trustworthy resources for your New York state trust forms can help establish a solid foundation for your trust.

Certain trusts, such as charitable remainder trusts and some irrevocable trusts, can be tax-exempt under specific conditions. These trusts must adhere to clear guidelines outlined in tax law. It is recommended to consult with a legal expert to ensure your New York state trust forms align with these tax-exempt criteria.

A trust qualifies as a New York trust if it is created by a New York resident or has its primary administration in New York. Additionally, the trust must comply with New York state laws regarding execution and operation. Familiarity with these criteria is essential for effectively drafting your New York state trust forms.