Ny Separation With Withholding Tax

Description

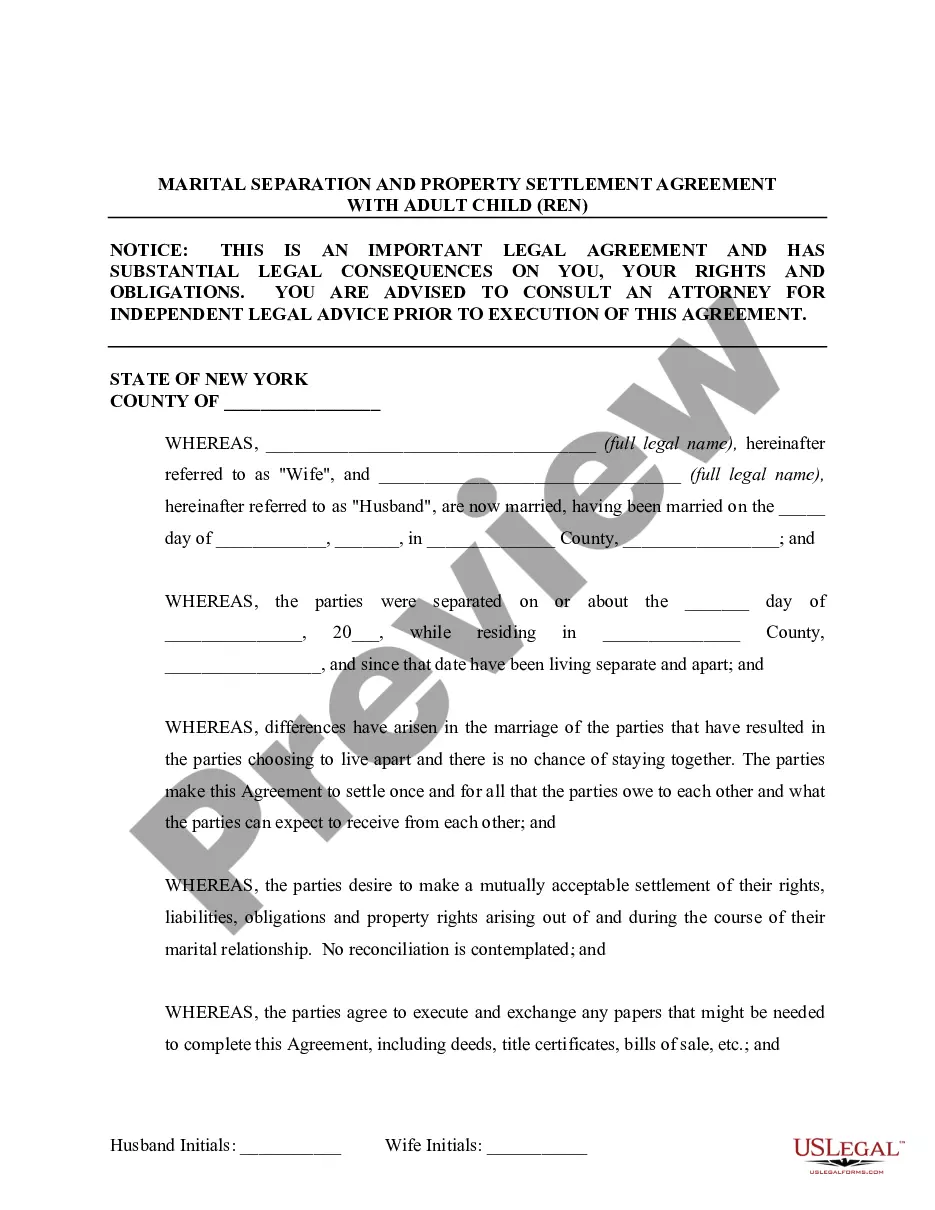

How to fill out New York Marital Separation With Property Settlement With Adult Children No Joint Property Or Joint Debts?

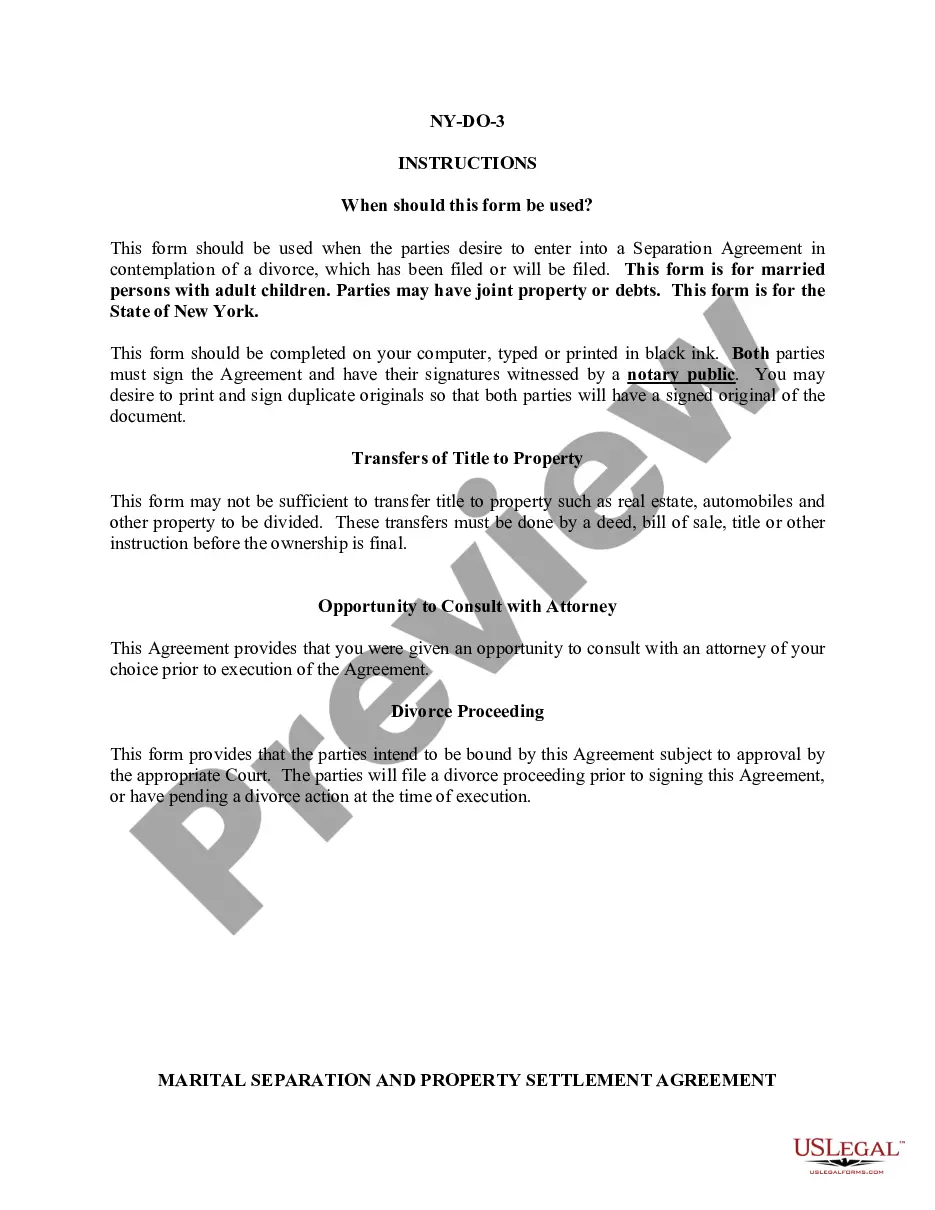

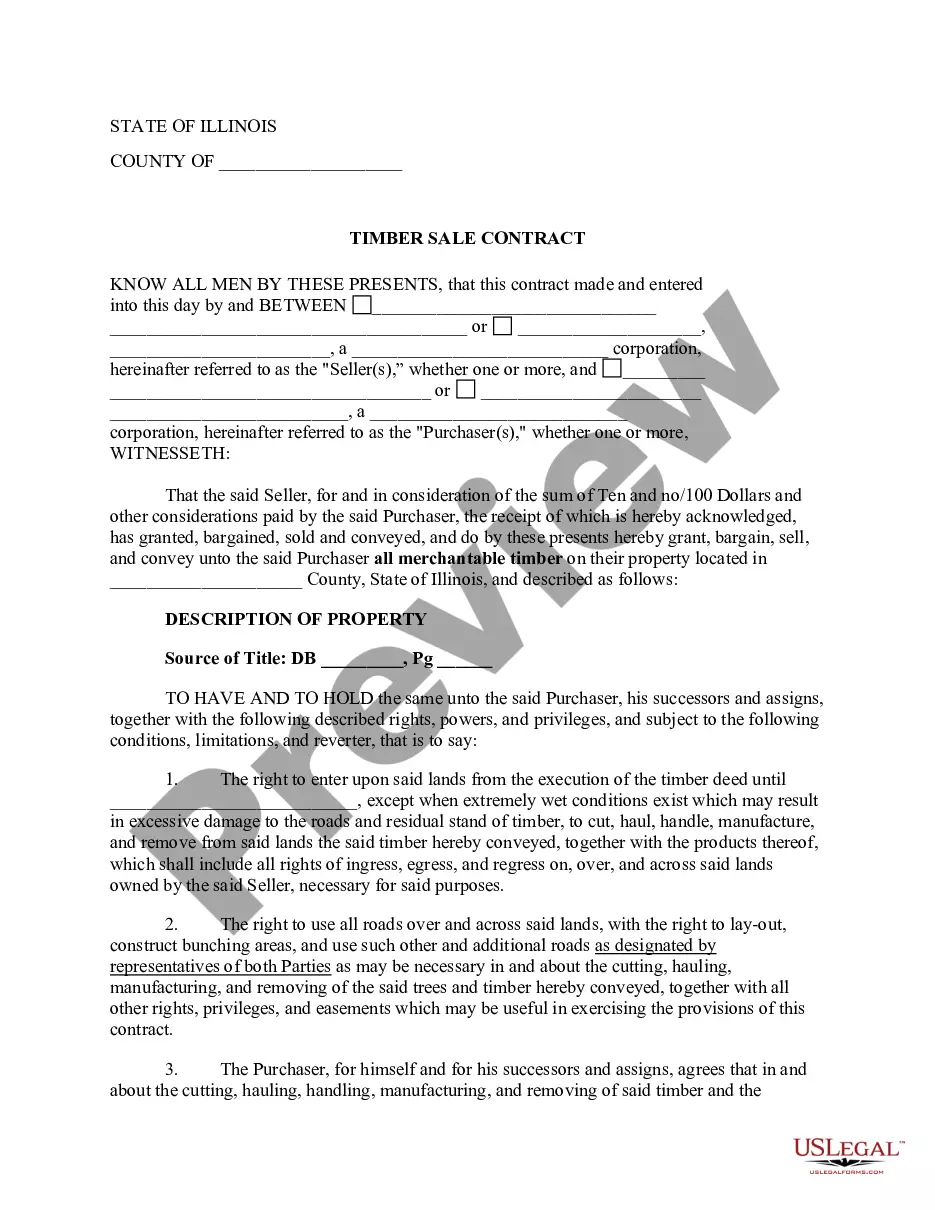

Handling legal paperwork and operations could be a time-consuming addition to your day. Ny Separation With Withholding Tax and forms like it usually require that you search for them and understand how to complete them effectively. As a result, regardless if you are taking care of economic, legal, or individual matters, having a thorough and convenient web catalogue of forms at your fingertips will go a long way.

US Legal Forms is the best web platform of legal templates, featuring more than 85,000 state-specific forms and numerous tools to help you complete your paperwork easily. Discover the catalogue of pertinent documents available to you with just one click.

US Legal Forms offers you state- and county-specific forms available at any moment for downloading. Safeguard your papers administration operations by using a top-notch service that lets you make any form in minutes without having extra or hidden charges. Just log in to the profile, find Ny Separation With Withholding Tax and download it immediately in the My Forms tab. You may also gain access to previously saved forms.

Could it be the first time making use of US Legal Forms? Register and set up an account in a few minutes and you’ll gain access to the form catalogue and Ny Separation With Withholding Tax. Then, stick to the steps listed below to complete your form:

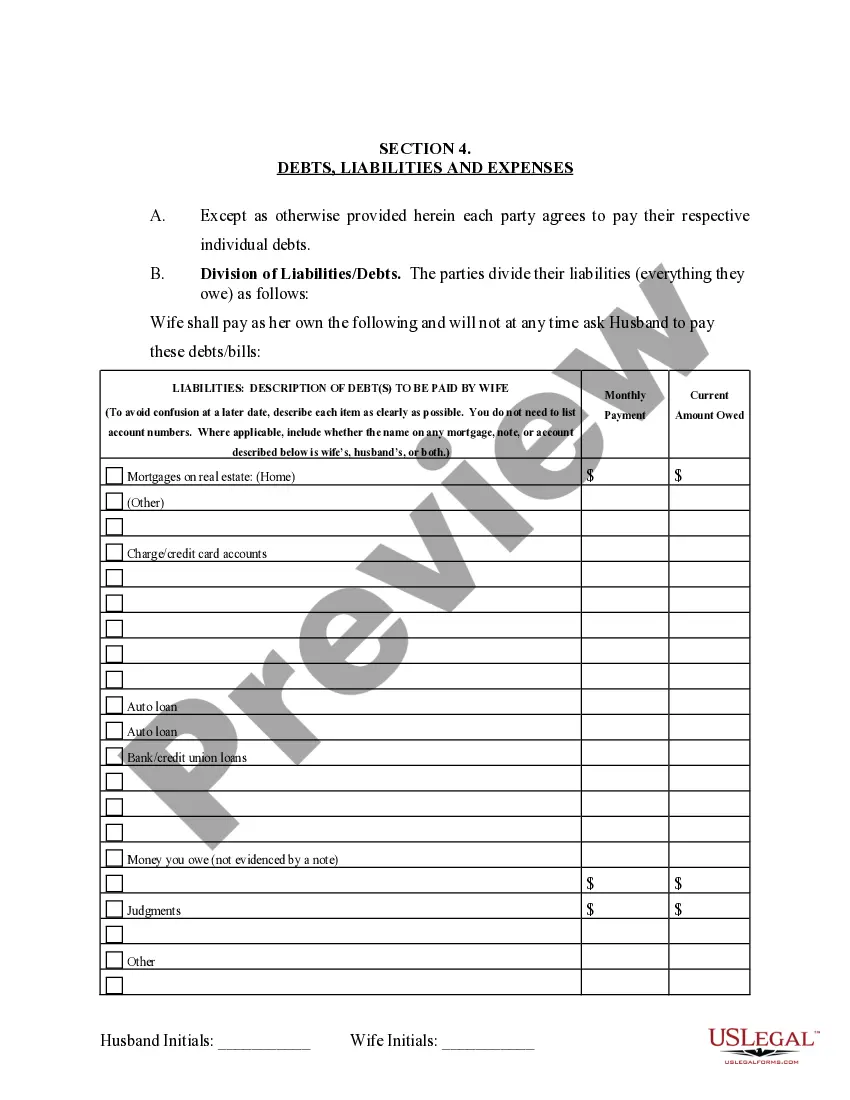

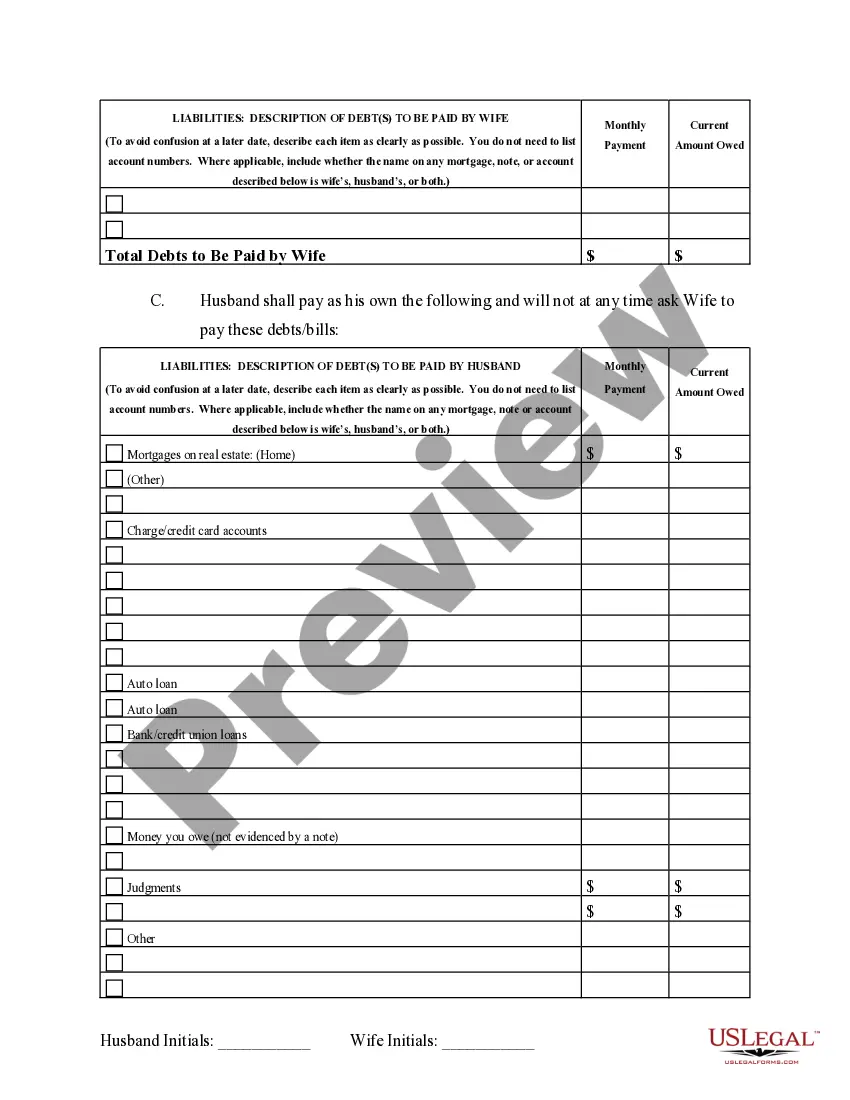

- Make sure you have discovered the correct form using the Review option and reading the form description.

- Choose Buy Now once all set, and select the subscription plan that is right for you.

- Press Download then complete, sign, and print out the form.

US Legal Forms has 25 years of expertise assisting consumers manage their legal paperwork. Find the form you require right now and improve any process without breaking a sweat.

Form popularity

FAQ

If you're married, you can claim two allowances ? one for you and one for your spouse. * You can divide your total allowances whichever way you prefer, but you can't claim an allowance that your spouse claims too.

Complete Form W-4 so that your employer can withhold the correct federal income tax from your pay.

Claiming 1 reduces the amount of taxes that are withheld from weekly paychecks, so you get more money now with a smaller refund. Claiming 0 allowances may be a better option if you'd rather receive a larger lump sum of money in the form of your tax refund.

If you are separated, you are still legally married. While you may think you should file separately, your filing status should be either: Married filing jointly (MFJ) Married filing separately (MFS)

By placing a ?0? on line 5, you are indicating that you want the most amount of tax taken out of your pay each pay period. If you wish to claim 1 for yourself instead, then less tax is taken out of your pay each pay period. 2. You can choose to have no taxes taken out of your tax and claim Exemption (see Example 2).