Assumed Name Certificate New York Format

Description

How to fill out New York Certificate Of Assumed Name?

The Presumed Name Certificate New York Format displayed on this page is a versatile official template created by experienced attorneys in compliance with federal and local laws and regulations. For over 25 years, US Legal Forms has supplied individuals, entities, and legal practitioners with over 85,000 validated, state-specific documents for any business and personal situation. It’s the fastest, easiest, and most reliable method to acquire the documentation you require, as the service ensures bank-level data security and anti-malware safeguards.

Acquiring this Presumed Name Certificate New York Format will only require a few straightforward steps.

Select the format you desire for your Presumed Name Certificate New York Format (PDF, DOCX, RTF) and save the document on your device. Complete and sign the document. Print out the template to fill it out by hand. Alternatively, use an online multi-functional PDF editor to swiftly and accurately complete and sign your form with a valid signature. Download your paperwork once more. Use the same document again whenever necessary. Access the My documents tab in your profile to redownload any previously purchased forms. Subscribe to US Legal Forms to access verified legal templates for all of life’s situations at your convenience.

- Search for the document you need and examine it.

- Browse through the sample you searched for and preview it or check the form description to confirm it meets your requirements. If it doesn't, utilize the search bar to find the appropriate one. Click Buy Now once you have located the template you need.

- Register and Log In.

- Select the pricing plan that fits you and create an account. Use PayPal or a credit card to make an immediate payment. If you already possess an account, Log In and review your subscription to proceed.

- Obtain the editable template.

Form popularity

FAQ

If your business operates under a business other than its legal name, you must receive a Certificate of Assumed Name from your county clerk. This certificate is often called a "business certificate." County clerks are separate for all five boroughs of New York City.

New York law requires that a company use its true legal name to conduct business. Thus, companies seeking to use a name other than their true legal name must file for a DBA. DBAs can be useful for a number of reasons. They allow a business to open a bank account and process transactions under a different name.

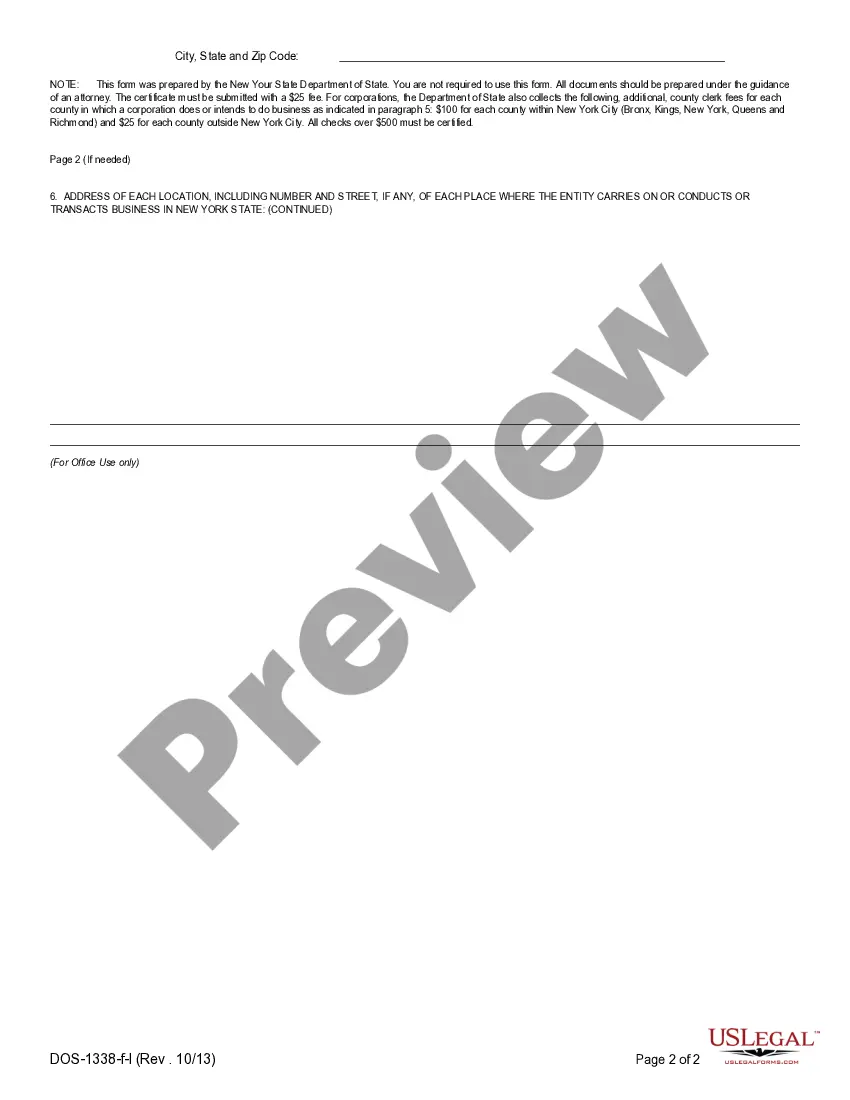

Step 1 ? New York business entity search. A DBA name must be unique and meet New York state requirements. ... Step 2 ? Filing a certificate of the assumed name New York. If your business is incorporated, you must file a DBA with the NYS Department of State. ... Step 3 ? Pay New York filing fees.

How much does a DBA filing cost in New York? For sole proprietors, the filing fee for a DBA in New York is $100. Certified copies of the business certificate are an additional $10 each. Sole proprietors file a DBA with the county clerk they plan on doing business with.

Copies of any documents filed with the Department of State's Division of Corporations may be obtained by submitting a written request to the New York State Department of State, Division of Corporations, One Commerce Plaza, 99 Washington Avenue, Albany, NY 12231.