New York Affidavit Of Survivorship

Description

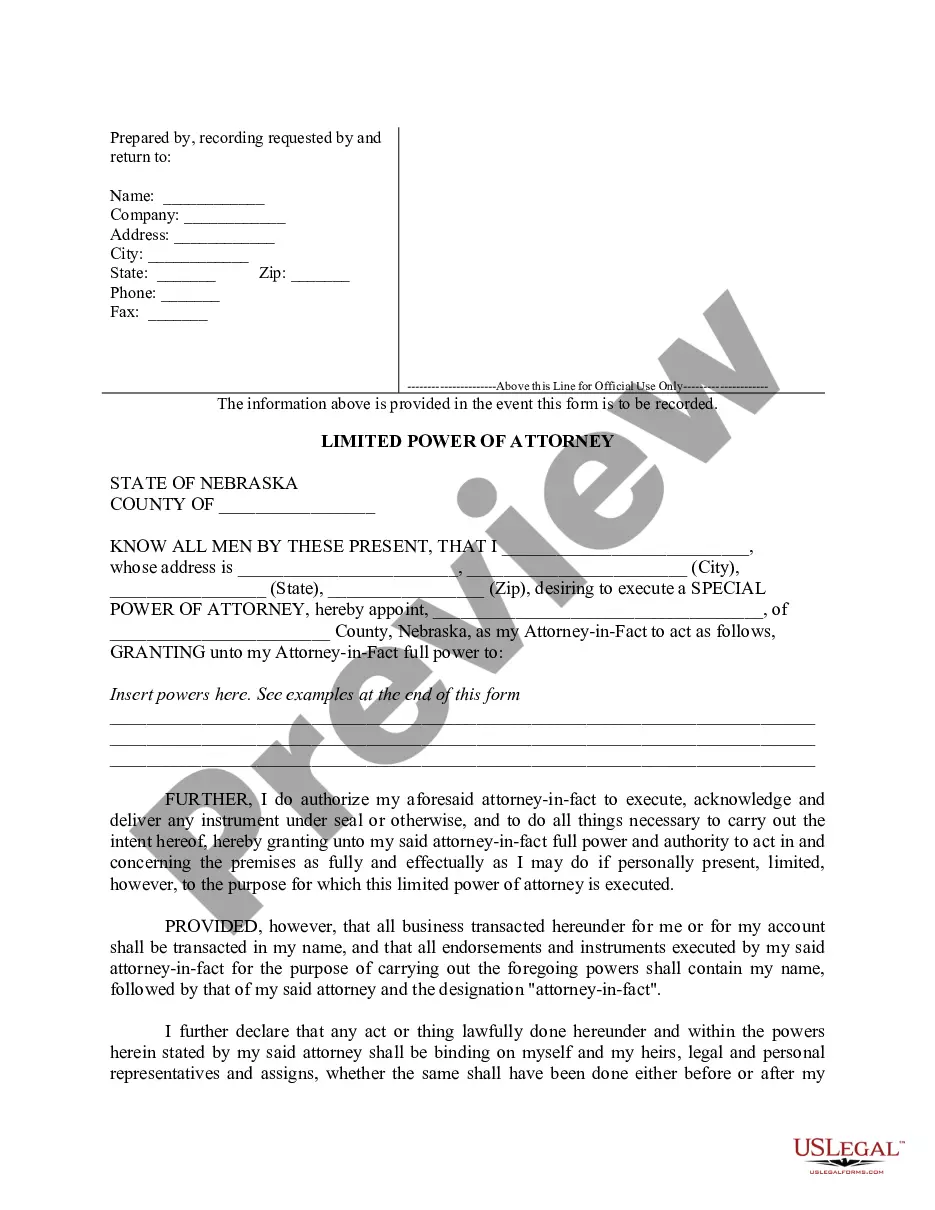

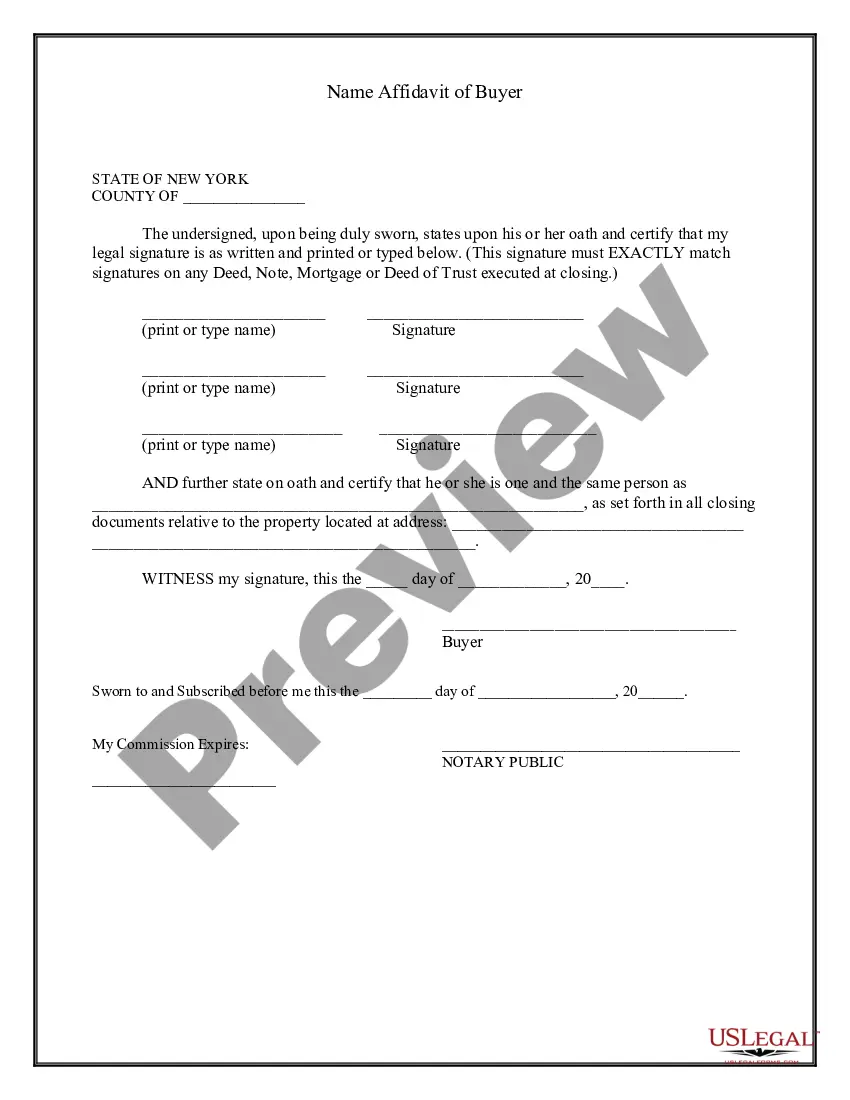

How to fill out New York Name Affidavit Of Buyer?

Individuals frequently link legal documentation with something intricate that only an expert can handle.

In some respects, this is accurate, as creating a New York Affidavit Of Survivorship requires a comprehensive grasp of subject matters, including state and local laws.

Nonetheless, with US Legal Forms, the process has become more straightforward: ready-to-use legal templates for any life and business situation tailored to state legislation are compiled in a single online directory and are now accessible to all.

Print your document or upload it to an online editor for quicker completion. All templates in our collection are reusable: once acquired, they remain stored in your profile. You can access them anytime needed through the My documents tab. Discover all the benefits of using the US Legal Forms platform. Subscribe today!

- US Legal Forms offers over 85k current documents organized by state and area of use, making it easy to search for the New York Affidavit Of Survivorship or any specific template in just a few minutes.

- Users who have previously registered with an active subscription must Log In to their account and select Download to acquire the form.

- New users of the service will initially need to create an account and subscribe before they can save any documents.

- Follow this sequential guide on how to obtain the New York Affidavit Of Survivorship.

- Review the page content meticulously to verify it meets your requirements.

- Read the form description or examine it utilizing the Preview option.

- If the first option does not meet your needs, look for another example using the Search field in the header.

- When you locate the appropriate New York Affidavit Of Survivorship, click Buy Now.

- Select the pricing plan that aligns with your requirements and budget.

- Create an account or Log In to advance to the payment section.

- Process your payment via PayPal or your credit card.

- Choose the format for your document and click Download.

Form popularity

FAQ

In a situation in which the sole owner's property is transferred to a beneficiary or the personal representative of the sole owner, the personal representative can transfer the property to the beneficiaries by simply filling out the whole of registered title: Assent AS1 form and submitting the required documents that

To prepare a small estate for an administrative hearing, the executor of the estate will need to file the will,a copy of the death certificate, and a small estate affidavit petition for the hearing with the Surrogate Court where the deceased lived.

Step 1 Verify Eligibility. This will consist of examining the estate of the decedent.Step 2 Gather Documents.Step 3 File the Affidavit.Section A Surviving Spouse.Section B Surviving Spouse, Blood Relative Or Creditor.Payment Request By Affiant.Section C Creditor Statement Only.New York Notary Public Action.

Common Ways to Transfer Property After DeathTransfer Via Last Will and Testament.Transfer Via Joint Ownership.Transfer Via Trust.Transfer Via Beneficiary Nomination.

You must file Form ET-706 within nine months after the decedent's date of death, unless you receive an extension of time to file the return. An extension of time to file the estate tax return may not exceed six months, unless the executor is out of the country.