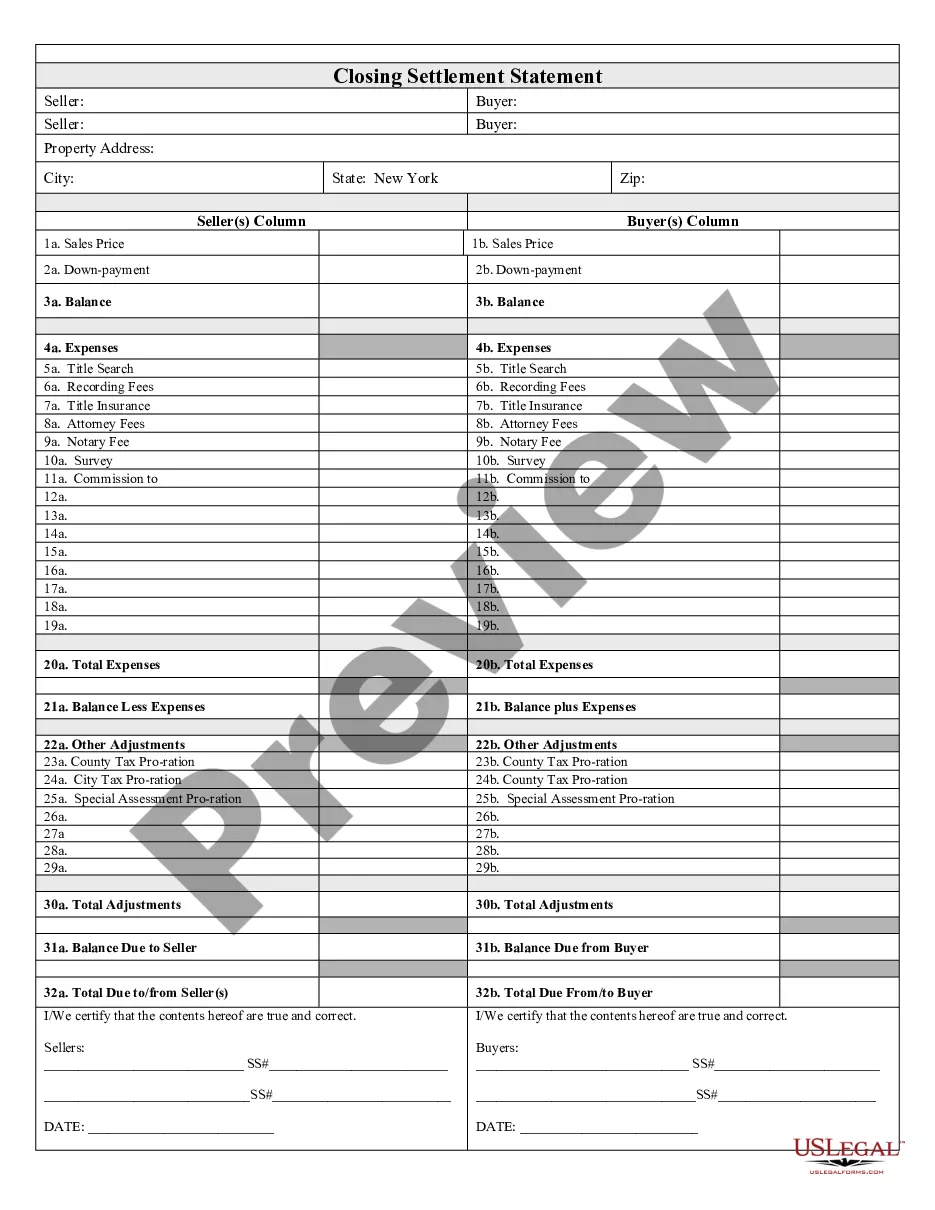

New York Closing Withholding

Description

How to fill out New York Closing Statement?

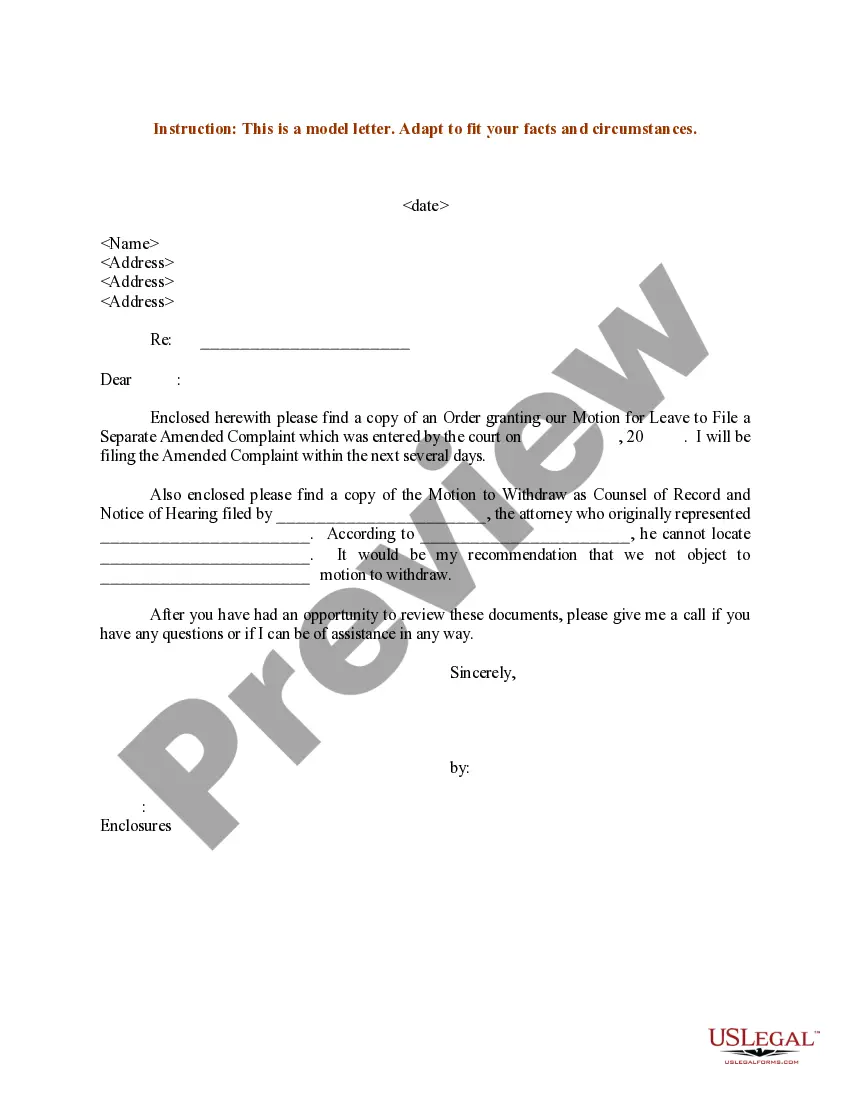

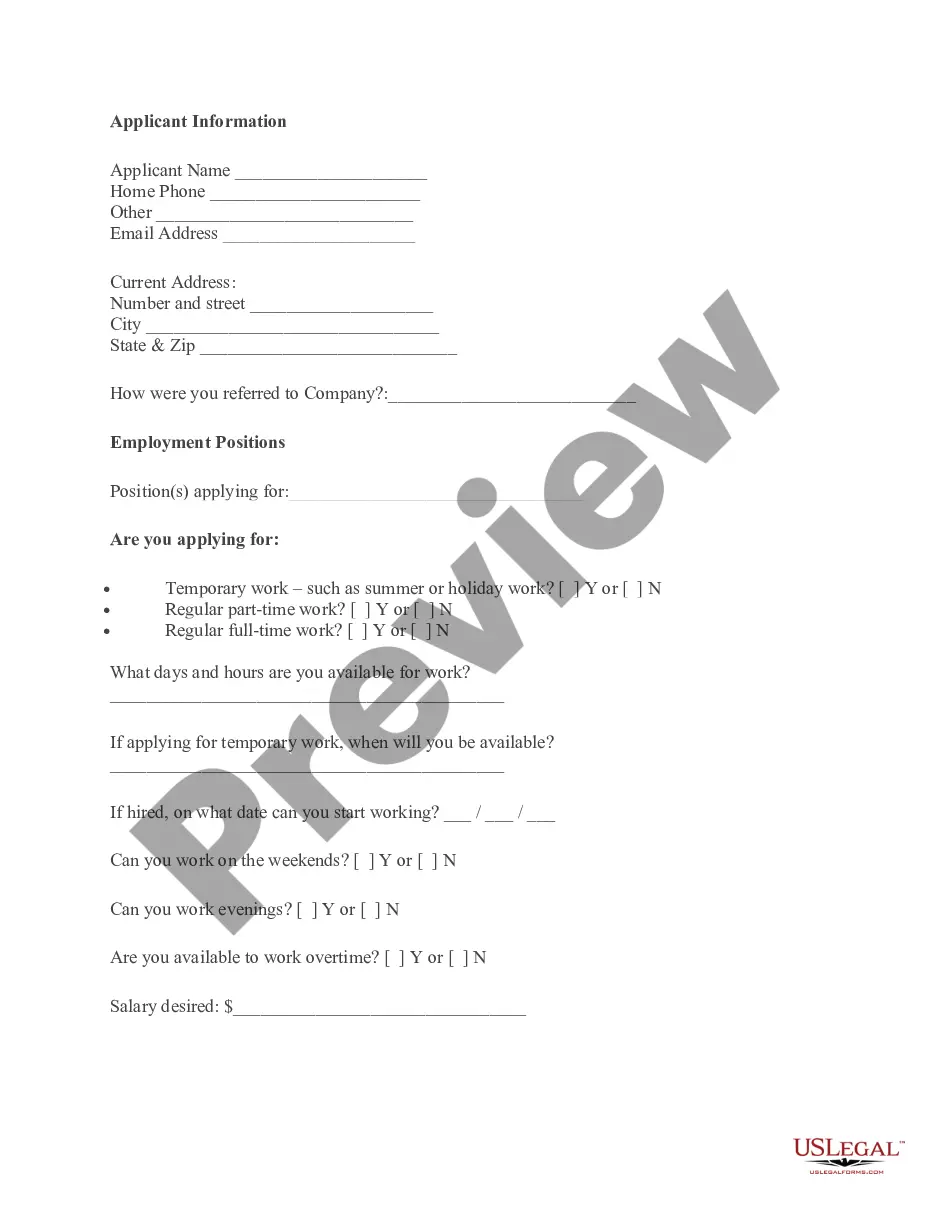

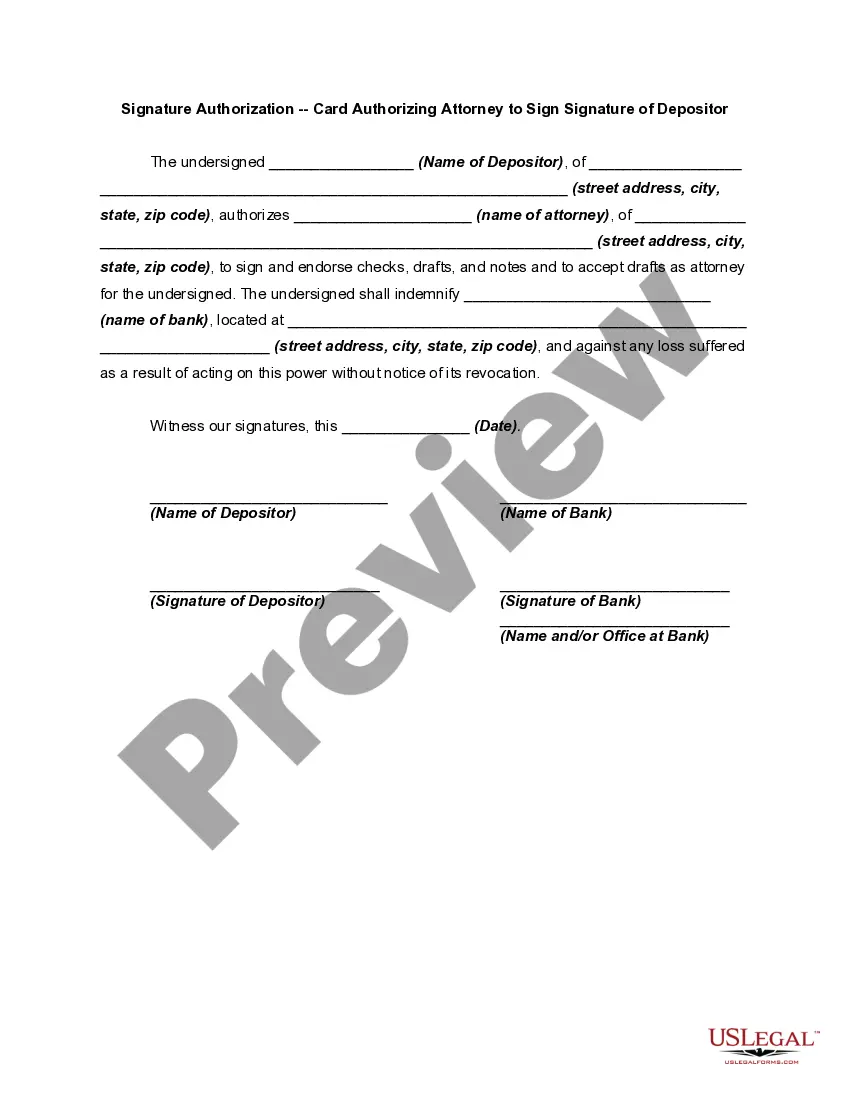

Drafting legal paperwork from scratch can often be daunting. Some cases might involve hours of research and hundreds of dollars invested. If you’re looking for a an easier and more cost-effective way of creating New York Closing Withholding or any other paperwork without the need of jumping through hoops, US Legal Forms is always at your disposal.

Our online collection of more than 85,000 up-to-date legal forms covers virtually every aspect of your financial, legal, and personal matters. With just a few clicks, you can quickly get state- and county-specific templates carefully prepared for you by our legal professionals.

Use our platform whenever you need a trustworthy and reliable services through which you can quickly find and download the New York Closing Withholding. If you’re not new to our services and have previously created an account with us, simply log in to your account, select the template and download it away or re-download it anytime later in the My Forms tab.

Don’t have an account? No problem. It takes little to no time to register it and navigate the library. But before jumping straight to downloading New York Closing Withholding, follow these recommendations:

- Review the form preview and descriptions to make sure you have found the document you are searching for.

- Make sure the template you select complies with the regulations and laws of your state and county.

- Choose the right subscription option to get the New York Closing Withholding.

- Download the form. Then complete, sign, and print it out.

US Legal Forms has a good reputation and over 25 years of expertise. Join us today and transform form execution into something simple and streamlined!

Form popularity

FAQ

If you don't want to reveal to your employer that you have a second job, or that you get income from other non-job sources, you have a few options: On line 4(c), you can instruct your employer to withhold an extra amount of tax from your paycheck. Alternatively, don't factor the extra income into your W-4.

The state as a whole has a progressive income tax that ranges from 4. % to 10.9%, depending on an employee's income level. There is also a supplemental withholding rate of 11.70% for bonuses and commissions.

New York State payroll taxes for 2023 Calculating taxes in New York is a little trickier than in other states. The state as a whole has a progressive income tax that ranges from 4. % to 10.9%, depending on an employee's income level. There is also a supplemental withholding rate of 11.70% for bonuses and commissions.

If you want to get close to withholding your exact tax obligation, claim 2 allowances for yourself and an allowance for however many dependents you have (so claim 3 allowances if you have one dependent).

A larger number of withholding allowances means a smaller New York income tax deduction from your paycheck, and a smaller number of allowances means a larger New York income tax deduction from your paycheck.