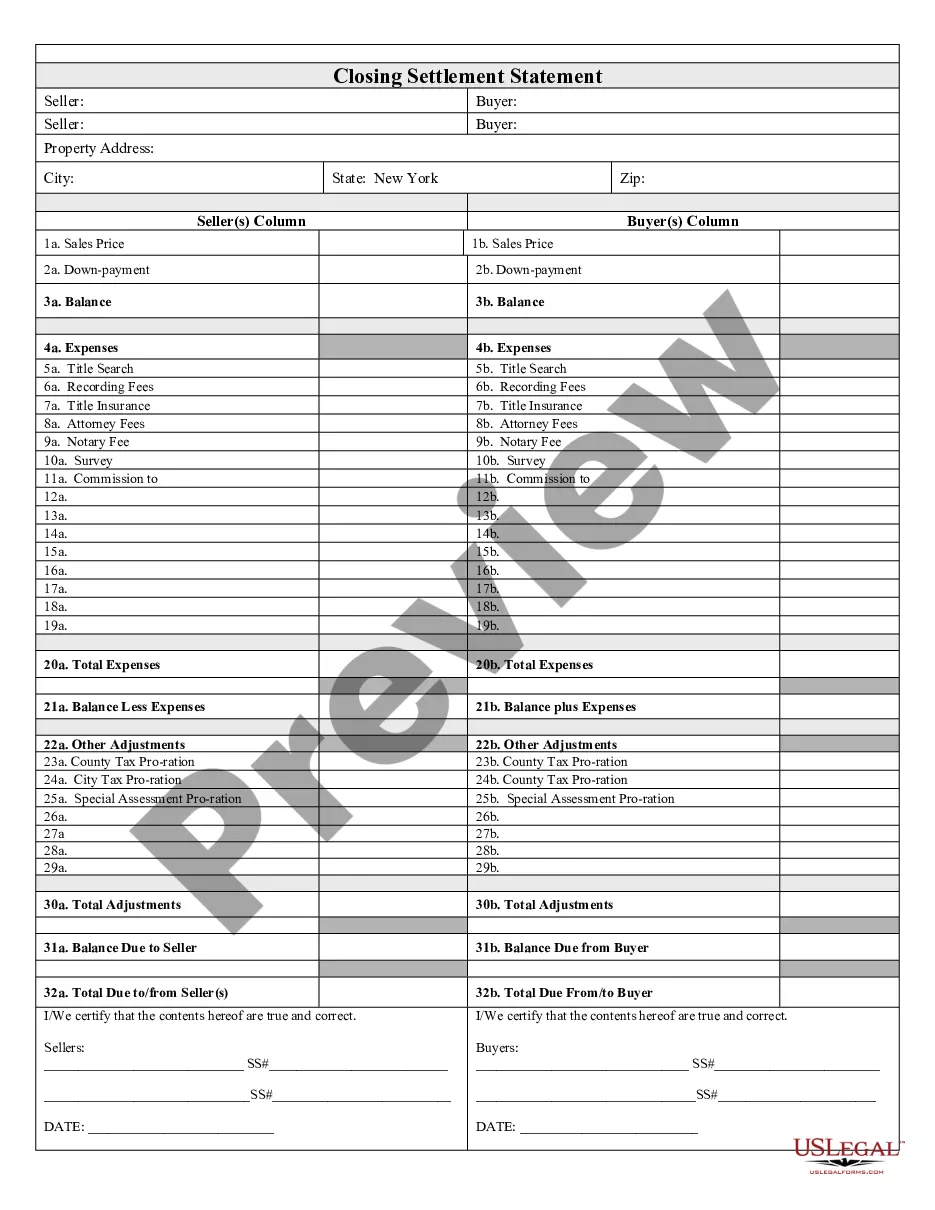

New York Closing Ny Without Notice

Description

How to fill out New York Closing Statement?

Whether for business purposes or for personal matters, everybody has to deal with legal situations sooner or later in their life. Completing legal documents requires careful attention, beginning from choosing the right form template. For instance, when you choose a wrong edition of the New York Closing Ny Without Notice, it will be turned down when you send it. It is therefore important to have a reliable source of legal papers like US Legal Forms.

If you need to get a New York Closing Ny Without Notice template, follow these simple steps:

- Find the template you need using the search field or catalog navigation.

- Examine the form’s description to make sure it suits your situation, state, and county.

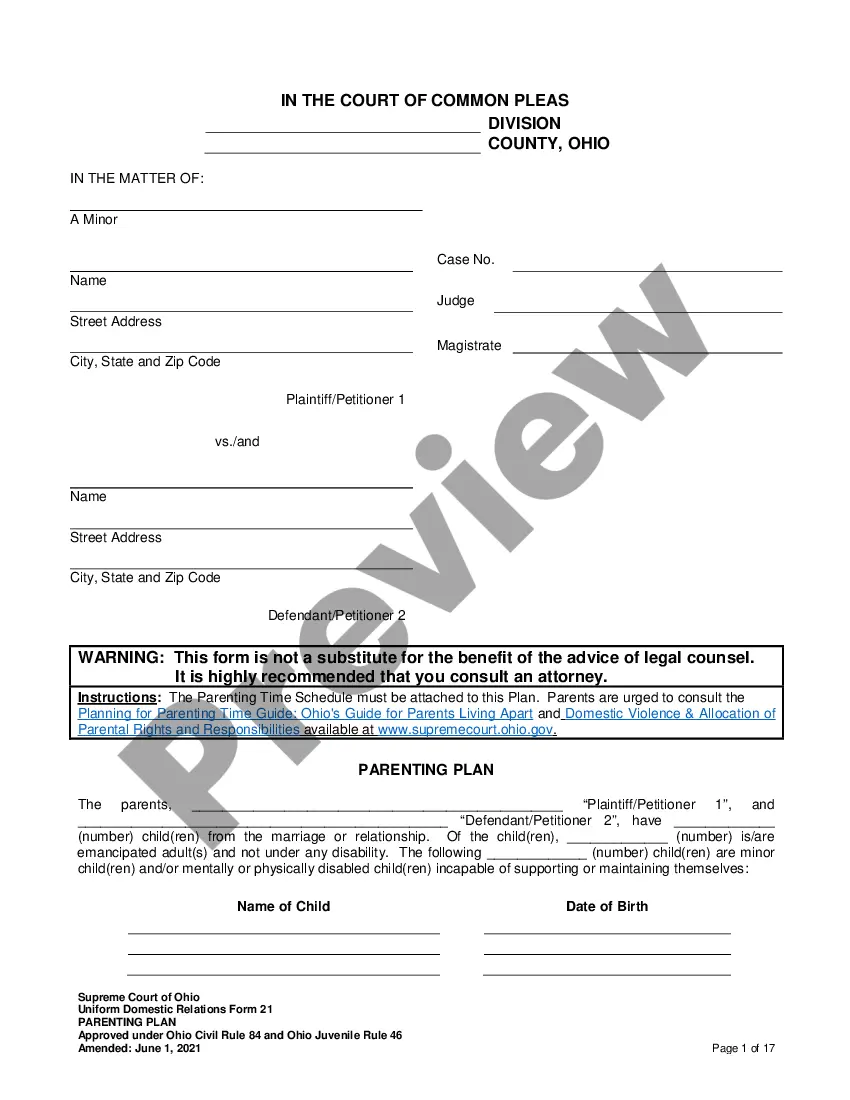

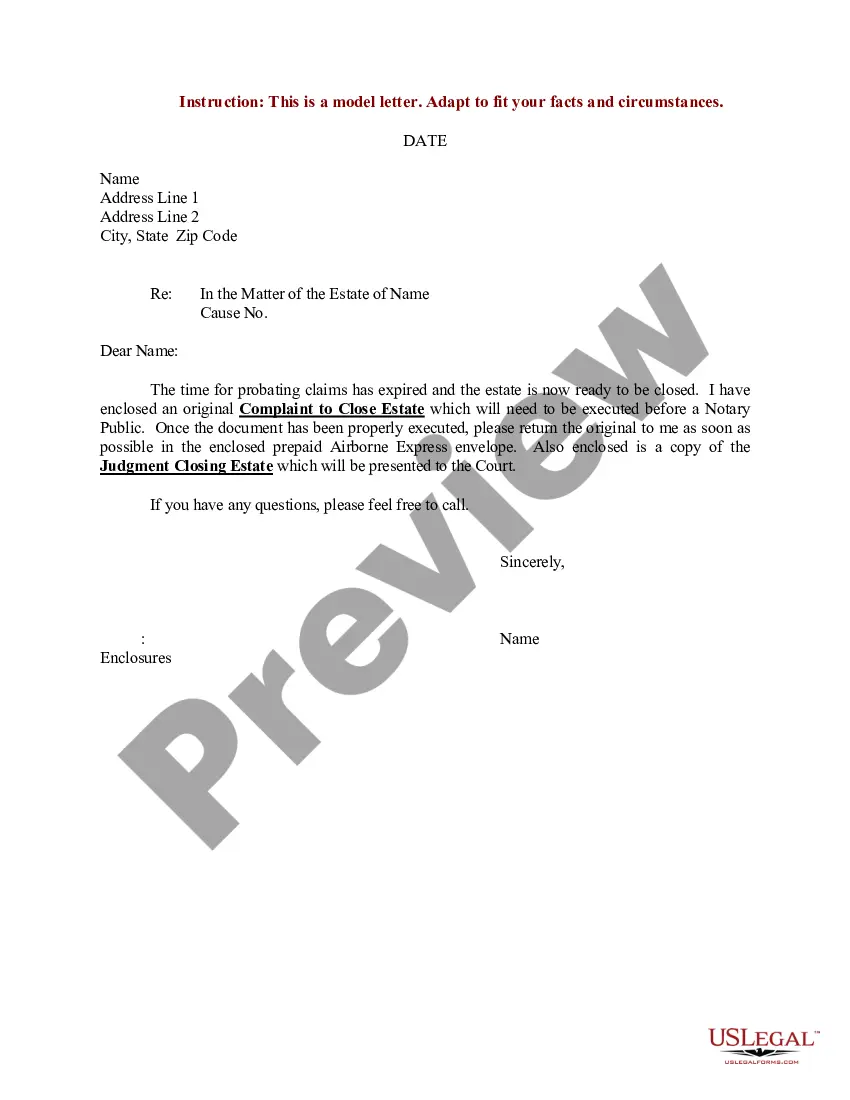

- Click on the form’s preview to view it.

- If it is the incorrect form, go back to the search function to locate the New York Closing Ny Without Notice sample you need.

- Get the file when it matches your requirements.

- If you already have a US Legal Forms account, just click Log in to access previously saved files in My Forms.

- If you do not have an account yet, you may obtain the form by clicking Buy now.

- Select the correct pricing option.

- Complete the account registration form.

- Pick your transaction method: you can use a bank card or PayPal account.

- Select the file format you want and download the New York Closing Ny Without Notice.

- After it is downloaded, you can complete the form with the help of editing applications or print it and complete it manually.

With a substantial US Legal Forms catalog at hand, you do not have to spend time looking for the right template across the internet. Use the library’s easy navigation to get the appropriate form for any occasion.

Form popularity

FAQ

Complete the process by filing with the New York Department of State written consent from the Tax Department (Form TR-960, Consent to Dissolution of a Corporation); one Certificate of Dissolution; and. a check for $60 payable to the New York Department of State.

A DBA is discontinued when the individual or partners cease to conduct business. There is no fee involved in filing a discontinuance, but the form must be purchased and completed by the filer. In the case of a partnership, a majority of those listed must sign the document.

Complete and file a Request for Cancellation of Reservation of Name with the Department of State. The filing receipt entitled ?Certificate of Reservation? issued by the New York Department of State must accompany the request to cancel the name reservation.

If you are registered for sales and use tax purposes in New York State, you must file sales and use tax returns. This bulletin explains the sales tax filing requirements for quarterly, part-quarterly (monthly), and annual filers, including the E-file mandate.

First, you need to be sure to include the legal name of your company. Second, your articles of dissolution should state the date when your company will be dissolved. Finally, there should be a statement that your corporation's board of directors or your LLC's members approved the dissolution.