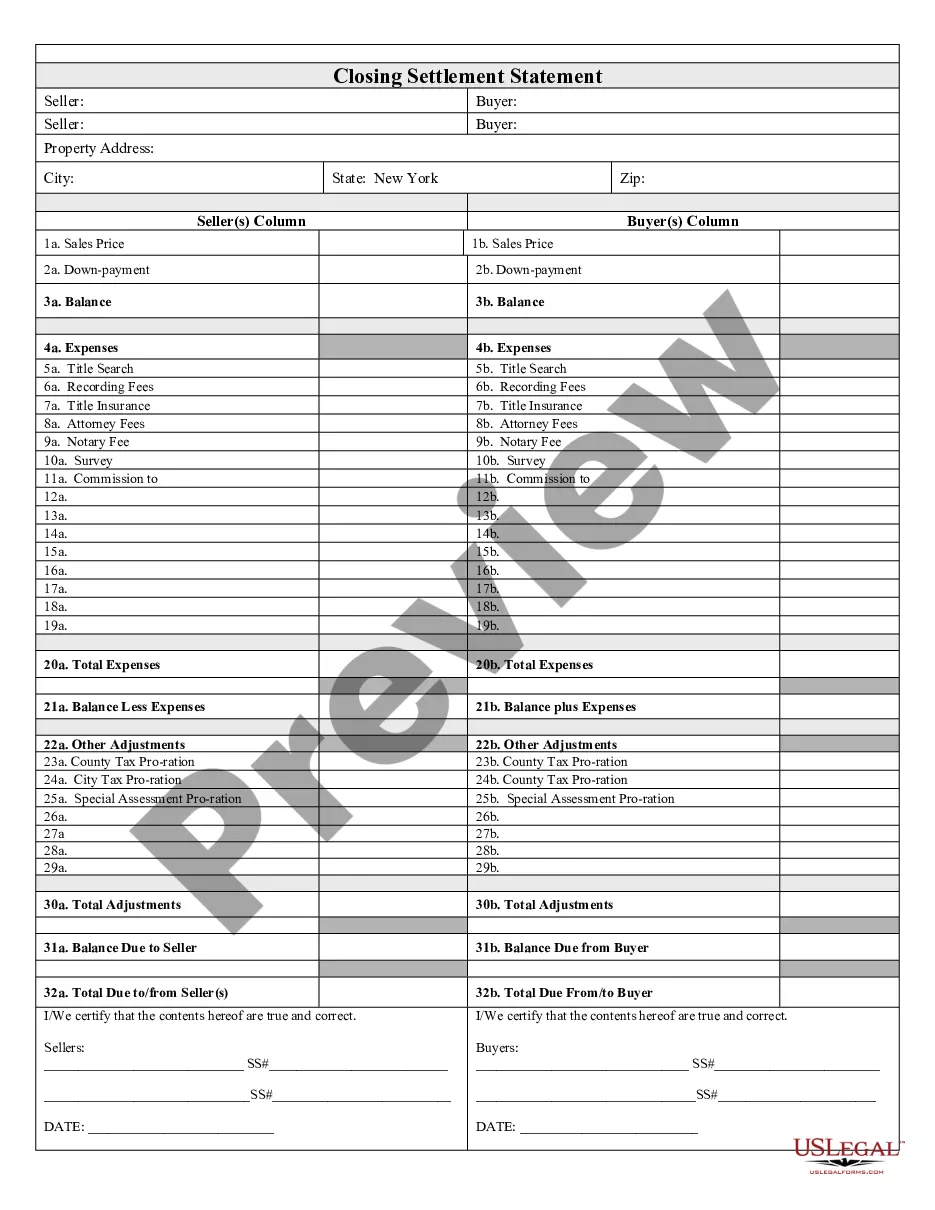

New York Closing Ny Without

Description

How to fill out New York Closing Statement?

Legal document managing can be mind-boggling, even for knowledgeable specialists. When you are interested in a New York Closing Ny Without and don’t have the a chance to spend in search of the appropriate and updated version, the procedures may be stressful. A robust web form catalogue can be a gamechanger for everyone who wants to deal with these situations efficiently. US Legal Forms is a market leader in online legal forms, with over 85,000 state-specific legal forms available to you at any time.

With US Legal Forms, you may:

- Gain access to state- or county-specific legal and business forms. US Legal Forms handles any needs you could have, from personal to business documents, all-in-one spot.

- Use advanced resources to finish and deal with your New York Closing Ny Without

- Gain access to a resource base of articles, tutorials and handbooks and materials related to your situation and requirements

Help save time and effort in search of the documents you need, and make use of US Legal Forms’ advanced search and Preview feature to get New York Closing Ny Without and acquire it. If you have a monthly subscription, log in to your US Legal Forms account, look for the form, and acquire it. Take a look at My Forms tab to find out the documents you previously saved and also to deal with your folders as you see fit.

Should it be your first time with US Legal Forms, make a free account and obtain unrestricted access to all advantages of the library. Listed below are the steps for taking after downloading the form you want:

- Verify it is the right form by previewing it and reading through its description.

- Ensure that the sample is recognized in your state or county.

- Choose Buy Now when you are ready.

- Select a subscription plan.

- Find the file format you want, and Download, complete, sign, print and send out your papers.

Enjoy the US Legal Forms web catalogue, backed with 25 years of expertise and trustworthiness. Transform your daily papers administration into a smooth and user-friendly process right now.

Form popularity

FAQ

A final return must be filed within 20 days after you cease business operations or the sale, transfer, or change occurs. After we process your final return, we will inactivate your sales tax account.

Closing/Dissolving a Business Notify government agencies that you are dissolving your business; Notify all lenders and creditors and settle any remaining debts; Collect all the money the business is owed (accounts receivables) or sell off any outstanding judgments, claims, and debts owed to the business;

Domestic and foreign business corporations are required by Section 408 of the Business Corporation Law to file a Biennial Statement every two years with the New York Department of State.

Complete the process by filing with the New York Department of State written consent from the Tax Department (Form TR-960, Consent to Dissolution of a Corporation); one Certificate of Dissolution; and. a check for $60 payable to the New York Department of State.