Statement Security Deposit With Credit Card

Description

How to fill out New York Landlord Tenant Closing Statement To Reconcile Security Deposit?

Whether for business purposes or for individual matters, everybody has to manage legal situations at some point in their life. Completing legal papers needs careful attention, beginning from choosing the appropriate form template. For instance, when you select a wrong version of a Statement Security Deposit With Credit Card, it will be turned down when you submit it. It is therefore important to have a reliable source of legal documents like US Legal Forms.

If you need to obtain a Statement Security Deposit With Credit Card template, follow these easy steps:

- Find the template you need by utilizing the search field or catalog navigation.

- Check out the form’s description to ensure it fits your case, state, and county.

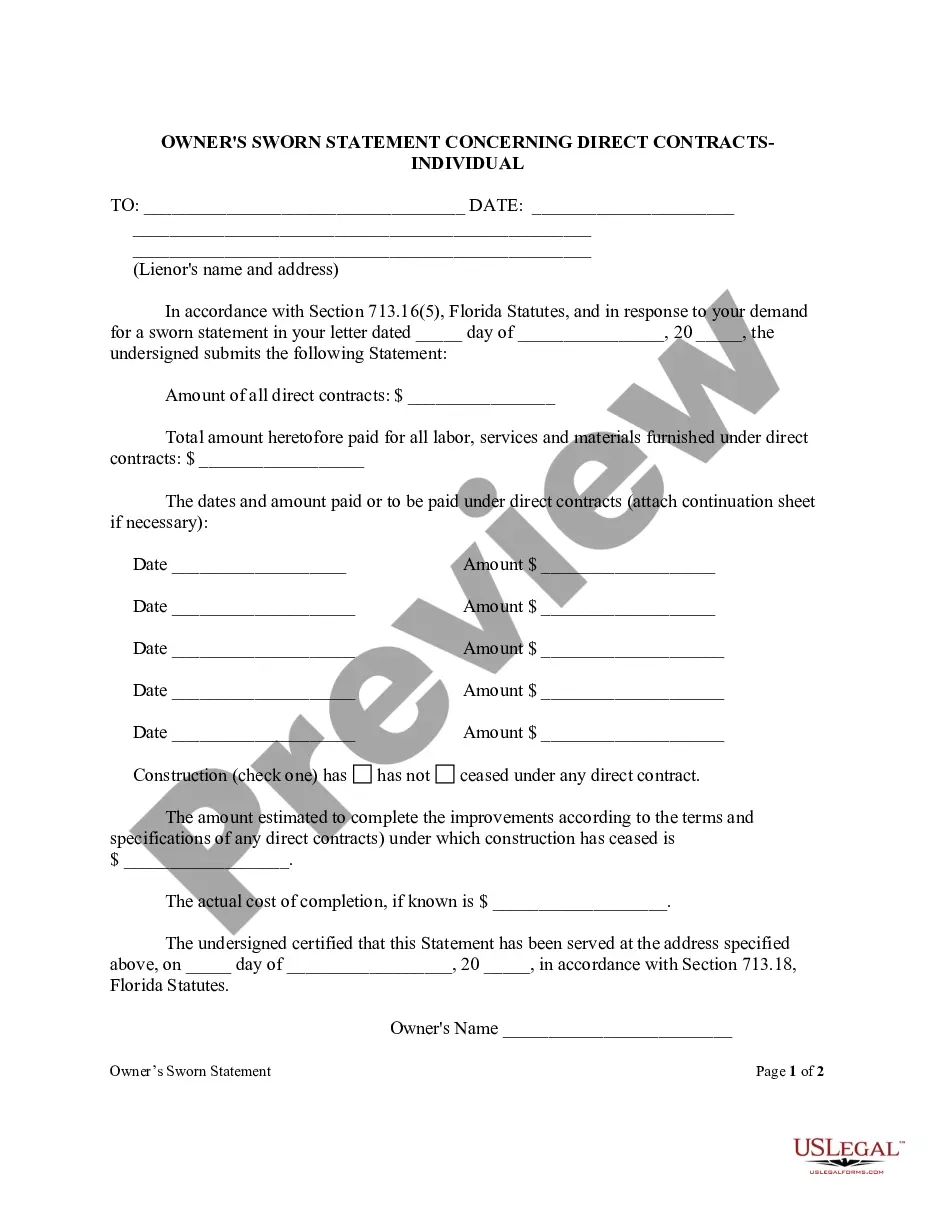

- Click on the form’s preview to examine it.

- If it is the wrong form, return to the search function to find the Statement Security Deposit With Credit Card sample you require.

- Get the template if it meets your needs.

- If you already have a US Legal Forms profile, simply click Log in to gain access to previously saved files in My Forms.

- If you do not have an account yet, you may download the form by clicking Buy now.

- Select the correct pricing option.

- Complete the profile registration form.

- Choose your payment method: use a bank card or PayPal account.

- Select the file format you want and download the Statement Security Deposit With Credit Card.

- When it is downloaded, you can fill out the form by using editing software or print it and finish it manually.

With a substantial US Legal Forms catalog at hand, you never need to spend time searching for the appropriate template across the web. Use the library’s easy navigation to find the proper form for any situation.

Form popularity

FAQ

A secured credit card is a type of credit card that requires a security deposit to open the account. The cardholder typically makes a one-time, refundable deposit that acts as collateral for the credit card issuer. A secured credit card can be a great option if you're trying to build, rebuild or establish credit. What Is a Secured Credit Card? | Capital One Capital One ? ... ? Money Management Capital One ? ... ? Money Management

It's reassuring to know that your secured credit card deposit is refundable. But exactly when will you get the money back? In most cases, your security deposit will be refunded once your account balance is paid off and the account is closed, or when your secured credit card is converted to an unsecured credit card.

The security deposit is used by the card issuer as collateral if a cardholder defaults on their credit card balance. The deposit is typically equal to the card's credit limit, though this can vary. As a result, you can often increase your credit limit by paying a larger security deposit. How Much Is A Secured Credit Card Deposit? - Bankrate bankrate.com ? finance ? secured-card-depo... bankrate.com ? finance ? secured-card-depo...

Secured credit cards generally require a minimum $200 security deposit, but you can deposit more. Your choice will likely hinge on how much you will want to charge each month and how much money you can comfortably afford to have tied up as a deposit. How Much Should You Deposit for a Secured Card? - Experian experian.com ? blogs ? how-much-should-y... experian.com ? blogs ? how-much-should-y...

Myth 1: Your credit card security deposit is nonrefundable Reality: The security deposit on your secured credit card is fully refundable ? you can get your security deposit money back if you close your account, so long as you pay your balance in full. Secured Credit Cards: Myths About Credit Cards & Security Deposits discover.com ? credit-cards ? secured-credit... discover.com ? credit-cards ? secured-credit...