New York Lease Ny Withholding On Paycheck

Description

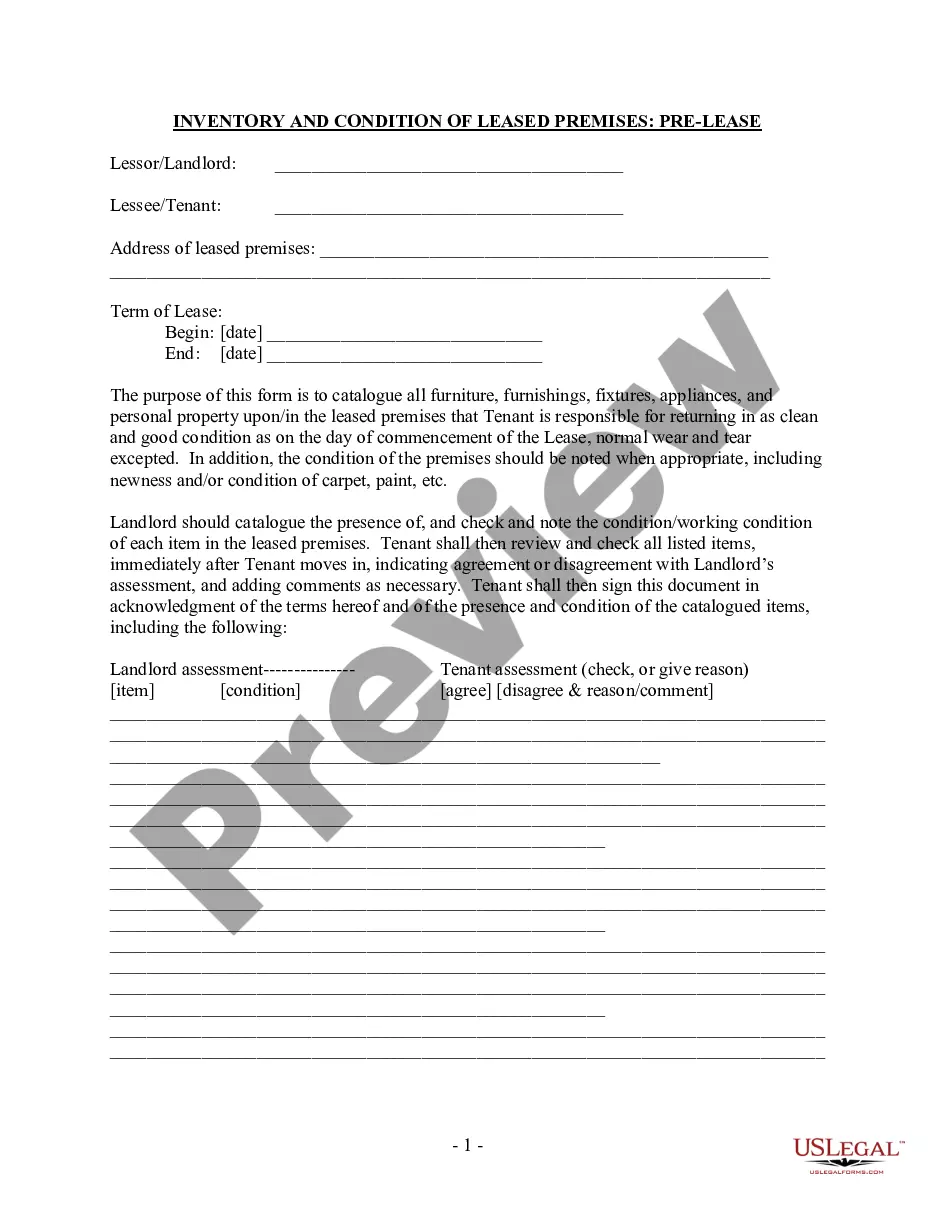

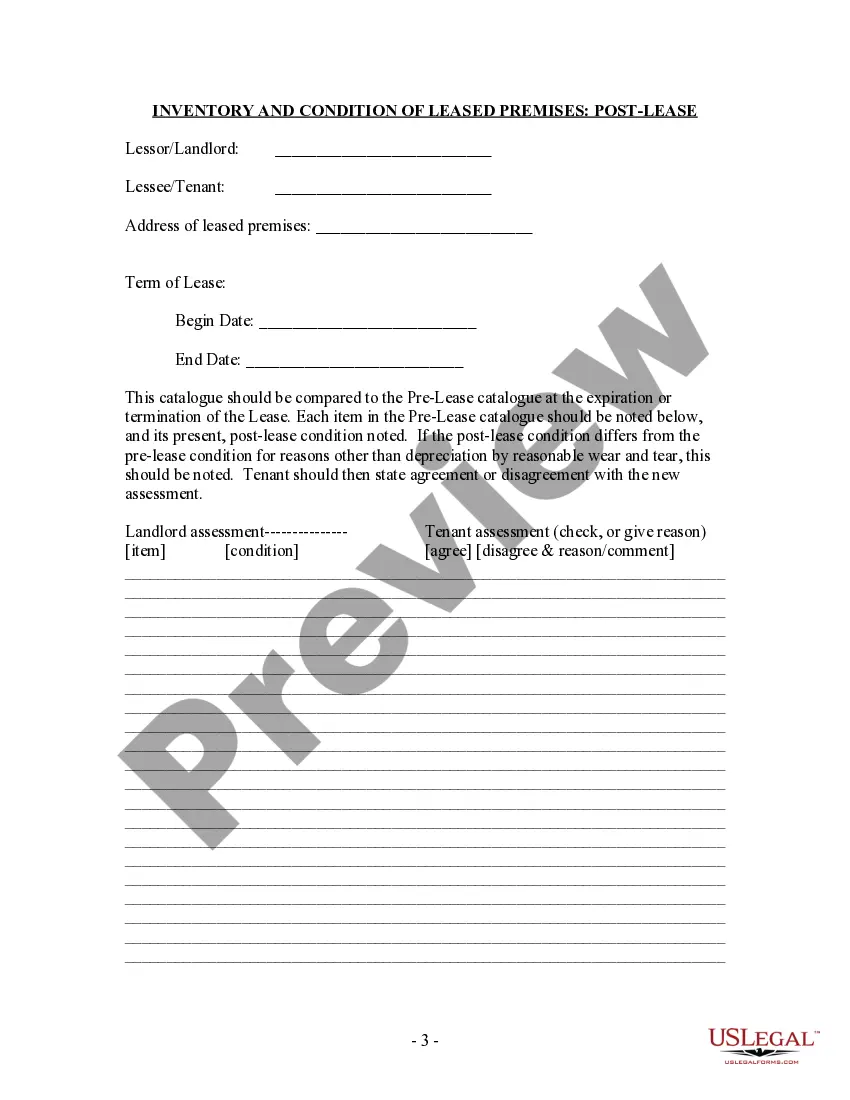

How to fill out New York Inventory And Condition Of Leased Premises For Pre Lease And Post Lease?

What is the most dependable service to obtain the New York Lease Ny Withholding On Paycheck and other updated versions of legal documents? US Legal Forms is the answer!

It’s the largest collection of legal forms for any situation. Each sample is accurately prepared and confirmed for adherence to federal and local laws and regulations.

Before you obtain any template, you must verify if it meets your usage terms and your state or county's regulations. Review the form description and utilize the Preview if it’s available.

- They are categorized by area and state of application, making it easy to find what you require.

- Experienced users of the website only need to Log In to the system, ensure their subscription is active, and click the Download button next to the New York Lease Ny Withholding On Paycheck to retrieve it.

- Once saved, the document remains accessible for additional use within the My documents section of your profile.

- If you do not yet have an account with our library, here are the steps you need to follow to create one.

Form popularity

FAQ

New York Payroll Taxes The state as a whole has a progressive income tax that ranges from 4. % to 10.9%, depending on an employee's income level. There is also a supplemental withholding rate of 11.70% for bonuses and commissions.

For employees, withholding is the amount of federal income tax withheld from your paycheck. The amount of income tax your employer withholds from your regular pay depends on two things: The amount you earn. The information you give your employer on Form W4.

New York Withholding: What you need to know The New York State Tax Law requires that employers withhold tax from all wages paid to residents regardless of where their services are performed, and from wages paid to nonresidents for services performed within New York State.

How to Complete the New Form W-4Step 1: Provide Your Information. Provide your name, address, filing status, and Social Security number.Step 2: Indicate Multiple Jobs or a Working Spouse.Step 3: Add Dependents.Step 4: Add Other Adjustments.Step 5: Sign and Date Form W-4.

A. Withhold at the New York State supplemental rate of 11.70% (. 1170) b. Add the supplemental and regular wages for the most recent payroll period this year.