Commercial Tenant Application Form For Section 8

Description

How to fill out New York Commercial Rental Lease Application Questionnaire?

The Commercial Tenant Application Form For Section 8 presented on this page is a versatile legal template created by expert lawyers adhering to federal and local statutes and regulations.

For over 25 years, US Legal Forms has supplied individuals, companies, and attorneys with more than 85,000 authenticated, state-specific forms for any business and personal circumstance. It’s the fastest, most direct, and most dependable method to secure the documents you require, as the service ensures bank-level data security and anti-malware safeguards.

Subscribe to US Legal Forms to have verified legal templates for all of life’s situations readily available.

- Browse for the document you require and review it.

- Select the pricing plan that best fits you and register for an account.

- Choose the format you desire for your Commercial Tenant Application Form For Section 8 (PDF, DOCX, RTF) and download the sample onto your device.

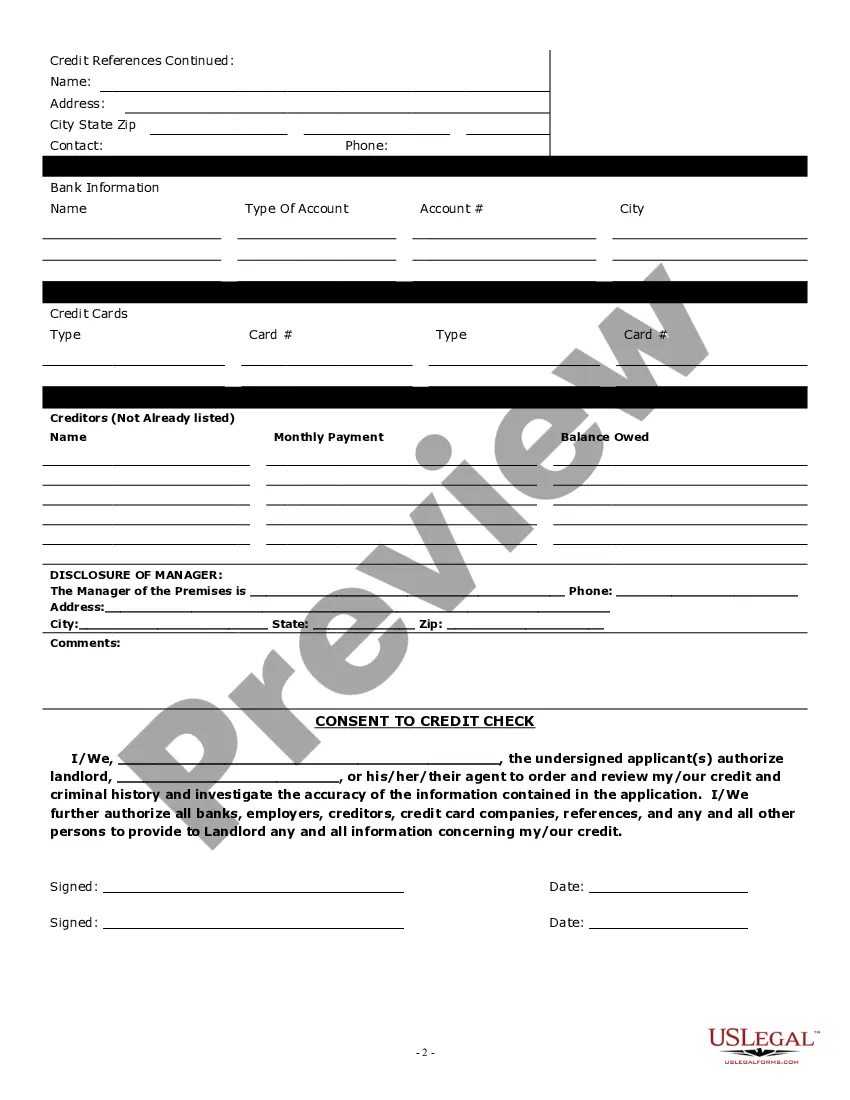

- Print the template to fill it out manually or use an online multi-functional PDF editor to quickly and accurately complete and sign your form with a legally-binding electronic signature.

- Access the same document again whenever necessary by visiting the My documents section in your profile to redownload any previously saved forms.

Form popularity

FAQ

The normal deposit for a commercial lease often ranges from one to three months' rent, depending on the landlord's policies and the lease terms. This deposit serves as a security measure for the landlord. When submitting a commercial tenant application form for Section 8, it's essential to clarify any deposit requirements to avoid surprises later.

Setting up a rental property for Section 8 involves ensuring the property meets local housing quality standards. Landlords must complete a commercial tenant application form for Section 8 to facilitate the approval process. Additionally, staying informed about program regulations and working closely with local housing authorities will help streamline the setup.

Approval for a commercial lease requires presenting a strong case to the landlord. This includes submitting a commercial tenant application form for Section 8 alongside your financial documents and business credentials. Establish good communication with potential landlords, and be prepared to discuss your business plan in detail.

Proving income for a commercial lease typically involves providing tax returns, bank statements, and profit and loss statements. Landlords want to see consistent revenue that covers your rent obligations. Completing a commercial tenant application form for Section 8 may also require you to detail your financial history, which helps landlords evaluate your application.

To get approved for a commercial lease, you need to demonstrate financial stability and provide necessary documentation. A completed commercial tenant application form for Section 8 can help landlords assess your eligibility and reliability. Additionally, having good credit, a solid business plan, and references can further strengthen your application.

When writing a letter of intent for a commercial lease, begin with a clear introduction stating your intention to lease the property. Outline the key terms you propose, including the lease duration, rental rate, and any other relevant conditions. Remember to mention that your interest may involve filling out a Commercial tenant application form for section 8, which could help secure financial assistance. Consider using US Legal Forms to access templates that can guide you in crafting a professional and effective letter.

To fill out a commercial lease application, start by gathering essential information about your business, including your financial history and business structure. Next, provide details about the property you wish to lease, such as the address and desired lease terms. Additionally, ensure you complete the Commercial tenant application form for section 8 accurately, as this will help landlords assess your eligibility for assistance programs. Utilizing platforms like US Legal Forms can streamline this process by providing easy-to-use templates tailored for such applications.