Commercial Lease Application Template With Personal Guarantee

Description

How to fill out New York Commercial Rental Lease Application Questionnaire?

Whether for business purposes or for individual matters, everyone has to handle legal situations sooner or later in their life. Completing legal documents demands careful attention, beginning from choosing the correct form template. For example, when you choose a wrong edition of the Commercial Lease Application Template With Personal Guarantee, it will be turned down when you submit it. It is therefore important to get a dependable source of legal files like US Legal Forms.

If you have to get a Commercial Lease Application Template With Personal Guarantee template, stick to these simple steps:

- Get the sample you need by utilizing the search field or catalog navigation.

- Check out the form’s information to make sure it matches your case, state, and region.

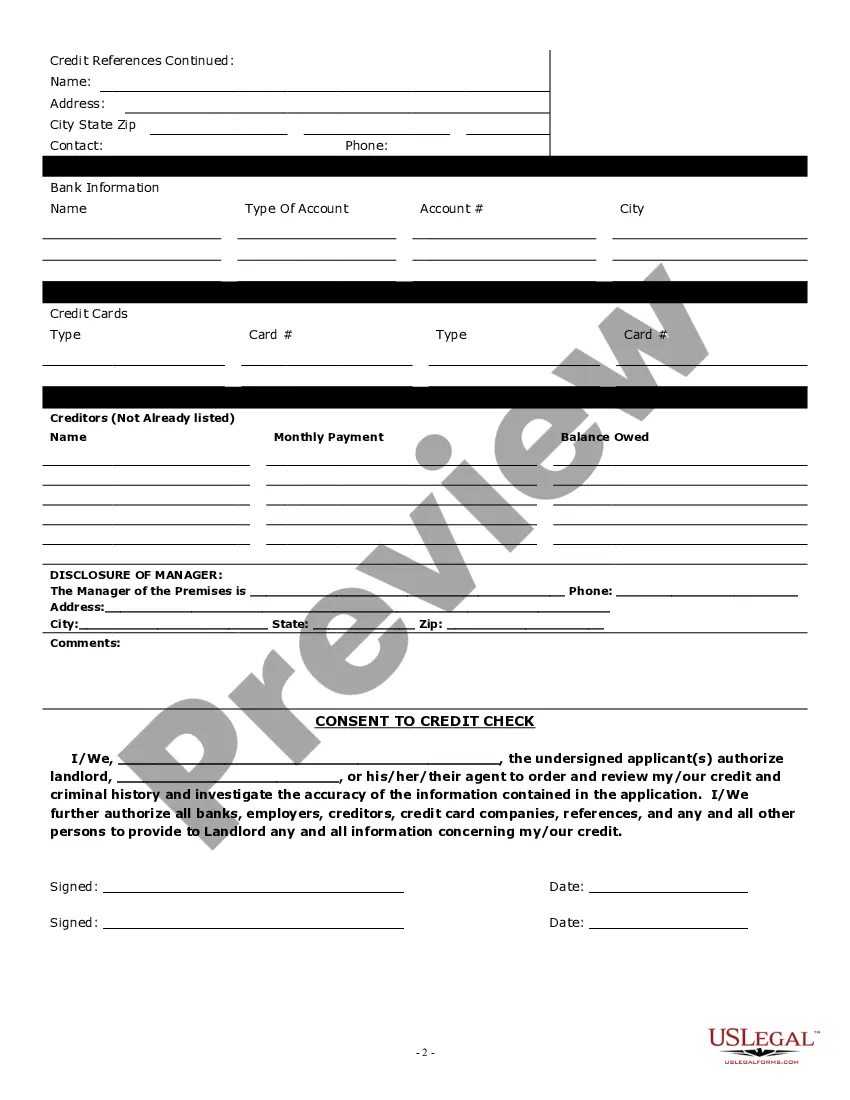

- Click on the form’s preview to examine it.

- If it is the wrong document, go back to the search function to find the Commercial Lease Application Template With Personal Guarantee sample you need.

- Download the file if it matches your needs.

- If you have a US Legal Forms profile, simply click Log in to gain access to previously saved files in My Forms.

- If you do not have an account yet, you can obtain the form by clicking Buy now.

- Select the appropriate pricing option.

- Complete the profile registration form.

- Select your transaction method: use a bank card or PayPal account.

- Select the file format you want and download the Commercial Lease Application Template With Personal Guarantee.

- When it is saved, you can fill out the form by using editing applications or print it and finish it manually.

With a vast US Legal Forms catalog at hand, you don’t need to spend time searching for the right sample across the internet. Utilize the library’s straightforward navigation to find the appropriate template for any situation.

Form popularity

FAQ

How to get out of a personal guarantee on a commercial lease. Subleasing the space to another tenant is often the simplest way to get out of a personal guarantee, but it can be difficult to find a qualified subtenant. You'll also need to get approval from your landlord before proceeding.

Dear (Landlord name), My name is (Your name), and I'm writing to you to express my interest in the home at (address or property name). I would love to live in this place because (reasons you want to rent the property). I currently am a tenant at (current address) but am ready to move because (reason for moving).

Once the landlord's consent has been obtained, the tenant and assignee can enter into a deed of assignment to transfer the lease to the assignee. If the lease is registered at the Land Registry the assignee will then need to register the assignment at the Land Registry.

By contrast, an assignment occurs when you transfer all your space to someone else (called an assignee) for the entire remaining term of the lease. As with a sublet, you are free to choose your assignee and determine the rent unless your lease says otherwise.

A personal guarantee is a provision a lender puts in a business loan agreement that requires owners to be personally responsible for their company's debt in case of default.