Fifty Dollars On A Check For 30

Description

How to fill out New York English Notice Of Dishonored Check - Civil - Keywords: Bad Check, Bounced Check?

Securing a reliable source for the most up-to-date and pertinent legal templates is a significant part of navigating administrative processes.

Locating the appropriate legal documents necessitates precision and diligence, which is why it’s crucial to obtain samples of Fifty Dollars On A Check For 30 exclusively from trustworthy providers, such as US Legal Forms. An incorrect template could squander your time and delay your current situation.

After you have the form on your device, you can edit it with the editor or print it and fill it out manually. Eliminate the hassle associated with your legal documentation. Explore the extensive US Legal Forms library to discover legal templates, evaluate their relevance to your situation, and download them instantly.

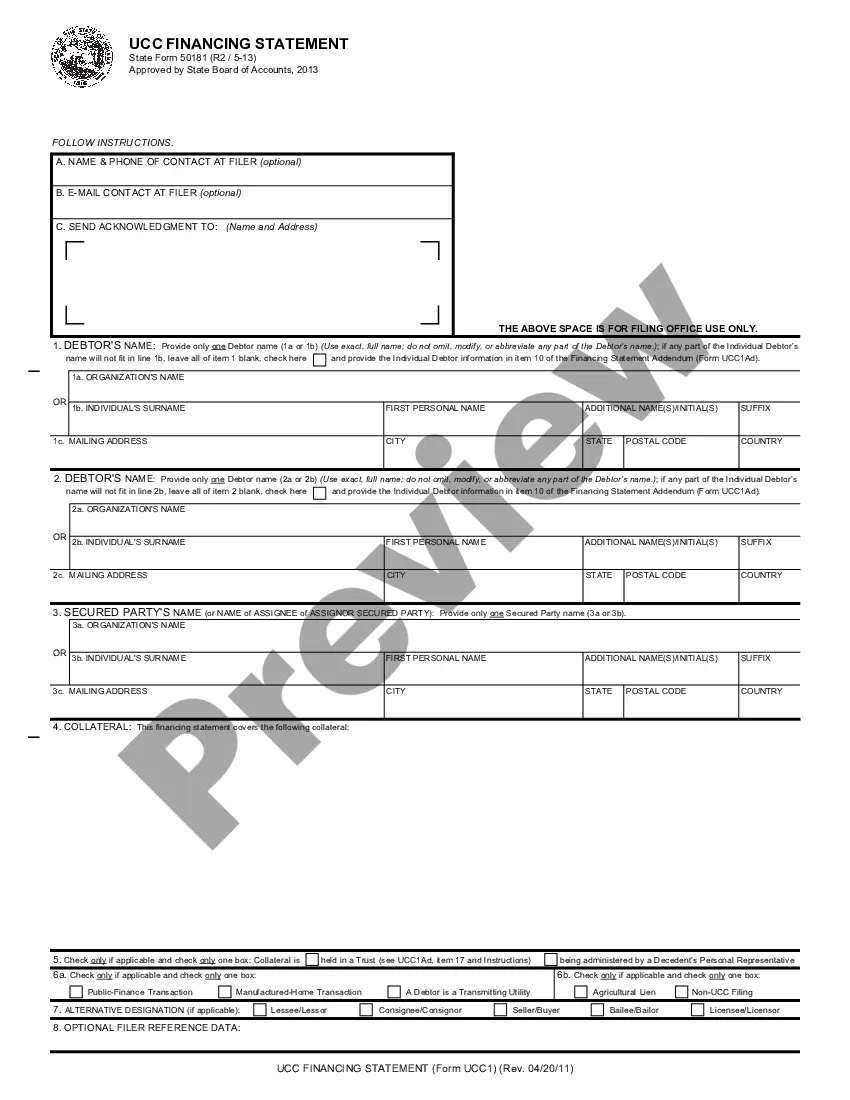

- Utilize the library navigation or search field to locate your template.

- Examine the form’s description to verify if it meets your state and county requirements.

- Check the form preview, if available, to confirm that the template matches what you’re looking for.

- Return to the search to find the appropriate template if the Fifty Dollars On A Check For 30 does not fit your needs.

- Once you are confident about the form’s applicability, download it.

- If you are a registered user, click Log in to authenticate and access your chosen templates in My documents.

- If you do not have an account yet, click Buy now to purchase the form.

- Choose the pricing option that matches your needs.

- Proceed with registration to finalize your purchase.

- Complete your transaction by selecting a payment method (credit card or PayPal).

- Choose the document format for downloading Fifty Dollars On A Check For 30.

Form popularity

FAQ

If you need help with how to write a check, these steps will have you covered. Include the date. Name the recipient. Fill in the amount with numerals. Write out the amount in words. Say what it's for. Sign your name.

To write a check for less than a full dollar, use a zero to show that there aren't any dollars. After that, include the number of cents just like all of the other examples.

If your check is for a whole number such as 50 or 75, always include the cents too so it shows as $50.00. It's always a good idea to include cents in all cases, such as $1,298.24. This keeps fraudsters from adding a few zeros to the number you wrote or changing any numbers.

Spell out the amount Below the recipient's name, you'll spell out the amount you wrote in numbers. Make sure to include cents and draw a line through any unfilled space. The above examples spelled out: Fifty Dollars and 0/100 cents.

First, write the date in the upper right-hand corner. Then write the name of the person or business you're making the check out to. Write the dollar amount in the small box and then spell it out in the dollars line directly below the pay to the order of line. If space remains, draw a line to prevent tampering.