New York Form Printable With Address

Description

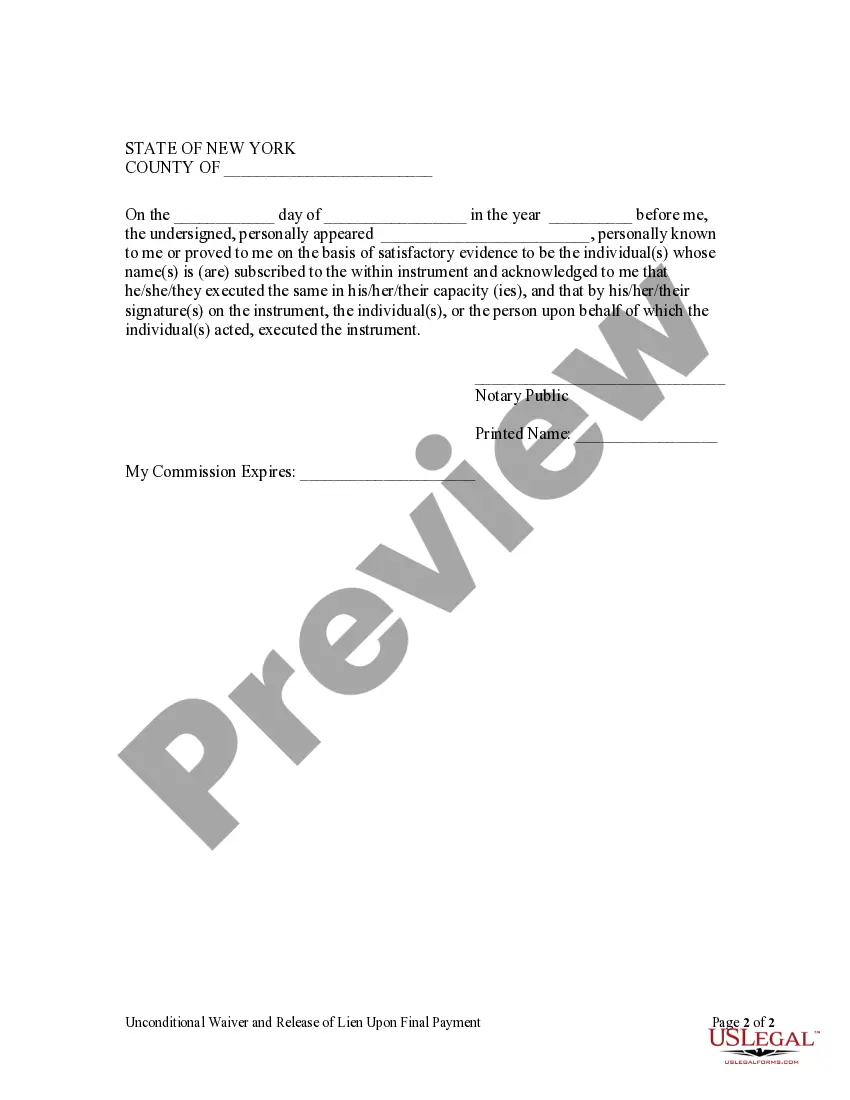

How to fill out New York Unconditional Waiver And Release Of Lien Upon Final Payment?

Creating legal documents from the ground up can frequently be somewhat daunting. Certain situations may require extensive research and significant financial resources.

If you’re looking for a more straightforward and economical method to prepare the New York Form Printable With Address or any other forms without unnecessary complications, US Legal Forms is always available to assist you.

Our digital library comprising over 85,000 current legal documents encompasses nearly every aspect of your financial, legal, and personal affairs. With just a few clicks, you can swiftly obtain state- and county-compliant templates meticulously prepared by our legal experts.

Utilize our platform whenever you need reliable and dependable services to quickly locate and download the New York Form Printable With Address. If you have used our services before and have an existing account, simply Log In to your account, select the template and download it, or retrieve it anytime from the My documents tab.

US Legal Forms enjoys a strong reputation and has over 25 years of experience. Join us today and make document execution a hassle-free and organized process!

- Review the form preview and descriptions to ensure you have located the document you need.

- Verify whether the form you select adheres to the regulations and laws of your state and county.

- Select the appropriate subscription option to obtain the New York Form Printable With Address.

- Download the document. Then fill it out, certify it, and print it.

Form popularity

FAQ

Non-resident individuals working in New York City typically need to use Form NYC-1127, which is tailored for non-resident taxation. This form is available through the New York form printable with address. If you require guidance on filling it out, you may want to explore the resources at USLegalForms.

The Missouri income tax form is pretty easy to fill out once you have calculated your federal taxes, because the Missouri form uses numbers from the federal 1040. In Missouri, both U.S. residents and nonresidents use the same forms. If you are single or married with one income, you can probably use the MO-1040A.

If you choose not to e-file, you may print any Missouri tax form from our website at dor.mo.gov/forms.

This is your Missouri resident credit. Enter the amount on Form MO-1040, Line 29Y and 29S. (If you have multiple credits, add the amounts on Line 11 from each MO-CR). Your total credit cannot exceed the tax paid or the percent of tax due to Missouri on that part of your income. Information to complete Form MO-CR.

If you earn more than $1,200 you must file Form MO-1040. If your home of record is Missouri and you are stationed in Missouri due to military orders, all of your income, including your military pay, is taxable to Missouri.

If you are not able to e-file your federal and state returns at the same time, or are not required to file a federal return, you can e-file your Missouri return as a State-Only return through the e-file program (if your software provider supports State-Only filing).

Form MO-1040 is a Form used for the Tax Amendment. You can prepare a current tax year Missouri Tax Amendment on eFile.com, however you cannot submit it electronically. In comparison, the IRS requires a different Form - Form 1040X - to amend an IRS return (do not use Form 1040 for an IRS Amendment).

Missouri franchise tax is paid by all corporations doing business in the state. Companies required to pay the tax must file Form MO-1120 or Form MO-1120S when paying their tax bill. Missouri has been collecting franchise tax from businesses since 1970.

Just like the federal level, Missouri imposes income taxes on your earnings if you have a sufficient connection to the state if you work or earn an income within state borders. You may not have to file a Missouri return if: You are a resident and have less than $1,200 of Missouri adjusted gross income.