New York Form Printable Format

Description

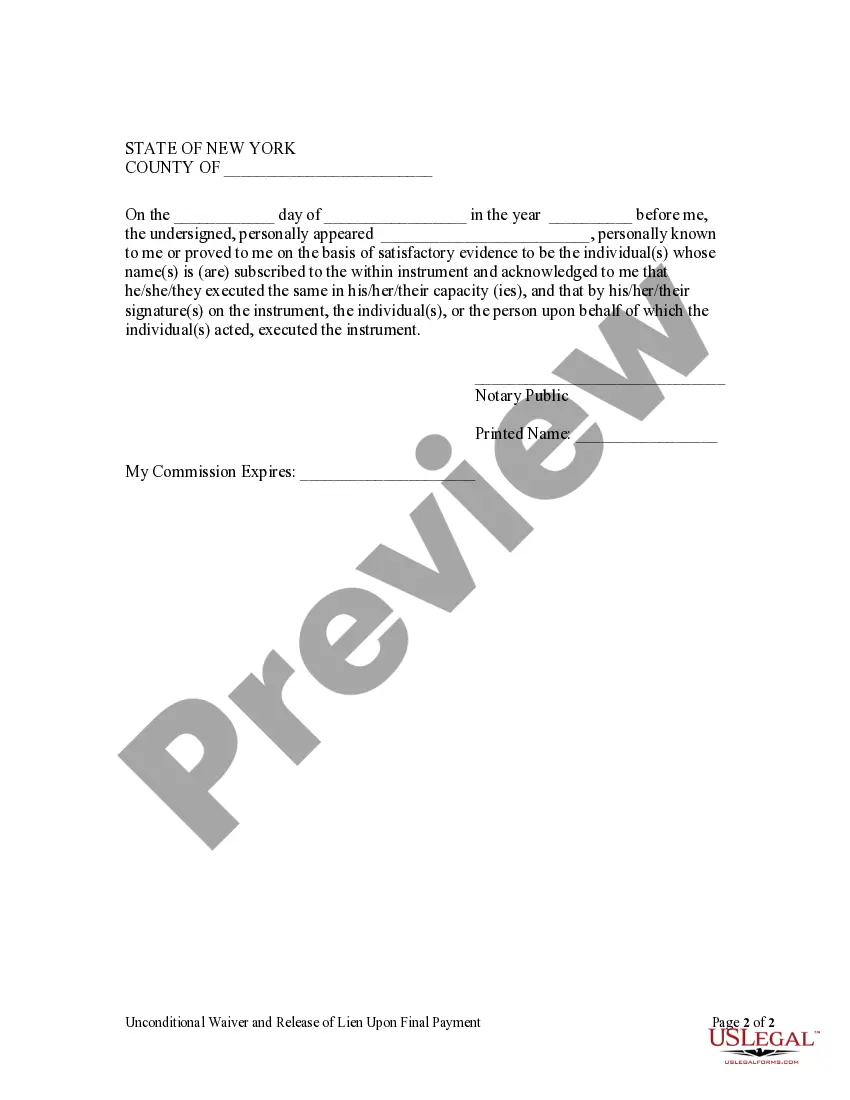

How to fill out New York Unconditional Waiver And Release Of Lien Upon Final Payment?

It’s well-known that you cannot become a legal specialist instantly, nor can you learn how to swiftly create New York Form Printable Format without possessing a specific skill set.

Assembling legal documents is a lengthy process that demands specialized education and expertise. So, why not entrust the creation of the New York Form Printable Format to the experts.

With US Legal Forms, one of the most extensive legal document repositories, you can find everything from court documents to templates for in-office communication. We understand the significance of compliance with federal and local laws and regulations.

Create a free account and select a subscription plan to buy the template.

Hit Buy now. Once the payment is completed, you can download the New York Form Printable Format, fill it out, print it, and send or deliver it to the necessary individuals or entities. You can regain access to your forms from the My documents tab at any time. If you’re an existing customer, simply Log In, and find and download the template from the same tab. Regardless of the reason for your paperwork—whether financial, legal, or personal—our website has you covered. Try US Legal Forms today!

- Therefore, on our platform, all forms are location-specific and current.

- Start with our website and acquire the document you need in just moments.

- Use the search bar at the top of the page to find the document you need.

- If this option is available, preview it and view the supporting description to see if New York Form Printable Format is what you seek.

- If you require a different form, begin your search again.

Form popularity

FAQ

The 201 NYS tax form, officially known as NYS IT-201, is the resident income tax return. It is used by individuals who lived in New York State for the entire year. When you search for New York form printable format, you will likely come across this influential form that outlines income, deductions, and credits.

The primary difference between NYS IT-201 and IT-203 lies in residency status. IT-201 is for full-year residents, while IT-203 is for non-residents or part-year residents. Understanding these distinctions can help you choose the correct New York form printable format, ensuring accurate tax reporting.

NY form IT-204 is the Partnership Return for New York State tax. It is filed by partnerships to report income, deductions, and credits attributable to New York sources. If you require a New York form printable format for this purpose, consider using uslegalforms to obtain the correct documentation easily.

Recall the Mortgage: In some cases, a lender may even have the right to recall the mortgage, meaning you'd have to pay all of it back at once. If you cannot pay it, the lender may even have to resort to foreclose or forcing a power of sale on the property.

Definition of 'Master Mortgage' The Master Mortgage is a document created when a property is purchased for the first time. It is filed in the public land records and its purpose is to keep track of the initial mortgage and of any liens that might be associated with the property.

If you have a 30-year loan, you can expect it to change hands one to three times over the course of the 30-year period. Lenders can sell your loan and they often do so to make money off the sale, replace funds used to make the loan and improve their liquidity, reduce liabilities or balance their portfolio.

If you have a 30-year loan, you can expect it to change hands one to three times over the course of the 30-year period. Lenders can sell your loan and they often do so to make money off the sale, replace funds used to make the loan and improve their liquidity, reduce liabilities or balance their portfolio.

This could result in a small change in the monthly payment amount. A mortgage can be transferred to a new servicing company any number of times during the life of the loan.

Legally, there isn't a limit on how many times you can refinance your home loan. However, mortgage lenders do have a few mortgage refinance requirements you'll need to meet each time you apply for a loan, and some special considerations are important to note if you want a cash-out refinance.

A mortgage note is a legal document that sets out all the terms of the mortgage between a borrower and their lending institution. It includes terms such as: The total amount of the home loan. The down payment amount. Whether monthly or bimonthly payments are required.