Lien Waivr

Description

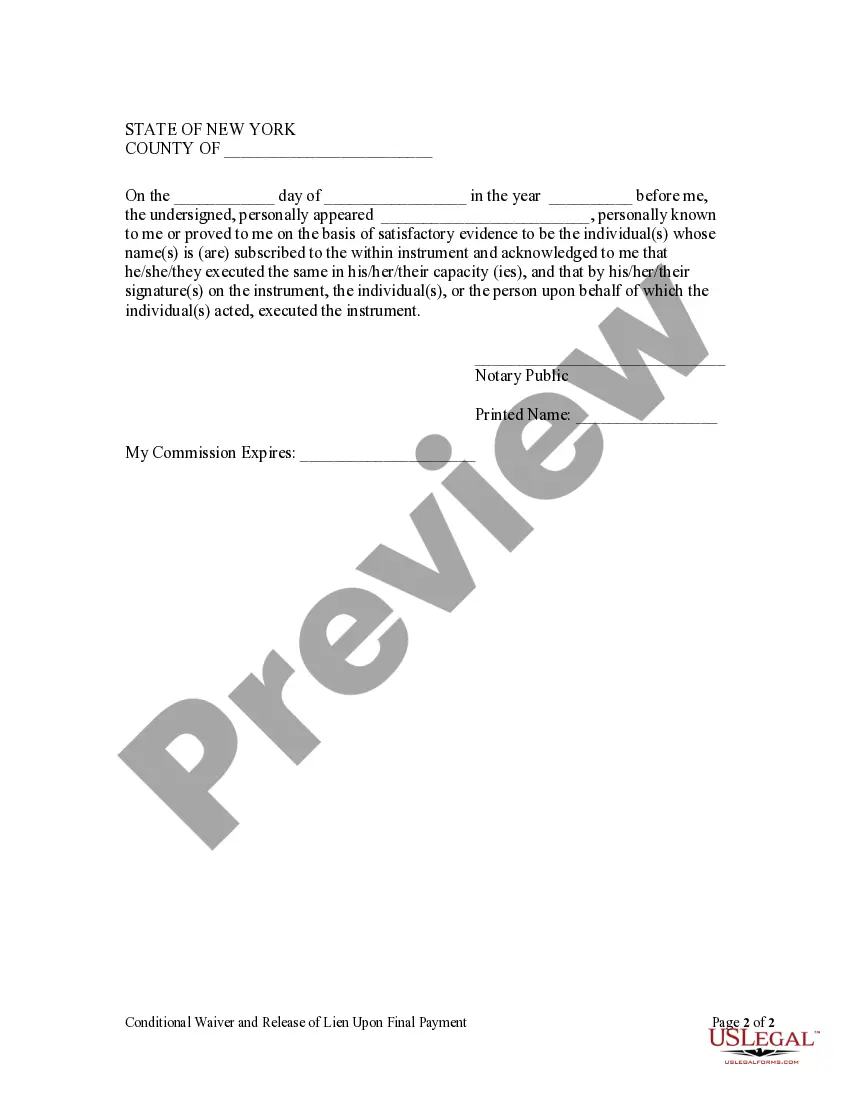

How to fill out New York Conditional Waiver And Release Of Lien Upon Final Payment?

- For returning users, log into your account and download your required form by clicking the Download button. Ensure your subscription is active; renew it as needed.

- If you’re new, begin by checking the Preview mode and form description to ensure it aligns with your legal needs and local jurisdiction.

- Search for alternative templates if necessary. Use the Search tab above to find other forms that may better fit your requirements.

- Purchase the document by clicking the Buy Now button and selecting a suitable subscription plan. An account registration is necessary to access all resources.

- Complete your payment using your credit card or PayPal for the subscription.

- Download your form to save on your device. You can easily access it later in the My Forms section of your profile.

Conclusion: By utilizing Lien waivr, you gain quick access to a vast array of legal documents tailored to meet your needs, along with premium expert assistance for maximum accuracy.

Don't wait! Start your journey with US Legal Forms today and simplify your legal document needs.

Form popularity

FAQ

The speed at which you can obtain a lien release may depend on various factors, such as the jurisdiction and the responsiveness of involved parties. Generally, if you have the necessary documents ready and all parties agree, the process can be completed quickly. For a more seamless experience, consider using US Legal Forms, which can expedite the creation and submission of your lien release.

Creating a lien release involves drafting the document to declare that the lien is no longer valid. You will require specific information, such as the lien's details and the reason for release. Using resources like US Legal Forms can streamline this process by providing templates tailored to your needs and ensuring compliance with legal standards.

Yes, lien waivers can be signed electronically, making the process more efficient and accessible. Many platforms offer secure electronic signature options, enabling all parties to sign from wherever they are. US Legal Forms is a reliable resource for creating lien waivers that meet state requirements, including provisions for electronic signatures.

To write a letter to release a lien, start with a formal greeting and clearly state your intention to release the lien. Include relevant details, such as the lien amount, property description, and any prior agreements. Consider using US Legal Forms for templates that simplify writing a comprehensive release letter, ensuring you cover all necessary points.

Completing a waiver of lien involves filling out the correct form with accurate details and ensuring all parties sign it. Each section should be completed thoughtfully to reflect the agreement's terms. For those looking for guidance, US Legal Forms offers step-by-step instructions and templates to help you complete a waiver of lien accurately.

In Texas, a lien waiver typically requires the parties involved to agree on the waiver's terms, including the scope and the particular project. It is essential to have all necessary information clearly stated, such as the project name and relevant dates. You can find helpful resources and templates on US Legal Forms to ensure your lien waiver in Texas meets all legal requirements.

To create a release of lien, you will need to gather the necessary documentation that outlines the details of the lien and its release. This usually includes the original lien document, proof of payment, and a form specifically for the release. You can simplify this process using a service like US Legal Forms, which provides templates and guidance for drafting a release of lien efficiently.

In Texas, lien waivers do not necessarily need to be notarized, but having them notarized can provide an extra layer of security. A notarized lien waiver serves as an official validation of the parties’ agreement, minimizing potential disputes. While it may not be a strict requirement, it’s often recommended for legal protection. Understanding the nuances of lien waivers helps ensure you meet all requirements effectively.

Someone needs a lien release to confirm that a debt has been settled and that no further claims exist against their property. This document is essential when selling or refinancing, as it clears any obstacles that may hinder the transaction. Without a lien release, you could face legal issues or delays during the sale process. Therefore, obtaining a lien release safeguards your rights and facilitates smoother financial dealings.

In Texas, a lien requires specific information such as the property description, the amount owed, and the names of the parties involved. Additionally, the lien must be filed with the county clerk’s office to be enforceable. To protect yourself, it is crucial to follow these requirements carefully to ensure that your claim is valid. Familiarizing yourself with Texas lien laws can help you manage your assets effectively.