Information Horse Form Withhold

Description

Form popularity

FAQ

Non-resident withholding tax is a tax applied to payments made to foreign individuals or entities when they earn income from US sources. Generally, this withholding can be as high as 30%, but it can vary based on specific treaties. It's important to fill out the Information horse form withhold to properly report your earnings. By understanding this, you can ensure compliant processing and potentially lower your tax burden.

US backup withholding tax is a specified rate applied to certain payments when the taxpayer fails to supply correct information to the IRS. If you cannot provide the necessary documentation prior to payment, your funds may be subject to backup withholding. Utilizing the Information horse form withhold assists in providing the needed data to avoid unnecessary withholding. Ensuring proper documentation can save you from higher taxes.

Publication 515 is a document provided by the IRS that details the withholding of tax on non-resident aliens and foreign entities. It includes instructions for how to report income and comply with US tax laws. If you are navigating withholding tax for winnings, utilizing the Information horse form withhold in conjunction with Publication 515 can help make the process clearer. It's recommended to read through this publication for comprehensive guidance.

To get tax back from your US winnings, you need to file a tax return with the Internal Revenue Service (IRS). Include all relevant information, such as the amounts won and any taxes already withheld from those winnings. You may also use the Information horse form withhold to provide necessary details on withheld taxes. Once processed, the IRS will determine if you are eligible for a tax refund.

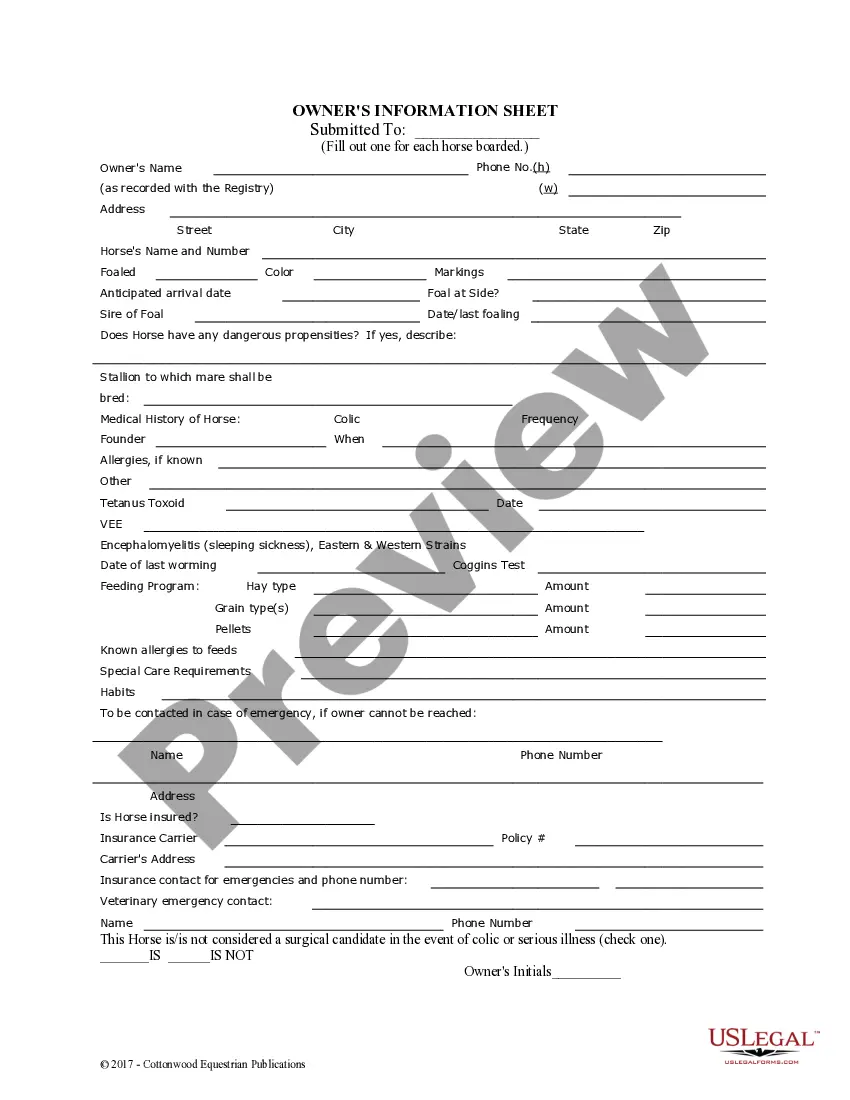

The B complex in horses refers to a group of vitamins that play essential roles in their metabolism and overall health. These vitamins are vital for energy production, muscle function, and maintaining a healthy nervous system. By understanding the nutritional needs of your horse, you can better support its well-being, and insights related to the information horse form withhold can guide you in making informed decisions about care.

Understanding horse form requires you to analyze various factors, including past performances, racing conditions, and the horse's physical condition. By breaking down these elements, you can gain insights into a horse's potential performance. Make sure to utilize resources that present this information clearly, so you can effectively grasp the information horse form withhold as you prepare for betting.

To check a horse's form, you need to look at its recent performance history, including finishes in previous races, the types of races run, and the conditions faced. Many platforms provide visual representations and summaries of this information, making it easier to analyze. Understanding the horse's form is vital, and utilizing the information horse form withhold ensures you have all relevant data at your fingertips.

The 'C' in horse racing form refers to a horse that has previously won a race class indicated by a specific grading system. This is an important factor to consider when analyzing the horse's competitiveness in upcoming events. As you explore these racing terms, the information horse form withhold is essential to elevate your betting strategies.

The 'B' in horse form typically indicates that the horse has finished in a particular position, often denoting a place or bet type. Using the horse form effectively means understanding all letters and symbols that accompany it. Thorough comprehension of these forms, including the information horse form withhold, can enhance your success at the racetrack.

In racing, the letter 'b' may signify that the horse has been 'bled,' meaning it experienced bleeding from the nose or mouth during or after a race. This notation alerts owners and bettors to potential health issues that could affect performance. Understanding such notations is part of the information horse form withhold, which allows you to make better choices when assessing a horse's capabilities.