Limited Lliability

Description

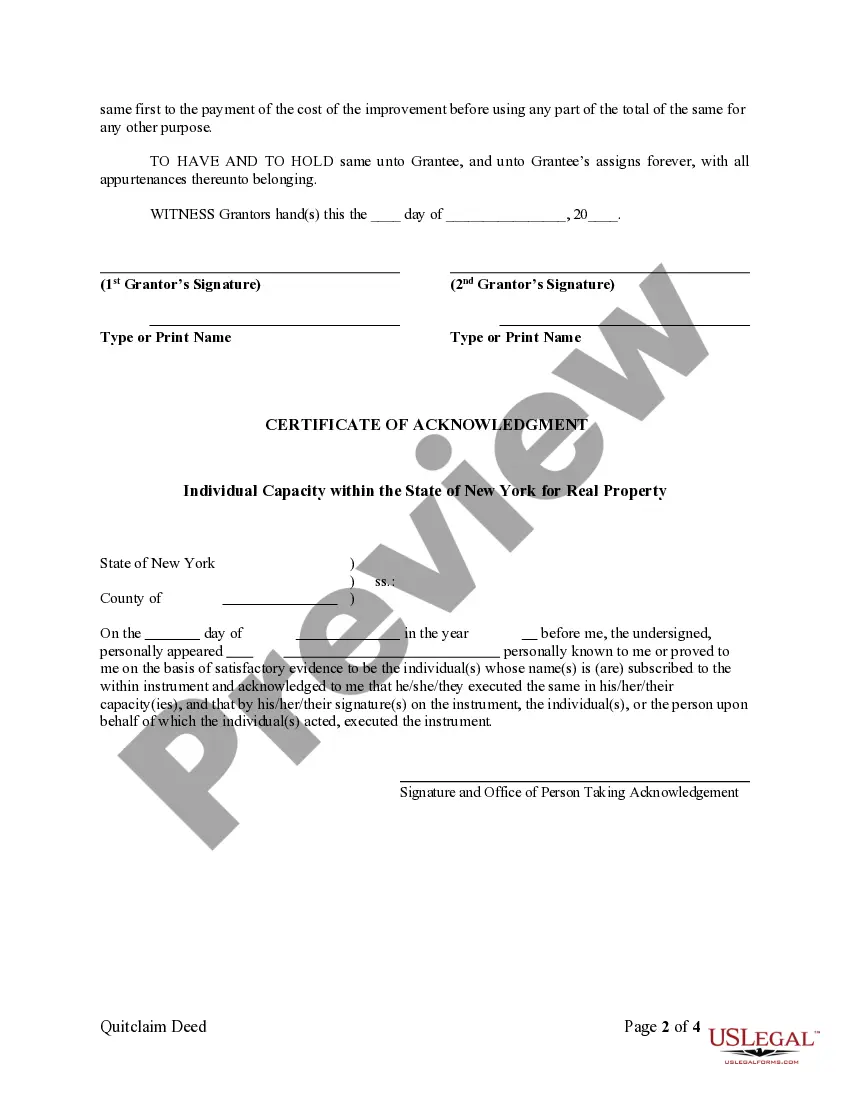

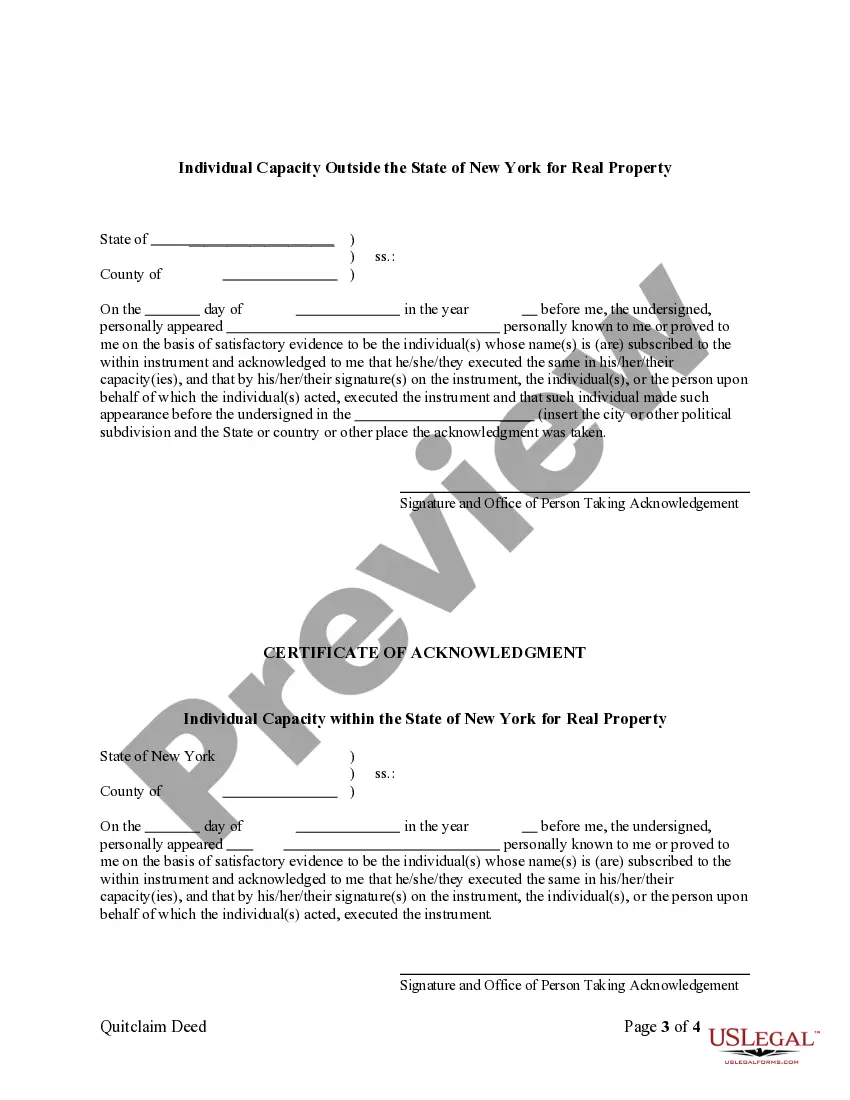

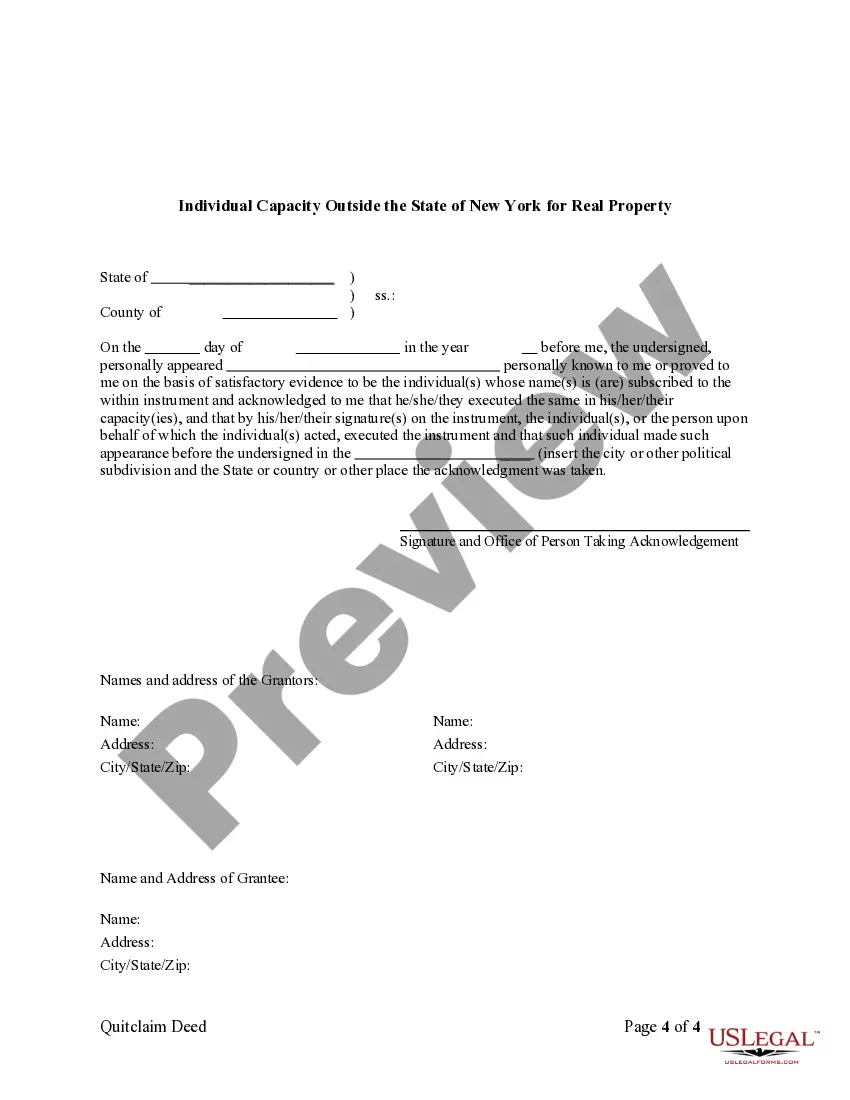

How to fill out New York Quitclaim Deed By Two Individuals To LLC?

- Log in to your US Legal Forms account if you are a returning user, ensuring your subscription is active. If not, renew your subscription as per your payment plan.

- For first-time users, visit the website and breeze through the preview mode and form descriptions to confirm you've selected the right document that aligns with your needs and local jurisdiction.

- In case the first choice isn’t suitable, utilize the Search tab to find another template that meets your requirements.

- Proceed to purchase the document by clicking the 'Buy Now' button, and select your preferred subscription plan. An account registration is necessary to tap into the library's offerings.

- Complete your purchase using your credit card or PayPal account to finalize your subscription.

- Download your selected form to your device. You can revisit it anytime through the 'My Forms' section of your profile.

With US Legal Forms, users benefit from a robust collection of over 85,000 customizable legal forms and packages. This expansive library not only offers more options at competitive prices but also ensures users receive accurate and reliable legal documents.

Ready to simplify your legal process? Visit US Legal Forms today and create your account to experience the ease of accessing legally sound documents.

Form popularity

FAQ

Filling out an LLC involves more than just paperwork; it requires understanding state regulations. Start by gathering essential information such as the LLC name, address, and the members' details. Then, complete the Articles of Organization provided by your state and include any additional documents required by your jurisdiction. For a seamless experience, consider using uslegalforms, which provides templates and guidance for establishing your limited liability company.

You can file your LLC separately from other business entities or personal businesses. Each LLC must meet state requirements and may have unique tax obligations. If you're unsure about the filing process, you might want to consult resources from uslegalforms for comprehensive assistance. They can help you navigate the specific steps required for your limited liability interests.

Yes, you can form an LLC and choose not to engage in business activities. However, even inactive LLCs usually require annual filings and fees. It's crucial to maintain compliance with state laws to preserve your limited liability status. If you need guidance on managing an inactive LLC, uslegalforms offers resources that can streamline this process for you.

A single owner LLC, also known as a single-member LLC, files taxes as a sole proprietorship. This means reporting business income on Schedule C of your personal income tax return. It's essential to keep detailed records to ensure compliance and take advantage of any deductions. Utilizing a platform like uslegalforms can help you find resources to accurately manage your tax filings for your limited liability entity.

Failing to file taxes for your LLC can lead to penalties and potential legal issues. The IRS treats LLCs as pass-through entities, which means the onus of tax filings typically falls on individual members. If you neglect this responsibility, your limited liability protections may also be at risk, making it crucial to stay current on your tax obligations. Consider seeking assistance from professional services, like uslegalforms, to navigate this process.

A common example of limited liability is a limited liability company (LLC). When you form an LLC, your personal assets, like your home or car, are safeguarded from business debts. For instance, if your LLC faces a lawsuit, only the funds within the business are at stake, so your personal wealth remains intact.

Limited liability protects owners from being personally responsible for business debts, while unlimited liability means that owners are personally liable for all financial obligations. In a limited liability setting, your risk is contained, providing a significant advantage for entrepreneurs. Conversely, unlimited liability leaves owners at risk of losing personal assets if the business fails.

Limited liability insurance protects business owners against claims from third parties due to negligence or accidents. This type of insurance coverage helps secure the owner's financial stability, as it covers legal fees and payouts, keeping personal assets safe. By incorporating limited liability insurance, business owners can operate confidently, knowing they are well-protected.

A limited liability company (LLC) is a flexible business structure that combines the benefits of a corporation and a partnership. It offers limited liability protection to its owners, known as members, while allowing profits to pass through to their personal tax returns. This model is popular among small business owners for its simplicity and legal advantages.

Yes, having limited liability is beneficial as it reduces personal risk for business owners. When you operate under a limited liability structure, your personal finances remain separate from your business debts. This protection encourages entrepreneurship, allowing you to take calculated risks without fearing personal loss.