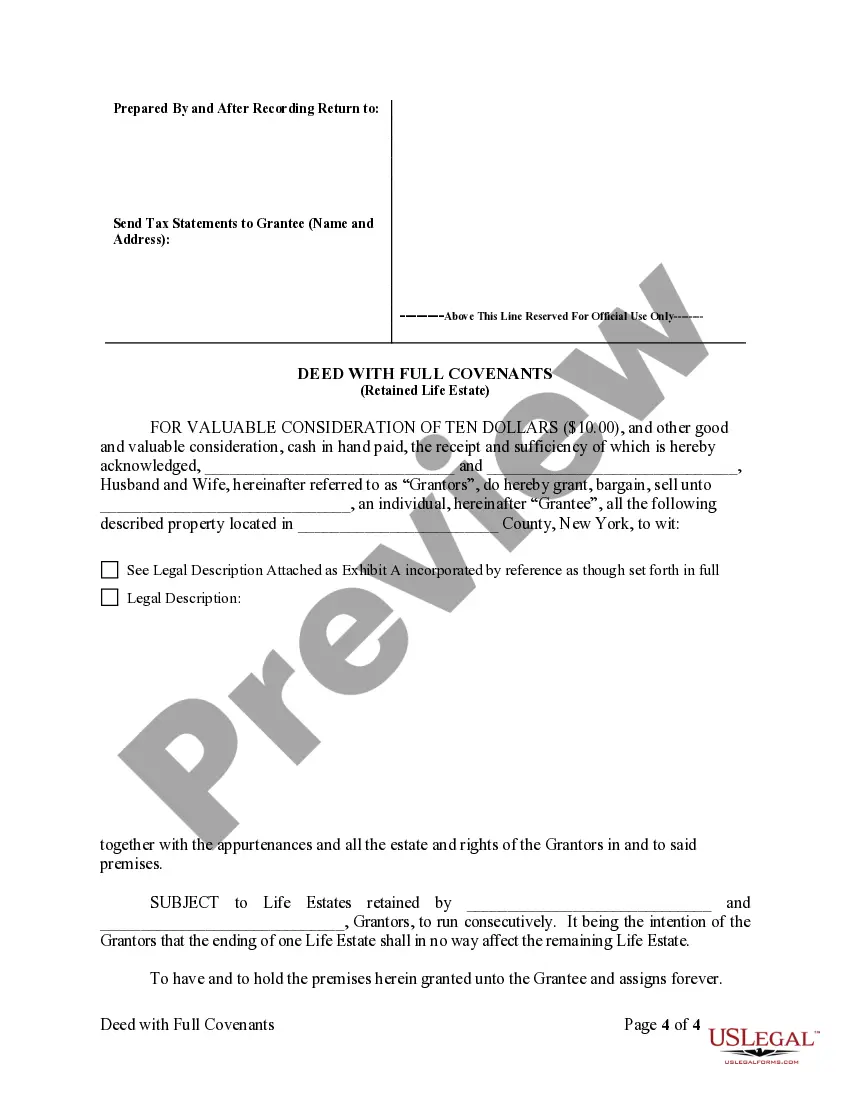

Life Estate Deed Example For Students

Description

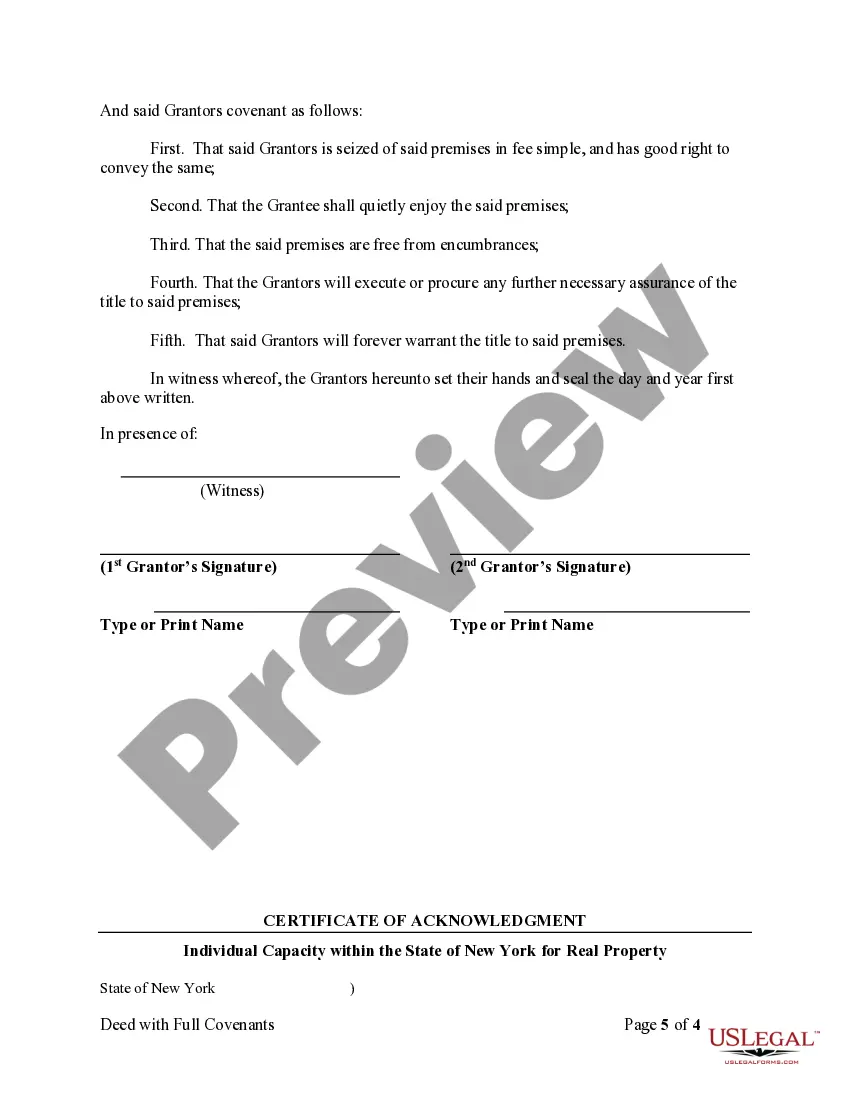

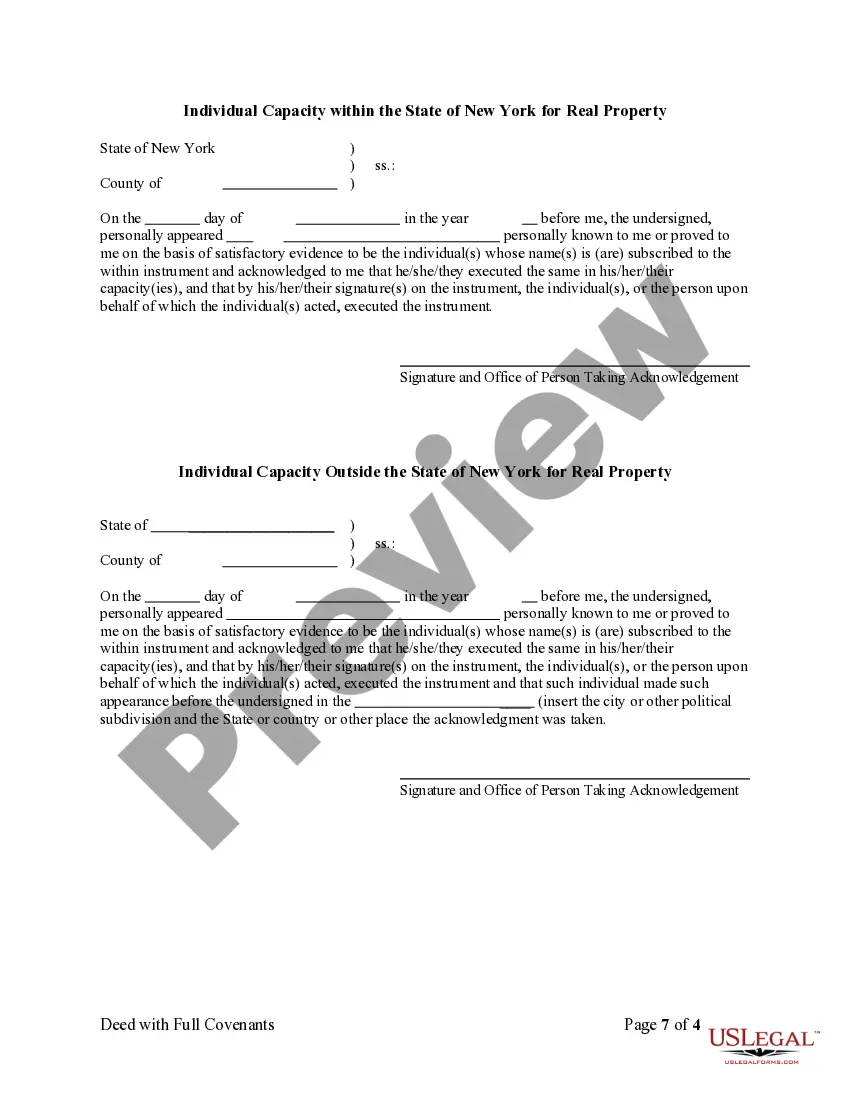

How to fill out New York Warranty Deed To Child Reserving A Life Estate In The Parents?

Whether for professional reasons or for personal matters, everyone must manage legal scenarios at some time in their existence.

Completing legal documents requires meticulous care, starting from selecting the appropriate form template.

With an extensive US Legal Forms collection readily available, you never need to waste time searching for the suitable sample online. Utilize the library’s simple navigation to find the correct template for any situation.

- Obtain the sample you require by using the search box or catalog navigation.

- Examine the form’s details to confirm it aligns with your situation, state, and county.

- Select the form’s preview to review it.

- If it is the wrong form, return to the search feature to find the Life Estate Deed Example For Students template you need.

- Download the template if it satisfies your criteria.

- If you have a US Legal Forms account, click Log in to access previously saved documents in My documents.

- If you do not have an account yet, you can download the form by clicking Buy now.

- Choose the appropriate pricing option.

- Complete the account registration form.

- Select your payment option: use a credit card or PayPal account.

- Choose the file format you desire and download the Life Estate Deed Example For Students.

- Once saved, you can complete the form using editing software or print it out and finish it by hand.

Form popularity

FAQ

The step-up basis in a life estate deed refers to the adjustment of the property's value to its market value at the time of the owner's death. This adjustment benefits the beneficiaries financially, potentially lowering their capital gains taxes when selling the property. Understanding this concept can be crucial when analyzing a life estate deed example for students, as it provides important financial implications for estate planning.

All customers whose principal business, office or agency, or legal residence (in the case of an individual) is located in the United States or in one of the U.S. Territories can apply for an EIN online.

Use Form SS-4 to apply for an employer identification number (EIN). An EIN is a 9-digit number (for example, 12-3456789) assigned to employers, sole proprietors, corporations, partnerships, estates, trusts, certain individuals, and other entities for tax filing and reporting purposes.

Two Ways to Start A New Business in New Hampshire Define your business concept. Draft a business plan. Choose a business name. Fund your startup costs. Choose a business structure. Register your business with the New Hampshire Secretary of State. Get your business licenses. Set up a business bank account.

Registration of New Business: All businesses operating in the State of New Hampshire are required to register with the Secretary of State's Office. Depending on your business structure, you may have additional filing requirements. Forms can also be downloaded off the Secretary of State's web site.

You may apply for an EIN online if your principal business is located in the United States or U.S. Territories. The person applying online must have a valid Taxpayer Identification Number (SSN, ITIN, EIN). You are limited to one EIN per responsible party per day.

We recommend applying for an EIN online if you have a SSN (Social Security Number) or ITIN (Individual Taxpayer Identification Number). This is the easiest filing method and it has the fastest approval time. Your EIN Number will be issued at the end of the online application, which takes about 15 minutes to complete.

If you are claiming a refund on behalf of a deceased taxpayer, you must file Form NH-1310. Mail forms to the New Hampshire Department of Revenue Administration, Taxpayer Services Division, PO Box 3306, Concord, NH 03302-3306.

You can use this number to do the following: Open a Bank Account in the USA. Apply for Business Permits. File a Business Tax Return. Hire Employees. Start a Corporation or Partnership. Withhold Employee Taxes. Apply For a Business Credit Card. Apply for Business Loans.