Estate Life

Description

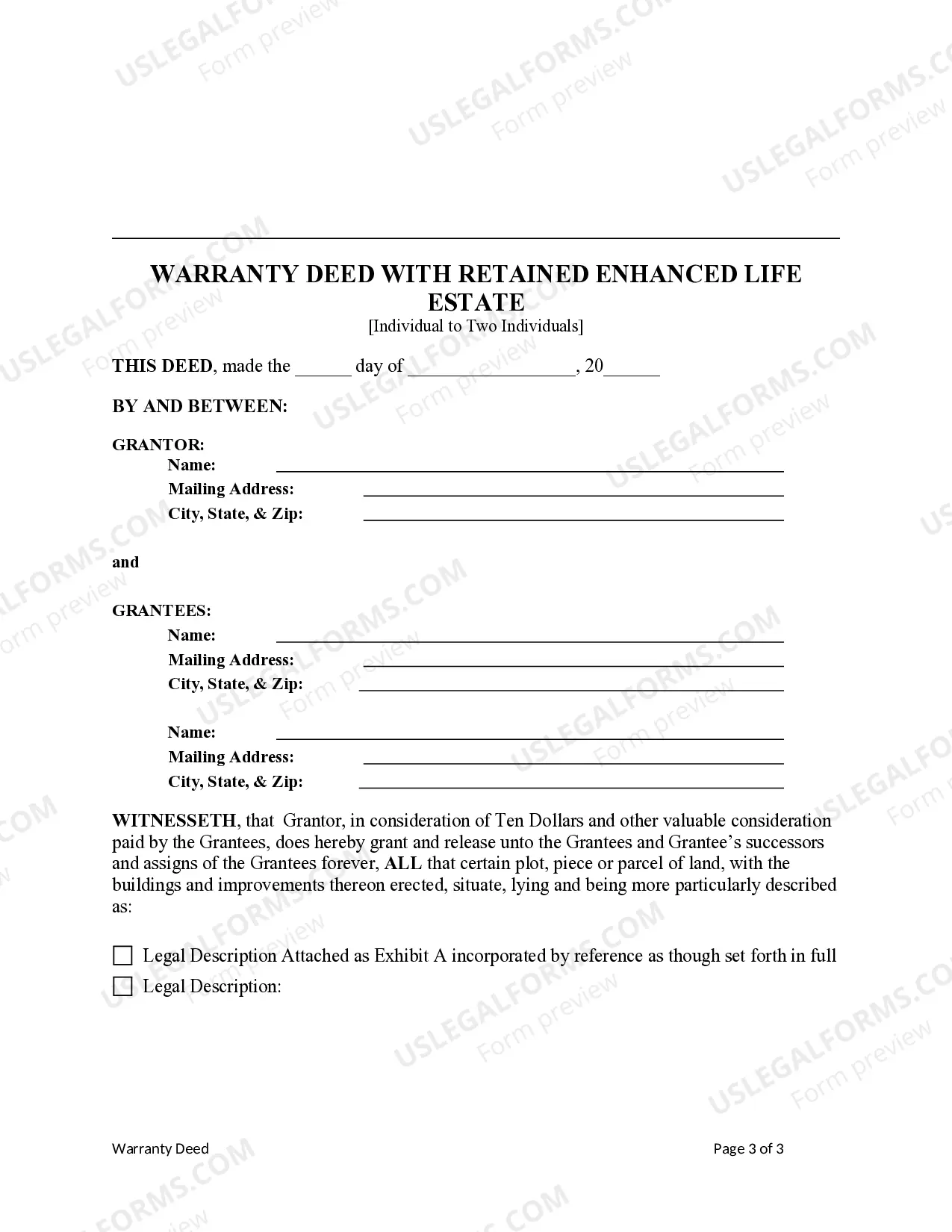

How to fill out New York Enhanced Life Estate Or Lady Bird Warranty Deed From Individual To Two Individuals?

- If you're a returning user, simply log in to your account and ensure your subscription is active. Download your required form template by clicking the Download button.

- For first-time users, begin by checking the Preview mode and the form description to confirm it fits your specific needs and complies with local laws.

- If the selected form doesn't meet your criteria, use the Search tab to find alternative templates that might better suit your requirements.

- Once you find the right document, click the Buy Now button and select your preferred subscription plan. You will need to create an account to access the full library.

- Proceed to make your purchase by entering your credit card details or through your PayPal account for subscription payment.

- Finally, download the form to your device. You can access it anytime via the My Forms section of your user profile.

US Legal Forms not only offers a vast collection of legal documents but also provides premium expert assistance, ensuring users achieve legally sound results.

Start your estate life journey today by leveraging the robust features of US Legal Forms—your partner in efficient legal solutions.

Form popularity

FAQ

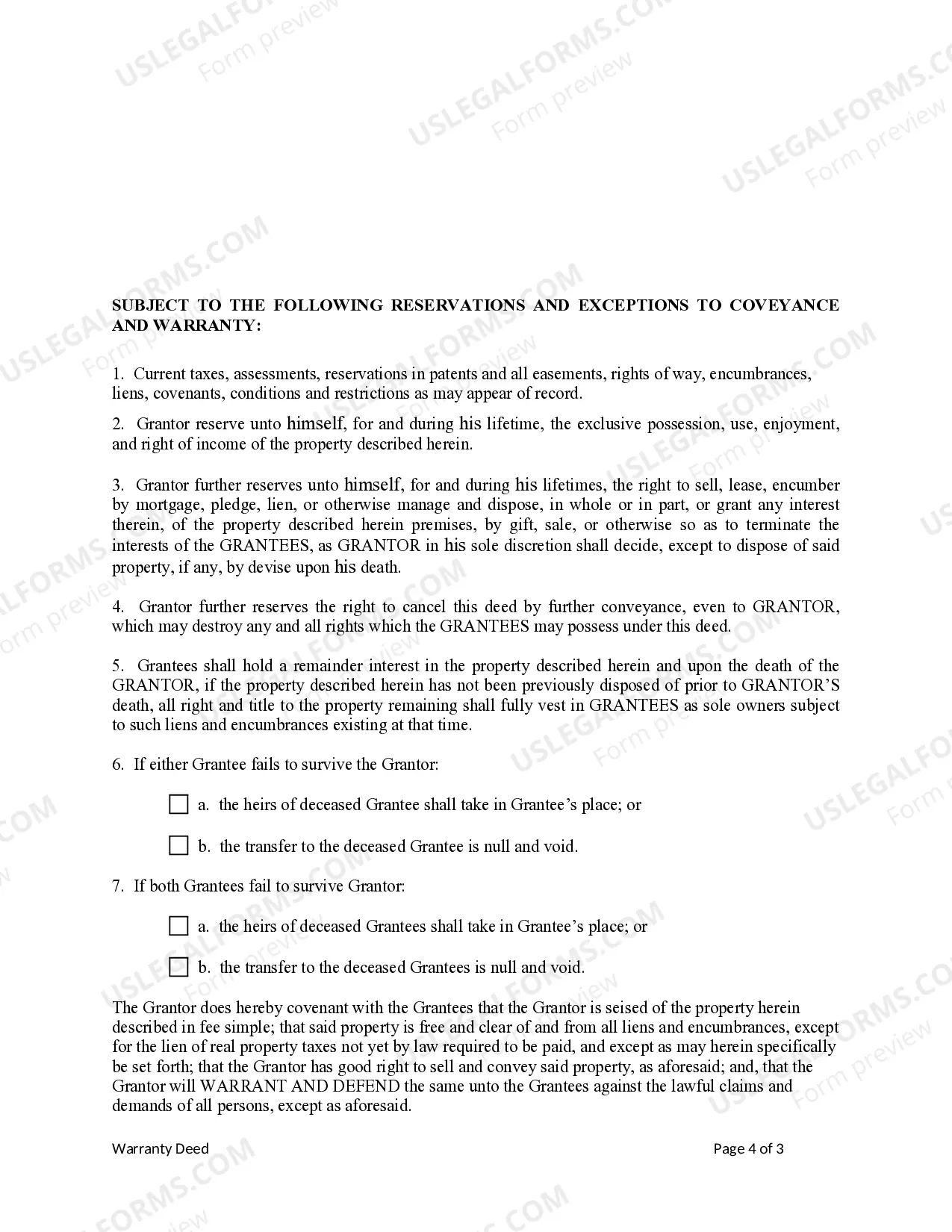

The two main types of life estate are 'traditional life estate' and 'legal life estate'. A traditional life estate allows the holder to live in and use the property for their lifetime, while a legal life estate is imposed by law. Understanding these distinctions can guide you in choosing the right structure for your estate life planning.

A life estate lasts for the lifetime of the designated life tenant. Once that individual passes away, the estate automatically passes to the remainderman or other specified beneficiaries. It's important to factor in longevity when planning your estate life to ensure your wishes are fulfilled.

A legal life estate is often dictated by state law and can refer to a life estate created through a legal instrument. An ordinary life estate, on the other hand, is more about the practical application of property rights during one’s lifetime. Clarifying these terms will aid you in making informed decisions regarding your estate life.

A legal life estate is established by law and typically arises from a will or trust. In contrast, an equitable life estate is created by the actions or agreement of the parties involved and benefits from equity principles. Knowing these differences helps you navigate legal frameworks surrounding estate life more effectively.

Yes, you can sell a house that is in a life estate, but doing so involves specific conditions. The person with the life estate can sell their interest, but the buyer can only occupy the property for the duration of the life estate. This means that after the life tenant passes away, the new owner has no further claim to the property. Understanding these implications is crucial to managing your estate life effectively.

To calculate a life estate, you often determine the value of the property and adjust it based on the life expectancy of the person holding the estate life. Actuarial tables can help provide accurate life expectancy data for this purpose. The calculations can be complex, so using tools or resources from platforms like uslegalforms can simplify this process for you.

Another name for a life estate is a 'life tenancy'. This term describes an arrangement where an individual holds an interest in property during their lifetime. Once the individual passes away, the property then transfers to another party, known as a remainderman. Understanding these terms can clarify your estate life planning.

The 3-year rule for a deceased estate determines whether gifts made within three years before death are subject to estate tax. It prevents individuals from significantly reducing taxable estates shortly before passing. Understanding this aspect of estate life ensures you are informed about potential tax implications.

The 3-year rule dictates that any gifts made within three years before death may be included in the taxable estate. This rule aims to prevent individuals from avoiding estate taxes through last-minute gifting. Awareness of this rule is essential for effective estate life planning.

To release a life estate, the life tenant must agree to give up their rights, usually through a legal document called a quitclaim deed. This process often requires consulting with a legal professional to ensure a smooth transition. Understanding the implications of this action is crucial for effective estate life management.