New York Foreign Corporation Application For Authority

Description

How to fill out New York Single Member Limited Liability Company LLC Operating Agreement?

Whether for business purposes or for individual matters, everyone has to handle legal situations sooner or later in their life. Filling out legal papers requires careful attention, beginning from selecting the right form sample. For instance, when you pick a wrong edition of a New York Foreign Corporation Application For Authority, it will be declined when you submit it. It is therefore important to have a trustworthy source of legal documents like US Legal Forms.

If you need to obtain a New York Foreign Corporation Application For Authority sample, follow these simple steps:

- Get the template you need by using the search field or catalog navigation.

- Look through the form’s description to ensure it suits your case, state, and county.

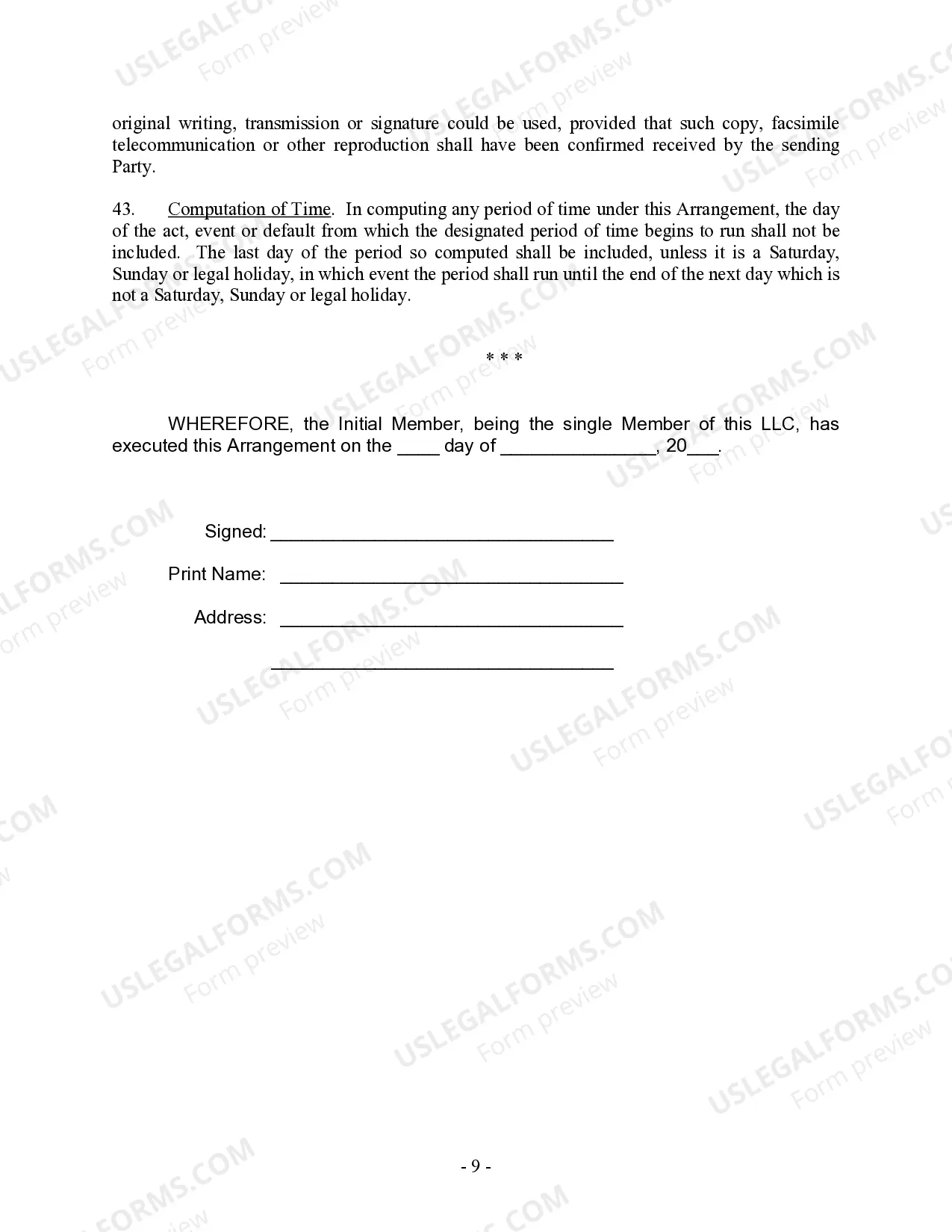

- Click on the form’s preview to examine it.

- If it is the wrong document, return to the search function to find the New York Foreign Corporation Application For Authority sample you require.

- Download the template when it meets your needs.

- If you have a US Legal Forms profile, just click Log in to gain access to previously saved documents in My Forms.

- If you do not have an account yet, you may obtain the form by clicking Buy now.

- Pick the proper pricing option.

- Complete the profile registration form.

- Choose your payment method: use a credit card or PayPal account.

- Pick the file format you want and download the New York Foreign Corporation Application For Authority.

- When it is downloaded, you can fill out the form with the help of editing software or print it and finish it manually.

With a substantial US Legal Forms catalog at hand, you do not need to spend time searching for the right template across the web. Utilize the library’s easy navigation to find the proper form for any situation.

Form popularity

FAQ

Out-of-state corporations that want to do business in New York State apply for this certificate. Corporations need to provide proof of incorporation in their home state or country. Applicants must provide a fee. Businesses do not always need a Certificate of Authority to do business in New York State.

To register a foreign corporation in New York, you must file a New York Application for Authority with the New York Department of State, Division of Corporations. You can submit this document by mail, by fax, or in person. The Application for Authority for a foreign New York corporation costs $225 to file.

To request consent, call the New York State Tax Commission at (518) 485-2639. The completed Application for Authority, consent of the New York State Tax Commission and the filing fee of $225 should be forwarded to the New York Department of State at the address indicated above.

In order for a foreign LLC to legally conduct business in New York, it needs to submit an Application for Authority to the Department of State and pay the $250 filing fee.

The filing fee varies depending on the type of company you own and your desired processing time: Limited liability company (LLC), $275 for a one-week processing time. LLC, $475 for processing within one to two business days. Corporation, $250 for a one-week processing time.