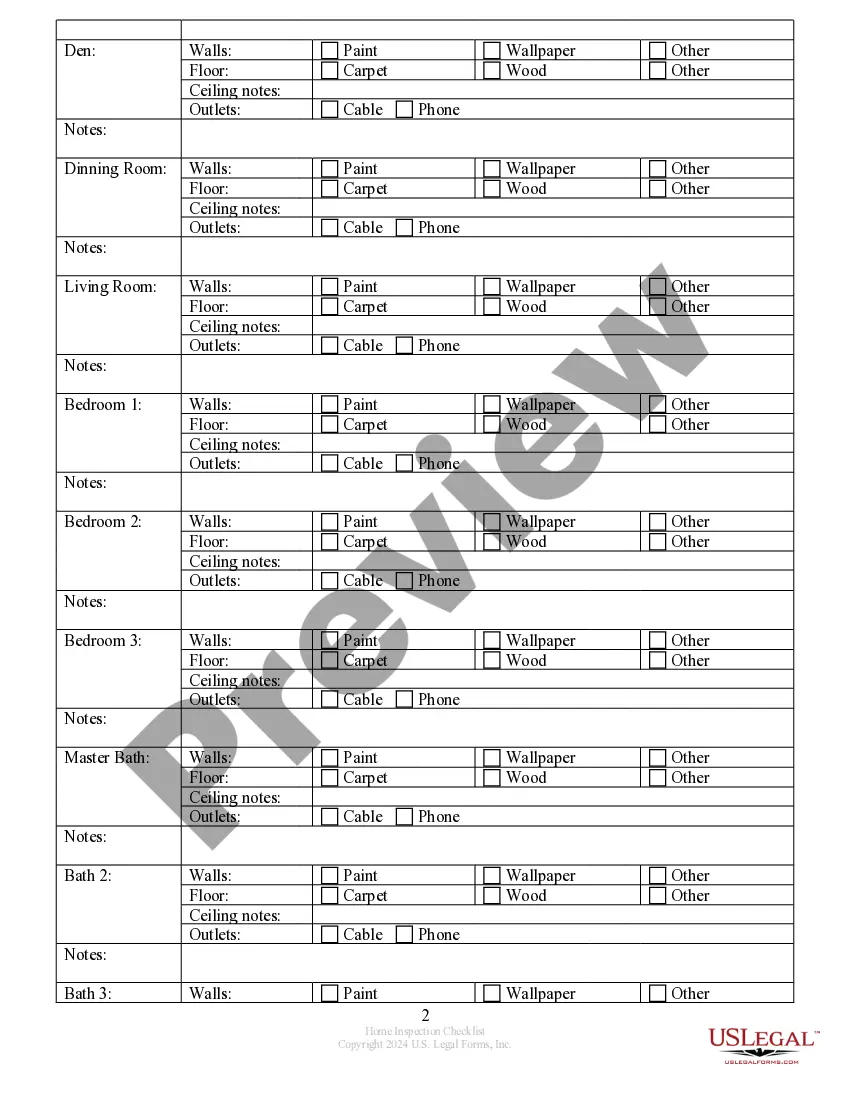

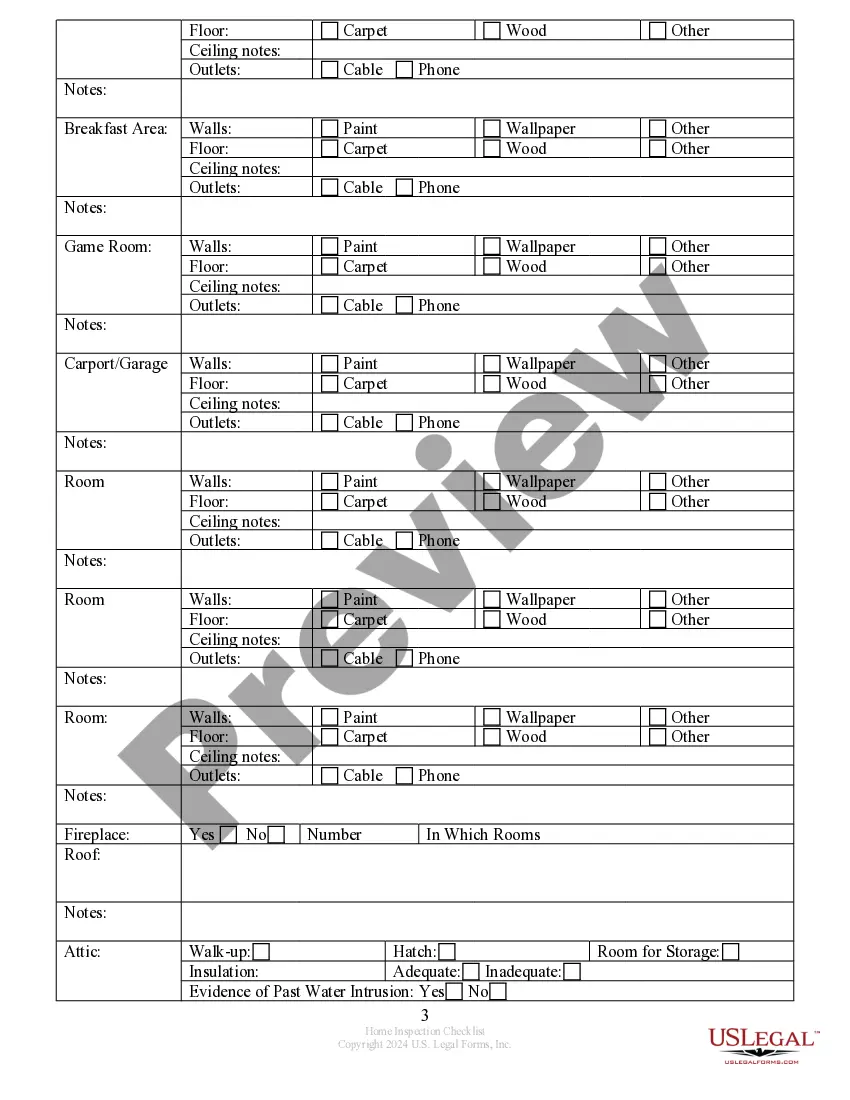

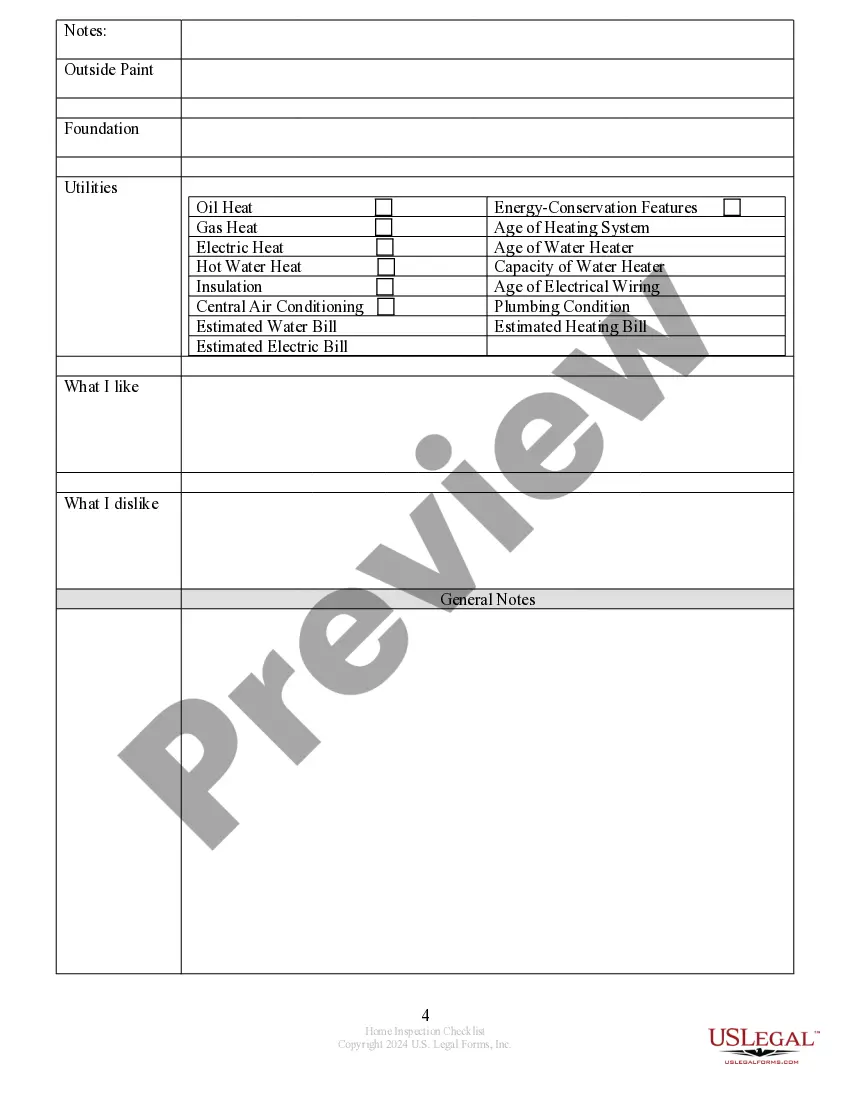

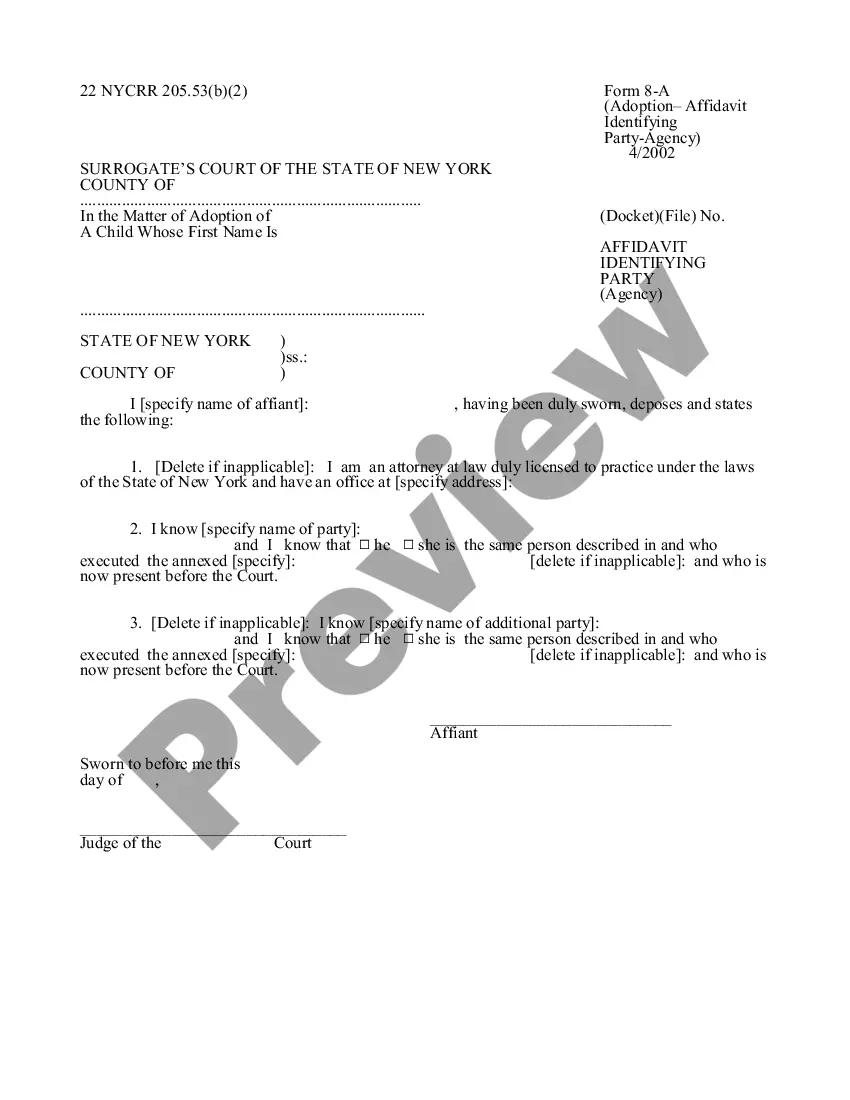

Ny Checklist For 2021

Description

How to fill out New York Buyer's Home Inspection Checklist?

The Ny Checklist For 2021 you observe on this page is a reusable official template created by professional attorneys in accordance with federal and local laws and regulations.

For over 25 years, US Legal Forms has supplied individuals, organizations, and lawyers with more than 85,000 validated, state-specific documents for any business and personal event. It’s the fastest, simplest, and most reliable method to acquire the documents you require, as the service ensures the utmost level of data protection and anti-malware security.

Register for US Legal Forms to have verified legal templates for all of life’s situations readily available.

- Search for the document you require and examine it.

- Choose the pricing plan that fits you and create an account.

- Select the format you want for your Ny Checklist For 2021 (PDF, Word, RTF) and download the sample onto your device.

- Print the template to complete it by hand or use an online multi-functional PDF editor to swiftly and accurately fill out and sign your form with a legally-binding electronic signature.

- Use the same document again whenever necessary.

Form popularity

FAQ

If you want to get close to withholding your exact tax obligation, claim 2 allowances for yourself and an allowance for however many dependents you have (so claim 3 allowances if you have one dependent).

As a resident, you pay state tax (and city tax if a New York City or Yonkers resident) on all your income no matter where it is earned. As a nonresident, you only pay tax on New York source income, which includes earnings from work performed in New York State, and income from real property located in the state.

Overview of New York's Nonresident Taxation Residents are taxable on one thing: Everything. Nonresidents, however, can be taxed only on income that is derived from or connected to New York sources.

Ing to Form IT-203-I, you must file a New York part-year or nonresident return if: You have any income from a New York source and your New York AGI exceeds your New York State standard deduction. You want to claim a refund for any New York State, New York City, or Yonkers taxes that were withheld from your pay.

If you are moving from New York to Florida, you have both income tax and estate tax incentives to establish your domicile in Florida, and to relinquish your New York domicile. A non-resident of New York is income taxed by New York only on New York source income (as opposed to all income regardless of source).